The threat of nuclear war has driven US Treasury yields down and revived interest in safe-haven currencies such as the Japanese yen and the Swiss franc. Will the fear help USDCHF bears? Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- Russia has amended its nuclear doctrine.

- The franc strengthens in times of uncertainty.

- The Swiss National Bank will continue to cut rates.

- Long trades on the USDCHF pair can be opened once the resistance of 0.886 is breached.

Monthly Fundamental Forecast for Swiss Franc

The escalation of the conflict in Eastern Europe has rekindled investor interest in the seemingly forgotten Swiss franc. Taking advantage of its safe-haven status, it strengthened against the US dollar against the backdrop of Russia’s revised nuclear doctrine. Fears of war reaching a new level led to a drop in US Treasury yields and forced USDCHF bulls to retreat.

The market is riddled with contradictions regarding the seriousness of Russia’s intentions. On the one hand, Moscow claims that nuclear weapons are primarily a weapon to prevent nuclear war. On the other hand, the Kremlin is unlikely to hesitate for long if it feels seriously threatened. There is an opinion that the escalation in the run-up to Donald Trump’s inauguration is taking place to end the conflict quickly. Trump will have good reason to blame Biden and put an end to it. If this is the case, the franc’s gains are expected to be short-lived.

The USDCHF’s uptrend is due to the divergence in economic growth and the different pace of monetary policy between the Fed and the Swiss National Bank. The new president of the SNB, Martin Schlegel, said that the regulator may cut interest rates further to maintain price stability. The SNB has pioneered the current cycle of global monetary expansion. It has already eased monetary policy three times.

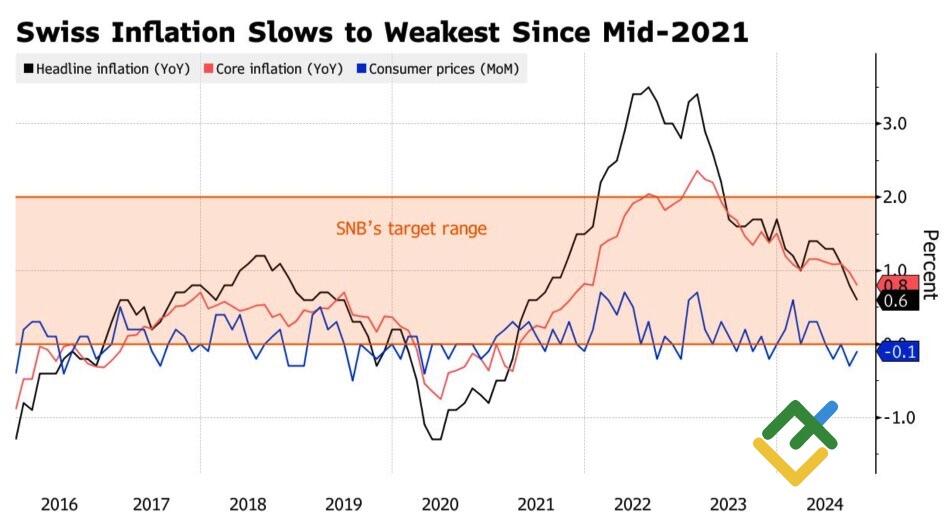

With inflation slowing to 0.6% in October, the lowest level since 2021, the futures market is pricing in a 50bp cut in December to 0.5% with a probability of around 30%. The odds of a smaller move of 25 bp are estimated at 70%.

Swiss Inflation Change

Source: Bloomberg.

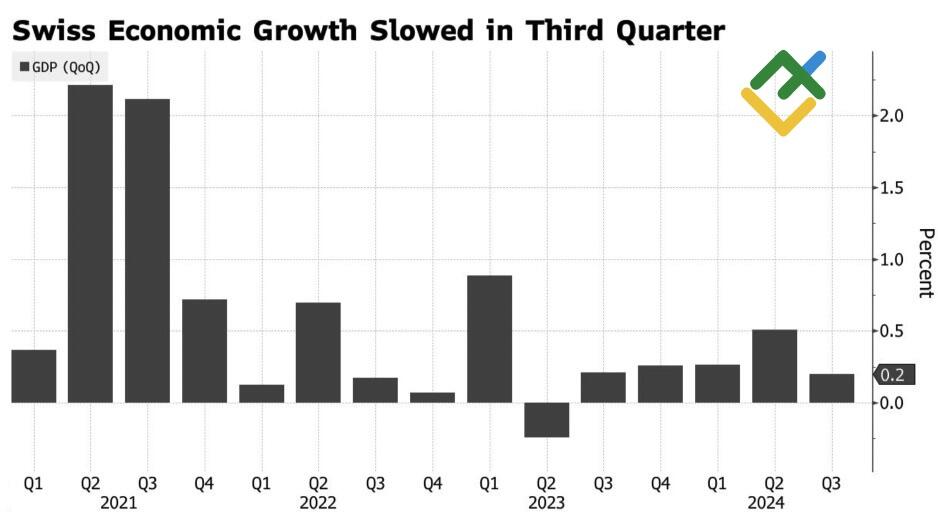

The SNB’s hawkish stance may also stem from the strengthening of the franc in the first half of the year. As a result, the export-oriented economy lost momentum in the third quarter, with GDP slowing from 0.5% to 0.2%. So far, growth in the services sector has offset the struggling industrial sector. In addition, Donald Trump’s trade tariffs threaten to hurt the eurozone, Switzerland’s main trading partner. The franc will also suffer losses.

Swiss GDP

Source: Bloomberg.

Can the escalating geopolitical tensions in Eastern Europe improve the situation? In the short term, it can. Martin Schlegel acknowledges that the Swiss franc’s safe-haven status tends to make it stronger when uncertainty rises, but the SNB has tools to counter excessive franc appreciation. It was a clear sign of currency intervention, which is likely to disappoint USDCHF bears.

Monthly USDCHF Trading Plan

Geopolitical factors can trigger a correction in the pair but are unlikely to reverse the uptrend as it is based on different paces of economic growth and monetary policies. The USDCHF pair’s rally towards 0.9015 and 0.915 is likely to continue. Long trades can be considered if the price breaks through the resistance level of 0.886.

Price chart of USDCHF in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.