The US dollar has shown the strongest quarterly performance since 2022, and rising treasury yields have led to speculation about the performance of gold. The question remains whether it will regain investors’ favor and reach the $3,000 mark. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- Donald Trump’s policies put pressure on gold quotes.

- The Fed’s pause prevents the XAUUSD from rising.

- The precious metal is expecting a tough start to the year.

- Gold may collapse to $2,565 and $2,525 per ounce.

Monthly Fundamental Forecast for Gold

The gold market had a strong start to 2024, driven by active buying from central banks, geopolitical risks, strong demand for safe-haven assets, the Federal Reserve’s monetary easing cycle, and de-dollarization. Against these factors, gold has managed to hit several all-time highs and posted a 30% increase in November, the best performance since 1979. However, the victory of Donald Trump in the US presidential election and an expected pause in the Fed’s rate cuts forced XAUUSD bulls to retreat.

According to Gold Newsletter, gold prices are expected to soar in early 2025, driven by central bank purchases and the Fed’s return to monetary expansion. The optimism exhibited by gold enthusiasts is noteworthy. The futures market indicates a 91% likelihood that the Fed Funds rate will not be cut at the January Fed meeting, and the December FOMC forecasts signal a drop to 3.9% in 2025, compared to September’s 3.4%.

Optimistic forecasts point to a rise in gold prices to $3,000 per ounce in the second half of 2025. This scenario suggests a 13% rally in the XAUUSD, which would not be comparable to the 25% rally in 2024. Notably, this bullish scenario requires lower US Treasury yields and a weaker US dollar.

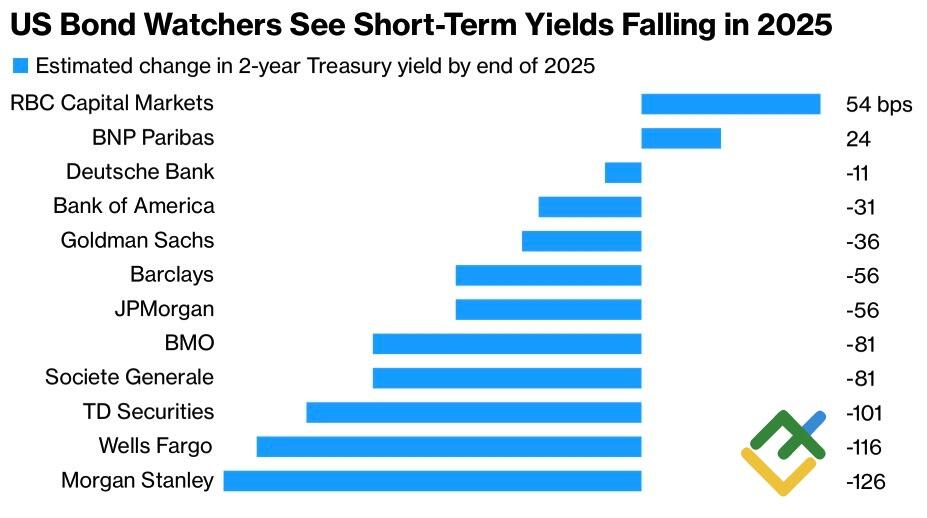

US Treasury Yield Forecast by Major Banks

Source: Bloomberg.

Major banks project that 2-year and 10-year US Treasuries will decrease by approximately 50 and 25 basis points to 3.75% and 4.25% in 2025, respectively. Gold, which does not generate interest income, tends to be bolstered by falling bond yields. However, given Wall Street strategists’ missteps in accurately predicting the debt market in 2024, there is a chance they could make the same mistakes twice.

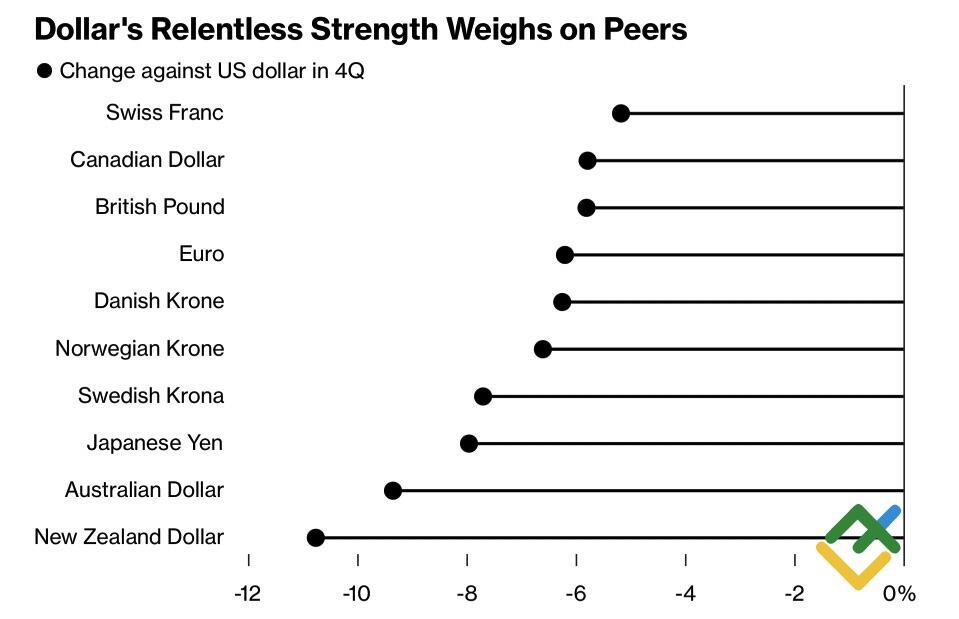

The primary pressure on the XAUUSD at the end of the current year is likely to come from the US dollar. The greenback has strengthened against the world’s major currencies in the fourth quarter, and there are currently no indications that the uptrend in the USD index will end. Given that gold is quoted in US dollars, a stronger USD could be a headwind for the precious metal.

US Dollar’s Performance Against Major Currencies

Source: Bloomberg.

The inauguration of Donald Trump will take place in January, and his policies of deregulation and fiscal stimulus will likely continue to boost the US economy. However, trade duties may temper GDP growth in other countries. This divergence in economic growth is expected to spur capital flows into the US, further strengthening the US dollar. As a result, the precious metal is projected to remain strong in early 2025.

Monthly Trading Plan for Gold

Short positions opened on the rise in gold quotes continue to generate profits. As a result, consider keeping them open. Short trades could be initiated on a rebound from $2,600, adding them to the ones opened near $2,715 per ounce. Consider opening more short positions with bearish targets at $2,565 and $2,525 per ounce.

Price chart of XAUUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.