Stellar is a blockchain network that primarily focuses on cross-border payments and remittances. Its native Lumens (XLM) token facilitates low-cost transactions, acting as an intermediary for currency exchange. The Stellar project is expanding partnerships with various financial institutions, including remittance-oriented companies and banking services. These strategic partnerships are expected to further solidify Stellar’s market foothold.

While experts’ forecasts on the price of Stellar Lumens in the short term are mixed, in terms of long-term investment, many analysts remain bullish. By 2030, experts predict Stellar Lumens will grow by more than 400% from current levels. While short-term volatility poses risks, the cryptocurrency’s broadening adoption and increasing number of partner projects could lead to significant long-term growth.

The article covers the following subjects:

Major Takeaways

- The current price of XLM is $0.29260 as of 25.03.2025.

- The XLM price reached its all-time high of $0.8756 on 2018-01-03. The cryptocurrency’s all-time low of $0.0004761 was recorded on 2015-03-05.

- In 2026, Changelly predicts an average XLM price of $0.47 and a maximum of $0.71 if the uptrend continues. In contrast, CoinCodex forecasts a range of $0.12 to $0.22.

- In 2027, forecasts vary significantly. Changelly anticipates an average price of $0.68, with upside potential reaching $0.89. On the other hand, CoinCodex sees a range of $0.12 to $0.16, projecting the crypto to embark on a downward trajectory.

- For 2030, Changelly anticipates XLM to climb to $2.95. In contrast, CoinCodex anticipates a maximum value of only $0.16. The future of Lumens remains highly uncertain.

- Between 2040 and 2050, Changelly forecasts the XLM token price to reach $287.96 by 2050, while CoinCodex expects it to slide to $0.006–$0.025.

XLM Real-Time Market Status

The current price of XLM is $0.29260 as of 25.03.2025.

In order to properly analyze XLM, it is essential to monitor the following key indicators:

- The market sentiment reflects the general opinion of market participants about XLM. A positive sentiment often signals heightened interest in an asset, potentially leading to an increase in its price.

- Trading volume over the last 24 hours serves as an indicator of an asset’s liquidity and market activity. High trading volume is a reliable indicator of significant investor demand.

- Price change over the last year. This is an indicator of asset volatility, which can be useful in assessing asset performance and possible investment risks.

- Market capitalization refers to the total value of all XLM in circulation. This metric is a key indicator of investor appetite for an asset.

- The circulating supply is the total number of tokens in circulation.

- The maximum supply indicates how many coins can be issued during the crypto’s lifespan. The scarcity of the coin supports its value.

These indicators offer comprehensive insights into the asset’s performance and investment appeal.

The following data is relevant as of 20.03.2025.

|

Metric |

Value |

|

Market capitalization |

$8.94 billion |

|

Trading volume over the past 24 hours |

$256.96 million |

|

All-time high |

$0.8756 |

|

Price change over the past year |

129.50% |

|

Circulating supply |

30.75 billion XLM |

|

Maximum supply |

50 billion XLM |

XLM Price Forecast for 2025 Based on Technical Analysis

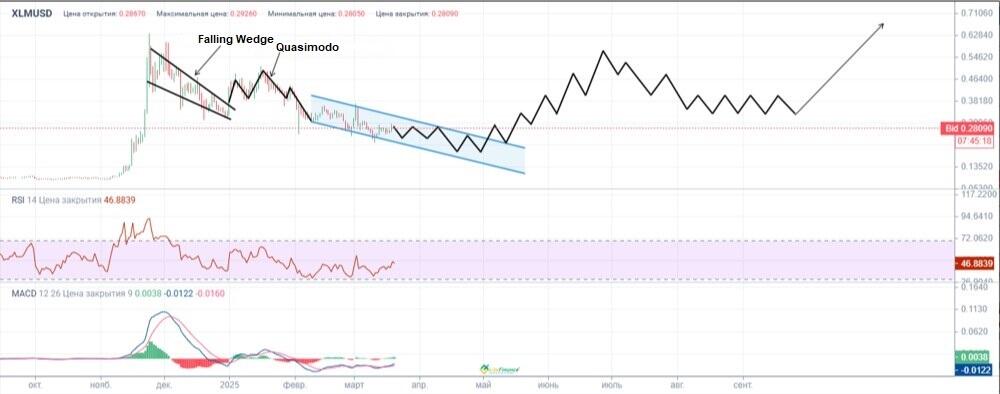

The Falling Wedge pattern emerged on the chart, and the price declined within this formation. After that, the cryptocurrency broke through the upward boundary of the Falling Wedge. The Quasimodo pattern can also be seen on the chart, signaling a trend reversal.

The RSI is rising, moving away from the oversold zone and consolidating in the neutral area. The indicator points to further upside for the asset.

The MACD line (blue) has crossed the signal line (red), indicating a downward trend reversal.

As a result, the price may pierce the upward boundary of the descending trading channel. If so, the XLM price will likely test the $0.48–$0.57 range in the middle of the year.

The following forecast extends until the end of 2025. It is crucial to remember that the cryptocurrency market is highly volatile, and the Stellar Lumens price is subject to corrections.

|

Month |

Minimum, $ |

Maximum, $ |

|

March |

0.22 |

0.37 |

|

April |

0.19 |

0.28 |

|

May |

0.21 |

0.40 |

|

June |

0.33 |

0.57 |

|

July |

0.40 |

0.51 |

|

August |

0.33 |

0.42 |

|

September |

0.33 |

0.40 |

|

October |

0.38 |

0.59 |

|

November |

0.50 |

0.60 |

|

December |

0.52 |

0.60 |

Long-Term Trading Plan for XLMUSD

According to the conducted technical analysis, the price of Stellar (XLM) will likely soar. The quotes have breached the upper boundary of the Falling Wedge pattern and rebounded from the swing lows.

Entry points:

- Secondary point: $0.18–$0.20 if the support level is tested.

- Main point: $0.22–$0.25 once the price leaves the trading channel.

Targets:

- Short-term target: $0.30–$0.36.

- Medium-term target: $0.40–$0.46.

- Long-term target: $0.50–$0.62.

Signals for locking in profits:

- The RSI reaches the overbought zone above 70.

- The price climbs to a strong resistance area of $0.50–$0.62.

Analysts’ XLM Price Projections for 2025

Stellar (XLM) price forecasts for 2025 vary. Let’s explore some of these predictions below.

CoinCodex

Price range in 2025: $0.1880–$0.4418 (as of 20.03.2025).

According to CoinCodex, high volatility is anticipated in the first half of 2025. In the latter half of the year, the XLM token is projected to trade within the range of $0.21 to $0.28, suggesting a phase of consolidation preceding further growth.

|

Month |

Minimum, $ |

Average, $ |

Maximum, $ |

|

March |

0.2636 |

0.3214 |

0.4025 |

|

April |

0.2936 |

0.3645 |

0.4418 |

|

May |

0.2323 |

0.2706 |

0.3214 |

|

June |

0.1946 |

0.2099 |

0.2273 |

|

July |

0.1880 |

0.2312 |

0.2767 |

|

August |

0.2413 |

0.2568 |

0.2834 |

|

September |

0.2160 |

0.2434 |

0.2776 |

|

October |

0.2516 |

0.2668 |

0.2842 |

|

November |

0.2117 |

0.2333 |

0.2562 |

|

December |

0.2137 |

0.2224 |

0.2310 |

Changelly

Price range in 2025: $0.248–$0.404 (as of 20.03.2025).

Changelly forecasts a gradual growth towards $0.331–$0.395 in the first half of the year. A correction is anticipated in the summer. In August, the price will embark on an upward trajectory again.

|

Month |

Minimum, $ |

Average, $ |

Maximum, $ |

|

March |

0.259 |

0.271 |

0.282 |

|

April |

0.331 |

0.363 |

0.395 |

|

May |

0.303 |

0.338 |

0.373 |

|

June |

0.299 |

0.317 |

0.335 |

|

July |

0.287 |

0.341 |

0.394 |

|

August |

0.320 |

0.362 |

0.404 |

|

September |

0.250 |

0.325 |

0.400 |

|

October |

0.248 |

0.283 |

0.318 |

|

November |

0.266 |

0.274 |

0.282 |

|

December |

0.266 |

0.275 |

0.284 |

LongForecast

Price range in 2025: $0.22–$0.48 (as of 20.03.2025).

LongForecast projects moderate growth for Stellar (XLM) in 2025. Following a correction in the summer, the price will likely recover by the end of the year, climbing to the range of $0.45–$0.48 in December.

|

Month |

Minimum, $ |

Average, $ |

Maximum, $ |

|

March |

0.23 |

0.30 |

0.36 |

|

April |

0.22 |

0.33 |

0.40 |

|

May |

0.29 |

0.34 |

0.37 |

|

June |

0.31 |

0.34 |

0.39 |

|

July |

0.28 |

0.33 |

0.36 |

|

August |

0.30 |

0.33 |

0.37 |

|

September |

0.33 |

0.36 |

0.39 |

|

October |

0.36 |

0.38 |

0.42 |

|

November |

0.37 |

0.40 |

0.43 |

|

December |

0.40 |

0.43 |

0.48 |

Analysts’ XLM Price Projections for 2026

Analysts offer mixed forecasts for XLM in 2026. Some experts anticipate an increase in XLM’s value, while others foresee corrections. Let’s examine the key forecasts from leading analytical platforms in this section.

CoinCodex

Price range in 2026: $0.1217–$0.2278 (as of 20.03.2025).

CoinCodex suggests that Stellar (XLM) will likely face corrections in 2026. The price will gradually decline from $0.20–$0.22 to $0.12–$0.13 by December. The average yearly price will hover near $0.1575.

|

Year |

Minimum, $ |

Average, $ |

Maximum, $ |

|

2026 |

0.1217 |

0.1575 |

0.2278 |

Changelly

Price range in 2026: $0.271–$0.636 (as of 20.03.2025).

Changelly analysts are bullish on the XLM price in 2026. The average yearly price will be $0.473. The yearly high is expected at $0.63 due to increased demand from institutional investors and the development of the Stellar blockchain ecosystem.

|

Year |

Minimum, $ |

Average, $ |

Maximum, $ |

|

2026 |

0.271 |

0.473 |

0.636 |

LongForecast

Price range in 2026: $0.44–$0.80 (as of 20.03.2025).

LongForecast anticipates a moderate upward trend for the Stellar token in 2026. The highest yearly price is expected in spring-summer when the asset is projected to consolidate above $0.70.

|

Year |

Minimum, $ |

Average, $ |

Maximum, $ |

|

2026 |

0.44 |

0.61 |

0.80 |

Analysts’ XLM Price Projections for 2027

In 2027, Stellar may experience both periods of growth and corrections. The key factors affecting the value of the asset will be the broader crypto market environment and demand for XLM.

CoinCodex

Price range in 2027: $0.121914–$0.166107 (as of 20.03.2025).

CoinCodex assumes that the Stellar Lumens (XLM) will maintain a moderately bearish trend in 2027. The projected average price will be $0.1386. Against this backdrop, traders may find it beneficial to consider short positions on the asset.

|

Year |

Minimum, $ |

Average, $ |

Maximum, $ |

|

2027 |

0.1219 |

0.1386 |

0.1661 |

Changelly

Price range in 2027: $0.544–$0.894 (as of 20.03.2025).

Changelly‘s forecast points to significant growth during 2027. Analysts predict XLM to surge by more than 200%. This projected growth can be attributed to the expansion of the Stellar ecosystem.

|

Year |

Minimum, $ |

Average, $ |

Maximum, $ |

|

2027 |

0.544 |

0.678 |

0.894 |

LongForecast

Price range in 2027: $0.57–$0.93 (as of 20.03.2025).

LongForecast analysts project that the XLM price will peak at $0.93 in the first half of the year, sliding to $0.57–$0.65 in the second half. Such market fluctuations may be related to the crypto market trends and demand for XLM.

|

Year |

Minimum, $ |

Average, $ |

Maximum, $ |

|

2027 |

0.57 |

0.72 |

0.93 |

Analysts’ XLM Price Projections for 2028

Analysts are divided on the future of Stellar. Some predict moderate growth, while others expect elevated volatility due to the shifts in the crypto market.

CoinCodex

Price range in 2028: $0.127423–$0.347571 (as of 20.03.2025).

CoinCodex analysts predict that Stellar (XLM) could exhibit both moderate drawdowns and rapid growth in 2028. During the year, price volatility is expected to be muted, but pronounced growth is expected in November and December, signaling a trend reversal.

|

Year |

Minimum, $ |

Average, $ |

Maximum, $ |

|

2028 |

0.127423 |

0.157616 |

0.347571 |

Changelly

Price range in 2028: $0.804–$1.34 (as of 20.03.2025).

According to Changelly, Stellar (XLM) will display a sustainable upward trend in 2028. The price may reach a new swing high in December.

|

Year |

Minimum, $ |

Average, $ |

Maximum, $ |

|

2028 |

0.804 |

0.988 |

1.340 |

LongForecast

Price range in 2028: $0.26–$0.61 (as of 20.03.2025).

LongForecast projects the XLM token to showcase mixed trading in 2028. The price is likely to decline until July. After that, the market is expected to recover.

|

Year |

Minimum, $ |

Average, $ |

Maximum, $ |

|

2028 |

0.26 |

0.37 |

0.61 |

Analysts’ XLM Price Projections for 2029

In 2029, XLM is projected to fluctuate widely between $0.1149 and $1.9300, mirroring elevated volatility throughout the year.

CoinCodex

Price range in 2029: $0.114978–$0.403247 (as of 20.03.2025).

According to CoinCodex, XLM will rise in early 2029, but then the piece is projected to correct. Later in the year, the asset may show high volatility, but the bullish trend will persist.

|

Year |

Minimum, $ |

Average, $ |

Maximum, $ |

|

2029 |

0.114978 |

0.214767 |

0.403247 |

Changelly

Price range in 2029: $1.17–$1.93 (as of 20.03.2025).

Changelly experts anticipate the average Stellar (XLM) price to trade around $1.49 in 2029. This growth will be driven by the global adoption of blockchain technology and an increase in the volume of transactions in the Stellar network. However, corrections are not ruled out.

|

Year |

Minimum, $ |

Average, $ |

Maximum, $ |

|

2029 |

1.17 |

1.49 |

1.93 |

CoinGape

Price range in 2029: $0.3907–$0.4171 (as of 20.03.2025).

CoinGape projects a slow but steady increase in XLM’s value. This projected growth can be attributed to Stellar’s leadership in the field of decentralized payments.

|

Year |

Minimum, $ |

Average, $ |

Maximum, $ |

|

2029 |

0.3907 |

0.4039 |

0.4171 |

Analysts’ XLM Price Projections for 2030

During 2030, XLM will likely trade within a wide range, making it an appealing asset for both long-term investors and short-term traders.

CoinCodex

Price range in 2030: $0.0396–$0.1602 (as of 20.03.2025).

CoinCodex forecasts that XLM will decline in the long term. At the same time, high volatility will likely persist, offering lucrative short-term trading opportunities.

|

Year |

Minimum, $ |

Average, $ |

Maximum, $ |

|

2030 |

0.0396 |

0.0797 |

0.1602 |

Changelly

Price range in 2030: $1.77–$2.95 (as of 20.03.2025).

Changelly analysts are optimistic about the Stellar Lumens token. The XLM rate will surge due to the widespread adoption of Stellar blockchain in global payment systems and the high demand for decentralized solutions.

|

Year |

Minimum, $ |

Average, $ |

Maximum, $ |

|

2030 |

1.77 |

2.19 |

2.95 |

CoinGape

Price range in 2030: $0.4172–$0.4436 (as of 20.03.2025).

Analysts at CoinGape expect Stellar to grow in 2030. The average price may reach $0.4291, and moderate rate fluctuations are expected.

|

Year |

Minimum, $ |

Average, $ |

Maximum, $ |

|

2030 |

0.4172 |

0.4291 |

0.4436 |

Analysts’ XLM Price Projections Until 2050

According to CoinCodex, Stellar (XLM) will trade between $0.0225 and $0.1443 in 2040 and $0.0066 and $0.0256 in 2050. The asset’s value is expected to show a significant decline.

Changelly projects that XLM could reach a range of $25.18–$219.97 in 2040 and $187.44–$287.96 by 2050. The forecast suggests strong growth, especially between 2040 and 2050, confirming Stellar’s long-term prospects.

CoinGape analysts forecast moderate growth for XLM. The asset will trade at $0.5496–$0.5760 in 2035, $0.6820–$0.7085 in 2040, increasing to $0.9470–$0.9734 by 2050. The Stellar network is expected to expand, deploying in various financial sectors.

|

Year |

CoinCodex, $ |

Changelly, $ |

CoinGape, $ |

|

2035 |

– |

– |

0.5615 |

|

2040 |

0.0406 |

195.15 |

0.6875 |

|

2050 |

0.0127 |

265.18 |

0.9605 |

Experts give mixed forecasts for the Stellar (XLM). However, most of them concur that the cryptocurrency’s trajectory will depend on the project’s technological development and popularity among users and developers. At the same time, the high volatility of the crypto market poses challenges to long-term predictions; however, XLM demonstrates considerable potential due to its integration into international payment systems.

Market Sentiment for XLM (Stellar) on Social Media

Social media sentiment analysis involves evaluating users’ opinions on different assets.

According to OKX, there were 6,800 posts about Stellar in the past 24 hours, and the number of social media interactions was 5.5 million. The sentiment score for Stellar is 84%, indicating a positive perception of the asset within the community.

User Prashora notes that Stellar (XLM) grew from $0.002 in 2014 to an all-time high of $0.87 in 2018. The user believes that XLM will showcase continued growth.

CRYPTO TISA predicts a decline in the rate of XLM. On the chart, Stellar formed a narrowing Falling Wedge.

According to Social media sentiment analysis, Stellar (XLM) is quite popular on social media platforms, which may set the stage for future developments and improvements.

XLM Price History

Stellar (XLM) reached its all-time high $0.8756 on 2018-01-03.

The lowest price of Stellar (XLM) was recorded on 2015-03-05 when the price declined to $0.0004761.

Below is a chart showing the performance of XLMUSD over the last ten years. In this connection, it is important to evaluate historical data to make predictions as accurate as possible.

- Between 2017 and 2021, XLM experienced significant price fluctuations, reaching $0.79 in May 2021 amid the overall growth of the crypto market. However, the price declined to $0.26 by the end of the year, following the global market correction.

- In 2022, a market downturn led to a further decline in Stellar’s value to $0.09, aligning with negative trends in the crypto industry.

- In 2023, the XLM exchange rate began to recover, with an average price increasing to $0.12.

- In 2024, Stellar’s exchange rate was influenced by macroeconomic factors and regulatory policies. However, strategic partnerships with VISA and MoneyGram helped to support demand for the token, resulting in a significant increase in the XLM exchange rate.

XLM Price Fundamental Analysis

The Stellar (XLM) rate is shaped by multiple factors, such as market demand and technological breakthroughs. The regulatory landscape and broader economic trends also play a critical role. New strategic partnerships and advancements in blockchain technology have a substantial impact, influencing demand and attracting additional investors.

What Factors Affect the XLM Price?

- Market demand. Adoption of XLM can boost the asset’s quotes.

- Technological advancements. Updates to protocols can enhance the efficiency and appeal of XLM.

- Third-party anchors. Organizations that link the blockchain to external financial systems are critical to Stellar’s performance.

- Regulatory framework. Crypto regulation directly affects the XLM price.

- Partnerships and tokenization. New partnerships drive demand for the coin.

- Global economy. In economically unstable regions, XLM may become a more attractive alternative, which increases demand.

More Facts About XLM

Stellar (XLM) was launched in 2014 to create a platform for efficient cross-border payments. Jed McCaleb and Joyce Kim, the project’s founders, designed Stellar as an open and decentralized blockchain network with the aim of facilitating faster and more cost-effective financial transfers between users and financial institutions.

The growth in value of XLM can be attributed to strategic partnerships with prominent companies such as IBM and its active support for government initiatives. XLM is a widely used cryptocurrency in the financial industry for money transfers and international payments. The blockchain technology behind XLM has garnered the attention of banks and financial institutions seeking cost-effective alternatives to traditional transaction methods.

Stellar’s popularity among traders can be attributed to its technological advantages and its focus on integration into traditional finance. Its instant transactions and low fees make XLM an attractive choice for both large banks and retail users, especially in developing countries.

Advantages and Disadvantages of Investing in XLM

Advantages:

- Low transaction fees. Stellar offers extremely low fees, making it attractive for cross-border payments and microtransactions, especially in developing countries.

- High speed. Transactions on the Stellar network are completed almost instantly, which is significantly faster than traditional wire transfers. This is a key factor for users and businesses that value speed.

- Partnerships and integration. Strategic partnerships and seamless integration with other systems are key to Stellar’s success. Strategic partnerships with prominent entities such as IBM and MoneyGram contribute to XLM’s strengthening market position.

- Open and decentralized network. Stellar’s commitment to financial inclusivity, making it an attractive option for users without access to traditional banks, is a key differentiator. Decentralization helps eliminate third-party control, making payments more secure.

- Technical support and development. Stellar is a dynamic entity, actively supported by the Stellar Development Foundation, which contributes to its innovative growth. This commitment to innovation has attracted significant investor interest and has a positive effect on the coin’s exchange rate.

Disadvantages:

- High volatility. As with many cryptocurrencies, XLM is subject to significant rate fluctuations, which pose significant risks to investors.

- Competition. Ripple (XRP), Stellar’s primary competitor, also provides cross-border payment solutions, which may hinder Stellar’s growth potential.

- Regulatory risks. Regulatory policies and restrictions on cryptocurrencies may negatively impact the XLM exchange rate.

- Dependence on partnerships. The success of Stellar depends on maintaining existing partnerships and establishing new ones. The loss of significant partnerships could have a negative impact on the value of XLM.

- Low adoption in some regions. XLM’s adoption remains limited in certain regions, constraining its global expansion and potential.

How We Make Forecasts

We employ a comprehensive approach that combines fundamental and technical analysis to forecast XLM prices.

Short-term forecasts consider current market sentiment, trading volumes, chart patterns, and indicators such as the RSI and MACD.

Medium-term forecasts rely on fundamental factors, including partnership agreements, technology upgrades, and regulatory changes. The impact of macroeconomic events is also analyzed.

Long-term forecasts are made by considering the prospects of network development, technology adaptation in various industries, the conclusion of key agreements, as well as the general trend of the cryptocurrency market.

Conclusion: Is XLM a Good Investment?

XLM is a promising asset due to its high-speed transactions and partnerships with large financial firms. However, due to its high volatility and the potential for regulatory risks, this asset is best suited for trading rather than investing.

Its long-term potential depends on the adoption of Stellar by global payment systems and the demand for its technology. Investors willing to assume a high level of risk may find XLM a lucrative investment opportunity.

XLM Price Prediction FAQs

The price of XLM may fluctuate due to macroeconomic factors, news related to cryptocurrencies, and general crypto market sentiment. The cryptocurrency market’s relative youth and its rapid response to external events contribute to XLM’s high volatility.

Regulatory changes, especially in the US and the EU, can promote or hinder the growth of XLM. The cryptocurrency’s global adoption and its future rate depend on the actions of regulators.

The current price of Stellar is $0.29260 as of 25.03.2025.

According to CoinCodex, the XLMUSD will trade between $0.1789 and $0.4417 in 2025. Under favorable market conditions, the crypto may grow higher, especially against the backdrop of partnership development and Stellar technology adoption.

According to Changelly, XLM could grow to $0.404 in 2025. Gradual growth is expected due to the expansion of the Stellar ecosystem and an increase in the number of network users.

Long-term forecasts vary. Changelly suggests that XLM could reach $2.95 by the end of 2030, while CoinCodex provides a more conservative estimate of $0.16. The actual price will depend on technology adoption and market trends.

Some analysts believe that Stellar will grow significantly amid the mass adoption of blockchain solutions. However, CoinCodex points to a potential depreciation by 2050, signaling high risks.

XLM has great potential because it is accessible to users outside the banking system, making it in demand in developing countries where the banking infrastructure is inefficient. Unique features and high transaction speeds support XLM’s future.

Price chart of XLMUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.