A reversal of capital spillover from the US to Europe is unlikely to be sufficient to restore the S&P 500 index’s uptrend. The broad stock index exhibits numerous vulnerabilities. Let’s discuss this topic and develop a trading plan.

The article covers the following subjects:

Major Takeaways

- Capital outflows are driving the S&P 500 index down.

- Corporate reporting in the US leaves much to be desired.

- The US economy is slowing down.

- Short trades can be considered on the S&P 500 index with a target of 5,500.

Weekly Fundamental Forecast for S&P 500

Investors have finally given up hope for assistance from Donald Trump and the Fed. Treasury Secretary Scott Bessent has stated that the current correction is normal, and the S&P 500 index is expected to grow in the long term. Fed officials are hesitant to cut rates due to the potential for rising inflation triggered by tariffs. Meanwhile, the stock market leaves much to be desired.

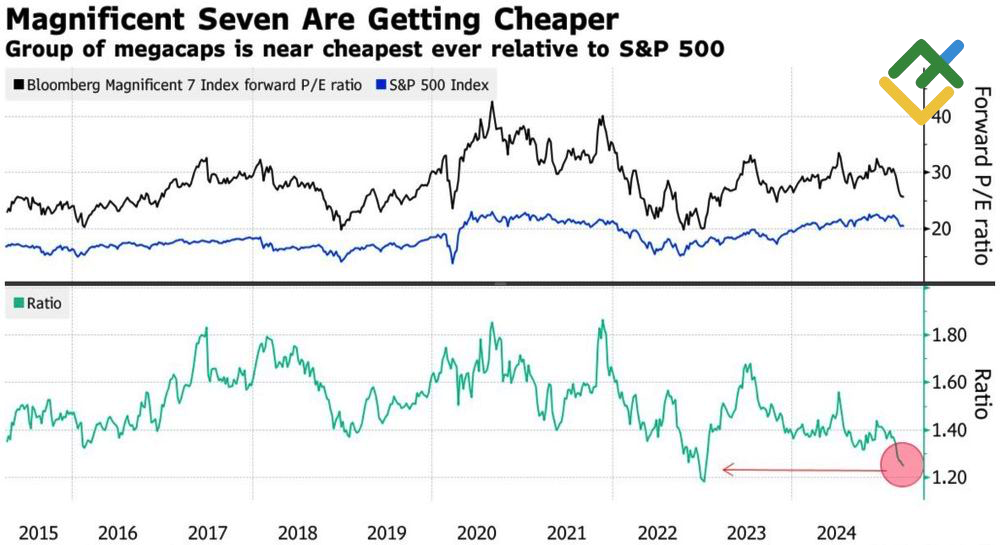

The decline in the S&P 500 index is due to a number of factors, not just the reversal of the Trump trade. The broad stock index’s loss of $4 trillion in capitalization from its February peak levels is due to capital flight from the US. The initial shockwave hit the overvalued companies comprising the Magnificent Seven. Their price-to-earnings (P/E) ratio soared to 45 at the end of winter, but by the end of March, it plunged to 35. The differential between the S&P 500 and these overvalued companies reached a two-year low.

Magnificent 7 P/E Ratio and S&P 500 Index Performance

Source: Bloomberg.

At the core of this process is the waning American exceptionalism. Competitors such as China’s DeepSeek and BYD are successfully displacing market leaders like NVIDIA and Tesla. Meanwhile, other US heavyweights have also faced challenges from formidable competitors.

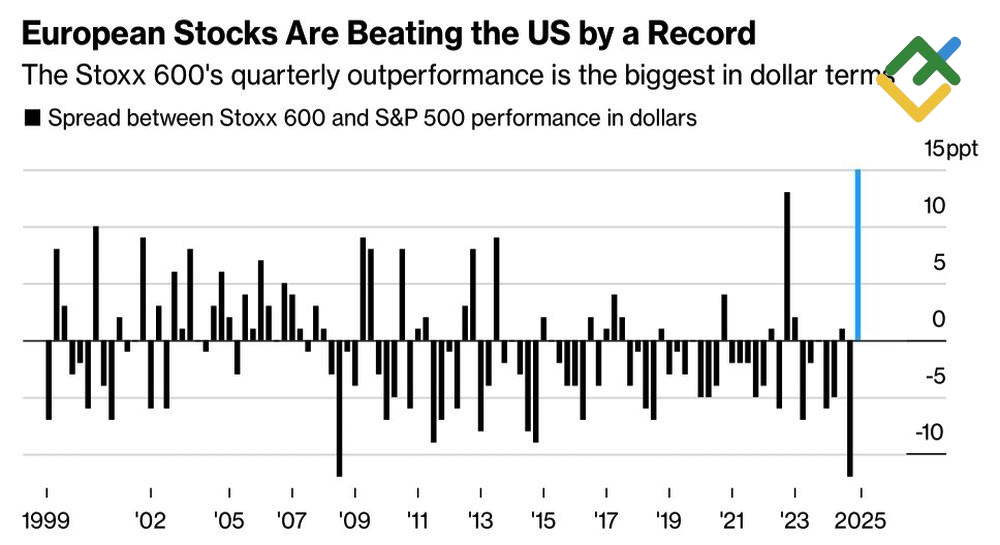

Europe has historically offered attractive investment opportunities, and the combination of Donald Trump’s policy uncertainty and Germany’s substantial fiscal stimulus has prompted investors to explore opportunities in Europe. According to Black Rock, the outperformance of the EuroStoxx 600 over the S&P 500 is not expected to persist. A select group of banks and defense industry companies will benefit from the adjustment of the so-called fiscal brake. Their US competitors will get used to the tariffs and benefit from the White House’s clarification of its trade policy.

Spread Between EuroStoxx 600 and S&P 500

Source: Bloomberg.

This perspective is in contrast to UBS’s forecast that the US economy will not face any significant headwinds after April 2. The US President will provide time for research and negotiations. As a result, an additional delay is expected to boost EU stock indices.

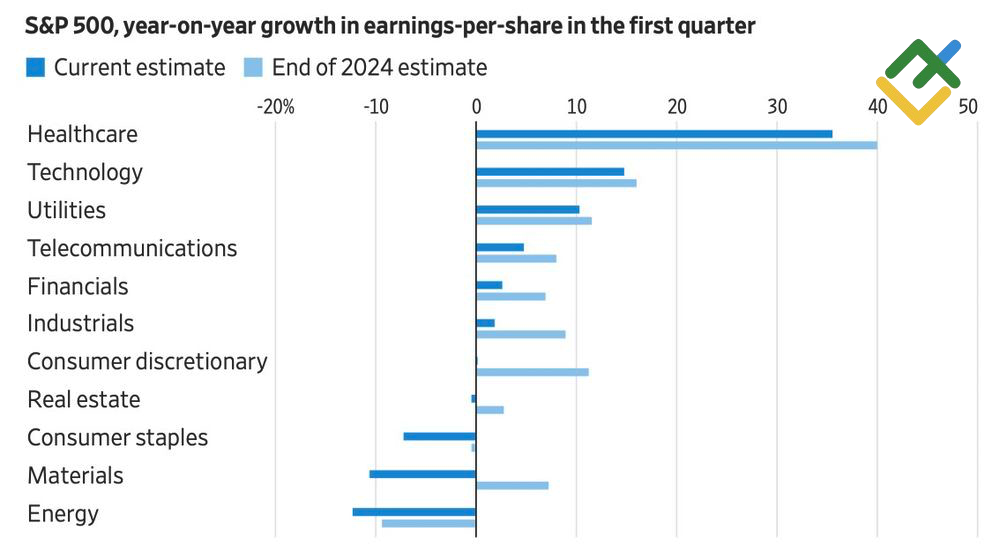

In the US, the first quarter corporate reporting season is about to begin, and the consensus estimate for earnings of 7.1% appears promising. However, in late 2024, the figure stood at 11%. A 4% drop in the forecast is unfavorable for the S&P 500 index, as this figure is above the historical average. In addition, growth estimates for 9 out of 11 sectors have been revised downwards.

S&P 500 Growth Estimates by Sector

Source: Wall Street Journal.

Weekly Trading Plan for S&P 500

When considering the slowdown in US GDP, the capital flight from the Magnificent Seven and US stocks, and the deteriorating outlook for corporate reporting, it becomes clear that the S&P 500 index does not have enough strength to restore the uptrend. Against this backdrop, the broad stock index can be sold with the target located at the lower boundary of the consolidation range established between 5,500 and 5,790.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of SPX in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.