In 2025, the broad stock index rose thanks to less aggressive tariffs from Donald Trump than expected, strong corporate earnings, and a solid economy. However, these drivers seem no longer valid for the S&P 500. Let’s discuss it and make a trading plan.

The article covers the following subjects:

Major Takeaways

- Tariffs and DeepSeek shock have undermined American exceptionalism.

- The S&P 500 is lagging European indices due to hopes for peace in Ukraine.

- High interest rates, slowing U.S. GDP, and tariffs increase the risk of a pullback.

- A drop in the S&P 500 below 6,082 will be a signal to sell.

Weekly Fundamental Forecast for S&P 500

Buy now or miss out! The fear of missing out (FOMO) in 2025 is driving the U.S. stock market, allowing the S&P 500 to reach several record highs. The broad stock index has managed to withstand both Donald Trump’s trade threats and the DeepSeek shock, which damaged the reputation of tech giants, and attracted new investors. However, they could ultimately shake things up.

The higher the price at which you bought into the S&P 500, the more nervous you might feel about upcoming storms. At any moment, late-stage bulls may exit the market. However, according to 22V Research, the U.S. stock market is much more resilient to shocks now than it was during Donald Trump’s first presidential term or the COVID-19 pandemic. Back then, those factors accounted for over 70% of all the movements in the broad stock index. Now, investors are focusing on a much broader range of factors, from geopolitics to corporate earnings.

This could explain the S&P 500’s bounce after a dip caused by tariff threats and the DeepSeek issue. What doesn’t kill us makes us stronger. The stock market has learned from those events. China’s competitor to NVIDIA forced investors to diversify their portfolios, shifting capital from the Magnificent Seven stocks toward other assets. At the same time, Donald Trump’s tariff delays became the main driver behind the rally in the highly overvalued broad index.

P/E Ratio Dynamics for the S&P 500

Source: Wall Street Journal.

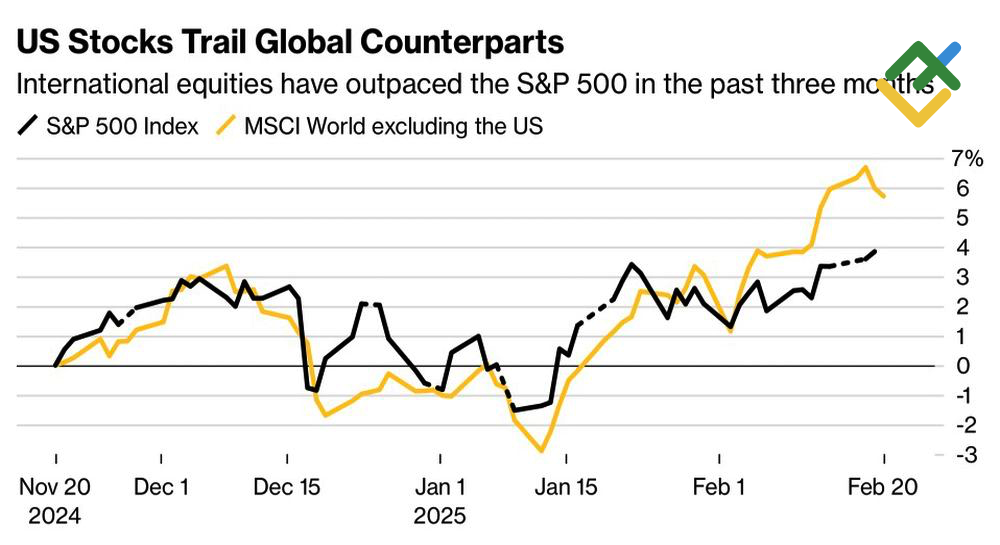

However, such major shocks leave their mark. The shift of capital from North America to Europe, coupled with hopes for the end of the conflict in Ukraine, has allowed European stock indices to outperform the S&P 500. For instance, the German DAX 40 has risen 12% since the beginning of the year, outpacing its American counterpart by three times. Thanks to Europe, the global stock market has outrun the U.S. stock market.

S&P 500 and Global Stock Market Dynamics

Source: Bloomberg.

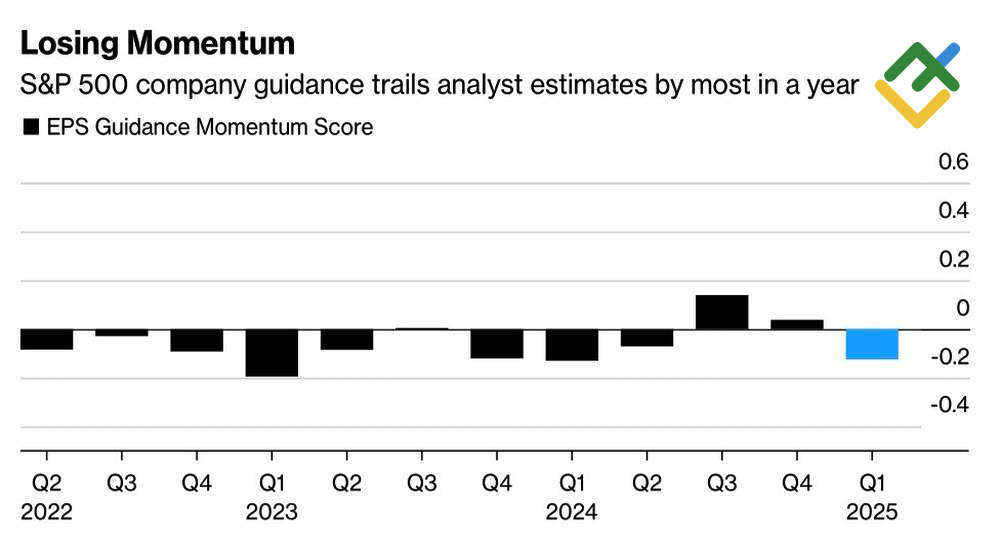

Investors are wary of Donald Trump’s ideas, remembering how his trade wars slowed U.S. GDP during his first term. Compared to Wall Street analysts, the CEOs of the issuing companies are far more pessimistic about the S&P 500’s outlook. The gap in their views is at extreme levels, the largest in at least a year.

Forecast Dynamics for the S&P 500

Source: Bloomberg.

Weekly Trading Plan for S&P 500

The rally in the broad stock index is losing steam. The prolonged hold of the Federal Reserve’s federal funds rate at 4.5%, signs of a slowing U.S. economy, and the end of Donald Trump’s tariff delays could trigger a correction in the S&P 500, followed by consolidation. A drop below the support level of 6,082 would be a signal to sell.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of SPX in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.