Donald Trump’s policies seem entirely favorable to the S&P 500, but that is not so. Although deregulation and fiscal stimuli will accelerate GDP and boost corporate profits, there is also a fly in the ointment. Let’s discuss it and make a trading plan.

The article covers the following subjects:

Major Takeaways

- Major banks forecast a 10% rally in the S&P 500 in 2025.

- Many positive factors have already been priced in, but the negative ones have not.

- The initial reaction of the stock index to the inauguration is important.

- A drop below 5,920 will be a reason to sell the S&P 500.

Weekly Fundamental Forecast for S&P 500

The stock market has some concerns regarding Donald Trump’s inauguration. While the S&P 500 soared after the Republican’s election victory, hoping fiscal stimulus and deregulation could boost the U.S. economy, investors are beginning to recognize that not all Republican policies are beneficial. Proposals such as import tariffs and anti-immigration measures present clear challenges, acting as a fly in the ointment. Import tariffs and anti-immigration measures are a fly in the ointment. These factors are yet to be fully reflected in the stock index’s valuations.

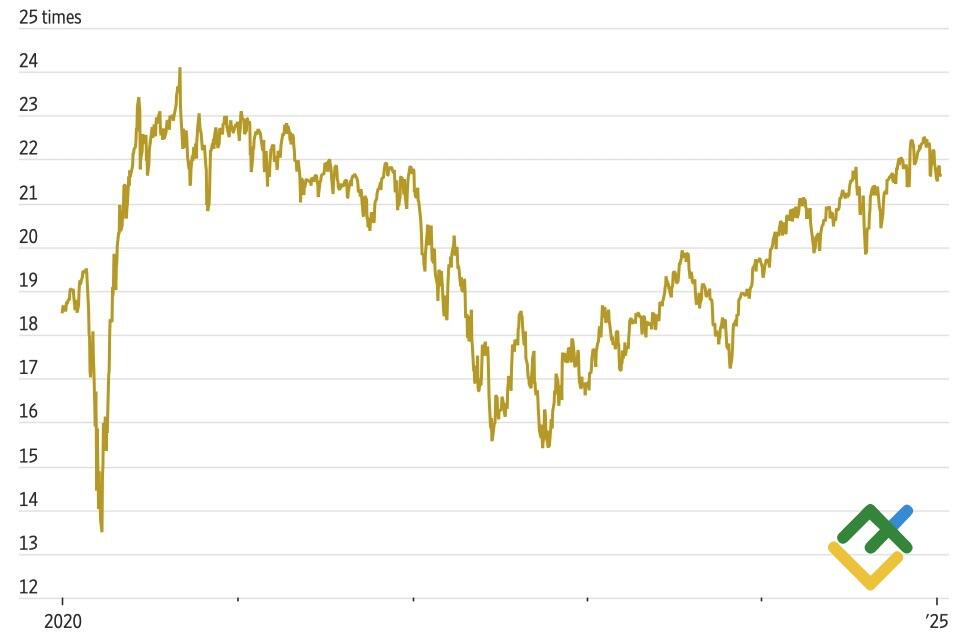

When the S&P 500 rose in the fourth quarter, investors dismissed the rapid rally in Treasury yields, seeing it as a byproduct of expectations for a stronger economy. However, their sentiment shifted by early 2025. Could a spike in 10-year yields to 5% indicate that GDP growth has hit a ceiling? A higher climb does not look plausible, while further stimulus could accelerate inflation, forcing the Fed to pause its expansionary cycle for a long period. Such a scenario will unlikely benefit the stock index that already appears overvalued.

S&P 500 and P/E Ratio

Source: Wall Street Journal.

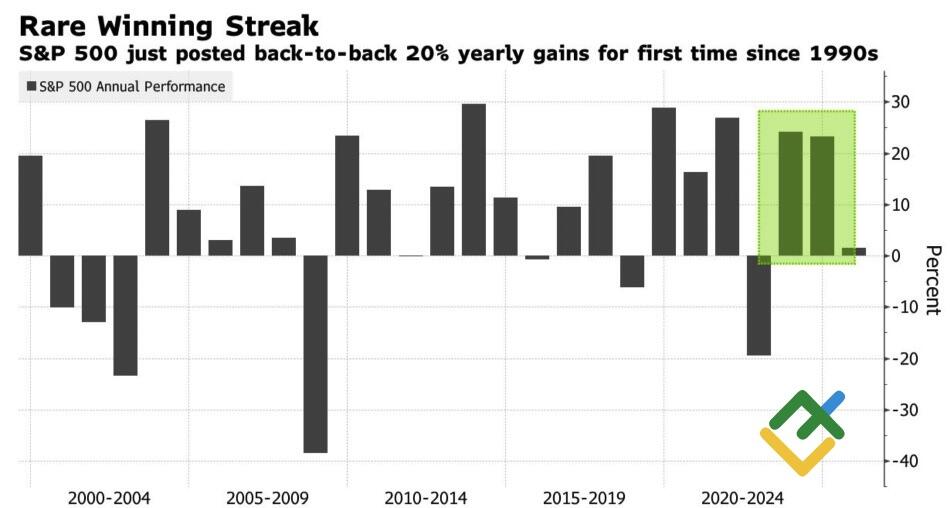

Although 61% of 553 investors surveyed by MLIV Pulse expect the S&P 500 to grow by the end of 2025, major banks provide more cautious estimates, the consensus forecast being 6,550—10% more than the current level. Deutsche Bank’s estimate of 7,000 is the highest, while Societe Generale’s forecast of 5,800 is the most “bearish” one. Bank of America sees a 20% rally as a shock scenario.

S&P 500 Yearly Dynamics

Source: Bloomberg.

The S&P 500 has not strengthened 20% or more for three consecutive years in the 21st century. However, Bank of America believes that several factors — such as a productivity boom, corporate tax cuts, a steady outflow of capital from passive funds, limited investment alternatives, and increased domestic production driven by tariffs — could push the index higher.

In my view, the trajectory of the S&P 500 will largely depend on the U.S. economy, which continues to be influenced by policies associated with Donald Trump. While the 2024 rally in the S&P 500 might have been fueled by a “Goldilocks” environment — characterized by GDP resilience to the Federal Reserve’s aggressive rate hikes in 2022–2023 and a moderation in inflation — the outlook in early 2025 looks less favorable. The risks of rising CPI and PCE have increased, and strong economic data has started negatively impacting stocks.

Weekly Trading Plan for S&P 500

The first reaction is always a key factor. According to Bloomberg insider information, Donald Trump has already prepared about a hundred executive orders, and many of them will certainly be related to tariffs. The stock index may start correcting if potential trade wars are not factored in the S&P 500 quotes. A fall below 5,920 may trigger sell-offs. Conversely, if the situation turns out better than expected, the index may rally, making buying above 5,975 a good strategy.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.