The erosion of American exceptionalism and capital flight are direct consequences of Donald Trump’s policy. His tariffs threaten the US economy rather than bringing in the “golden age of America.” Let’s discuss this topic and make a trading plan for the S&P 500 index.

The article covers the following subjects:

Major Takeaways

- US GDP may contract in Q1.

- US bonds outperform stocks.

- European stock indices are outpacing the S&P 500 index.

- Short trades formed at $6,082 should be kept open until tariffs are canceled.

Weekly Fundamental Forecast for S&P 500

Are US stock indices falling because of the approaching recession in the US economy, or are recession fears pushing the S&P 500 lower? The loss of American exceptionalism and capital outflows have cost the US $3.4 trillion. That’s how much capitalization has fallen from its February highs. Tariffs against Mexico and Canada have dealt another blow.

As a rule, stock indices are a reliable barometer for the health of the US economy. Investors are particularly anxious in light of the Federal Reserve Bank of Atlanta’s projection of a 2.8% contraction in US GDP in the first quarter. The unpredictability of White House policy is a significant concern for American businesses, particularly in light of retaliatory tariffs imposed by other countries.

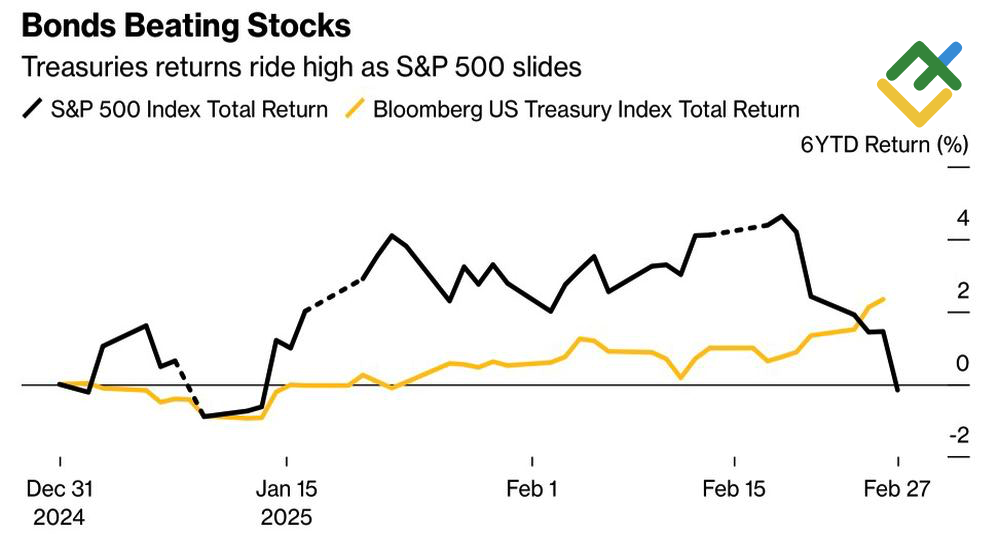

Significant cuts to the state apparatus compound the challenges, as import duties during President Donald Trump’s first term had a similar effect, causing investors to shift from equities to bonds. This shift in capital from the stock market to the bond market contributes to the decline in the S&P 500 index.

US Stocks and Treasury Bond Returns

Source: Bloomberg.

Moreover, European stock indices have outperformed their US counterparts for three consecutive months. Severe undervaluation, expectations of fiscal stimulus from Germany and the EU, and the continuation of the ECB’s monetary expansion cycle have served the EuroStoxx 50 and its peers well. Capital is flowing from North America to Europe, keeping the S&P 500 under pressure.

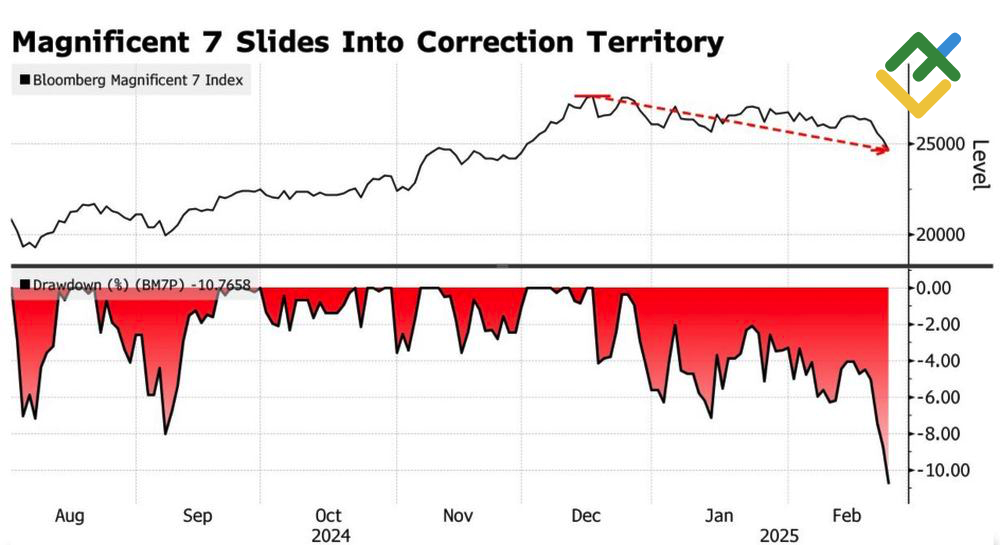

The strategy of investing in the Magnificent Seven stocks, which had previously yielded over 50% in 2023–2024, has lost its allure. These stocks were the first to enter a correction phase due to fierce competition from Chinese AI firms.

Magnificent 7 Index

Source: Bloomberg.

Concerns about a recession and capital outflows are weighing on the S&P 500 index. What factors could potentially support the market? A potential catalyst could be President Donald Trump, who, during his previous term, repeatedly referenced equity markets as a barometer for his performance. He mentioned stock indices 156 times between 2016 and 2020, including 60 times during his first year in office. In a recent study, there has been only a single mention in his 126 posts on social media since November 2024!

Weekly Trading Plan for S&P 500

The more aggressive Trump’s protectionist policies are, the more significant the decline in the S&P 500 index will be. If tariffs are not canceled or postponed in the coming days, it is better to keep your short positions formed at $6,082 open. Any postponements in tariffs or agreements will create opportunities for profit-taking and opening long positions. There is a high probability of consolidation in the broad stock index, which would allow traders to implement a “buy low, sell high” strategy.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of SPX in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.