By Maximilian Heath and Daniela Desantis

BUENOS AIRES/ASUNCION (Reuters) – South America’s agricultural sector, a key source of global food, celebrated on Friday as the regional Mercosur bloc and the European Union struck a free trade agreement, though farmers said they wanted to see the small print of the deal.

The agreement was reached after 25 years of negotiations, in Uruguay’s capital, Montevideo, that were attended by the President of the European Commission, Ursula von der Leyen, and the leaders of Argentina, Uruguay, Paraguay and Brazil, the four member states of the South American bloc.

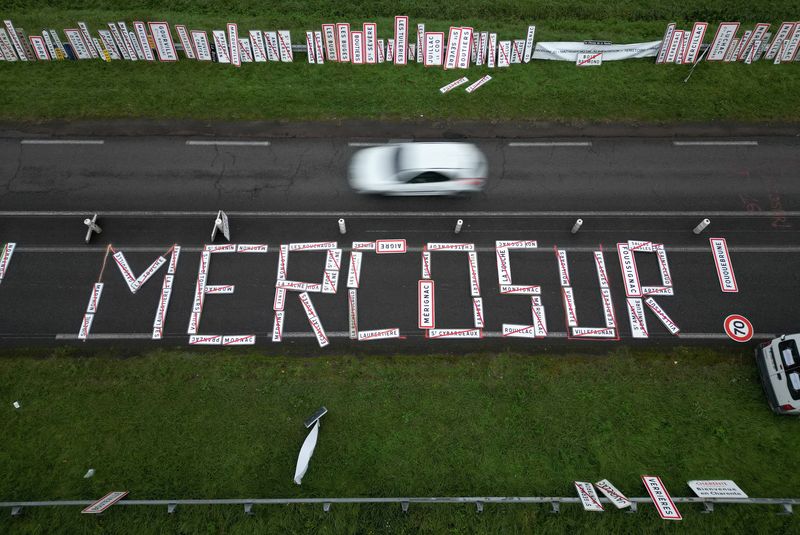

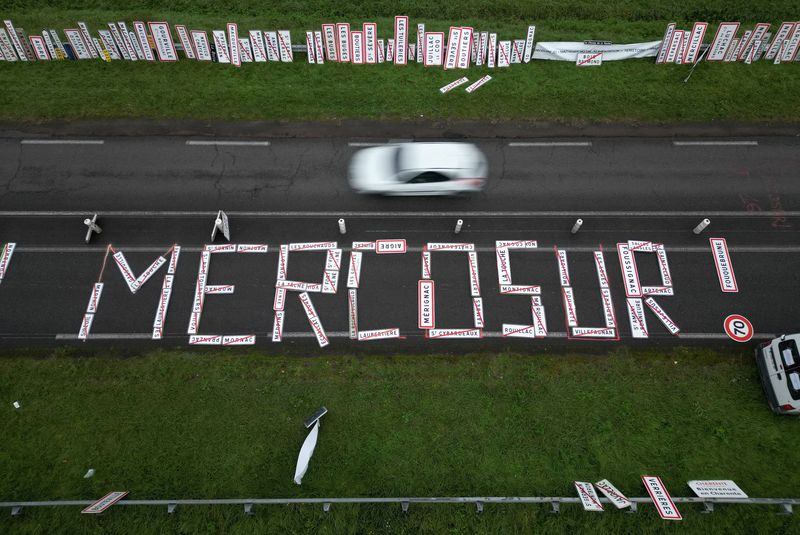

The deal still faces a lengthy process to be ratified and go into effect, which could take years. It could get blocked with France a staunch opponent, in part over fears of increased South American farm goods arriving in Europe.

“Any market opening is favorable, I think it’s an opportunity, but you have to look at the fine print, what the conditions are,” Carlos Castagnani, president of the Argentine Rural Confederations, told Reuters.

“We have to ensure that our way of producing is respected.”

Argentina is the world’s top exporter of processed soy, the no. 3 for corn, and a key supplier of wheat and beef.

South American farmers and exporters are keen to have greater access to the huge European market. However, fears that environmental clauses will limit trade and opposition from some EU countries to the agreement have dampened expectations.

Among the European demands are limits on the use of genetically modified seeds and deforestation, which have been common practices in South America in recent decades.

Argentina’s grain exporters and processors’ chamber CIARA-CEC said that while the agreement was a positive step for the bloc, its real impact would not be immediate.

Products such as oil or biodiesel, will only see significant tariff reductions starting in seven to ten years, CIARA-CEC president Gustavo Idigoras told Reuters.

Argentina was over a decade ago the world’s largest supplier of biodiesel, but was hit badly by European tariffs and other protectionist measures.

The agreement is important for South America’s producers to stay competitive, with major economies around the world threatening protectionist policies, said Pedro Galli, member of the Rural Association of Paraguay, a key soybean exporter.

However, Hector Cristaldo, president of the Union of Production Guilds, the main association of Paraguayan soybean producers, called for calm as the final text gets finalised and emphasized the complexity of the process that awaits the deal.

(Report by Maximilian Heath and Daniela Desantis)

This post is originally published on INVESTING.