The USDCHF pair has slumped to a 10-year low due to heightened demand for safe-haven assets amid trade tensions. However, as the situation de-escalated, the franc lost its allure. The central bank’s discontent further complicates the existing situation. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- The franc was the best-performing G10 currency in April.

- The US-China deal has triggered a correction in the USDCHF pair.

- The SNB does not rule out a return to negative rates.

- Long trades on the EURCHF pair can be considered with targets at 0.9525 and 0.9615.

Monthly Fundamental Forecast for Franc

There is only one step from the sublime to the ridiculous. In April, the franc surged and became the top-performing G10 currency, driven by the collapse of US stocks and a surge in demand for safe-haven assets. The USDCHF pair plummeted to a 10-year low amid the US administration’s introduction of large-scale tariffs on America’s “Liberating Day.” However, the de-escalation of trade conflicts and a 17% rally in the S&P 500 index allowed investors to flee safe havens, dealing a severe blow to the Swiss franc.

The strengthening of the franc was not a component of the Swiss National Bank’s strategic plans. Chairman of the Governing Board of the Swiss National Bank (SNB) Martin Schlegel has stated that the Swiss currency’s exchange rate is overvalued, noting that the SNB has never abandoned the practice of intervening in the Forex market. Notably, the central bank refrained from taking such action in 2024. During Donald Trump’s first tenure as president, the US administration blacklisted Switzerland as a currency manipulator. However, the Treasury Department has included it in a list of 15 countries prioritized for trade agreements.

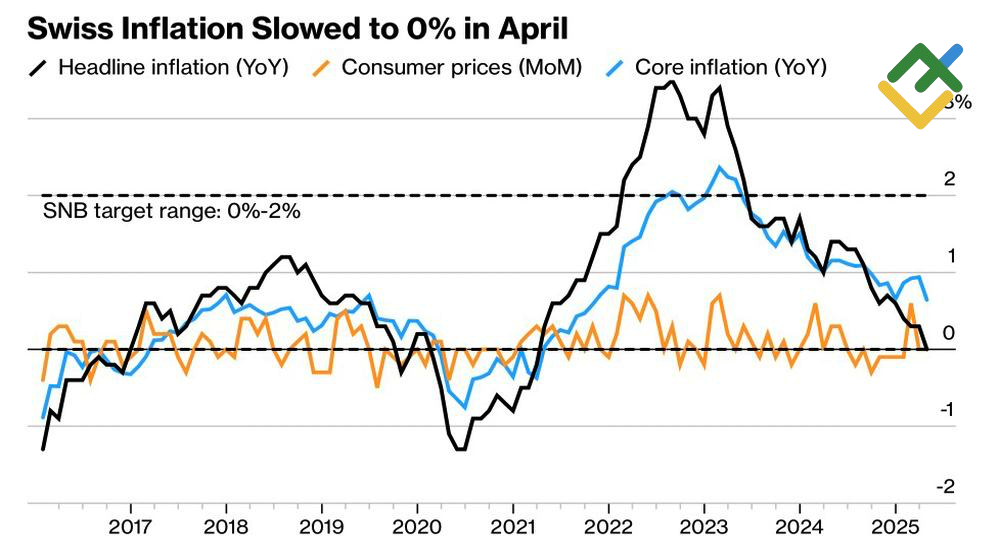

Swiss Inflation Change

Source: Bloomberg.

The National Bank’s verbal intervention can be easily explained. The strengthening of the franc led to consumer prices slowing to zero in April. The country nearly experienced another period of deflation, which the SNB had fought to prevent throughout most of the 21st century, often with limited success. This scenario heightens the likelihood of the key rate reverting to negative territory, where it remained for seven years before shifting to positive in 2022.

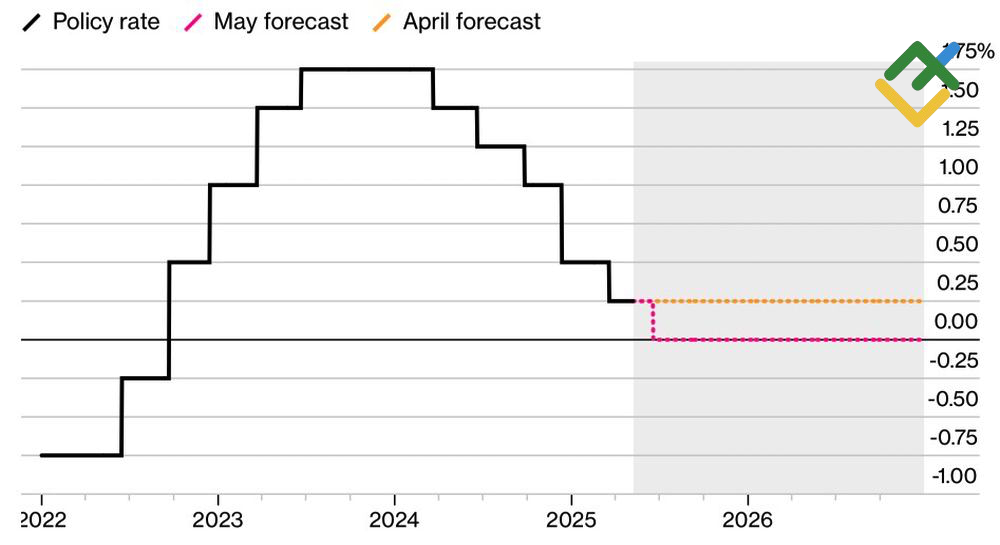

Martin Schlegel did not dismiss the possibility of negative rates, acknowledging that such measures are unpopular but emphasizing that the SNB is prepared to implement them if necessary, and the need for such a move is gaining urgency. The central bank’s inflation forecast is 0.4%, with deflation anticipated. UBS has lowered its Swiss economic growth forecast from 1.5% to 1% amid the introduction of US import tariffs. According to Bloomberg, borrowing costs will likely be slashed as early as June.

SNB Rate Forecasts

Source: Bloomberg.

Meanwhile, Donald Trump has expressed dissatisfaction with the substantial US trade deficit with Switzerland and has considered implementing a 31% tariff as a response. According to the President of the Swiss Confederation, Karin Keller-Sutter, the negative balance will be eliminated if services are considered. She will likely leverage this argument in negotiations with officials from Washington to ensure that the conditions she seeks are equivalent to those the UK has secured.

Monthly USDCHF and EURCHF Trading Plan

Once the current euphoria in the financial markets subsides, the USDCHF pair will likely continue its downward trend due to the weakness of the US dollar. However, it may be worthwhile to consider a more interesting trade, such as buying the EURCHF pair with targets at 0.9525 and 0.9615. Such a trade would be driven by the divergence in economic growth between the eurozone and Switzerland, the fiscal stimulus in Germany, and the SNB’s intention to return to negative rates.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of USDCHF in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.