Facing the risk of being labeled a currency manipulator, the Swiss National Bank is forced to revert to negative interest rates. Will this policy shift support USDCHF bulls, or will broader headwinds outweigh the upside? Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- The US has not yet designated Switzerland as a currency manipulator.

- Negotiations on reducing the 31% tariffs remain ongoing.

- Deflation increases the risk of the SNB introducing negative interest rates.

- If the USDCHF pair falls below 0.819 or pulls back after hitting 0.83, consider short trades.

Weekly Fundamental Forecast for Franc

It is common to choose the lesser of two evils. Despite Switzerland’s efforts to avoid negative interest rates, other options are not currently feasible. Although the US has not formally labeled Switzerland as a currency manipulator, it has included it on a special monitoring list. Perhaps one of the conditions in the trade agreement, which includes a 31% tariff reduction, may involve the SNB preventing a significant increase in the USDCHF exchange rate.

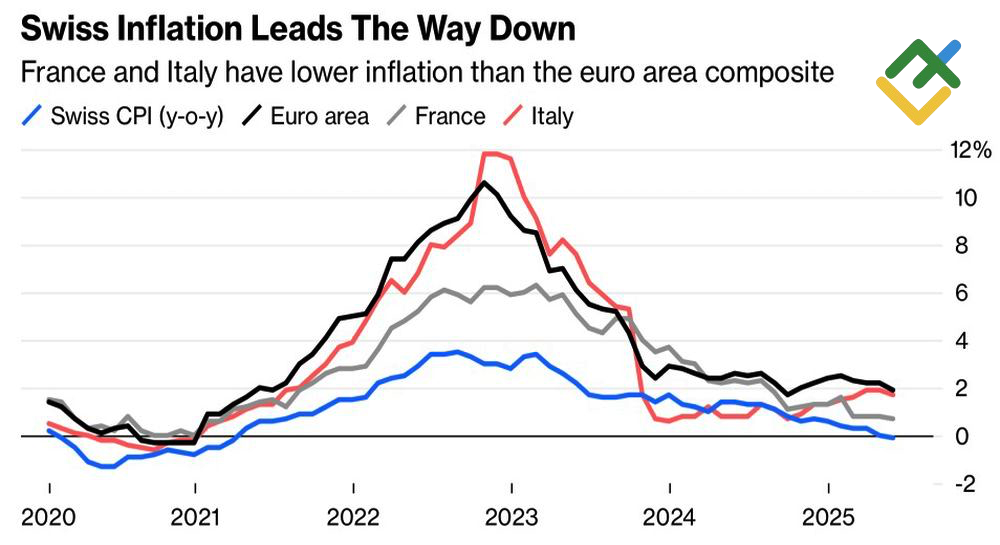

The Swiss National Bank asserts that it does not manipulate currency, acting only to ensure price stability, with no focus on improving the trade balance. Over the past three years, the Swiss franc has appreciated nearly 17% against the US dollar, outperforming all G10 currencies. This revaluation has contributed to the slowest inflation in Switzerland, with consumer prices dipping into negative territory in May for the first time in three years.

Inflation Trends in Switzerland and Other Countries

Source: Bloomberg.

The Swiss franc is bolstered by its status as a safe-haven asset in Europe and globally. Geopolitical tensions, including the conflict in Ukraine, political instability in Europe, and Donald Trump’s return to US politics, are driving high investor demand for the franc. If the SNB is forced to stop weakening the franc through currency interventions, it may have no choice but to bring back negative interest rates.

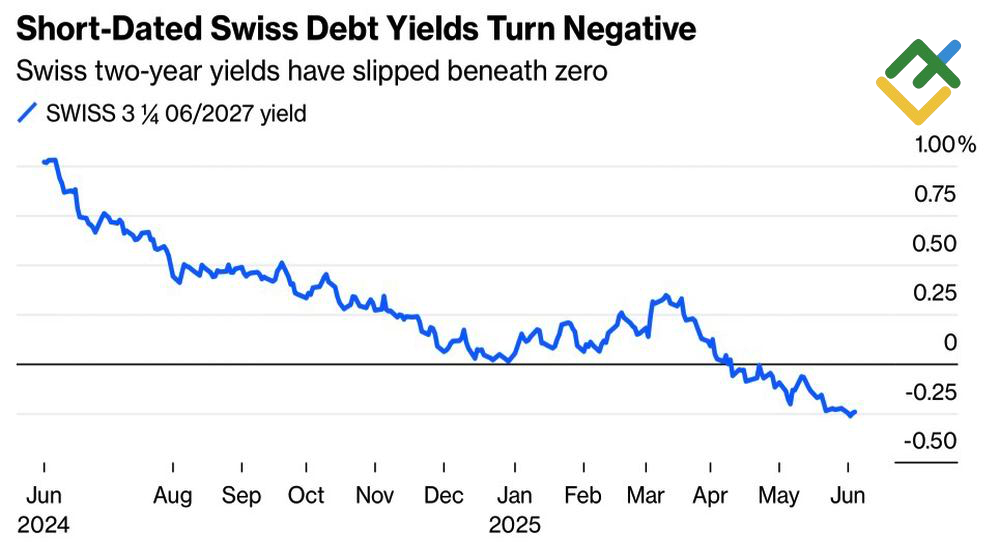

Switzerland maintained a negative interest rate policy from 2015 to 2022. Now, with Swiss bond yields once again slipping into negative territory, markets are on alert. According to Bloomberg analysts, the SNB is expected to cut its key rate to zero in June, with a possibility of re-entering negative territory in September.

Swiss Bond Yields

Source: Bloomberg.

Essentially, the Swiss National Bank is facing global challenges, such as financial markets using the Swiss franc as a safe haven and concerns over a potential slowdown in the global economy. According to the World Bank’s estimates, if tariffs climb by just 10%, global economic growth may drop to 1.8%. Additionally, Donald Trump’s protectionist policies are believed to lead to rising prices in countries implementing tariffs, while those facing import duties may experience slowed GDP growth.

Although Switzerland’s economy accelerated to 0.8% in the first quarter, this was due to a surge in US imports and a gradual improvement in domestic demand.

Weekly USDCHF Trading Plan

The SNB is facing this struggle alone. With currency intervention off the table, the central bank should return to negative rates, but even those are unlikely to deter USDCHF bears. If the quotes fall below 0.819 or rebound from 0.83, one may consider short trades.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of USDCHF in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.