Secrets are bound to come to light eventually. The use of silver in the military industry has resulted in a larger market deficit than official data indicates. Numerous projects are shrouded in secrecy. Let’s discuss this topic and make a trading plan for the XAGUSD pair.

The article covers the following subjects:

Highlights and key points

- Wars are fuelling the demand for silver.

- The precious metals are rising due to the Trump trade.

- The XAGUSD pair takes advantage of de-dollarisation.

- Silver can soar to $40 per ounce.

Monthly fundamental forecast for silver

What was once considered implausible in the 21st century has now become a tangible reality. The ongoing conflicts in Eastern Europe and the Middle East have spurred the demand for assets used in the military industry, including silver. This metal is essential for modern missiles, bombs, shells, tanks, submarines, torpedoes, night vision devices, radar systems, space technology, and nuclear technology. Much of this was previously classified, but when it became public, the XAGUSD pair skyrocketed.

All confidential information eventually becomes public. The US relies on external sources to meet 79% of its silver demand, with 47% of imports coming from Mexico and 23% sourced from Canada. However, it is highly suspicious that the metal was not included on the list of critical materials and that its stockpiles were kept strictly confidential. According to The Jerusalem Post, the use of silver in the military industry may be greater than in electronics, solar panel production, and investment combined.

Russia’s intention to expand the list of its strategic assets to encompass silver and platinum, which it believes are currently undervalued, creates a new catalyst for the XAGUSD rally. Until now, de-dollarization has primarily favored gold, but recently, not only has the leading precious metal been increasing in parallel with the US dollar index.

Silver and US dollar performance

Source: Trading Economics.

The Kremlin’s desire to purchase more silver for its own reserves may be a cover for its actual intention to use it for military purposes. Given the prolonged armed conflicts in Ukraine and the Middle East, the demand for the white metal is expected to surge.

In the lead-up to the US presidential election, silver, gold, and Bitcoin have become the primary focus of the Trump trade. The Republicans’ aggressive protectionist stance, their leader’s intention to restructure the global trading system, and the associated potential slowdown in global GDP, as predicted by the IMF, are boosting the demand for safe-haven assets. Unsurprisingly, the XAGUSD pair is appreciating along with the US dollar.

The London Bullion Market Association survey suggests silver will continue to outperform gold in the medium and long term. Respondents anticipate the gold price to reach $2,917.4 per ounce and XAGUSD to increase by 40% to $45 per ounce over the next 12 months.

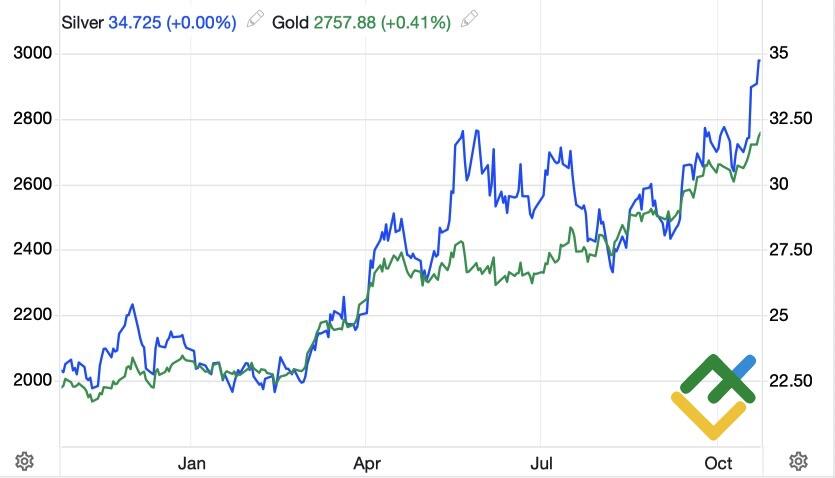

Gold and silver trends

Source: Trading Economics.

Monthly trading plan for silver

The use of silver in the military industry, the prolonged armed conflicts, and the intention of the conventional East to increase the share of the white metal in reserves indicate a continuation of the XAGUSD rally. The September targets of $32.7 and $36 per ounce seem outdated. Consider long trades with the target of $40.

Price chart of XAGUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.