After a slow start, silver has gained momentum heading into summer. The XAG/USD rally was fueled in part by gold’s failure to hold above the psychologically important $3,500/oz level. Let’s discuss it and make a trading plan.

The article covers the following subjects:

Major Takeaways

- Surging demand for solar panels favors silver.

- The silver market remains in deficit for the fourth consecutive year.

- ETF holdings have climbed 8% since February.

- Long positions on XAG/USD targeting $37 and $39 remain in play.

Monthly Fundamental Forecast for Silver

Slow and steady wins the race — or at least helps close the gap. After giving gold an early lead this year, silver and other precious metals are beginning to catch up. Over the past month, XAG/USD has gained over 10%, narrowing the performance gap with XAU/USD to just 4 percentage points since January. Silver benefits from a dual role — it’s both an investment asset and an industrial metal.

In theory, Donald Trump’s tariffs are expected to slow down global economic growth. However, ahead of their implementation, there was a front-loaded surge in U.S. imports, which has supported business activity in the manufacturing sector and added momentum to the XAG/USD rally.

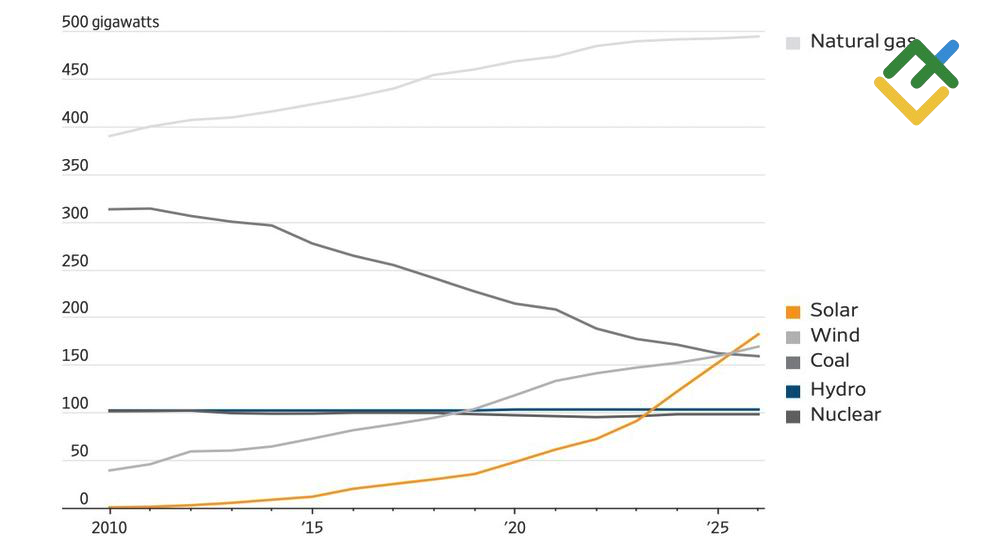

One of silver’s strongest long-term catalysts? Solar panels. According to the U.S. Energy Information Administration, solar power capacity is set to outpace coal by mid-2026 and surpass wind energy by the end of that year. Solar is projected to account for 8% of U.S. electricity production, up from just 5% in 2024.

Electricity Generation Sources in the U.S.

Source: Wall Street Journal.

The Silver Institute expects the metal’s supply deficit to persist for a fourth straight year. TD Securities forecasts that strong industrial and investment demand will continue to draw down above-ground reserves and drive prices higher, especially if XAG/USD rises above $35. That could spark a wave of buying from ETF investors. In fact, ETF silver holdings have already risen 8% since February.

Investor psychology also plays a role: investors often buy an asset simply because it’s growing. As FX Empire notes, when silver has broken above $35 in the past, the move toward $50 has come quickly. While silver has outperformed gold by more than 10% in the past month alone, the gold-to-silver ratio has dropped to 93, still far above its long-term average of around 60. That suggests silver has plenty of room to grow.

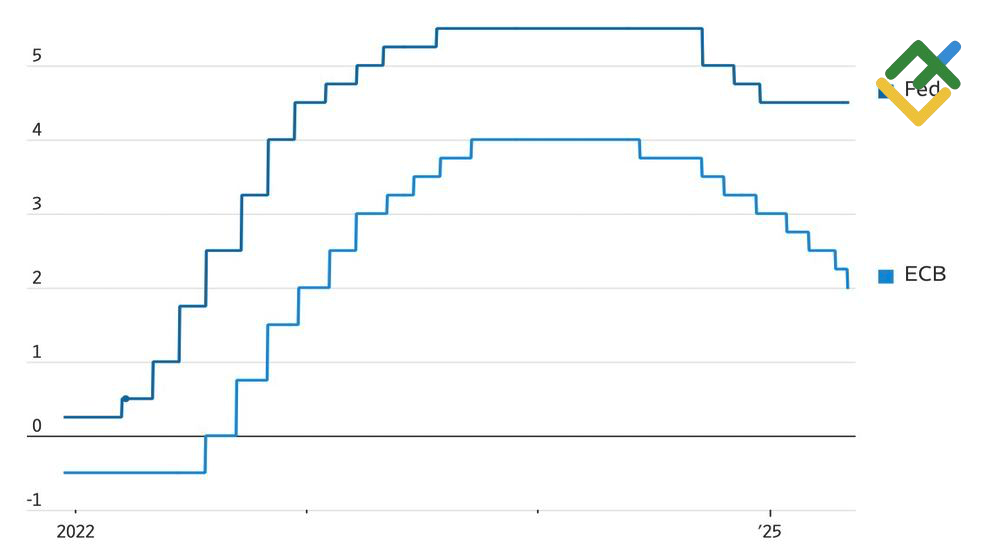

Interest Rate Trends: Fed vs. ECB

Source: Wall Street Journal.

Gold’s failure to break and hold above $3,500 has likely cooled investor enthusiasm, prompting traders to seek alternatives. Silver fits that bill, especially as the U.S. dollar weakens. The European Central Bank has signaled that it’s nearing the end of its monetary easing cycle, which has boosted the euro. Meanwhile, the derivatives market is pricing in at least two Fed rate cuts — and potentially more.

Monthly Trading Plan for XAGUSD

In this situation, it makes sense to keep long positions opened on the breakout above the $33.70 consolidation level — and even build them up. Initial upside targets lie at $37 and $39.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of XAGUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.