I welcome my fellow traders! I have made a price forecast for the USCrude, XAUUSD, and EURUSD using a combination of margin zones methodology and technical analysis. Based on the market analysis, I suggest entry signals for intraday traders.

Short-term forecast for oil, gold, and euro-dollar today. Gold hit a new all-time high yesterday.

The article covers the following subjects:

Major Takeaways

- USCrude: Oil is correcting upward within a short-term downtrend.

- XAUUSD: Gold has broken through the resistance zone 2940 – 2933.

- EURUSD: Euro buyers failed to break above the upper Target Zone, so the price is correcting downward.

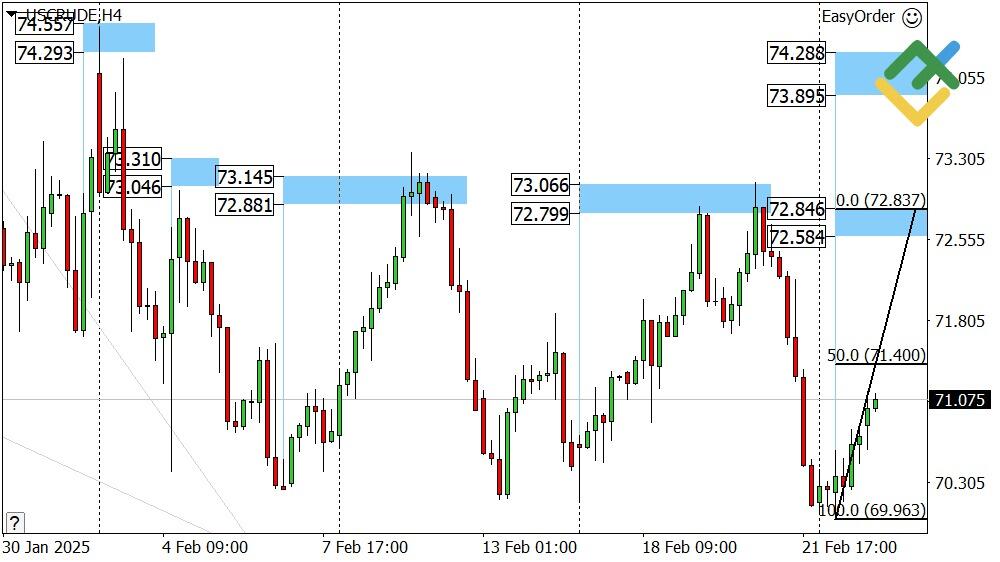

Oil Price Forecast for Today: USCrude Analysis

After breaking below the February 17 low, oil is correcting upward, presumably targeting the resistance (А) 72.84 – 72.58. If this zone is reached, new shorts can be considered with the first target of 71.40 and the second one near 69.96.

If the asset price breaks above the resistance (A), it will then head for the trend’s key resistance of 74.28 – 73.89. Once it’s reached, we can also consider shorts with a key target at this week’s low.

USCrude Trading Ideas for Today:

Sell near resistance (А) 72.84 – 72.58. TakeProfit: 71.40, 69.96. StopLoss: 73.33.

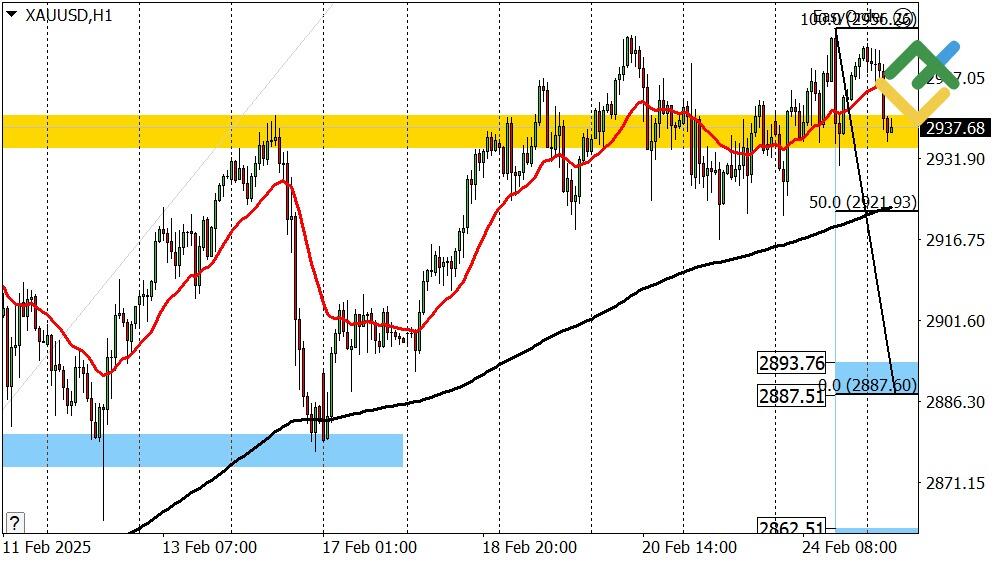

Gold Forecast for Today: XAUUSD Analysis

Gold hit a new all-time high yesterday, breaking through the Gold Zone 2940 – 2933. Thus, the next growth target of the short-term uptrend is the Target Zone 3008 – 2996.

Consider new longs on a correction. Strong levels from which positions could be opened are support (A) 2893 – 2887 and support (B) 2862 – 2853. The key target for these longs will be yesterday’s high.

XAUUSD Trading Ideas for Today:

Buy near support (А) 2893 – 2887. TakeProfit: 2921, 2956. StopLoss: 2876.

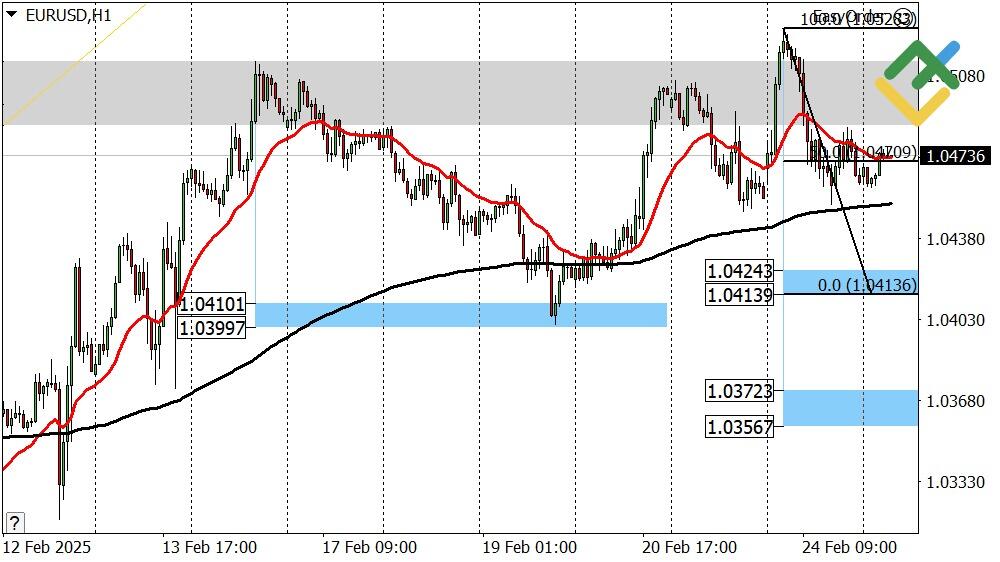

Euro/Dollar Forecast for Today: EURUSD Analysis

Euro quotes corrected downward after another attempt to break above the Target Zone 1.0514 – 1.0486. If the correction continues today, expect the price to test support (А) 1.0424 – 1.0413. Once this zone is tested, consider new longs with the first target at 1.0470 and the second one near yesterday’s high.

If the support (А) is broken to the downside, the price will correct to the trend’s boundary of 1.0372 – 1.0356, from which longs can also be considered.

EURUSD Trading Ideas for Today:

Buy near support (А) 1.0424 – 1.0413. TakeProfit: 1.0470, 1.0528. StopLoss: 1.0395.

Would you like to learn more about technical analysis methods and principles? Explore our comprehensive guide.

P.S. Did you like my article? Share it in social networks: it will be the best “thank you” 🙂

Useful links:

- I recommend trying to trade with a reliable broker here. The system allows you to trade by yourself or copy successful traders from all across the globe.

- Use my promo code BLOG for getting deposit bonus 50% on LiteFinance platform. Just enter this code in the appropriate field while depositing your trading account.

- Telegram chat for traders: https://t.me/litefinancebrokerchat. We are sharing the signals and trading experience.

- Telegram channel with high-quality analytics, Forex reviews, training articles, and other useful things for traders https://t.me/litefinance

Price chart of XAUUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.