Dear readers,

I’ve prepared a short-term forecast for Bitcoin, Ripple, and Ethereum based on the Elliott wave analysis.

The article covers the following subjects:

Highlights and key points

- BTCUSD: a horizontal correction is completed, and a bearish trend has begun developing. Consider opening short positions from the current levels with Take Profit at 58,806.53.

- XRPUSD: a correction is expected to end near 0.562. Consider long positions with Take Profit at 0.562.

- ETHUSD: a bearish impulse may end near the previous low. Consider selling from the current level with Take Profit at 2,091.94.

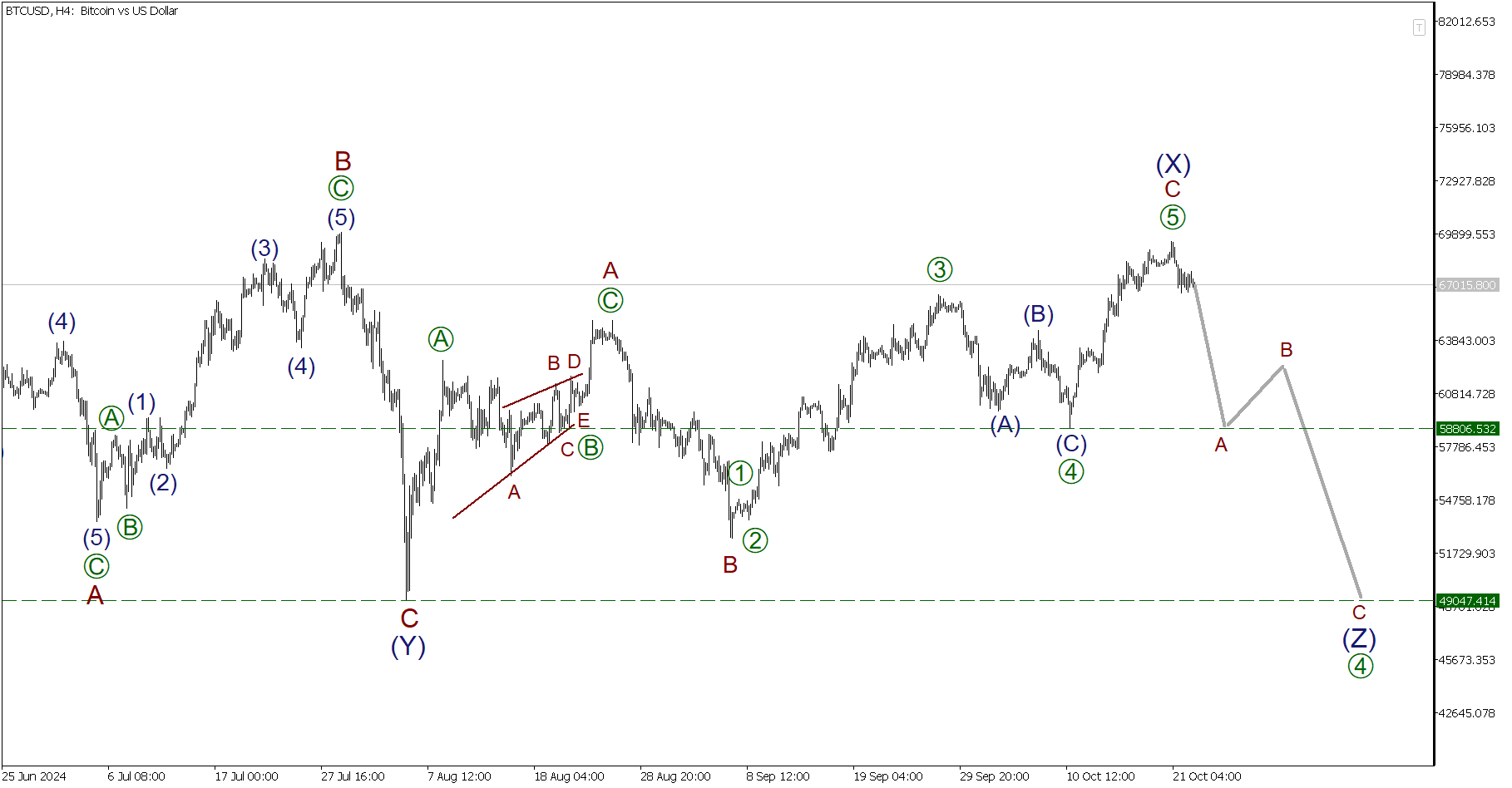

Elliott Wave Analysis for Bitcoin

The BTCUSD is expected to form a large corrective trend in the form of a triple zigzag (W)-(X)-(Y)-(X)-(Z). Its second linking wave (X) is presumably completed as a horizontal flat A-B-C. The pair is declining in the last segment of the chart, potentially confirming that the final actionary wave (Z) has started unfolding. Wave (Z) will likely develop as a regular zigzag A-B-C. The first impulse wave is expected to end near a low of 58,806.53.

Trading plan for BTCUSD for today:

Sell 67,015.80, Take profit: 58,806.53

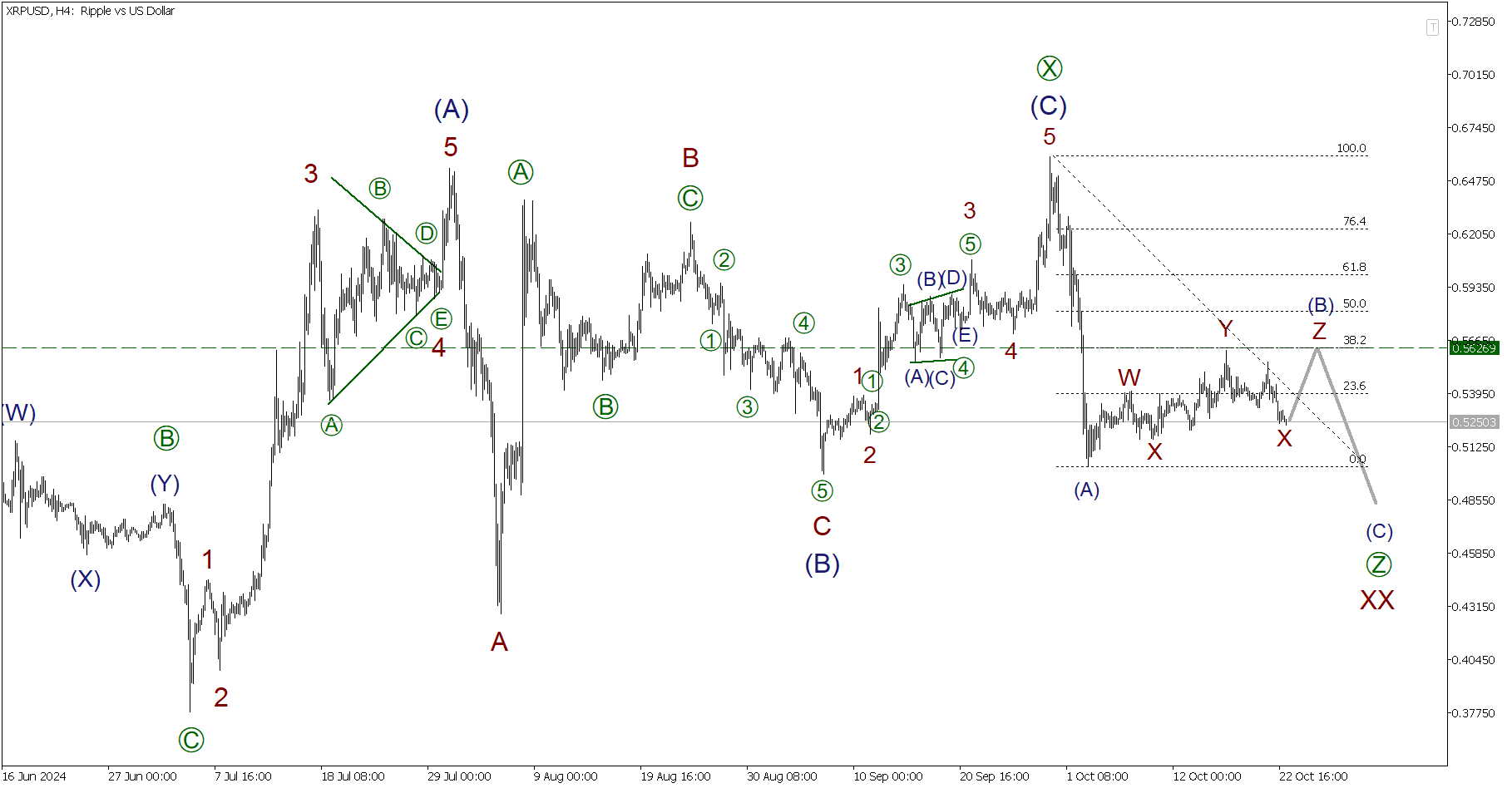

Elliott Wave Analysis for Ripple

In the medium term, the XRPUSD pair appears to be building a linking wave XX as a triple zigzag [W]-[X]-[Y]-[X]-[Z]. Its zigzag-shaped linking wave [X] has already formed, and the first part of the actionary wave [Z] is currently unfolding. It may become a simple zigzag (A)-(B)-(C), as shown in the chart. Bearish impulse wave (A) is likely completed, and correction (B) may form shortly as a triple zigzag W-X-Y-X-Z. Its last subwave Z may end near a level of 0.562, where correction (B) will equal 38.2% of impulse (A) according to Fibonacci lines. Consider long positions.

Trading plan for XRPUSD for today:

Buy 0.525, Take profit: 0.562

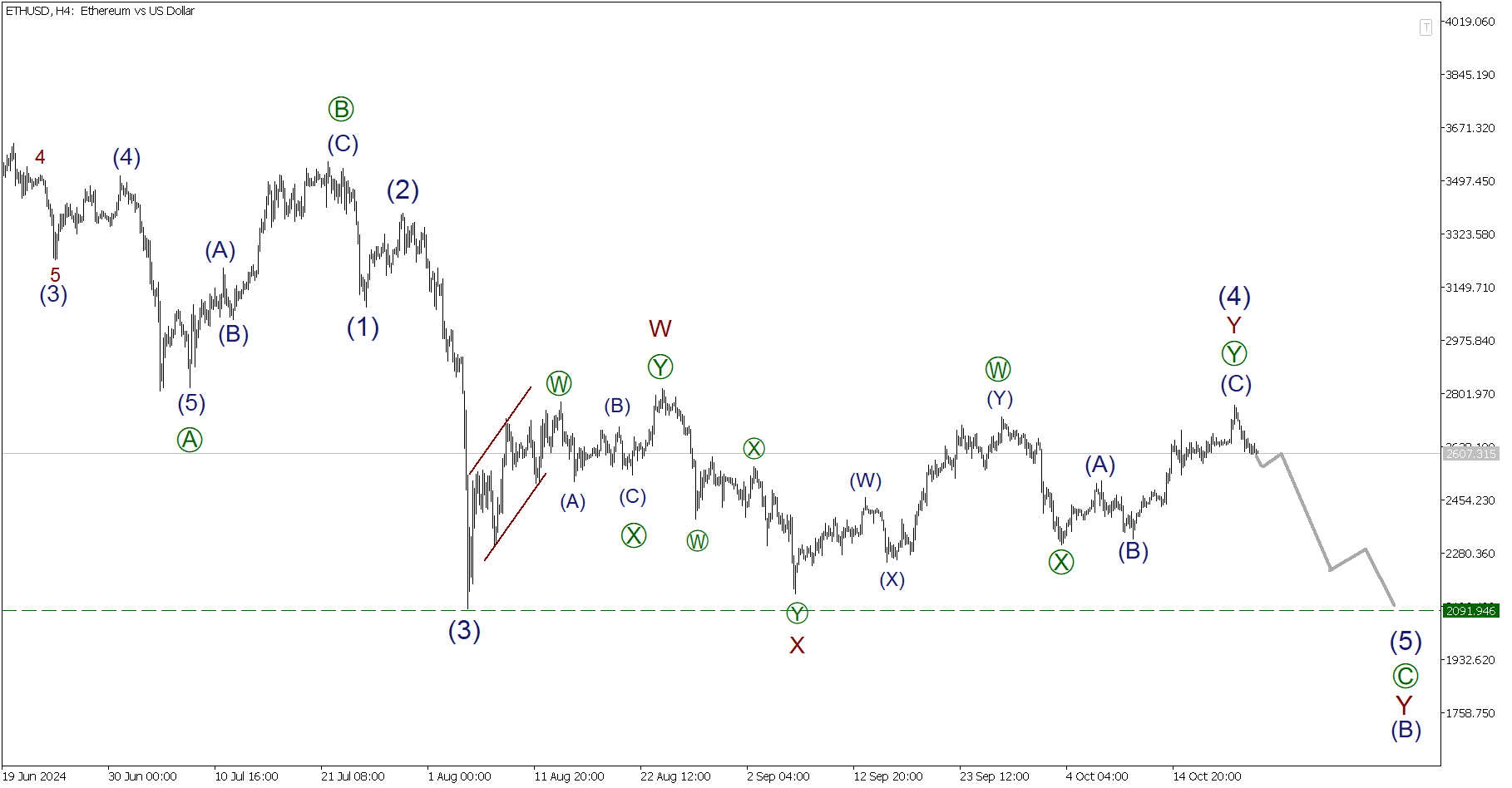

Elliott Wave Analysis for Ethereum

Ethereum‘s chart shows a breakdown of a bearish impulse wave [C] of (B). The first three parts of impulse [C] are fully formed. Corrective wave (4) is likely completed as a double zigzag W-X-Y. A new bearish wave (5) is currently unfolding, presumably as an impulse, as shown in the chart. The price will likely drop to a low of 2,091.94, marked by impulse (3).

Trading plan for ETHUSD for today:

Sell 2,607.31, Take profit: 2,091.94

P.S. Did you like my article? Share it in social networks: it will be the best “thank you” 🙂

Ask me questions and comment below. I’ll be glad to answer your questions and give necessary explanations.

Useful links:

- I recommend trying to trade with a reliable broker here. The system allows you to trade by yourself or copy successful traders from all across the globe.

- Use my promo code BLOG for getting deposit bonus 50% on LiteFinance platform. Just enter this code in the appropriate field while depositing your trading account.

- Telegram chat for traders: https://t.me/litefinancebrokerchat. We are sharing the signals and trading experience.

- Telegram channel with high-quality analytics, Forex reviews, training articles, and other useful things for traders https://t.me/litefinance

Price chart of BTCUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.