The pullback in the gold price proved to be less pronounced than expected. The precious metal held above $2600 per ounce and then returned to its initial level. The question now is, what will happen next? Let’s discuss this topic and develop a trading plan.

The article covers the following subjects:

Highlights and key points

- The XAUUSD correction attracted new bulls.

- Central banks do not intend to stop buying gold.

- The rise in Treasury yields and the strengthening of the US dollar do not pose a threat to the precious metal.

- Gold continues to move towards $2,800 per ounce.

Weekly fundamental forecast for gold

The surge in gold’s value in 2024 can be attributed to various factors. Since the beginning of the year, the value of gold has increased by a quarter from the February lows, marking a 35% gain. The XAUUSD rally cannot be attributed to a single factor but rather a combination of factors working together. When one factor weakens, others come into play to compensate. The recent small pullback of the precious metal has confirmed the belief that there is little desire to sell the asset.

The diversification of reserves by central banks, which has accompanied the de-dollarisation process, has been a key factor influencing the XAUUSD since 2022. The freezing of Russian assets by Western regulators has prompted a greater focus on gold as an alternative investment. The Impact Evaluation Lab estimates that the average central bank holds approximately 15% of its reserves in precious metals at market value. At the LBMA conference in Mexico, the Czech Republic and Mongolia reaffirmed their commitment to continue purchasing gold in response to geopolitical tensions and lower interest rates.

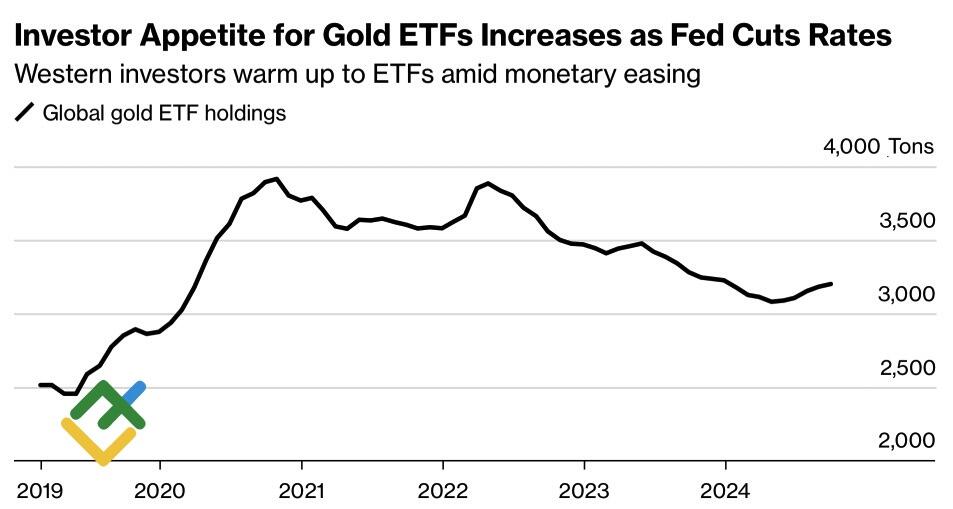

There are similarly encouraging indications among retail investors. Over the past five months, holdings of gold-focused ETFs have shown consistent growth, reaching 3,200 tonnes by the end of September. Despite a net selling of 25 bps year to date, there has been a $389 million increase in valuations.

Gold ETF holdings data

Source: Bloomberg.

The primary driver behind the surge in specialized exchange-traded fund stocks is the anticipation of a more accommodative stance by the US Fed. The regulator commenced its policy tightening in September, and although only two 25 bp cuts in the federal funds rate are expected before the end of the year, the lower cost of borrowing typically provides support to gold. Notably, the precious metal does not generate interest income and, therefore, cannot compete with US Treasuries if yields are rising.

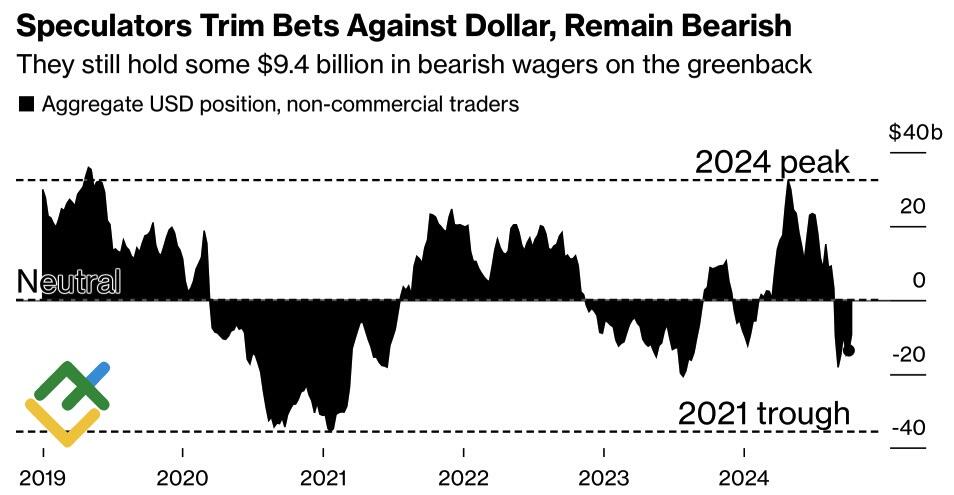

However, in practice, gold may exceed the Treasury yield values. Despite the increase in the US debt market rate and the US dollar strength, XAUUSD did not experience a correction. Speculators may return to the greenback amid a reassessment of the federal funds rate trajectory, but the 2022-2023 scenario is happening again. During that period, gold showed resilience against both the rally in the US dollar index and the rise in treasury yields, with other factors boosting its performance.

Speculative positions on the US dollar

Source: Bloomberg.

Gold is an effective tool for diversifying investment portfolios due to its weak correlation with stocks and currencies. When the S&P 500 experiences pullbacks, the price of XAUUSD tends to drop as investors sell off precious metals to offset losses in equities. If the stock index does not start a correction, it is unlikely that gold will undergo it either.

Weekly trading plan for gold

Without a serious drop in the S&P 500 and the US dollar appreciation, XAUUSD is unlikely to fall deeply. As long as the market is stable, consider long trades on pullbacks with the target at the previously outlined level of $2,800 per ounce.

Price chart of XAUUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.