When investors are on tenterhooks, even a tiny piece of news can trigger a storm in financial markets. The EURUSD pair faced a roller coaster ride due to the S&P 500. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- Rumors of US tariff postponements have caused market volatility.

- China is gearing up for a trade war with the US.

- The EU is exploring avenues for negotiations.

- Short trades on the EURUSD pair can be opened on rebounds from 1.100 and 1.105.

Weekly US Dollar Fundamental Forecast

A spark will ignite a flame. Such a spark was a social media hoax that the White House was considering a pause in tariffs. The US stock market capitalization immediately soared by $2.4 trillion, only to fall by the same amount when the news was called a fake. Given the EURUSD pair’s close dependence on stock indices, the pair’s next roller coaster ride should come as no surprise.

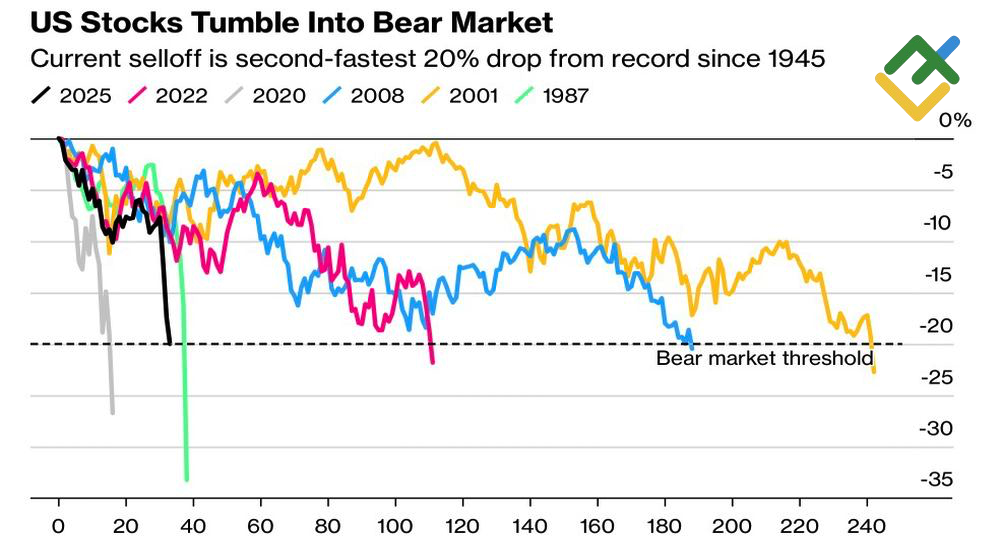

US tariffs have been imposed, yet market uncertainty persists. Markets are not enjoying the current developments, which is why the S&P 500 has fallen into bear market territory at the fastest pace since 1945, excluding the pandemic period. According to a survey conducted by Goldman Sachs in March, investors anticipated an average increase in import duties to 8.6%. However, the actual figure has exceeded expectations, reaching more than 20%.

S&P 500 Bear Market Threshold

Source: Bloomberg.

Markets remain unenthusiastic about Donald Trump’s promise to impose reciprocal tariffs, which have turned out to be much higher. For instance, Vietnam’s average duty stands at 9.4%, whereas the US imposes a 46% tariff on that nation. A similar discrepancy is evident in the case of Taiwan, where the tariffs are 2% and 32%, respectively. Washington is attempting to balance foreign trade by imposing these tariffs, but tariffs are not the sharpest tool in the shed.

In response, countries are taking varied approaches. Some, like Israel, have committed to addressing trade imbalances by imposing zero reciprocal tariffs. Conversely, China has chosen a different approach, opting not to seek immediate redress from Washington. Beijing imposed retaliatory duties of 34%, and after Donald Trump promised to increase them by another 50%, bringing them to 104%, it vowed it would retaliate.

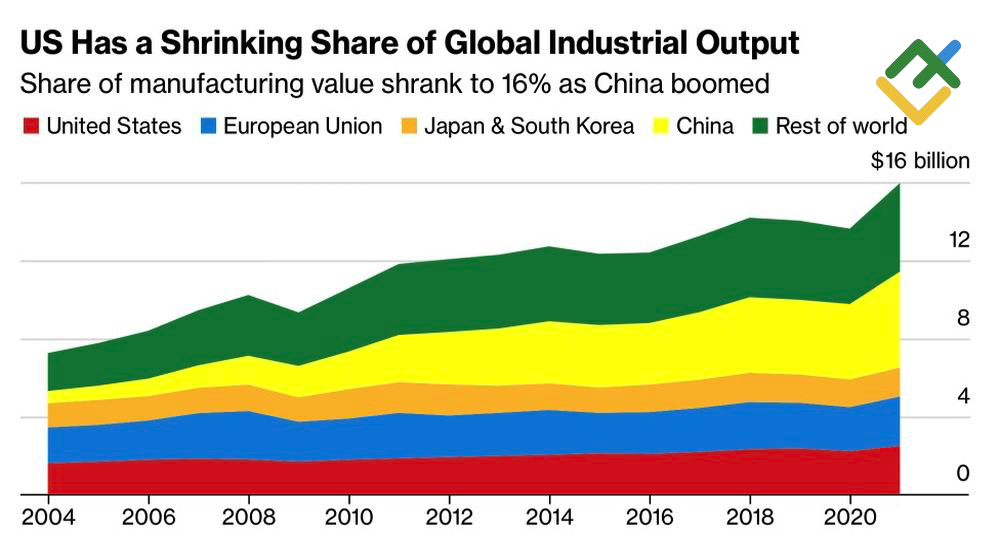

The EU appears to be adopting a more strategic approach. It is gradually reducing tariffs. Brussels swiftly imposed tariffs on steel and aluminum, equivalent to $26 billion in US exports. A response to the 20% universal levies is still in the pipeline. The EU is taking a deliberate approach, allowing itself a period to negotiate and present offers that Washington has so far declined. According to Donald Trump, the absence of reciprocal tariffs on manufactured goods is insufficient. If reciprocal tariffs were implemented, it could potentially enable both the US and Europe to confront China in this area.

Global Industrial Output

Source: Bloomberg.

Trade wars are unfavorable for stocks, which are a key factor for the EURUSD pair. As a result, the euro declines during the European session and rises in the American session on Forex. Meanwhile, the EuroStoxx 50 and the S&P 500 have typically closed in the red.

Weekly EURUSD Trading Plan

Against the current backdrop, it would be profitable to open positions on rebounds. Short trades on the EURUSD pair can be opened if the price fails to test the resistance levels of 1.105 and 1.1. Long trades can be considered when the price approaches the support levels of 1.09–1.091 and 1.085.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.