The French financial regulator, Autorité des Marchés

Financiers (AMF), has published new data on the behaviour of retail investors.

The report is based on a 2024 survey of individuals who carried out at least

one transaction in French financial instruments.

Active Retail Investors in France Increase, Female Share

Declines

According to the AMF, the number of active retail investors

in France rose to 1.7 million in 2024. This marks a 21.5% increase compared to

2022. However, the growth was almost entirely driven by men. The number of

active female investors remained stable at around 430,000. As a result, women

made up 25% of active investors in 2024, down from 30% in 2022.

The AMF first studied investor profiles in 2022. The latest

report tracks changes in age, platform use, and investment habits between 2022

and 2024.

Global Trend: More Women Enter Investing

However, Last year Finance Magnates reported a

global trend of more women entering the world of investing, challenging

long-standing gender norms.

According to XTB data published for International

Women’s Day, the share of new female investors is rising in markets like

Romania and the MENA region, with women making up over 20% of new entrants. In

2023, women favored instruments such as EUR/USD, gold, stock indices, and ETFs.

You may find it interesting at FinanceMagnates.com: Lights,

Camera, Discrimination: Hollywood Bias Costs Women $567B in Lost Investments.

Shift Toward Younger Investors

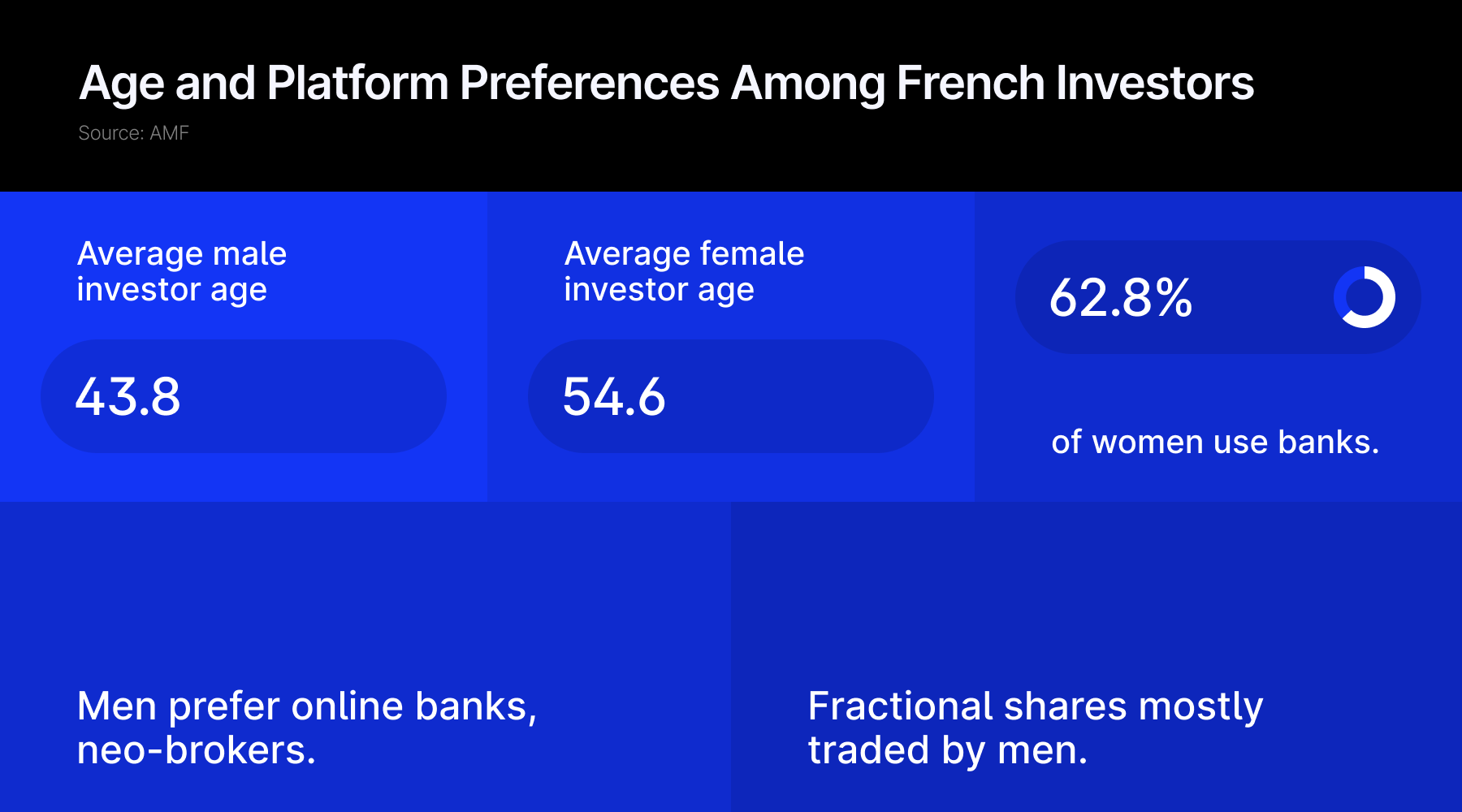

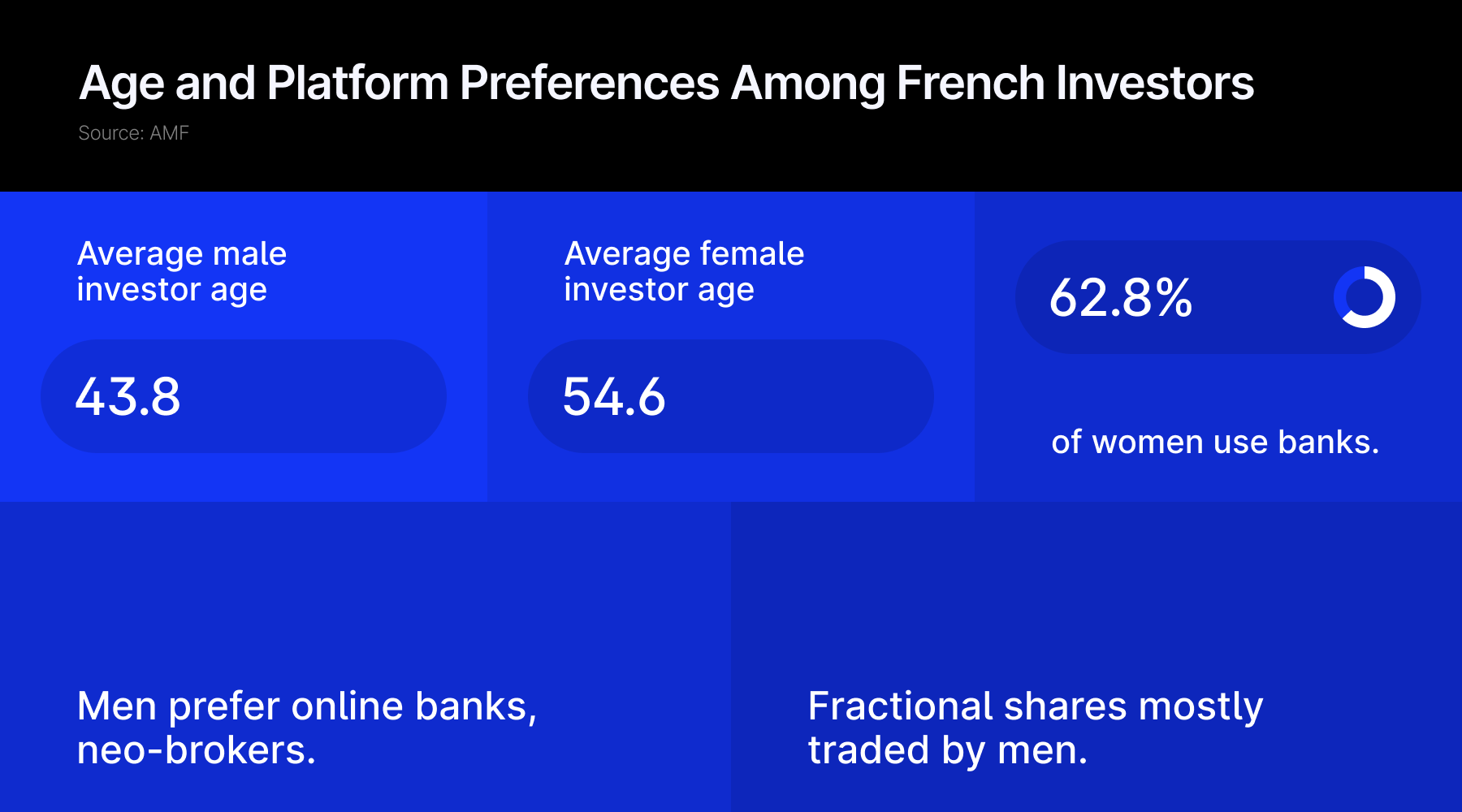

The latest AMF data shows a continued shift toward younger

investors. By the end of 2024, the average age of male investors had fallen to

43.8 years, down from 49.6 in 2022. For women, the average age was 54.6 years,

compared to 60.1 two years earlier.

The report also highlights differences in platform use. Most

women, 62.8%, still invest through traditional banks. In contrast, only 38% of

men rely on these institutions. Men are more likely to use online banks, 33.3%,

and neo-brokers, 28.7%.

Women investors are driving high-impact, global change 💪🏻💪🏼💪🏽💪🏾💪🏿

Maaike Doyer, founder of Epic Angels, shares why women are the future of angel investing at #GEC2025.https://t.co/kAdBnvipVn #TheBoldChangeThe World pic.twitter.com/jnWwoi864n— Global Entrepreneurship Network (@unleashingideas) July 7, 2025

Neo-broker usage continued to grow in 2024, especially among

men. Around 20% of their transactions were conducted on these platforms. For

women, the figure was below 10%.

Investment Product Preferences and Gender Gap

Regarding investment products, younger investors of both

genders showed equal interest in Exchange Traded Funds. However, there

were large differences in the use of newer tools such as fractional shares.

Among all active investors who traded fractional shares, 89% were men and 11%

were women.

The AMF said the findings help inform its broader investor

protection work. The research supports the regulator’s “Impact 2027”

plan, which focuses on financial education and risk prevention.

The French financial regulator, Autorité des Marchés

Financiers (AMF), has published new data on the behaviour of retail investors.

The report is based on a 2024 survey of individuals who carried out at least

one transaction in French financial instruments.

Active Retail Investors in France Increase, Female Share

Declines

According to the AMF, the number of active retail investors

in France rose to 1.7 million in 2024. This marks a 21.5% increase compared to

2022. However, the growth was almost entirely driven by men. The number of

active female investors remained stable at around 430,000. As a result, women

made up 25% of active investors in 2024, down from 30% in 2022.

The AMF first studied investor profiles in 2022. The latest

report tracks changes in age, platform use, and investment habits between 2022

and 2024.

Global Trend: More Women Enter Investing

However, Last year Finance Magnates reported a

global trend of more women entering the world of investing, challenging

long-standing gender norms.

According to XTB data published for International

Women’s Day, the share of new female investors is rising in markets like

Romania and the MENA region, with women making up over 20% of new entrants. In

2023, women favored instruments such as EUR/USD, gold, stock indices, and ETFs.

You may find it interesting at FinanceMagnates.com: Lights,

Camera, Discrimination: Hollywood Bias Costs Women $567B in Lost Investments.

Shift Toward Younger Investors

The latest AMF data shows a continued shift toward younger

investors. By the end of 2024, the average age of male investors had fallen to

43.8 years, down from 49.6 in 2022. For women, the average age was 54.6 years,

compared to 60.1 two years earlier.

The report also highlights differences in platform use. Most

women, 62.8%, still invest through traditional banks. In contrast, only 38% of

men rely on these institutions. Men are more likely to use online banks, 33.3%,

and neo-brokers, 28.7%.

Women investors are driving high-impact, global change 💪🏻💪🏼💪🏽💪🏾💪🏿

Maaike Doyer, founder of Epic Angels, shares why women are the future of angel investing at #GEC2025.https://t.co/kAdBnvipVn #TheBoldChangeThe World pic.twitter.com/jnWwoi864n— Global Entrepreneurship Network (@unleashingideas) July 7, 2025

Neo-broker usage continued to grow in 2024, especially among

men. Around 20% of their transactions were conducted on these platforms. For

women, the figure was below 10%.

Investment Product Preferences and Gender Gap

Regarding investment products, younger investors of both

genders showed equal interest in Exchange Traded Funds. However, there

were large differences in the use of newer tools such as fractional shares.

Among all active investors who traded fractional shares, 89% were men and 11%

were women.

The AMF said the findings help inform its broader investor

protection work. The research supports the regulator’s “Impact 2027”

plan, which focuses on financial education and risk prevention.

This post is originally published on FINANCEMAGNATES.