The recent budget cuts have led to a downward adjustment in UK GDP forecasts, yet they have not dragged the GBPUSD pair down. Even the slowdown in CPI failed to support bears. Investors are awaiting the US’s decision on tariffs, which has led to a consolidation in the pair. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- The Treasury has cut £14 billion in budget spending.

- The fiscal margin is the third-smallest ever.

- Tariffs will severely damage the US economy.

- Short trades can be opened if the GBPUSD pair fails to return to 1.265.

Weekly Fundamental Forecast for Pound Sterling

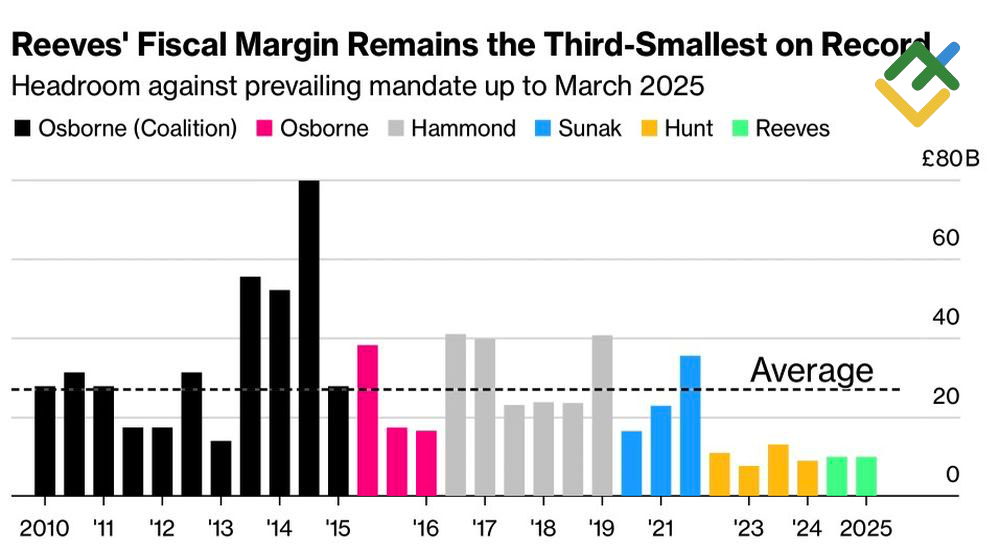

Contrary to Germany’s approach, the UK is cutting government spending, keeping the so-called fiscal margin at £9.9 billion, the third lowest on record. As a result, the Office for Budget Responsibility has revised its GDP forecast for 2025, lowering it from 2% to 1%. However, GBPUSD bears have demonstrated a muted reaction to the news. Investors are divesting from the US dollar, which is beneficial for the British pound.

UK Fiscal Margin

Source: Bloomberg.

The UK has a budgetary rule that taxes should fund day-to-day spending, known as the fiscal margin. Following a decision to increase military spending, Chancellor of the Exchequer Rachel Reeves was tasked with sourcing some £14 billion to cover the increase. Given the prevailing sentiment of discontent among businesses, the option of raising taxes was deemed unfeasible. Therefore, alternative solutions had to be explored. The Chancellor successfully addressed this issue without causing any disruption in the financial markets.

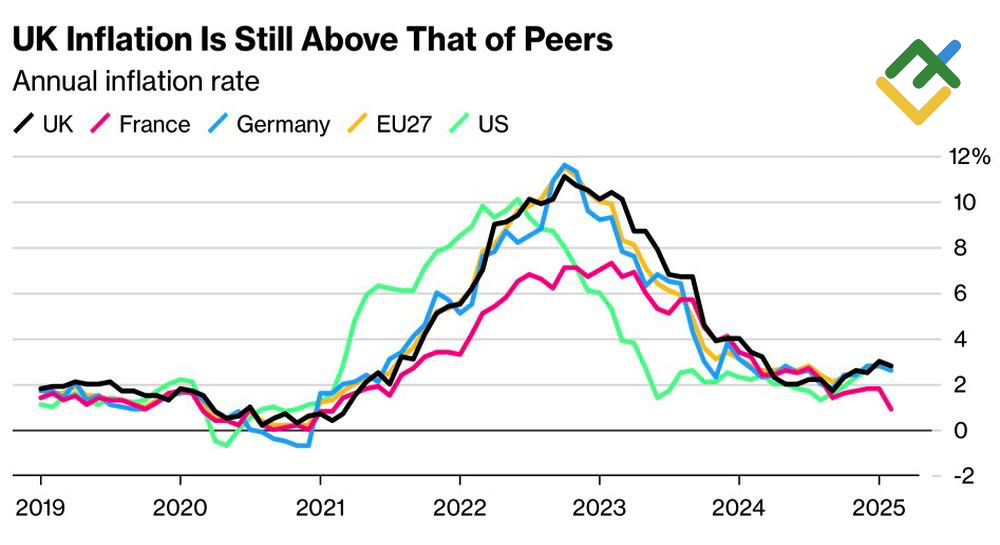

The Treasury’s announcement regarding bonds for £299 billion, a figure below the expected £302 billion, led to a decline in the yield of debt obligations. The slowdown in inflation from 3% to 2.8% in the UK also contributed to this development, increasing the likelihood of a repo rate reduction in May to 72%. Against this backdrop, GBPUSD quotes fell to 1.287, but the decline was short-lived.

Inflation in UK and Other Countries and Regions

Source: Bloomberg.

Recently, US President Donald Trump has announced 25% tariffs on automobiles, which created strong headwinds for the greenback. A leading indicator from the Federal Reserve Bank of Atlanta signaled a modest 0.2% expansion in US GDP in the first quarter. The US economy has been bolstered by globalization, while protectionist policies could hinder its expansion. In light of the ongoing trade wars, other countries may opt to reduce their holdings of US Treasuries, and investors may divest from US equities.

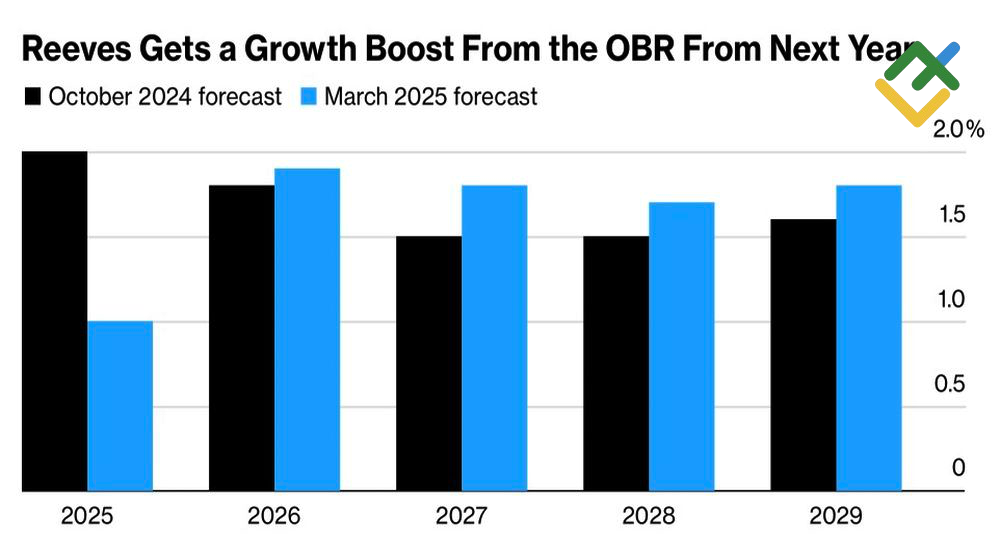

Washington’s policy will likely narrow, not widen, the divergence of US economic growth from that of other countries. It is particularly relevant when considering the economic implications of the UK. The Office for Budget Responsibility has revised its GDP estimate for 2025 but has raised its forecast for 2026 and beyond. The primary risk in this scenario is a global trade war.

UK GDP Growth Forecasts

Source: Bloomberg.

Weekly GBPUSD Trading Plan

The market is still determining how to react to the US tariffs expected on April 2. Concerns regarding their implementation are exerting pressure on the GBPUSD pair. However, if the pair returns to 1.2965, it will confirm the “buy the rumor, sell the news” principle, thereby prompting traders to open long positions. As long as the pound remains below this critical threshold, it is better to keep your short positions initiated at 1.295 open.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of GBPUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.