The UK aims to ramp up trade with the US and avoid tariffs. This decision, influenced by robust macroeconomic data and capital inflows, has boosted the GBPUSD pair. The question remains whether this positive trend will persist. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- The US does not rule out that the UK can avoid tariffs.

- The UK wants to increase trade with the US.

- Capital is flowing from North America to Europe.

- If a trade war sparks, one can sell the EURGBP pair on a breakout of 0.8425.

Weekly Fundamental Forecast for Pound Sterling

The United Kingdom has been trying to charm the US president with statements about its willingness to increase trade with the US and is getting a hint that tariffs can be avoided. This, coupled with positive macroeconomic statistics, has led to a 7% surge in the GBPUSD rate compared to the January highs. Notably, this bullish trend is likely to continue.

Chancellor Rachel Reeves points out that Britain’s trade volume with the US increased during Donald Trump’s first term. The official anticipates a similar outcome during Trump’s second tenure. In 2024, the total value of goods and services traded between the two countries amounted to £294 billion. During a meeting with British Prime Minister Rishi Sunak in Washington, US President Donald Trump stated that he was working on a trade agreement and suggested that London could avoid tariffs if it complied with its terms.

In the Forex market, rumors are circulating that during a global trade war, the currencies of neutral countries not directly involved in the conflict can benefit the most. In this context, the heightened investor interest in the British pound appears well-founded.

This is particularly relevant given that recent data on the UK’s GDP and retail sales has surpassed expectations, leading to a shift away from a stagflationary scenario. While prices remain high, this limits the Bank of England’s ability to aggressively cut rates. However, if the economy continues to improve, this will not be necessary.

Capital flows from North America to Europe, including those driven by Germany’s planned amendments to the fiscal brake rule, support the GBPUSD bullish trend. Since the beginning of the year, the FTSE 100 index has gained 4.5%, while the S&P 500 has lost 5.3%. UK 10-year bond yields are 45 basis points higher than their US counterparts. Investors are seeking opportunities in the UK market, which is more attractive than that of the US.

Thus, the GBPUSD rally is based on the high probability that the UK will avoid tariffs, a shift from the stagflationary scenario, and capital inflows due to the greater attractiveness of UK assets.

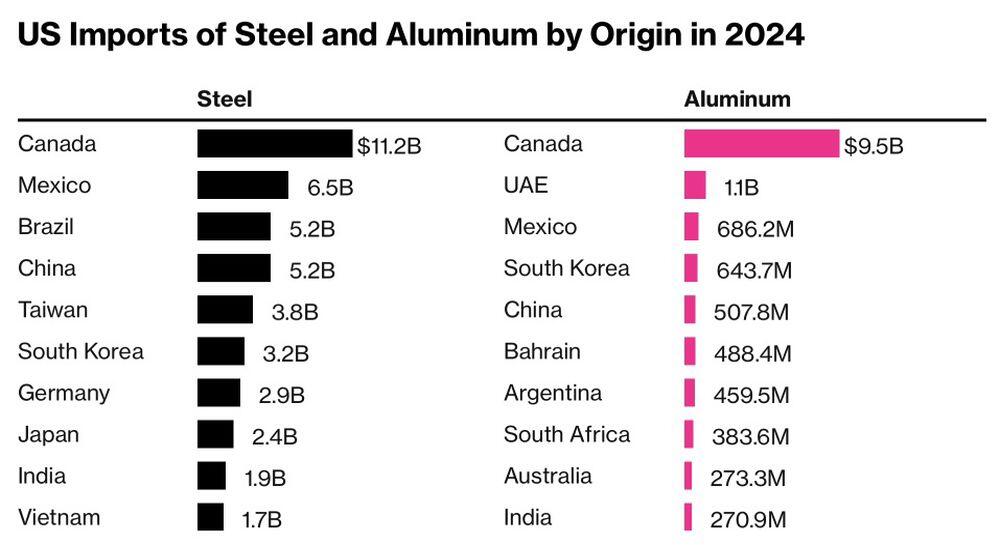

US Imports of Steel and Aluminum

Source: Bloomberg.

The decision of the United States to impose 25% tariffs on steel and aluminum has led to a global trade war. In response, the EU plans to impose retaliatory tariffs on US goods amounting to €26 billion. This development signals the beginning of a protracted trade dispute. It is likely that the shift in Germany’s fiscal policy from restraint to spending has already been factored in the euro quotes.

Weekly EURGBP and GBPUSD Trading Plan

Therefore, a large-scale conflict between Washington and Brussels will create an opportunity to sell the EURGBP pair on a breakout of the support level of 0.8425. As for the GBPUSD pair, one may consider long trades, adding them to the ones formed at 1.2355 if US inflation slows significantly.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of GBPUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.