For much of the year, the pound sterling was the top-performing G10 currency due to the Bank of England’s measured response to inflation. However, as the BoE neared its inflation target, the balance of power on Forex shifted. Let’s discuss this topic and develop a trading plan for the GBPUSD pair.

The article covers the following subjects:

Highlights and key points

- The British wage rate has fallen below 5%.

- Inflation has dropped below the 2% target for the first time in three years.

- The odds of BoE’s two monetary expansion rounds in 2024 have increased.

- Sell the GBPUSD pair on a pullback with the targets of 1.295 and 1.284.

Weekly fundamental forecast for pound sterling

Did the Bank of England’s success in tackling inflation impact the pound sterling positively? In fact, events took a different turn. The first decline in inflation below the 2% target in three years, amid a historic plunge in average wages below 5%, negatively impacted the GBPUSD bulls. Prior to the CPI data release, the derivatives market predicted a 50% chance of two 50 bps repo rate cuts in 2024. However, following the release of key statistics, the likelihood increased to 75%.

The pound sterling has proved unable to withstand a significant number of economically pivotal occurrences. The UK average wage growth rate has exhibited the slowest pace since 2020, and its current values, excluding bonuses, have decreased below the repo rate for the first time since the global economic crisis of 2008.

UK Inflation, wages, and Bank of England rate changes

Source: Bloomberg.

It is evident that the BoE is succeeding in its efforts to control high prices. Andrew Bailey’s hint that he could have adopted a more assertive approach has prompted market participants to begin selling the pound sterling. Subsequently, the GBPUSD pair faced downward pressure due to negative UK employment and inflation data.

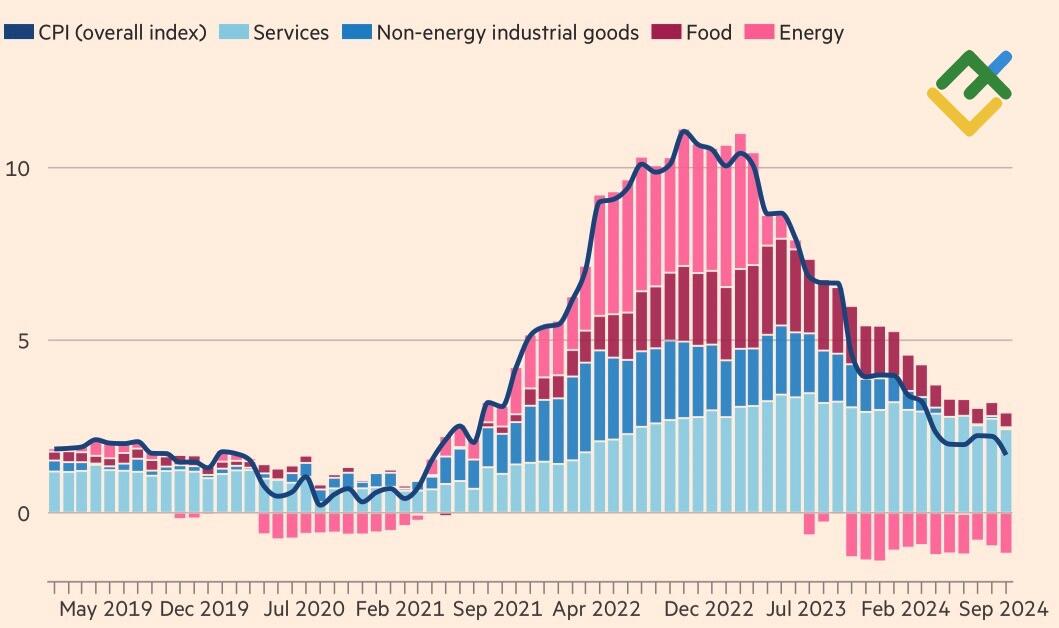

In September, the UK saw a slowdown in consumer prices, dropping from 2.2% to 1.7%. Core inflation also decelerated from 3.6% to 3.2%, and services inflation fell below 5% for the first time since May 2022. Despite the BoE forecast that the CPI may accelerate by the end of the year, its estimate for September of 2.1% is significantly higher than the actual figures. There is a strong possibility that inflation will remain at around 2%.

UK inflation trends and its structure

Source: Financial Times.

Therefore, market analysts predict that both the Bank of England and the US Federal Reserve will implement two rounds of monetary expansion before the end of 2024. Previously, the market expected more from Washington and then tempered its appetite. In contrast, the outlook for London is more optimistic. Prior expectations were for the Bank of England to adopt a sluggish monetary easing approach, but now the pace is expected to increase.

Consequently, market participants sold the pound sterling and bought the US dollar, resulting in a 3.4% fall in the GBPUSD pair from its September highs. If this trend continues, the British pound may fail to maintain its lead in the G10 currency race.

Furthermore, as the deadline of 30 October approaches, when the Labour Party will announce its draft budget, less and less time is left. The IMF has warned that if Chancellor Rachel Reeves does not provide clear answers on how she plans to stabilize the national debt, she risks causing instability in the financial markets. In 2022, the value of the pound sterling fell to near parity with the US dollar as a result of the budget proposed by Liz Truss.

Weekly trading plan for GBPUSD

In my view, the euro’s rebound after the European Central Bank’s decision to cut the deposit rate by 25 bp to 3.25% could support sterling. However, consider selling the GBPUSD pair on pullbacks with the previously mentioned targets of 1.295 and 1.284.

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.