The Bank of England intends to cut the repo rate four times in 2025 but is unlikely to commence the cycle before March or April. Given the necessity to raise taxes, the UK economy is the fastest-growing in Europe. Let’s discuss these topics and make a trading plan for the GBPUSD pair.

The article covers the following subjects:

Major Takeaways

- The pound remains stable despite rumors of four acts of monetary expansion.

- The UK economy will outpace most G7 counterparts.

- Investors are reducing long positions on the US dollar.

- The GBPUSD pair may continue rising once the resistance level of 1.275 is pierced.

Weekly Fundamental Forecast for Pound Sterling

The value of the British pound can be compared to a tennis ball. It resurfaces each time you try to drown it. It would appear that Andrew Bailey’s assertion regarding four interest rate cuts in 2025 should have prompted a significant decline in the British pound against the US dollar, given that markets expected three cuts. However, bears had to step back. Similarly, the OECD announcement that the UK will have to raise taxes even more to stabilize its finances was expected to hurt the pound sterling severely. Instead, it underwent a correction against the greenback.

The acceleration in UK inflation in October prompted the derivatives market to reduce the scope of the BoE’s implied monetary expansion in 2025 to 75 basis points. Weak retail sales and business activity data allowed the scope to increase, but investors still anticipated three acts of monetary expansion by the Bank of England with little likelihood of a fourth. In this regard, Andrew Bailey’s announcement that borrowing costs would decline from 4.75% to 3.75% should have forced GBPUSD bulls to flee the market.

Initially, bulls retreated, but then the BoE head noted that uncertainty over the economy’s response to Labour’s fiscal stimulus and Donald Trump’s tariffs may cause the central bank to put the cycle on pause. It is possible that the monetary expansion cycle will only resume in the second quarter, which caused GBPUSD bears to retreat.

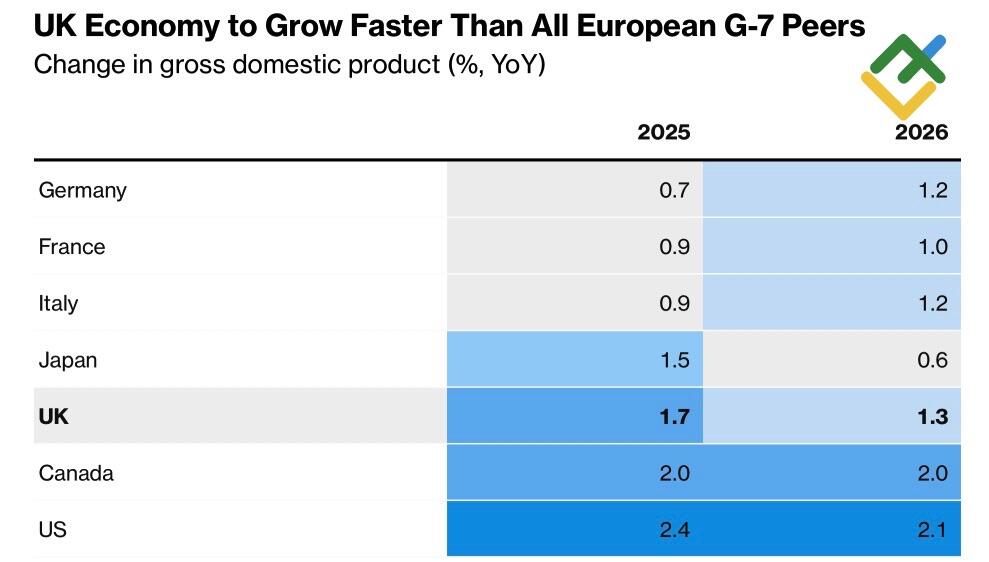

OECD G7 GDP Growth Forecasts

Source: Bloomberg.

Similarly, the OECD’s assertion regarding increased taxation in the UK is another factor. The organization anticipates that UK GDP will expand at a faster rate than in other European countries and Japan.

I believe this is a reasonable assumption. Fiscal stimulus from Rachel Reeves and London’s reduced vulnerability to Washington’s trade tariffs will undoubtedly play a crucial role. The UK economy is centered on banking, consulting, and other services, which are growing rapidly amid the adoption of AI technology. While there is a perception that the UK is on the verge of stagflation, the reality may offer a more nuanced picture.

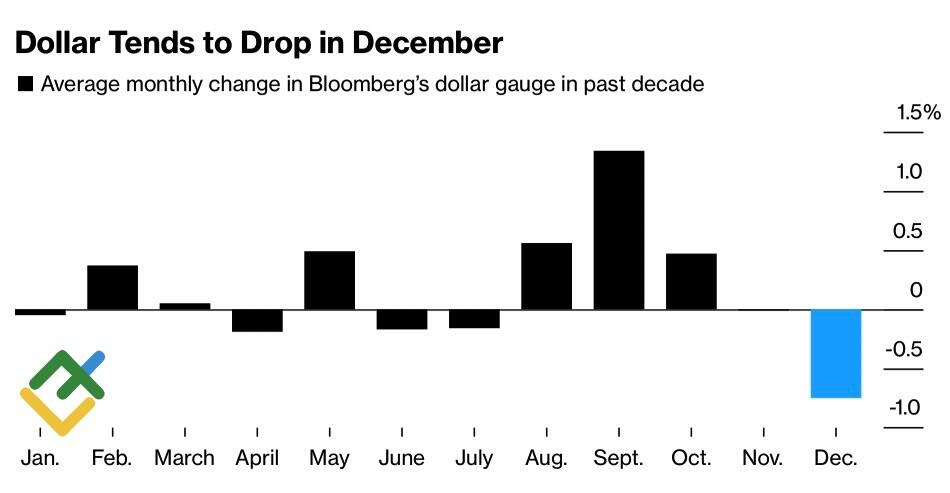

Seasonal Performance of US Dollar

Source: Bloomberg.

GBPUSD bulls are supported by investors’ desire to reduce their short positions. The Trump trade is retreating due to uncertainty about fulfilling all of Trump’s election promises and the contradictory nature of his social media posts. Investors are increasingly inclined to believe that the White House is more interested in negotiations than in tariffs. In addition, December is traditionally a weak month for the US dollar.

Weekly GBPUSD Trading Plan

If the pair breaches the 1.275 level, it may develop a correction within the downtrend, allowing traders to open short-term long trades and switch to medium-term short trades after that. However, this will depend on the US employment report for November, which is likely to drive the GBPUSD pair’s rate.

Price chart of GBPUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.