The GBPUSD pair is rising due to the postponed implementation of tariffs by Donald Trump. However, the pound is more likely to decline against the US dollar as the UK economy faces stagflation. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- The Bank of England is set to cut interest rates in February.

- Stagflation in the UK hampers the BoE’s decisions.

- The delayed introduction of tariffs strengthens the pound.

- Short positions on the GBPUSD pair can be opened on a rebound from 1.26 and 1.2685.

Weekly Fundamental Forecast for Pound Sterling

While Donald Trump claims that the US economy is crippling and needs to be rescued, UK officials assure that the UK economy is just fine. However, according to Chancellor Rachel Reeves, the UK should brace for a slowdown in economic growth, vowing to go further and faster to kickstart economic growth. Nevertheless, the GBPUSD pair continues to post gains.

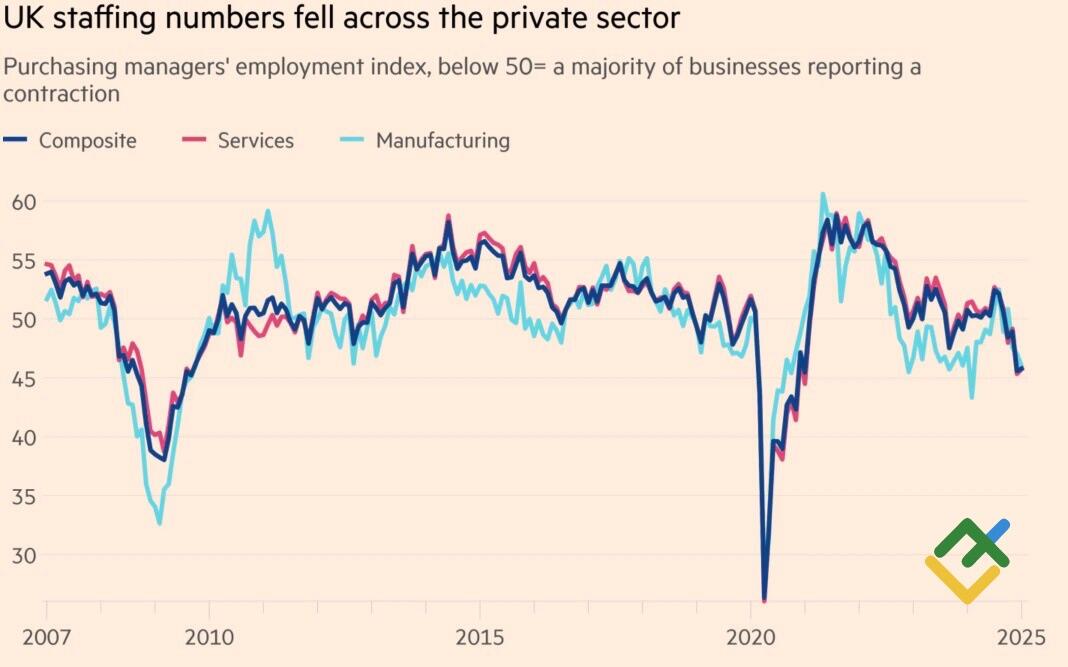

A closer look at the details reveals that Britain’s stronger-than-expected January PMI figures did not mislead investors. Companies are currently laying off employees at the fastest pace since the global economic crisis of 2008–2009, excluding the pandemic, and passing costs onto consumers at the fastest rate since July 2023. This intensifies the stagflationary pressures, presenting a daunting challenge for the Bank of England.

UK Purchasing Managers’ Employment Index

Source: Financial Times.

Capital Economics anticipates that, in light of these developments, the Bank of England will be compelled to implement rate cuts in a gradual manner. The futures market forecasts two acts of monetary expansion in 2025, with a low likelihood of a third. The first rate cut is expected to occur in early February.

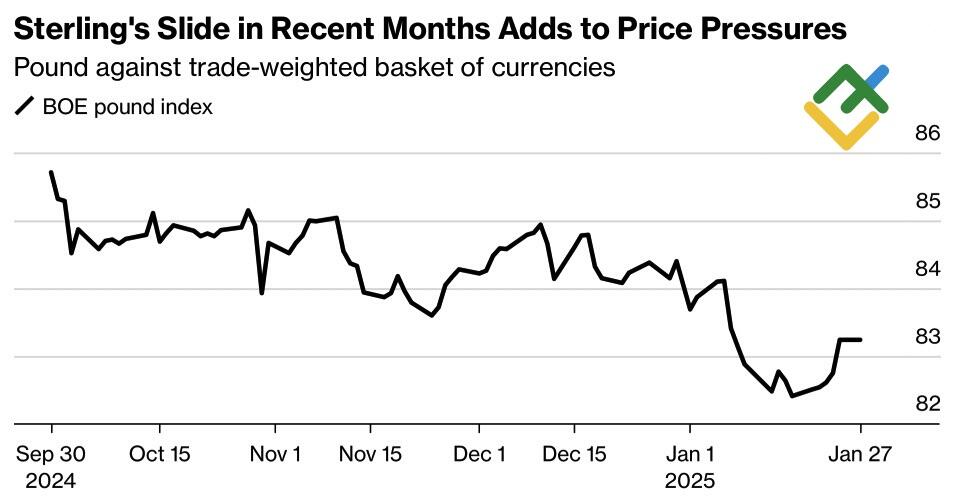

Meanwhile, Pantheon Macroeconomics notes that higher payroll taxes, global uncertainty, and tariff threats are making inflation and output head in opposite directions. The Bank of England is also grappling with the sluggish performance of the national currency in early 2025, which has been an outsider in the Forex market due to concerns about the debt crisis in the country. Only the slower-than-expected Donald Trump’s tariff policy has allowed GBPUSD quotes to enter a correction phase.

Pound’s Performance Against Trade-Weighted Basket of Currencies

Source: Bloomberg.

According to Bloomberg’s estimates, the fall in the trade-weighted sterling exchange rate will add 0.23% to inflation in the coming quarters due to the rising cost of imports. If the BoE accelerates its monetary expansion cycle, the GBPUSD pair will weaken, and the problem will only get worse. This is why the UK regulator is in no hurry to tackle the issue.

Notably, Britain’s cost of borrowing is 4.75%, higher than any other world’s major economy. This higher cost of borrowing hampers economic growth but also strengthens the pound in times of high global risk appetite. As a result, the rally in the US stock indices buoys the GBPUSD exchange rate.

Weekly GBPUSD Trading Plan

The pair’s ongoing correction may continue only if Donald Trump postpones tariffs again. Once the trade war sparks, the GBPUSD pair will likely plummet against a pullback in the S&P 500 index and the inherent economic weakness of the UK compared to the US. Therefore, consider opening short trades if the GBPUSD pair rebounds from the resistance levels of 1.26 and 1.2685 or dips below the support level of 1.239.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of GBPUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.