The BoE is faced with the challenge of making crucial decisions in the context of ongoing uncertainty. The budget proposed by the Labour Party and Trump’s proposed protectionist policies are likely to influence inflation in the UK. Let’s discuss these topics and make a trading plan for the GBPUSD pair.

The article covers the following subjects:

Major takeaways

- The repo rate would be 50 bps lower without Labour’s budget.

- UK inflation will accelerate to 3% in early 2025.

- The Bank of England will be forced to act slowly.

- The GBPUSD pair may drop to 1.27 and 1.25.

Weekly fundamental forecast for pound sterling

The Bank of England will have to navigate a thorny road and a rapidly changing landscape. In light of Donald Trump’s victory in the US presidential election, other regulators are adjusting their monetary policies. Meanwhile, the BoE should consider the implications of the new Labour budget. The UK regulator has the opportunity to take its time to mull over the situation. The markets expect the Bank of England to cut the repo rate to 4.75% for the second time in the cycle at the November 7 meeting and to slow down rate cuts further. This development is encouraging GBPUSD bulls.

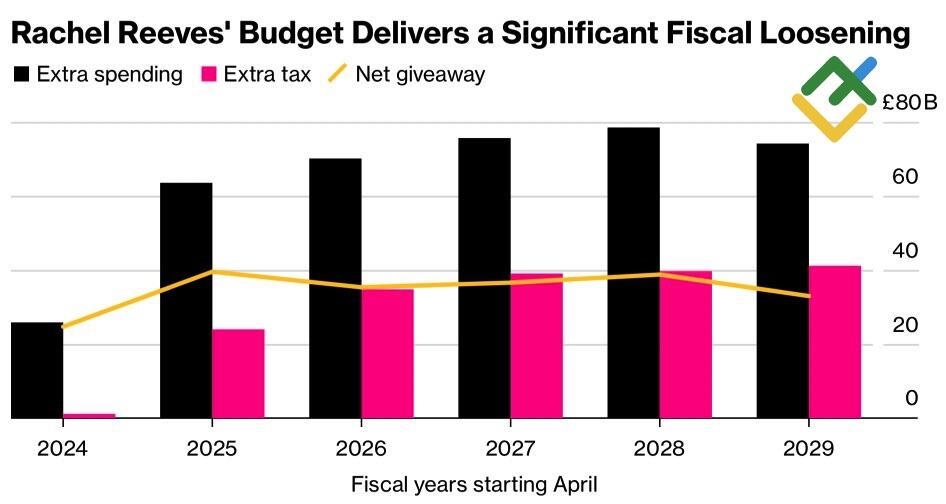

The government of Keir Starmer is expected to implement fiscal stimulus measures that will increase the volume of British bond issuance by £30 billion per year. This is likely to limit the scope for aggressive monetary policy easing by the country’s regulator. Without the increase in government spending and investment, the repo rate could be 50bp lower.

Scale of fiscal stimulus in UK

Source: Bloomberg.

Donald Trump’s pledged tariffs add to the uncertainty. The 60% increase in duties on imports from China and the 20% increase applied to imports from other countries will harm the global economy. However, the effect of these factors on inflation in the UK is unclear. JP Morgan Asset Management anticipates that Europe will implement increased fiscal stimulus to bolster local businesses and defense spending, which will contribute to accelerated price growth. In contrast, Citigroup believes that China will redirect its inexpensive products from the New World to the Old World, which will decelerate CPI.

The National Institute of Economic and Social Research (NIESR) has stated that the effects of supply chain disruption due to US protectionism, Labour’s fiscal stimulus, and rising energy commodity prices will result in inflation reaching 3% in early 2025, up from the current 1.7%. The rate is projected to return to the 2% target by the end of next year and remain there through 2026.

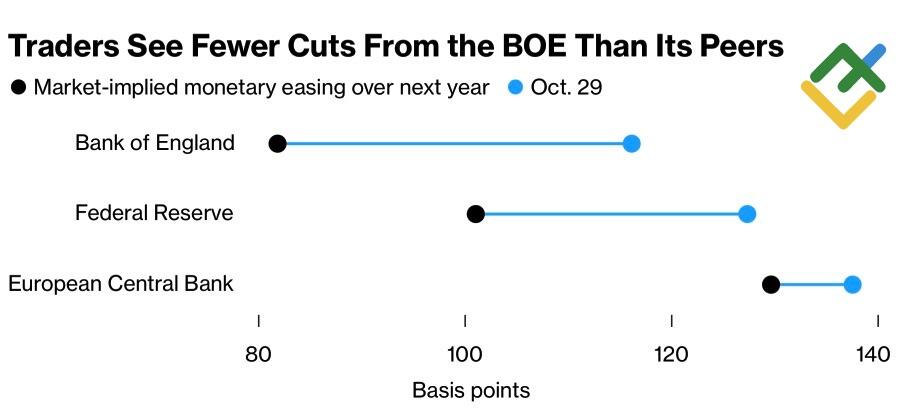

In light of these projections, NIESR predicts that the Bank of England will implement a single repo rate cut in 2024 and three such cuts in 2025, lowering the cost of borrowing from 5% to 4%. This process is expected to unfold slower than in the US and Eurozone, boosting the British pound.

Market expecattions on interest rates

Source: Bloomberg.

Donald Trump’s tariffs and fiscal stimulus will accelerate inflation, primarily in the US. The global economy will see slower growth, prompting the Fed to adopt a more hawkish stance and forcing other central banks to adopt a more dovish approach. As the likelihood of a Fed pause in monetary easing increases, the US dollar will continue to appreciate against major global currencies, including the pound sterling.

Weekly GBPUSD trading plan

The GBPUSD pair will decline slower than other USD-related currency pairs, but the downtrend is inevitable. This provides an opportunity to open short positions on upward pullbacks, adding them to the ones initiated on a rebound from the resistance level of 1.305. The targets are 1.27 and 1.25.

Price chart of GBPUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.