The beginning of 2025 has created a sense of déjà vu. As in the fall of 2022, UK gilt yields are soaring rapidly, and the pound is plummeting. How will this development affect the GBPUSD pair? Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- The 30-year UK bond yield has reached its highest level since 1998.

- Rising debt rates will not allow London to balance its budget.

- Another tax hike will damage the economy.

- The GBPUSD pair is approaching 1.22.

Weekly Fundamental Forecast for Pound Sterling

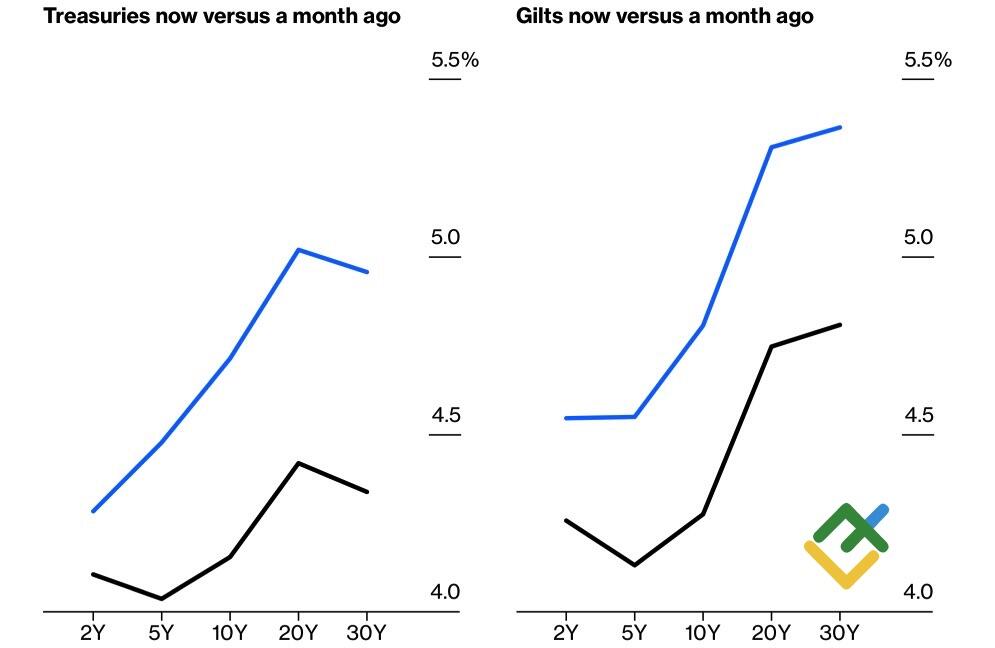

The US dollar’s recent strength, evidenced by an increase in US Treasury yields, is exerting pressure on the pound sterling. While the greenback is gaining ground, UK debt rates are rising at a faster pace, contributing to the decline in the GBPUSD exchange rate. Investors are expressing concerns that Finance Minister Rachel Reeves will succeed in balancing the budget amidst rising long-term borrowing costs, reaching levels not seen since 1998. This may lead to new tax hikes, which could potentially harm the UK economy.

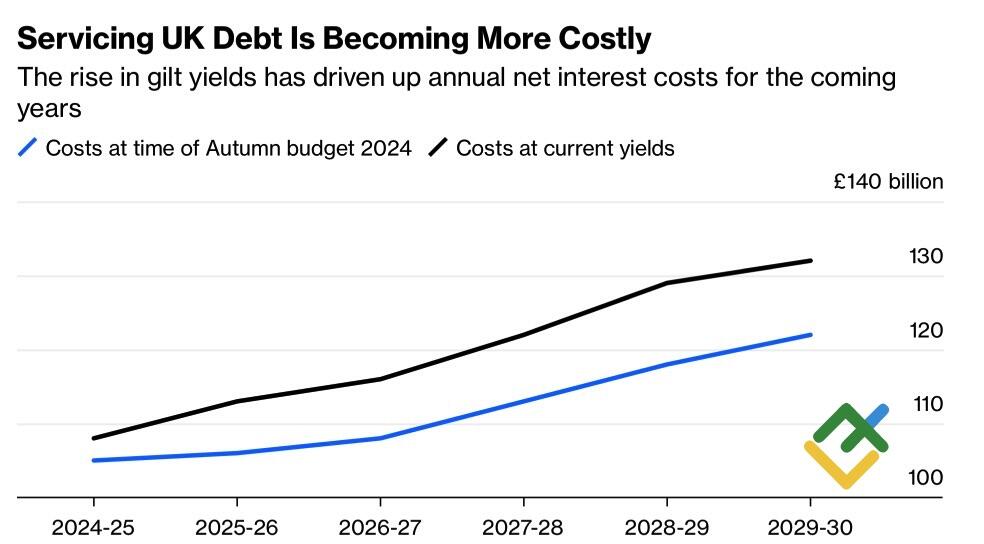

The current financial climate echoes the events of the fall of 2022, when the disastrous mini-budget of the Liz Truss government spurred British bond yields, collapsed the pound sterling to near parity against the US dollar, and the prime minister was forced to announce resignation. Deutsche Bank anticipates that the Labour government will not achieve a balanced budget before 2030 due to rising interest costs, which have increased by £10 billion since September.

UK Debt Servicing Cost

Source: Bloomberg.

Investors have expressed skepticism regarding Andrew Bailey’s hints of a 100bp repo rate cut in 2025, anticipating that the Bank of England will follow the Fed’s lead with a limited number of monetary expansion acts. This scenario could have adverse consequences for the British economy, which is currently experiencing greater challenges compared to its US counterpart. If the Fed can manage to maintain its current policy stance until May, the BoE may face more pressing constraints in terms of action. The current economic environment, characterized by stagflation, presents significant challenges for the UK regulator. However, it is crucial to recognize that addressing a declining economy should prevail over the pursuit of anchoring inflation near 2%.

US Treasury and UK Gilt yields

Source: Bloomberg.

The UK enjoyed a stable political landscape in 2024, but now it is poised to face a significant financial crisis in early 2025. Investors are closely monitoring Rachel Reeves’s approach to addressing budgetary shortfalls, particularly in the context of rising bond yields. Speculation is mounting on potential policy shifts, such as cuts to government spending or an increase in taxes. These measures, if implemented, could further strain an economy that is already showing signs of fragility.

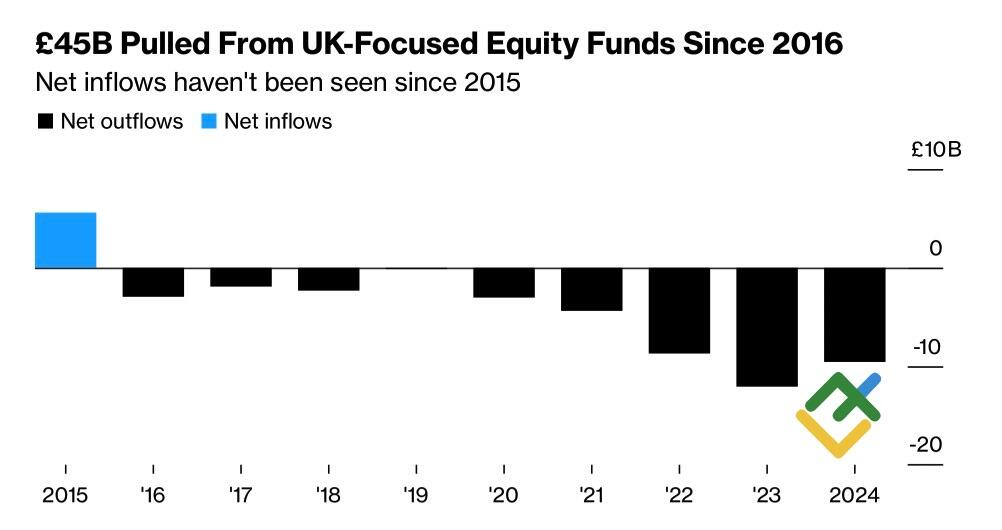

The ongoing exodus of non-residents from the UK underscores the gravity of the situation. This trend is evident not only in the debt market, where yields are rising faster than in the US but also in UK equity funds, which have experienced significant outflows over the past nine years, totaling £45 billion.

Capital Flows into UK Equity Funds

Source: Bloomberg.

Weekly GBPUSD Trading Plan

The British pound has shown notable weakness, shifting from a clear leader in the Forex market a year ago to a confirmed underdog. Since the beginning of 2025, the UK currency has lost approximately 1.9%. The Bank of England’s lethargic response failed to support the national currency, along with the anticipation that Donald Trump’s tariffs would have a less significant impact on the British economy compared to that on the eurozone or China. When capital flees a country, its currency tends to experience significant headwinds. The GBPUSD pair is approaching a bearish target of 1.22. The recommendation is to keep short positions open.

Price chart of GBPUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.