The UK economy is not performing as well as anticipated, and the Labour Party has been unable to provide the required stimulus. The deterioration in global risk appetite due to the conflict in the Middle East has also had an adverse effect on GBPUSD quotes. Let’s discuss these issues and make a trading plan.

The article covers the following subjects:

Highlights and key points

- The prospect of tax hikes is exerting downward pressure on the pound.

- The Labour Party has failed to improve relations with the EU.

- The UK currency is suffering from a declining global risk appetite.

- Long positions can be opened if the GBPUSD pair returns above 1.315.

Weekly fundamental forecast for pound sterling

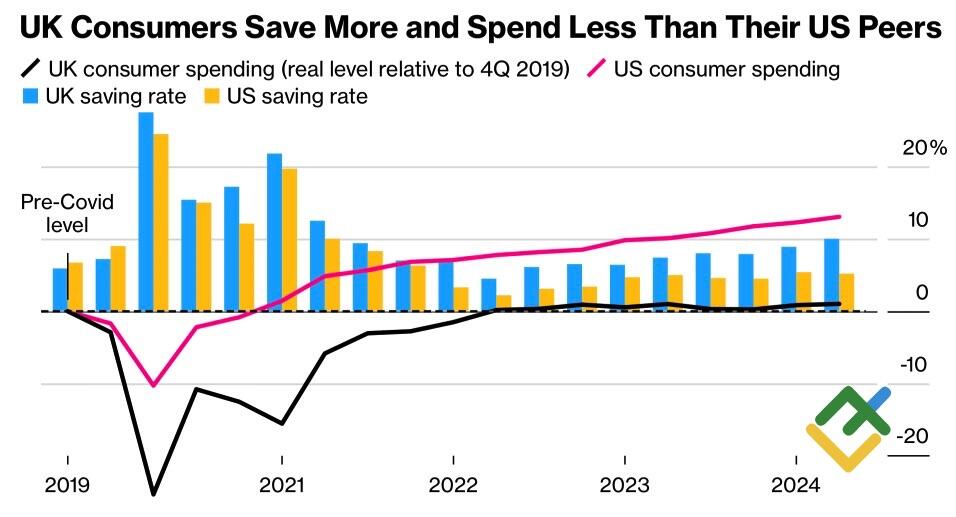

There is only one step from the sublime to the ridiculous. The British pound has undergone a significant decline in popularity, moving from a position of strength to one of relative weakness. The GBPUSD pair saw a significant plunge due to the intensification of geopolitical unrest in the Middle East, the gradual pace of monetary policy adjustments by the US Federal Reserve, and a more subdued outlook for the British economy compared to previous expectations. In the second quarter, the rate of growth slowed to 0.5% from 0.7%, rather than reaching 0.6% as initially estimated. In addition, the household savings rate increased to 10% from 8.9%, representing the highest level since 2021.

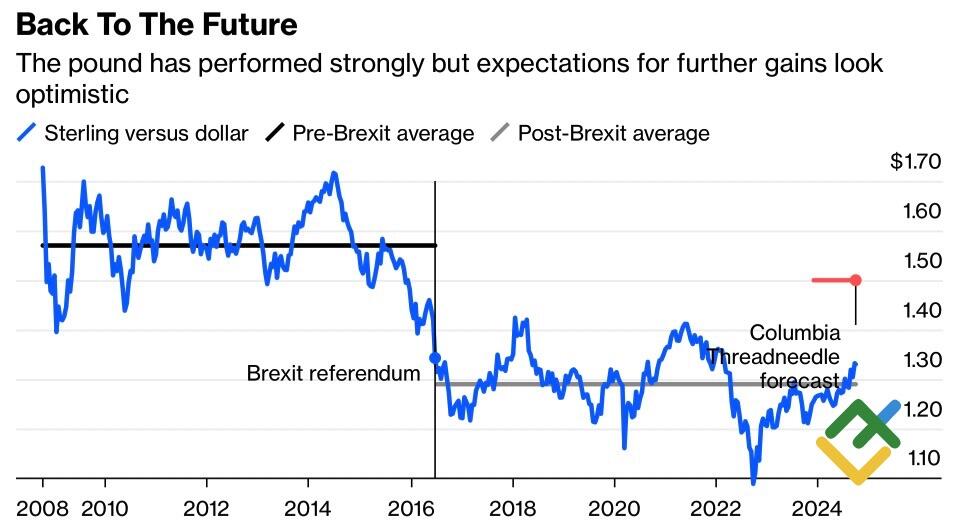

Between April and September, the British pound was a strong performer in the foreign exchange market, reaching its highest levels in 2.5 years and appreciating by 30% against the US dollar from its historical lows in the autumn of 2022. While it has not yet reached the levels seen prior to the Brexit referendum, asset manager Columbia Threadneedle Investments predicts that the GBPUSD rate will reach 1.5 in 2025.

Pound’s performance before and after Brexit

Source: Bloomberg.

The pound’s appreciation was driven by several factors, including the acceleration of the UK economy, which outperformed other G7 economies in the first half of the year, the differing approaches to monetary expansion by the Fed and the Bank of England, and the active use of the currency in carry trade transactions.

The derivatives market projects a reduction in the repo rate to 4.3% in six months. By that time, the federal funds rate should reach 3.5%. However, for a sustainable upward movement, the currency must be supported by a more optimistic economic outlook. Despite a promising beginning, the UK cannot boast of its economic results.

Following the Labour Party’s electoral victory, there was optimism regarding the prospect of improved relations with the EU. However, the initial negotiations revealed that London is uncertain about its objectives. The UK’s intention to remain outside the single market and customs union presents a challenge to dialogue. The growth of savings indicates a prevailing sense of uncertainty among households. Concurrently, business pessimism has reached its highest levels since the end of 2022. Companies are concerned that the cooling of the labor market and the tax increases announced by the Labour Party on October 30 will severely harm GDP growth.

US and UK saving rate and consumer spending

Source: Bloomberg.

In contrast, the US economy is expected to grow by 3.1% in the third quarter, according to the Atlanta Fed’s leading indicator. The pace of the Fed’s monetary expansion is not expected to match the initial projections. Furthermore, the increasing demand for the US dollar as a safe haven asset in the context of the escalating geopolitical conflict in the Middle East has posed challenges for GBPUSD bulls.

The decline in global risk appetite is prompting carry traders to get rid of the British pound. As long as the likelihood of conflict between Israel and Iran remains high, this trend is likely to persist.

Weekly trading plan for GBPUSD

The GBPUSD pair will hit the bottom and rebound if there are weak statistics on the US labor market and a measured response from Israel, which will subsequently de-escalate the conflict. The pair’s return above 1.315 will allow traders to open long positions.

Price chart of GBPUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.