The BOE head’s dovish comments and robust US employment statistics for September prompted GBPUSD bulls to retreat. What are the implications for the market? Let’s discuss this topic and develop a trading plan.

The article covers the following subjects:

Highlights and key points

- The Bank of England may act more aggressively.

- The synchronized pace of monetary expansion has hurt the GBPUSD pair.

- Divergence in GDP growth will determine the currency pair’s trajectory.

- The pound may sag to 1.295 and 1.283.

Weekly fundamental forecast for pound sterling

It is unclear whether the Bank of England’s actions were deliberate and resulted in a decline in the national currency. Andrew Bailey’s remarks that the BoE may become more proactive in cutting the repo rate set the stage for the most significant GBPUSD collapse since February 2023. HSBC has indicated that a shift in the central bank’s approach could mark a pivotal moment for the pound sterling.

GBPUSD weekly performance

Source: Bloomberg.

The GBPUSD pair’s plunge was fueled by a strong US labor market report for September, which allowed the derivatives market to rule out the chances of a 50bp cut in the federal funds rate in November. The probability of the key rate remaining at 5% rose from zero to 15%.

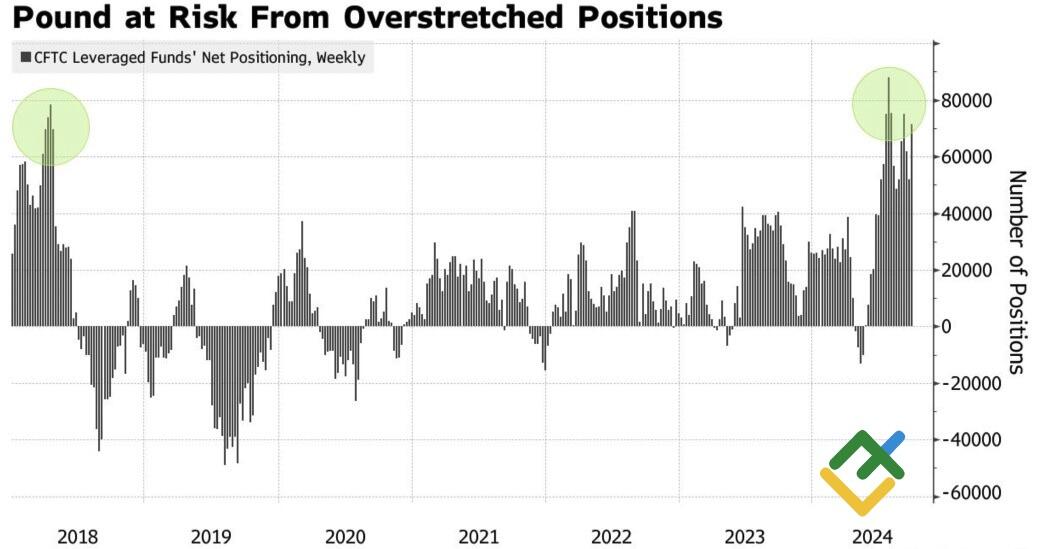

The market no longer believes the Fed will loosen its monetary policy by 150 bp in the current cycle. On the contrary, dovish comments from the Bank of England governor raised the estimated scope of monetary expansion to 119 bp by end-2025. HSBC believes such estimates are underestimated, and a 225bp cut is more likely to occur. The leveling speed on the background of overextended bullish positions of speculators on the pound has sent GBPUSD quotes tumbling.

Hedge funds’ positions on British pound

Source: Bloomberg.

Following a significant decline, the British pound’s potential for reversal reached its lowest point in three months, while the cost of insurance against fluctuations in the pair reached its highest level since April 2023. Lequeux anticipates a decline in the GBPUSD exchange rate to 1.2, representing a 10% decrease from current levels. Conversely, Rabobank projects that the pair will appreciate to 1.34, as enhanced political stability will stimulate further capital inflows into British markets.

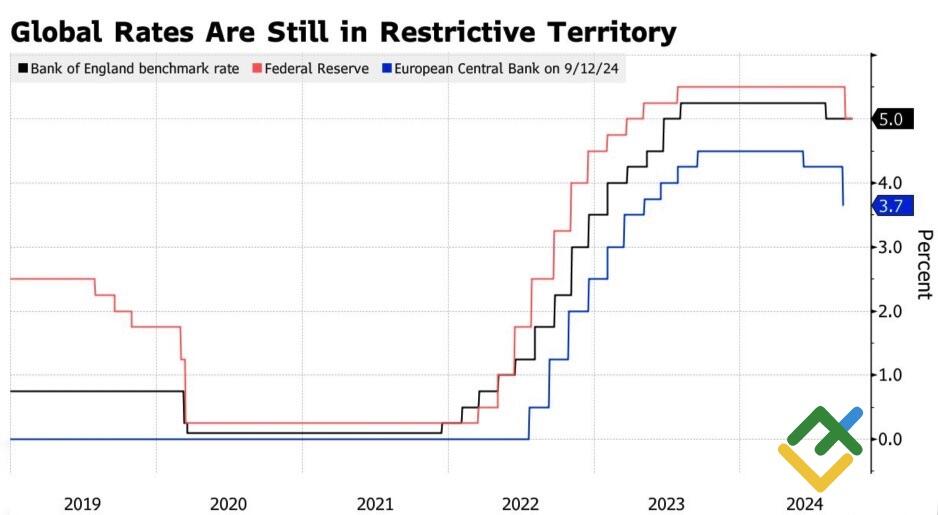

The future trajectory of the GBPUSD pair will be influenced by the extent to which central banks implement monetary policy easing. Regardless of the outcome of the US presidential election in November, new fiscal stimulus measures to accelerate economic growth in the US will be implemented. Meanwhile, the UK will face tax increases from the Labour Party, which will have a negative impact on GDP growth. The Bank of England will have a greater incentive to accelerate the monetary expansion cycle than the Fed, which will exert pressure on the value of the pound sterling.

Interest rates in the US and the UK will be higher than currently anticipated. Globalization and the availability of inexpensive Chinese labor have contributed to a decline in inflation over the past three decades. It is time for rates to return to higher levels, which requires maintaining elevated borrowing costs.

Global central banks’ interest rates

Source: Bloomberg.

Weekly trading plan for GBPUSD

At the same time, the market overestimated the likelihood of a 150 bp cut in the federal funds rate to 3.5%. Indeed, it may ultimately reach the 4-4.5% range, bolstering the US dollar. In such an environment, upward pullbacks in GBPUSD quotes should be viewed as opportunities to sell the pair with targets at 1.295 and 1.284 after the release of US inflation data for September.

Price chart of GBPUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.