The aggressive start of the Fed’s monetary expansion has changed the rules of the game. Now, central banks are forced to consider whether they should also accelerate their expansionary policies. The Bank of England will be the first to announce its decision. Let’s discuss this topic and make a trading plan for the GBPUSD pair.

The article covers the following subjects:

Highlights and key points

- The Fed has set a high speed of monetary expansion.

- The Bank of England will follow the Fed or remain cautious.

- The BoE’s decision will determine the medium-term prospects of the pound.

- The GBPUSD pair may rise to 1.35 and 1.37 or fall below 1.323.

Daily fundamental forecast for pound sterling

Central banks tend to align their decisions. While some central banks have already reduced interest rates in anticipation of the Fed’s move, the aggressive start allows other central banks to accelerate their rate-cut cycles. The question is whether they will have the courage to do so. The Bank of England is the first to make an announcement, and based on the GBPUSD rally, it appears there may be reluctance to follow suit. A stronger pound will have an adverse effect on the UK’s international competitiveness as an exporter.

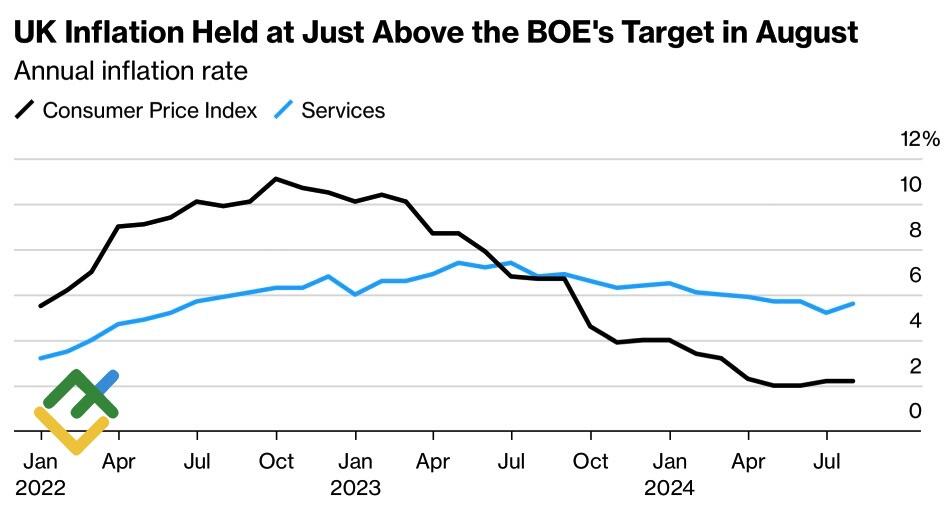

The futures market indicates a 35% probability that the BoE will maintain its monetary expansion cycle in September, following the August reduction of the repo rate from 5.25% to 5%. While not a high probability, the odds have increased from 20% in the previous week. This is despite the stability of UK inflation. Consumer prices in August remained at 2.2%, while core inflation and services prices accelerated from 3.3% to 3.6% and from 5.2% to 5.6%, respectively.

UK inflation rate

Source: Bloomberg.

If the Fed believes that its recent reduction in the federal funds rate is justified by the imminent approach of inflation to the 2% target, can the Bank of England draw the same conclusion? There is no obstacle to this course of action. The CPI and services inflation are below the Bank of England’s August forecast of 2.4% and 5.8%, respectively. The economy is exhibiting a cooling trend following a period of turbulence, and the growth rate of average wages remains in decline.

Investors anticipate that the BoE will maintain the repo rate at 5% by a vote of 7-2 at its meeting on September 19. Additionally, the BoE’s head will address the market during a press conference, seeking to dissuade an aggressive cycle of monetary easing. The derivatives market has indicated the potential for two further steps along the road of monetary expansion in the UK, namely in November and December, as a result of the signs of a cooling economy.

However, the Fed’s aggressive approach creates a significant incentive for the Bank of England and other central banks to engage in currency wars. A strong currency is having a negative impact on exports, while its weakening amid slowing prices will help avoid the 21st-century scourge of deflation. Central banks have employed a variety of strategies to combat this challenge, including ultra-low rates and quantitative easing programs. However, it was only the pandemic and supply chain disruption that provided a significant opportunity for them to overcome it.

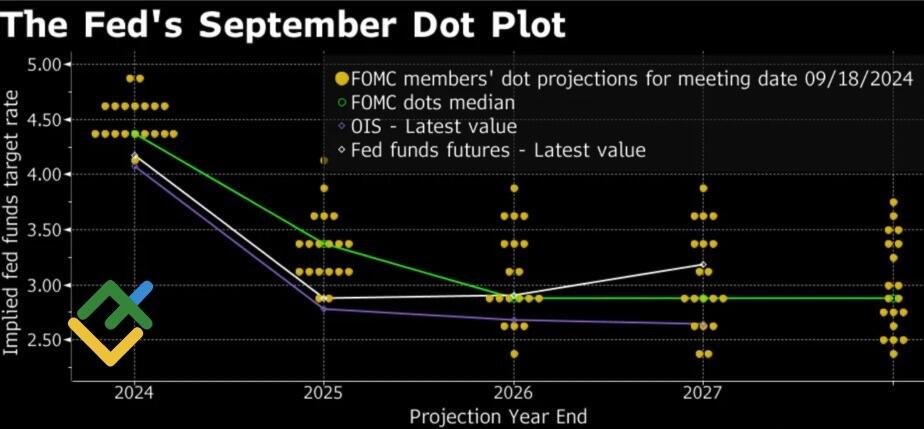

If the Bank of England maintains the cautious approach that the market anticipates, the probability of a resumption of the uptrend in the GBPUSD pair will increase. The latest FOMC forecasts indicate a reduction in the federal funds rate from 5% to 4.5% by the end of 2024. For the first time in a considerable period, it could decline below the repo rate, which would boost the pound sterling.

FOMC federal funds rate forecasts

Source: Bloomberg.

Daily trading plan for GBPUSD

The BoE’s slowness provides an opportunity to purchase the GBPUSD pair with targets at 1.35 and 1.37. Should the Bank of England cut borrowing costs by 25 bp to 4.75%, or if the pair returns below 1.323, one may sell the British pound.

Price chart of GBPUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.