The pound sterling is trying to use its advantages, but they are no longer relevant. The UK economy is expanding. However, wages are decelerating. Why does the Bank of England delay a repo rate cut? Let’s discuss this topic and make a trading plan for the GBPUSD pair.

The article covers the following subjects:

Highlights and key points

- UK’s economy may lose its G7 leadership.

- Markets are overly optimistic about BoE’s slowness.

- Reassessment of Fed rate outlook drags the GBPUSD pair down.

- The British pound risks falling to $1.295 in the near future.

Weekly fundamental forecast for pound sterling

Despite the expectation of a slower pace of monetary policy easing by the Bank of England compared to its US counterpart, the GBPUSD pair is declining due to a reassessment of risks. The fresh labor and inflation data from the US indicate that the economy remains robust. In contrast, the disappointing UK GDP data for July raises doubts about a continued acceleration in the third quarter. If this is the case, it would appear that the pound is becoming increasingly vulnerable.

Given that the UK economy is growing at the fastest pace among the G7 countries, and services inflation and wage growth rates are high, the Bank of England is experiencing difficulty in identifying reasons to pursue a monetary expansion path at the same pace as the Fed. The futures market anticipates a 40 basis point reduction in the repo rate in 2024, which is considerably less than the 100 basis point cut projected for the federal funds rate. According to a poll of 65 Reuters experts, 49 of them expect another monetary policy shift from the BoE in 2024, while the remaining 16 foresee two rate cuts in November.

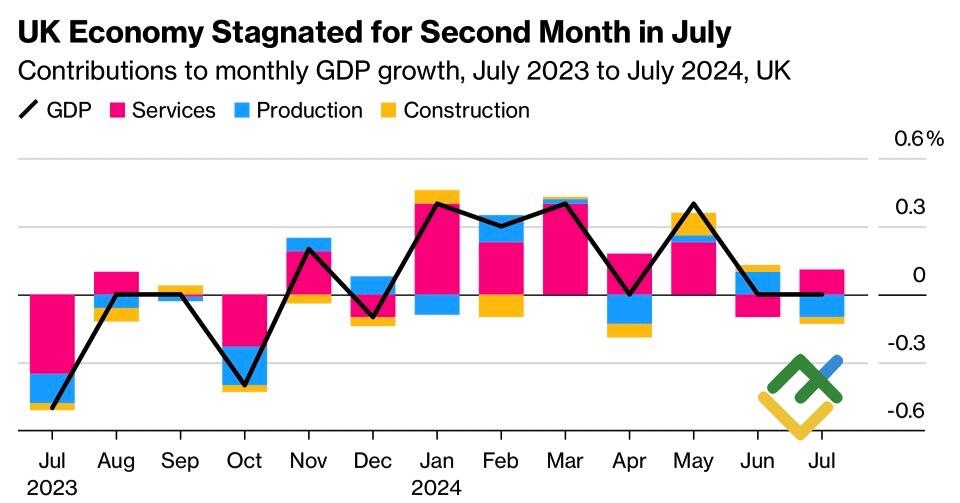

Despite a spark of optimism, the situation may not be as positive as it appears. Following Britain’s zero GDP growth in July, JP Morgan and Deutsche Bank have shelved the idea of accelerating UK GDP in the third quarter. The UK economy may lose steam and fall behind its G7 counterparts.

UK economy performance

Source: Bloomberg.

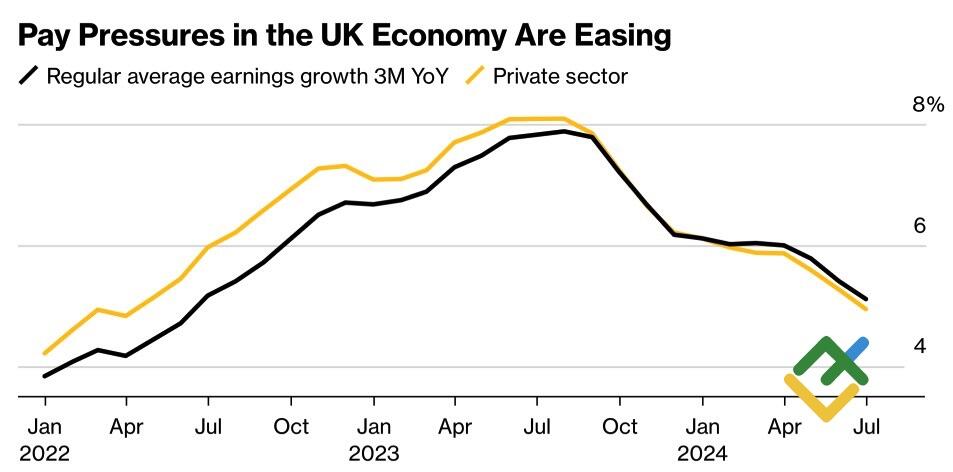

The slowdown in average wages to a two-year low is causing concern at the Bank of England. Inflation in the UK reached 2% in May-June and accelerated to 2.2% in July. However, if it is not driven by the labor market, it will be easier to anchor. Given these conditions, it would be prudent to consider a faster reduction in the repo rate to prevent the country from sliding into deflation. This is particularly important given the fiscal consolidation measures introduced by the new Labour government, which will likely slow down prices.

UK average earnings

Source: Bloomberg.

Investors have not yet been confronted with the consequences of the UK’s fastest economic growth among the G7 countries. The market is likely to overestimate the pace of the Bank of England’s monetary expansion, which could have an adverse impact on the British pound. Meanwhile, the GBPUSD pair is declining as market participants re-evaluate the outlook for the federal funds rate.

Following the release of US employment data for August, the likelihood of an aggressive start to the Fed’s monetary expansion by half a point in September rose above 50%. By the end of the second week of autumn, they fell to 13%. There has been a notable shift in discourse on Forex, with a decline in speculation about a recession and an increase in discussions about a soft landing. This has contributed to a surge in the US dollar’s value. In addition, the uncertainty surrounding the presidential election is providing further support for the greenback.

Weekly trading plan for GBPUSD

The bearish pressure on the GBPUSD rate is a result of a reassessment of market views on the federal funds rate expectations. The pair has reached the first bearish target of 1.3020, aiming to hit the second target of 1.295. The recommendation is to sell.

Price chart of GBPUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.