A trade deal with the US, strong UK macroeconomic data, the Bank of England’s cautious approach, and the fact that the UK will avoid a fiscal crisis are all factors that are boosting the GBPUSD pair. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- The trade deal with the US has dispelled uncertainty.

- Accelerating inflation allows the BoE to proceed without haste.

- The UK will avoid a fiscal crisis.

- Long trades on the GBPUSD pair can be considered with the targets at 1.35 and 1.38.

Weekly Fundamental Forecast for Pound Sterling

Due to the fact that the UK was the first to conclude a trade agreement with the US and its weighted average tariff is at the lower end of the 8-39% range, the British pound has ranked second among G10 currencies over the past month. The Norwegian krone became the top-performing currency, but the GBPUSD pair surge was also noteworthy. The recent strengthening of the British pound is not solely attributable to reduced uncertainty surrounding trade policy.

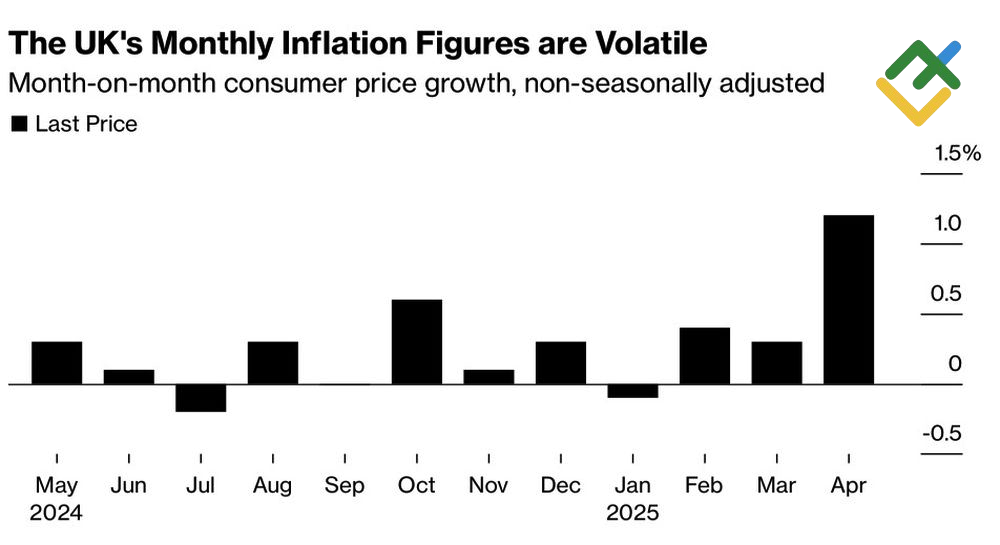

The UK economy is enjoying a period of robust performance. In the first quarter, GDP grew faster than its US and European counterparts, and the 1.2% surge in retail sales in April indicates further growth potential. Accelerated economic growth, reduced geopolitical tensions, and the de-escalation of the US-China trade conflict have improved consumer confidence. As a result, a payroll tax increase in October spurred inflation to 3.5%, marking the highest jump in CPI since the autumn of 2022.

UK Inflation Rate

Source: Bloomberg.

In light of the stronger-than-expected May PMI data, Huw Pill’s statements become particularly relevant. The chief economist has voiced concerns that the Bank of England is reducing rates at a rapid pace. It would be advisable to implement this adjustment on a quarterly basis, as wage growth has been significant and the services inflation has yet to reach its target.

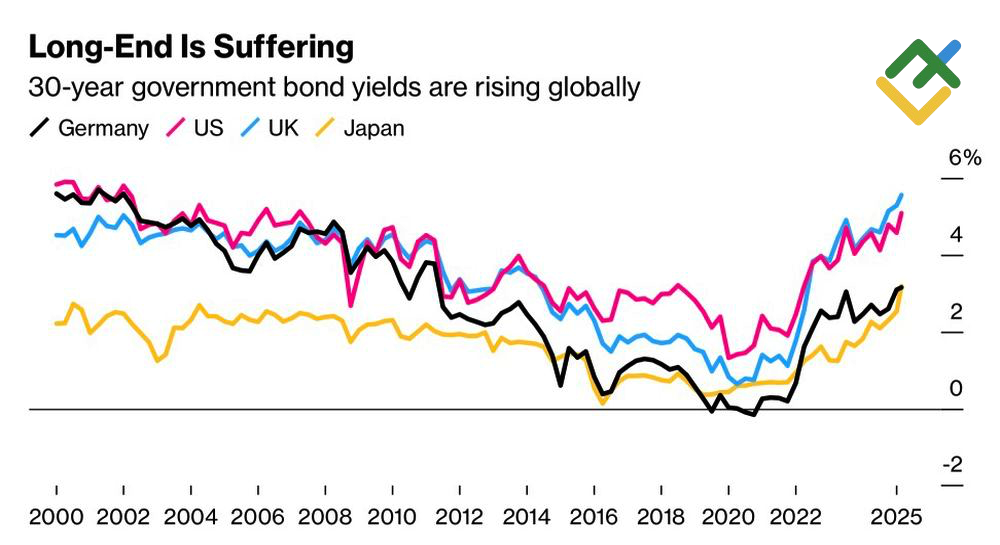

The elimination of uncertainty in trade policy, robust macroeconomic data, and the Bank of England’s measured approach are among the key factors contributing to the positive outlook for the GBPUSD pair. The pound has hit a 3-year high against fiscal problems in the US, which, at first glance, appear to be spreading to the rest of the world.

Indeed, soaring Treasury bond yields have little to do with a robust economy. Investors are concerned that Donald Trump’s bill will expand the budget deficit by 7% of GDP, a figure last seen during wartime or periods of low unemployment in the US. The contagion appears to be spreading to the rest of the world, evoking associations with events in the US in the 1990s, in the eurozone in the 2010s, and in the UK in 2022. At the time, the authorities were compelled to reverse their previous decisions due to the collapse of the debt markets.

30-Year Gilt Yield and Other Countries’ 30-Year Bond Yields

Source: Bloomberg.

The GBPUSD pair will unlikely witness any sharp or sudden price movements. Chancellor Rachel Reeves is pursuing a balanced fiscal policy, while fiscal problems in the US are facilitating the “sell America” strategy. The US dollar’s weakness stems from a decline in confidence, compounded by high tariffs, which negatively impact real incomes and corporate profit margins and lead to capital flight from North America to Europe.

Weekly GBPUSD Trading Plan

The previously announced targets of 1.35 and 1.38 for GBPUSD purchases remain relevant. Therefore, long trades can be considered on a breakout of swing highs or pullbacks.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of GBPUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.