UK bond yields have not soared as they did two years ago and the GBPUSD pair has not collapsed to parity. However, the impact of Labor’s budget has yet to be assessed. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Highlights and key points

- The UK has raised taxes by £41 billion and increased spending by £74 billion.

- The Labour’s budget looks pro-inflationary.

- The Bank of England will cut rates at a slower pace.

- The GBPUSD may soar to 1.305 and 1.31.

Weekly fundamental forecast for pound sterling

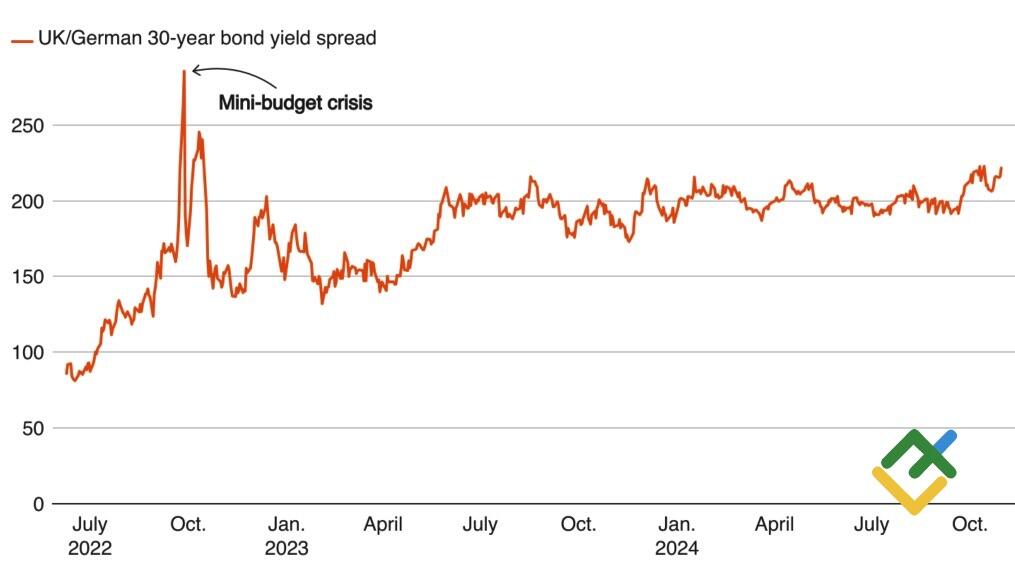

The new budget from Rachel Reeves did not evoke the same feeling of déjà vu as the Liz Truss administration did two years ago. The yield differential between UK and German bonds has not reached the same levels as in the autumn of 2022, and the GBPUSD has not collapsed towards parity. Investors considered the presented plan worthy of approval, which bodes well for the future of the British pound.

UK and German bond yield differential

Source: Reuters.

The Labour Party has initiated a significant tax increase, the largest since 1993, which has led to an elevated per capita tax burden compared to the levels since the end of World War II. At the same time, Rachel Reeves’ statement that the Conservative Party had left a £22 billion shortfall in the budget and that the United Kingdom’s national debt was approaching 100% prompted a reaction in the financial markets. However, the current fiscal year borrowing plan of £297 billion is higher than the £278 billion predicted by financial analysts surveyed by Bloomberg.

However, investors were reassured by the fact that, in addition to a £41 billion tax increase, the Labour Party intends to increase public spending by £74 billion and allocate approximately £100 billion for investment over the next five years. In light of these developments, the Office for Budget Responsibility has revised its forecast for UK GDP in 2025 to 2%, representing a significant increase from the previous estimate of 1.1% for 2024. The fiscal watchdog cautioned that Rachel Reeves’ proposed measures could potentially accelerate inflation by 0.4 pp. It anticipates that consumer prices may rise to 2.5% in 2025, exceeding the BoE’s target.

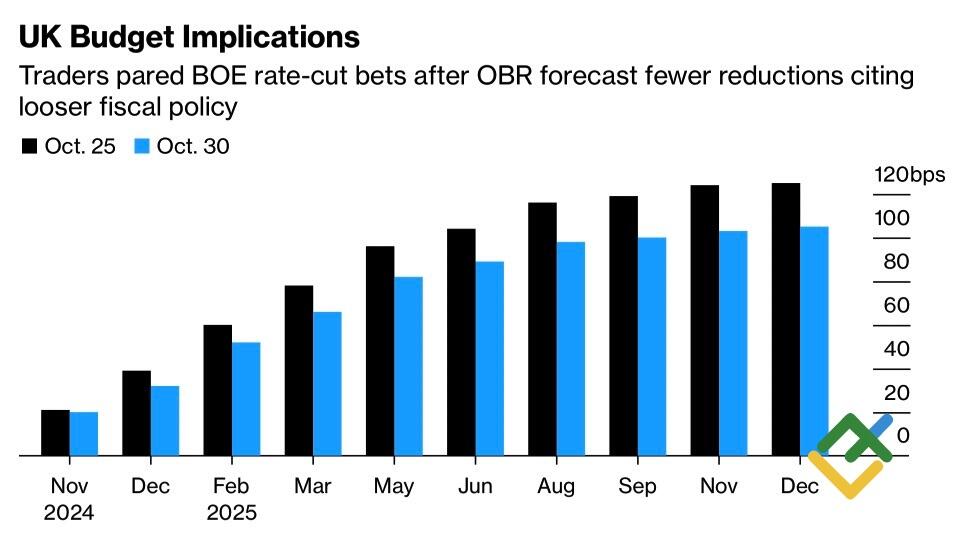

The pro-inflationary budget has prompted the derivatives market to reassess the likelihood of a repo rate cut. Prior to its presentation, the market was expecting two acts of monetary expansion in 2024. However, the forecast has been reduced to one cut following its introduction.

Market expectations on BoE rate

Source: Bloomberg.

The slower pace of BoE monetary tightening, coupled with a potential acceleration in the growth of the UK economy, is favorable for the British pound. However, the implementation of the Labour Party’s plans is still pending, and the Bank of England’s estimates may differ from those of the Office for Budget Responsibility. The program presented by Rachel Reeves requires further analysis, so the GBPUSD pair will likely stabilize after the recent excessive volatility.

Weekly trading plan for GBPUSD and EURGBP

From a fundamental standpoint, the budget has reinforced the value of the UK currency. Therefore, the EURGBP pair’s surge presents a selling opportunity with a target of 0.826. Weak US non-farm payroll data may drive GBPUSD quotes to 1.305 and 1.31, but the market will swiftly recover, and bears will regain ground, particularly if Donald Trump wins the US presidential elections.

Price chart of GBPUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.