In 2022-2023, USDMXN bears succeeded due to the carry trade, the weakness of the Japanese yen, the strength of the US economy, and other factors. However, the situation changed significantly in 2024. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Highlights and key points

- Political shifts have increased the peso’s volatility.

- Carry traders are abandoning the Mexican currency.

- The Trump trade pushes the USDMXN pair higher.

- An uptrend may return if the pair recovers above 18.1.

Weekly fundamental forecast for Mexican peso

Against major political shifts, investors are reallocating their holdings from assets that used to bring double-digit gains. In 2022-2023, the peso was the best performer on Forex thanks to its main trading partner’s economic resilience, transfers from Mexicans working in the US, the transfer of Chinese manufacturing to Latin America, and carry trade operations. However, Claudia Sheinbaum and her Morena party won the elections, and the US presidential election is coming up, so everything changed for the USDMXN pair.

The “super peso” has become a thing of the past, taking a double hit from politics. Mexico’s new president is planning to introduce some market-unfriendly, which may elevate volatility and add to the uncertainty. This is bad news for the Mexican peso, which has performed well over the past 18 months. The funding currency was the Japanese yen, which has been strengthening on the back of currency interventions and a decline in US Treasury yields. This factor dealt a blow to those betting on a decline in the USDMXN pair.

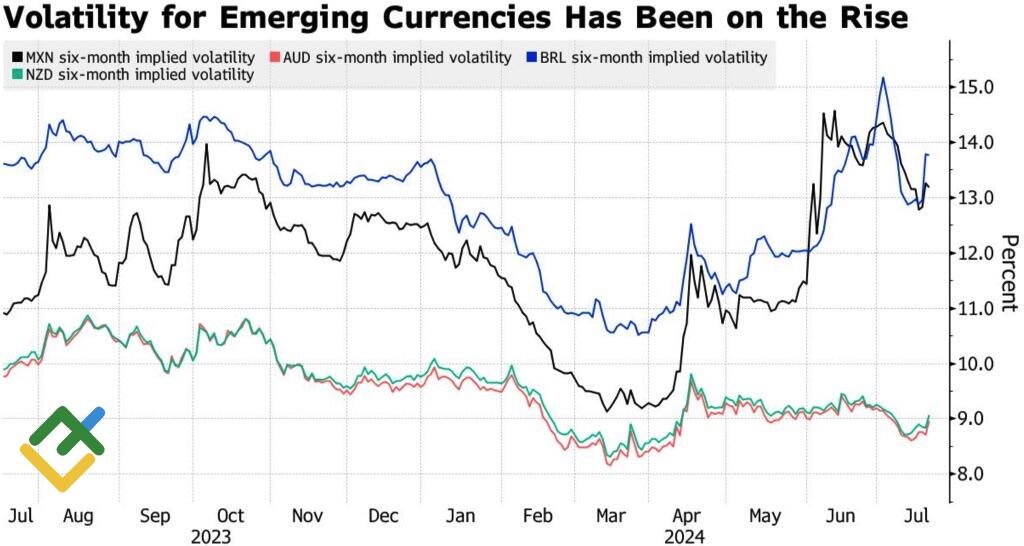

Emerging currencies’ volatility

Source: Bloomberg.

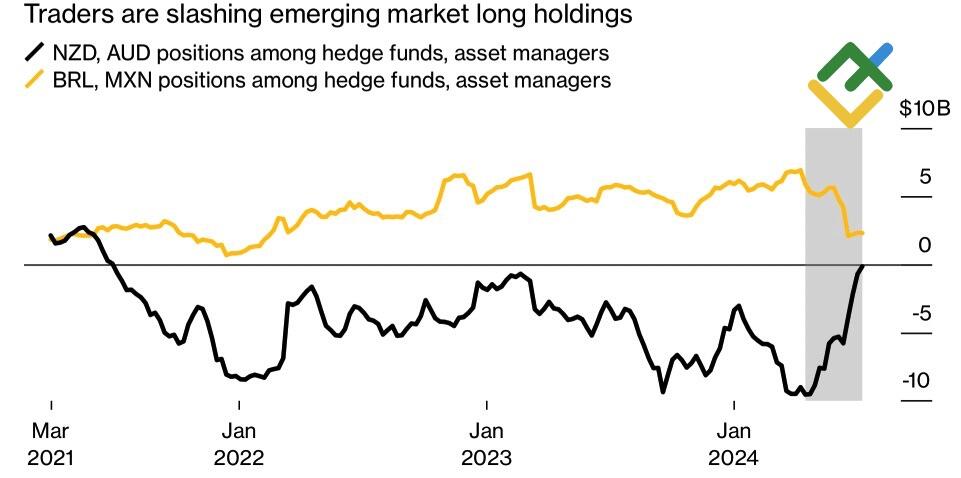

As a result, carry traders are swapping the more volatile Latin American currencies for the Australian and New Zealand dollars, which are also lucrative currencies. Thus, the total speculative positions on them have reached their highest levels since 2021, while the Mexican peso and Brazilian real have fallen to their lowest levels since 2022.

Speculative net long positions on emerging currencies

Source: Bloomberg.

The slowdown in the US economy and Donald Trump’s rise to power could erase all the peso’s successes and eliminate its advantages. So, Trump is going to tighten immigration, which will reduce the number of Mexicans willing to work in the US and limit their transactions to their homeland. The former president is planning to impose a 200% tax on imported products that contain Chinese components. Therefore, China will have to postpone the construction of new plants in Mexico. Some of the older ones will start to close.

Notably, the peso is one of the main victims of the Trump trade. The only thing that made bulls think twice was that Joe Biden dropped out of the presidential race. Kamala Harris is unlikely to beat the Republican, so the USDMXN rally could resume soon.

Meanwhile, TS Lombard thinks the Brazilian and Mexican currencies will benefit the most from the Fed cut. These currencies are oversold because of the slowing economy in the case of the real and because of politics in the case of the peso. If this prediction is true, the USDMXN pair may take its time to consolidate while markets are caught in a tug-of-war.

Weekly USDMXN trading plan

Having lost its main advantages, USDMXN bears will be forced to retreat. Therefore, one can open long trades on a pullback from the support levels of 17.9 and 17.75 or if the pair returns above 18.1.

Price chart of USDMXN in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.