When one party controls Congress and the White House, it is called a sweep and allows it to enact reforms quickly. In this respect, the Republican victory in the elections is good news for the greenback. Let’s discuss this topic and make a trading plan for EURUSD.

Weekly US dollar fundamental forecast

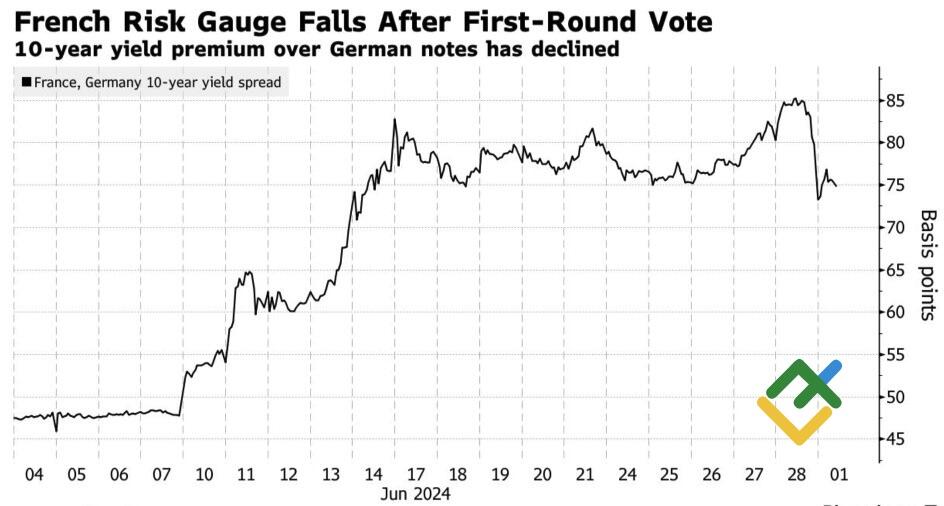

Markets hate uncertainty. Politics has changed all the rules. The unconditional victory of Claudia Sheinbaum and her Morena party in Mexico drained the peso. Conversely, the reduced chances of an absolute majority in parliament for the National Rally narrowed the yield spread between French and German bonds and drove the EURUSD higher. Investors worry that the market will see unfavorable reforms if power is concentrated in the hands of one party. However, this is not the case in the US. The Republican sweep is perceived as a strong argument in favor of a USD index rally.

France-Germany bond yield differential

Source: Bloomberg.

Donald Trump’s uncontested victory and the Supreme Court’s ruling that he is immune from prosecution for an official act as president has spurred Treasury yields and forced the EURUSD pair to retreat.

The greenback is king in the Forex market while Joe Biden holds office, but he has the loose fiscal policy and the Fed’s monetary restraint to thank for that. However, everything will change in 2024. Excess household savings are depleted, the central bank is set to cut rates, and Democrats will have a hard time getting new fiscal stimulus packages through Congress.

Conversely, if Donald Trump returns to the White House, a Republican sweep is fraught with an extension of the tax-cut program and a widening budget deficit. More issuance of Treasuries will be needed to finance all of this, and increased supply will drive prices down and yields up. This is a tailwind for EURUSD bears.

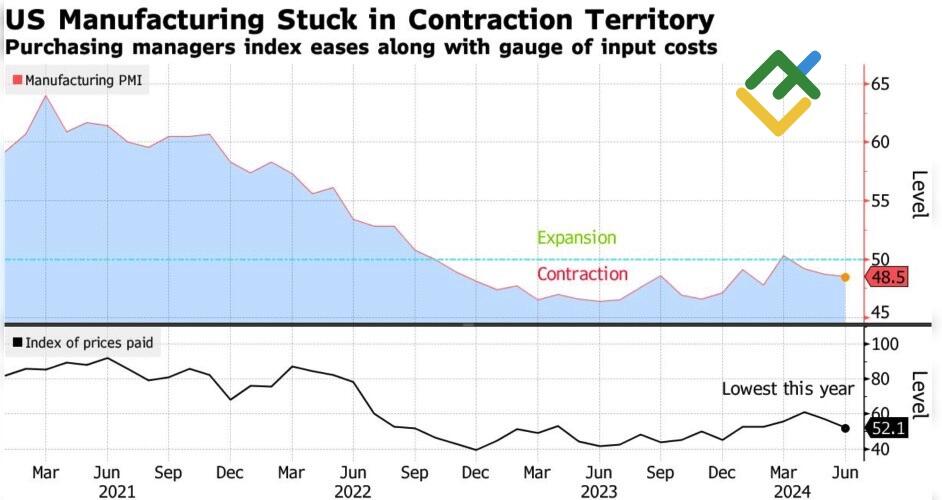

Even another sign of the cooling US economy in the form of disappointing statistics on the manufacturing PMI from ISM did not help EURUSD bulls.

US Manufacturing PMI

Source: Bloomberg.

If we add Donald Trump’s intention to raise tariffs on imports, which should accelerate inflation and force the Fed to keep rates at 5.5%, the EURUSD will face a roller coaster ride. The slowdown in German consumer prices from 2.4% to 2.2% in June reinforces the risks of two acts of ECB monetary expansion in 2024, and political uncertainty in France persists.

Indeed, the composition of the National Assembly will only be known after the second round. The right wing may still get an absolute majority, which is seen as bad news for the euro. However, the most likely scenario seems to be a minority government, which will eventually narrow the yield spread between French and German bond yields and allow the major currency pair to rise.

Weekly EURUSD trading plan

Meanwhile, investors should take into account the proximity of important releases on European inflation and the US labor market. A drop in the EURUSD pair below 1.07 could be a catalyst for a downtrend recovery and a trigger for selling. As long as the euro is trading higher, the focus should remain on long trades.

Price chart of EURUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.