Plug Power Inc. is one of the leading players in the renewable energy sector that has been developing hydrogen technologies since 1997. The company specializes in hydrogen fuel cell systems that replace traditional batteries in electric vehicles, power plants, and industrial solutions. Today, the company is deeply involved in hydrogen infrastructure projects, reflecting the global trend toward clean and sustainable energy generation.

Plug Power’s stock is listed on the NASDAQ exchange under the ticker PLUG. The company’s shares remain popular with investors due to the growing interest in environmental sustainability. In light of fundamental changes in the global energy industry, as well as changed economic conditions and growing government support for green energy solutions, Plug Power continues to exhibit strong potential for further growth.

This article examines current factors and future trends, including macroeconomic conditions and technological advances, that could affect the company’s stock price, and discusses what role Plug Power may play in the global transition to renewable energy.

The article covers the following subjects:

Major Takeaways

- The current price of PLUG is $0.85 as of 01.05.2025.

- The PLUG price reached its all-time high of $1,565 on 23.01.2000. The stock’s all-time low of $0.12 was recorded on 26.02.2013.

- Forecasts for Plug Power’s share price for the coming years vary significantly. In 2025, the asset is expected to range from $0.86 to $1.53.

- Long-term estimates for 2026–2030 suggest a price range from $0.29 to a high of around $1.84, reflecting the uncertainty of the market situation.

- The company is actively developing in the hydrogen sector, expanding its filling station infrastructure and establishing strategic partnerships with major energy companies.

- Key factors bolstering share price include global demand for clean energy, falling hydrogen production costs, and technological innovation.

PLUG Real-Time Market Status

The PLUG stock is trading at $0.85 as of 01.05.2025.

To assess the current status of the Plug Power (PLUG) stock, it is essential to monitor the following key performance indicators:

- Market sentiment is an indicator that reflects the general attitude or mood of investors and traders regarding a stock. Positive sentiment can drive stocks up, while negative sentiment can drag them down.

- Trading volume measures the number of shares that are traded over a given period. High trading volume can indicate increased investor interest and liquidity.

- Price change over the last 12 months. Analyzing price changes helps to determine general market trends and predict possible price movements. It is important to consider both the lows and highs over this period.

- Market capitalization is the total value of all shares of a company. The indicator helps to understand its scale and position in the market. High capitalization may indicate the stability of the company.

These indicators help investors get a deeper insight into the current market situation and make more informed trading decisions.

|

Indicator |

Value |

|

Market cap |

$788 million |

|

Shares outstanding |

971.7 million |

|

Trading volume over the last 24 hours |

62.329 million |

|

Price change over the last 12 months |

-66.3% |

|

EBITDA |

-1.032 billion |

|

Dividends |

no |

|

P/E ratio |

-0.6 |

PLUG Stock Price Forecast for 2025 Based on Technical Analysis

The daily chart of PLUG shares shows a steady downtrend.

- The current price of the asset is significantly below the EMA and SMA, indicating strong bearish sentiment.

- Bollinger Bands show a broadening channel, signaling increased volatility and potential further declines.

- The MACD indicator is far below zero, highlighting the dominance of sellers.

- The RSI value has fallen to a critical level of 27, pointing to an oversold condition and a possible short-term rebound.

The price may test the resistance of 1.30–1.50 in the near future. However, the overall technical background remains negative. Thus, the price will likely drop further and test the 0.60–0.70 levels.

The table below shows the projected values of Plug Power for the remainder of 2025.

|

Month |

Minimum, $ |

Maximum, $ |

|

May |

0.75 |

0.95 |

|

June |

0.90 |

1.09 |

|

July |

0.97 |

1.15 |

|

August |

0.99 |

1.05 |

|

September |

1.00 |

1.15 |

|

October |

0.94 |

1.16 |

|

November |

1.00 |

1.16 |

|

December |

0.95 |

1.05 |

Long-Term Trading Plan for PLUGUSD for 2025

Since Plug Power (PLUG) shares are trading in a bearish trend, a cautious trading strategy is advisable. Long trades can be considered once the price reverses and breaks through 1.00, settling above the EMA and SMA. A MACD crossover above zero and the RSI rising above 30, exiting an oversold condition, will confirm a buy signal.

The main target is the resistance of 1.30–1.50. If this zone is pierced, the next target will be 1.80. A stop-loss order should be set below the key support of 0.70–0.75. If the downtrend continues and the price breaks through the 0.75 level, short trades can be opened with a target of 0.60.

Analysts’ Plug Power Shares Price Projections for 2025

2025 promises to be a volatile year for Plug Power shares, given the unstable economy and changes in the energy sector. This section reviews forecasts from leading analysts to determine possible fluctuations in PLUG’s price in the near future.

LongForecast

Price range in 2025: $0.86–$1.53 (as of 27.04.2025).

LongForecast predicts that PLUG shares will gradually recover in 2025 after the challenges of recent years. The price is expected to range between $0.86 and $1.53, with a significant uptick in the year’s second half due to improved market conditions.

|

Month |

Open, $ |

Min–Max, $ |

Close, $ |

|

May |

0.98 |

0.86–1.00 |

0.93 |

|

June |

0.93 |

0.92–1.08 |

1.00 |

|

July |

1.00 |

0.93–1.09 |

1.01 |

|

August |

1.01 |

1.01–1.20 |

1.11 |

|

September |

1.11 |

1.06–1.24 |

1.15 |

|

October |

1.15 |

1.09–1.29 |

1.19 |

|

November |

1.19 |

1.19–1.48 |

1.37 |

|

December |

1.37 |

1.31–1.53 |

1.42 |

PandaForecast

Price range in 2025: $0.75–$1.16 (as of 27.04.2025).

According to PandaForecast, PLUG’s share price will range between $0.75 and $1.16 in 2025. The forecast predicts a moderate increase, buoyed by a gradual development of hydrogen technologies and stabilizing investor interest in the alternative energy market.

|

Month |

Minimum, $ |

Average, $ |

Maximum, $ |

|

May |

0.75 |

0.85 |

0.95 |

|

June |

0.90 |

0.98 |

1.09 |

|

July |

0.97 |

1.04 |

1.15 |

|

August |

0.99 |

1.02 |

1.05 |

|

September |

1.00 |

1.06 |

1.15 |

|

October |

0.94 |

1.04 |

1.16 |

|

November |

1.00 |

1.05 |

1.16 |

|

December |

0.95 |

1.01 |

1.05 |

Analysts’ Plug Power Shares Price Projections for 2026

2026 can become a pivotal year for Plug Power in terms of business expansion and entering new markets. Below are expert forecasts assessing the company’s potential share price prospects during this period.

LongForecast

Price range in 2026: $1.19–$1.84 (as of 27.04.2025).

According to LongForecast, PLUG’s share price is expected to climb moderately in 2026. The projected range of $1.19–$1.84 reflects expectations that the company’s financial position will strengthen amid rising global demand for hydrogen energy and optimization of production processes.

|

Month |

Open, $ |

Min–Max, $ |

Close, $ |

|

January |

1.42 |

1.34–1.58 |

1.46 |

|

February |

1.46 |

1.39–1.63 |

1.51 |

|

March |

1.51 |

1.45–1.71 |

1.58 |

|

April |

1.58 |

1.45–1.71 |

1.58 |

|

May |

1.58 |

1.51–1.77 |

1.64 |

|

June |

1.64 |

1.56–1.84 |

1.70 |

|

July |

1.70 |

1.40–1.70 |

1.52 |

|

August |

1.52 |

1.19–1.52 |

1.29 |

|

September |

1.29 |

1.29–1.60 |

1.48 |

|

October |

1.48 |

1.48–1.84 |

1.70 |

|

November |

1.70 |

1.50–1.76 |

1.63 |

|

December |

1.63 |

1.28–1.63 |

1.39 |

PandaForecast

Price range in 2026: $0.72–$1.12 (as of 27.04.2025).

PandaForecas anticipates that PLUG shares will fluctuate between $0.72 and $1.12 in 2026. Although analysts emphasize the impact of competition and macroeconomic factors, they also highlight the asset’s upside potential by year-end, driven by ongoing initiatives aimed at lowering production costs.

|

Month |

Minimum, $ |

Average, $ |

Maximum, $ |

|

January |

0.86 |

0.96 |

1.00 |

|

February |

0.89 |

0.93 |

1.03 |

|

March |

0.79 |

0.82 |

0.85 |

|

April |

0.72 |

0.77 |

0.83 |

|

May |

0.80 |

0.84 |

0.94 |

|

June |

0.81 |

0.87 |

0.92 |

|

July |

0.74 |

0.82 |

0.88 |

|

August |

0.86 |

0.92 |

0.96 |

|

September |

0.94 |

1.05 |

1.12 |

|

October |

0.97 |

1.07 |

1.12 |

|

November |

0.97 |

1.03 |

1.08 |

|

December |

0.80 |

0.90 |

1.00 |

Analysts’ Plug Power Shares Price Projections for 2027

2027 may become a period of consolidation or new challenges for Plug Power, depending on industry trends and global developments. Expert estimates below will help outline possible scenarios for the company’s share price.

LongForecast

Price range in 2027: $0.86–$1.43 (as of 27.04.2025).

LongForecast‘s outlook indicates possible instability in PLUG’s share price in 2027. The expected range of $0.86–$1.43 reflects experts’ cautious approach, taking into account the impact of technological innovations, shifts in market demand, and possible corrections in the stock market.

|

Month |

Open, $ |

Min–Max, $ |

Close, $ |

|

January |

1.39 |

1.09–1.39 |

1.18 |

|

February |

1.18 |

0.92–1.18 |

1.00 |

|

March |

1.00 |

1.00–1.24 |

1.15 |

|

April |

1.15 |

1.15–1.43 |

1.32 |

|

May |

1.32 |

1.06–1.32 |

1.15 |

|

June |

1.15 |

1.00–1.18 |

1.09 |

|

July |

1.09 |

1.08–1.26 |

1.17 |

|

August |

1.17 |

1.09–1.29 |

1.19 |

|

September |

1.19 |

1.19–1.40 |

1.30 |

|

October |

1.30 |

1.02–1.30 |

1.11 |

|

November |

1.11 |

0.86–1.11 |

0.94 |

|

December |

0.94 |

0.94–1.17 |

1.08 |

CoinCodex

Price range in 2027: $0.744136–$0.782665 (as of 27.04.2025).

CoinCodex expects PLUG’s share price to remain relatively steady in 2027, with a projected range between $0.744136 and $0.782665. Experts emphasize the impact of macroeconomic instability and fluctuating demand for alternative energy.

|

Month |

Minimum, $ |

Average, $ |

Maximum, $ |

|

January |

0.76708 |

0.774779 |

0.780619 |

|

February |

0.77291 |

0.776742 |

0.782665 |

|

March |

0.762926 |

0.767303 |

0.773036 |

|

April |

0.757782 |

0.760301 |

0.765514 |

|

May |

0.755349 |

0.757121 |

0.759413 |

|

June |

0.757237 |

0.760377 |

0.764179 |

|

July |

0.761752 |

0.766102 |

0.769724 |

|

August |

0.756305 |

0.760286 |

0.768854 |

|

September |

0.754875 |

0.756505 |

0.757957 |

|

October |

0.750673 |

0.752958 |

0.75532 |

|

November |

0.744136 |

0.747623 |

0.752684 |

|

December |

0.745451 |

0.74666 |

0.747793 |

Analysts’ Plug Power Shares Price Projections for 2028

2028 may prove to be a year of new challenges for Plug Power amid technological competition and changes in global energy policy. This section presents expert estimates of the company’s share price in 2028.

LongForecast

Price range in 2028: $0.36–$1.08 (as of 27.04.2025).

LongForecast predicts a possible decline in PLUG’s share price in 2028. The expected price range of $0.36–$1.08 suggests that market factors and internal challenges in the implementation of large-scale hydrogen production and distribution projects may pressure the stock.

|

Month |

Open, $ |

Min–Max, $ |

Close, $ |

|

January |

1.08 |

0.85–1.08 |

0.92 |

|

February |

0.92 |

0.75–0.92 |

0.81 |

|

March |

0.81 |

0.63–0.81 |

0.69 |

|

April |

0.69 |

0.66–0.78 |

0.72 |

|

May |

0.72 |

0.65–0.77 |

0.71 |

|

June |

0.71 |

0.55–0.71 |

0.60 |

|

July |

0.60 |

0.47–0.60 |

0.51 |

|

August |

0.51 |

0.42–0.51 |

0.46 |

|

September |

0.46 |

0.36–0.46 |

0.39 |

|

October |

0.39 |

0.39–0.49 |

0.45 |

|

November |

0.45 |

0.45–0.56 |

0.52 |

|

December |

0.52 |

0.46–0.54 |

0.50 |

CoinCodex

Price range in 2028: $0.740649–$0.747456 (as of 27.04.2025).

CoinCodex offers a more cautious outlook for 2028, predicting steady values within a narrow range of $0.740649–$0.747456. Analysts point to risks of growth deceleration amid intensifying competition and global economic uncertainty.

|

Month |

Minimum, $ |

Average, $ |

Maximum, $ |

|

January |

0.741421 |

0.744895 |

0.747456 |

|

June |

0.741324 |

0.742483 |

0.744141 |

|

December |

0.740649 |

0.741417 |

0.742052 |

Analysts’ Plug Power Shares Price Projections for 2029

In 2029, Plug Power may encounter potential opportunities for business expansion or confront challenges associated with shifts in the investment landscape. Let’s take a look at expert forecasts for this period.

LongForecast

Price range in 2029: $0.29–$0.50 (as of 27.04.2025).

LongForecast indicates a possible further decrease in PLUG’s share price in 2029. The projected range of $0.29–$0.50 represents cautious market expectations amid potential stricter regulations and higher costs for hydrogen infrastructure development.

|

Month |

Open, $ |

Min–Max, $ |

Close, $ |

|

January |

0.50 |

0.40–0.50 |

0.40 |

|

June |

0.43 |

0.34–0.43 |

0.37 |

|

December |

0.37 |

0.29–0.37 |

0.31 |

CoinCodex

Price range in 2029: $0.699806–$0.987559 (as of 27.04.2025).

CoinCodex presents a more upbeat forecast for PLUG in 2029, with a range of $0.699806–$0.987559. The forecast takes into account potential technological advances and increased global demand for clean energy sources, which support the company’s growth.

|

Month |

Minimum, $ |

Average, $ |

Maximum, $ |

|

January |

0.740121 |

0.741474 |

0.743307 |

|

June |

0.72788 |

0.794396 |

0.871905 |

|

December |

0.699806 |

0.800908 |

0.987559 |

Analysts’ Plug Power Shares Price Projections for 2030

2030 could be a milestone year for Plug Power’s strategic development, particularly in light of the global transition to sustainable energy sources. The expert forecasts below provide insights into potential share price movements.

CoinCodex

Price range in 2030: $0.294095–$0.778367 (as of 27.04.2025).

CoinCodex predicts a wide range of values for PLUG shares in 2030. The range of $0.294095–$0.778367 shows the uncertainty around long-term investments in hydrogen technology and possible changes in global economic policy and energy demand.

|

Month |

Minimum, $ |

Average, $ |

Maximum, $ |

|

January |

0.455922 |

0.582144 |

0.717544 |

|

February |

0.506637 |

0.554288 |

0.616619 |

|

March |

0.557647 |

0.644162 |

0.725443 |

|

April |

0.538346 |

0.64621 |

0.778367 |

|

May |

0.347822 |

0.432871 |

0.557411 |

|

June |

0.36097 |

0.422073 |

0.46802 |

|

July |

0.406942 |

0.454621 |

0.542053 |

|

August |

0.559788 |

0.680713 |

0.749596 |

|

September |

0.534918 |

0.65479 |

0.73665 |

|

October |

0.397767 |

0.467232 |

0.564882 |

|

November |

0.369826 |

0.394498 |

0.443971 |

|

December |

0.294095 |

0.344974 |

0.393348 |

Analysts’ Plug Power Shares Price Projections until 2050

CoinCodex predicts that PLUG’s share price will reach $0.5232 by 2030, then fall to $0.00005867 in 2040, potentially hitting $0.086399 by 2050. This decrease can be attributed to the declining demand for environmentally friendly technologies.

StockScan projects that the price will reach $2.76 by 2030, followed by a notable surge to $3.37 in 2035. In the long term, starting in 2040, considerable appreciation is expected, with the price possibly exceeding $11.61 by 2050.

|

Year |

CoinCodex, $ |

StockScan, $ |

|

2030 |

0.523215 |

2.76 |

|

2035 |

– |

3.3719 |

|

2040 |

0.00005867 |

11.61 |

|

2050 |

0.086399 |

26.49 |

Overall, long-term forecasts indicate mixed prospects for PLUG shares. Despite the slump predicted by CoinCodex, StockScan anticipates moderate gains in the long term. These differences underscore the high degree of uncertainty and dependence on the further development of hydrogen energy.

Market Sentiment for PLUG (Plug Power) on Social Media

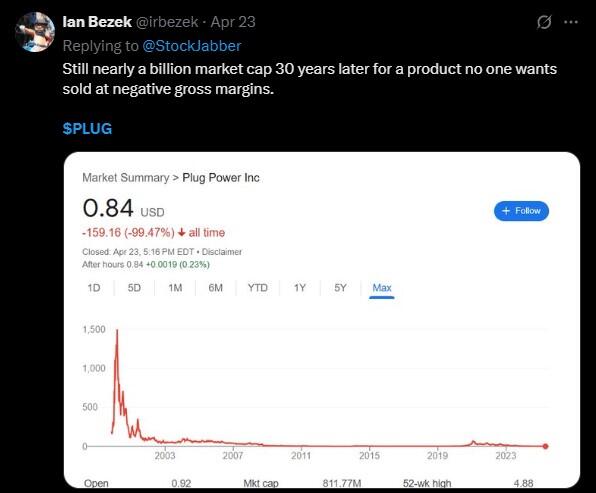

Media sentiment plays a crucial role in shaping investor expectations. Sentiment on social media regarding PLUG is predominantly negative. The screenshots from the X (Twitter) platform below demonstrate skepticism among users.

For example, user @Stockspy1 is disappointed by the long-term performance of the stock.

Meanwhile, user @irbezek emphasizes the low margins and lack of demand for the company’s products.

Heightened concern over financial performance and falling prices is exacerbating negative sentiment surrounding PLUG. Overall, the investor community is cautious, which may weigh on the stock in the short term.

PLUG Price History

Plug Power’s highest price of $1,565 was recorded on 23.01.2000. The lowest price was posted on 26.02.2013 and stood at $0.12.

Between 2021 and 2023, Plug Power’s stock price fluctuated significantly, illustrating the volatility of the renewable energy sector and changing investor sentiment. In 2021, amid enthusiasm for clean energy and the company’s expansion, the stock peaked at around $75, reflecting investor optimism.

In 2022, changing market conditions and competition drove the stock down to a range of $20 to $30. Despite the challenges, Plug Power continued to build on its technology and infrastructure successes. In 2023, the stock price stabilized around $30.

In 2024, the PLUG stock continued to experience significant volatility amidst multiple factors impacting the renewable energy sector. At the beginning of the year, the stock price fell to approximately $1.87. This decline was the result of general market volatility caused by high inflation and rising interest rates, which negatively impacted sectors with high capitalization and long-term projects, such as hydrogen power.

At the end of 2024, Plug Power shares demonstrated a brief attempt to recover, climbing from swing lows in September. However, in early 2025, the uptrend reversed again. After a short-term increase from December 2024 to January 2025, the share price plummeted by more than 50% by April 2025.

Weak financial reports, a lack of new major contracts, and a general declining interest in the green energy sector contributed to the slump. The chart shows sustained bearish pressure, with the price setting new swing lows. Therefore, PLUG will need to significantly improve its operating performance and restore investor confidence for a long-term recovery.

PLUG Shares Fundamental Analysis

Plug Power stock is garnering investor interest as a frontrunner in hydrogen technology and renewable energy. To gauge the potential of the company’s stock, it is essential to evaluate a range of fundamental factors, including market sentiment and macroeconomic conditions, which directly influence the asset’s value.

What Factors Affect the PLUG Stock?

The future of Plug Power stock is shaped by a number of factors, including technological advancement, shifts in government policy, and economic conditions. Given the complex interplay of these elements, accurately forecasting the exchange rate is challenging.

- Market trends and sentiment. The renewable energy market and investor sentiment significantly affect shares of Plug Power. Optimistic expectations for hydrogen power development and the transition to clean energy could boost the stock, while negative sentiment due to financing issues could drag the value down.

- Technology advances. Innovations in hydrogen fuel cells, improvements in manufacturing efficiency, or advances in cost reduction have a significant impact on Plug Power’s market position. For example, successful developments in hydrogen infrastructure or batteries could improve the company’s prospects and have a positive impact on its stock price.

- Government regulation. Government support and subsidies for hydrogen technology play an important role. Any changes in government policy, such as new subsidies or green energy support programs, have a direct impact on Plug Power’s profitability and attractiveness to investors.

- Partnerships and contracts. Plug Power proactively seeks strategic partnerships with companies in a range of sectors, including equipment manufacturing, automotive, and energy. Such agreements can facilitate market expansion, enhancing the company’s position and positively impacting shareholder value.

- Competition. The increasing competition from other hydrogen fuel cell manufacturers, as well as global energy companies, presents a challenge for Plug Power. Any changes in market share or technology breakthroughs by competitors could have a negative impact on the company’s value.

- Financial results and profitability. The company’s regular reports of financial results, including earnings and EBITDA, influence investor sentiment. Strong profitability in reporting periods boosts the stock, while weak reports can cause the stock to decline.

- Macroeconomic factors. General economic conditions such as inflation rates, interest rates, economic growth, and changes in energy prices have a significant impact on the attractiveness of the Plug Power stock. Lower interest rates or an increased focus on sustainability could create a more favorable environment for the company’s stock.

More Facts About PLUG Shares

Plug Power Inc. is a leading company in the field of hydrogen power and fuel cells, with a strong commitment to the advancement of sustainable energy technologies. The company was established in 1997 and has been engaged in the development, manufacturing, and implementation of innovative solutions for hydrogen infrastructure. The primary objective of hydrogen technology was to create an alternative to conventional energy sources.

The growth of Plug Power’s share price in recent years is largely attributable to the global trend towards decarbonization, which has generated considerable interest in hydrogen energy solutions. Plug Power’s technologies are utilized in a variety of industries, including transportation, warehousing, and logistics. One of their largest customers is Amazon, reflecting the practical relevance and reliability of the company’s solutions.

PLUG’s popularity among traders is attributable to both its high volatility and significant upside potential in response to the growing demand for hydrogen solutions. Investors view Plug Power shares as a means of capitalizing on the renewable energy market’s growth potential, making the stock an appealing long-term and short-term investment.

Advantages and Disadvantages of Investing in PLUG

The advantages of investing in PLUG to consider first are as follows:

- Growth in the renewable energy sector. Plug Power is one of the leading companies in the hydrogen energy sector. With the increasing demand for green energy, Plug Power has prospects for significant growth due to its developments in hydrogen technology.

- Government support and subsidies. Many governments are introducing subsidy and incentive programs for companies that develop alternative energy. Plug Power receives support under such programs, which improves the financial position of the company.

- Innovations and new technologies. Plug Power is actively developing new solutions for the application of hydrogen in various industries. The innovations open new opportunities for growth and strengthen the company’s position in the global market.

- Partnerships and market expansion. The company enters into partnerships with major players in the market, which allows it to expand its sphere of influence and develop in new directions. Examples include partnerships with automobile manufacturers and logistics companies.

To gain a comprehensive understanding, it is essential to consider the potential drawbacks of investing in PLUG:

- High volatility. Plug Power’s stock is known for its high volatility, which may make it a less attractive option for investors who prefer a more stable investment environment. Fluctuations in the stock price may occur due to sudden changes in energy demand or market-moving news.

- Dependence on government regulation. The company relies heavily on government support and subsidies. Any changes in policy or reductions in subsidies could have an adverse effect on the company’s earnings and future prospects.

- Competition in the industry. The hydrogen energy sector is growing, and competition in this area is intensifying. Multiple companies, including major players, are seeking leadership positions, which may adversely affect Plug Power’s market share.

- Financial risks and costs. Plug Power continues to invest considerable sums in the development of new technologies, which increases its financial burden. If these ventures do not succeed as anticipated, the company may find it difficult to service its debts and attract new investments.

How We Make Forecasts

Short-term forecasts are based on current market data, including trading volume, market sentiment, technical indicators such as the RSI and MACD, and price chart analysis. Any recent changes or events that may affect an asset’s price are considered to determine the trend.

Medium-term forecasts include a more comprehensive analysis of fundamental factors, such as a company’s quarterly financial reports, strategic partnerships, technology developments, and shifts within the sector. In addition, we consider general economic and geopolitical trends that may impact the market.

Long-term forecasts entail an in-depth examination of the company’s strategic plans, market position, the sector’s growth potential, and the influence of macroeconomic factors, including regulatory changes and green energy trends.

Conclusion: Is PLUG a Good Investment?

Plug Power represents a potentially lucrative yet highly risky investment opportunity. The company operates in the emerging hydrogen energy sector, creating long-term growth potential. However, its current financial challenges, high volatility, and negative market sentiment elevate the investment risks. Investing in PLUG makes sense only if one is ready to incur short-term losses and has a long-term vision for the advancement of hydrogen technologies.

PLUG Price Prediction FAQs

The share price of Plug Power is subject to a number of external factors, including macroeconomic conditions, market sentiment, technological developments, government regulations, partnerships, and competition. These factors exert a significant influence on the company’s share price.

The volatility in Plug Power’s stock is attributable to fluctuations in interest in renewable energy, regulatory changes, and market reaction to the company’s financial reports, including substantial shifts in revenues and expenses.

Plug Power remains one of the prominent players in the hydrogen technology market, actively developing infrastructure for hydrogen production and storage. The company’s prospects depend on the demand for alternative energy, successful project implementation, and its ability to improve financial performance amid strong competition in the sector.

Plug Power does not currently pay dividends, as it is focused on investing in business expansion. The company’s strategy is aimed at the long-term growth of its position in the hydrogen solutions market. Therefore, no dividend payments are expected in the near future.

The current PLUG price is $0.85 as of 01.05.2025.

The decision to buy or sell Plug Power shares requires careful risk assessment. The shares remain volatile amid heightened competition and financial challenges. However, there is still long-term upside potential thanks to the development of hydrogen energy and the company’s efforts to reduce carbon footprint.

Forecasts for 2026 predict a price range of $0.72–$1.84, depending on the source. The successful implementation of hydrogen solutions, economic conditions, and the stability of demand for alternative energy in the coming years will determine the asset’s trajectory.

Analysts expect Plug Power shares to trade between $0.29 and $0.77 in 2030. The expected appreciation is linked to the development of hydrogen infrastructure. However, there is a high degree of uncertainty due to the company’s financial performance and market competition.

Plug Power shares still have long-term potential as the hydrogen economy expands. However, their future will largely depend on the company’s ability to improve profitability, meet regulatory standards, and stay competitive in an increasingly crowded market.

Price chart of PLUG in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.