The gold market is overbought and experiencing consolidation. Investors are seeking alternative investments, and platinum has emerged as a viable option. As a result, XPTUSD quotes have reached their highest level since 2014. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- The US and China are competing for platinum reserves.

- The platinum market has endured a deficit for three years.

- Gold is overbought, which is good news for the XPTUSD.

- Platinum can be bought on a pullback with a target of $1,515.

Monthly Fundamental Forecast for Platinum

After a period of dormancy that spanned four years, platinum has emerged as a highly effective asset class in the financial market in 2025. Since the beginning of the year, XPTUSD quotes have increased by 52%, reaching their highest level since 2014. The precious metal is demonstrating robust growth, with a rate of expansion that is double that of other assets in the sector. Over the past month, it has experienced a 22% increase, and there is more to come!

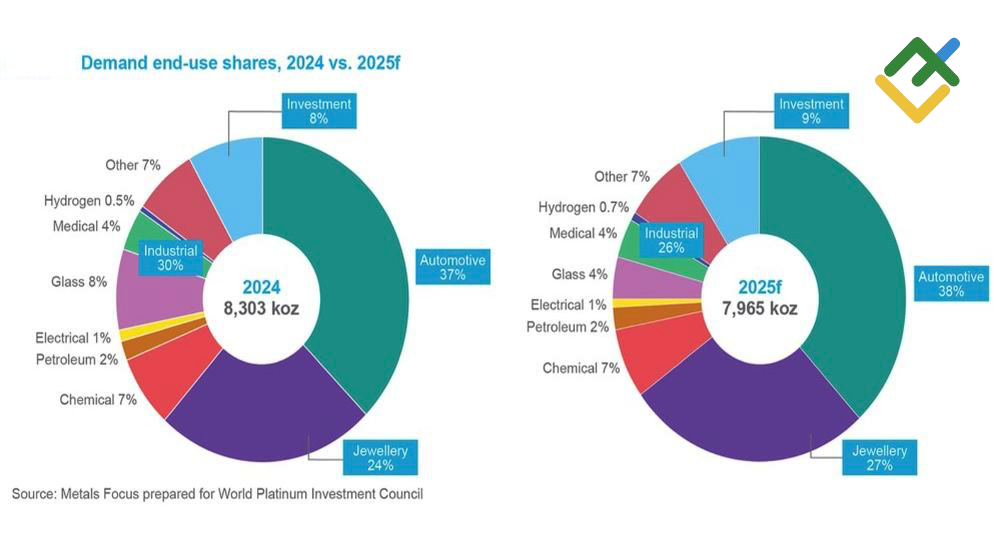

The rally in the XPTUSD is driven by both physical demand and capital flows from the gold market. Over the past three years, there has been a persistent shortage of platinum. In 2025, there will be a significant competition for land-based reserves.

Platinum Market Supply-Demand Balance

Source: WPIC.

The impetus for this development was concerns that the US administration would impose tariffs on precious metal imports. These fears have led to a 500,000-ounce increase in platinum stocks on US exchanges. Following the events of “Liberating Day,” it became evident that tariffs would not be implemented. However, platinum does not seem to be in a rush to return to its country of origin.

The US and China are engaged in a strategic competition for land reserves. This has resulted in an increase in lease rates from zero to 13%. Spot market prices are higher than futures prices, indicating increased demand amid a shortage of supply. The competition for platinum reserves is resulting in reduced availability for trading, contributing to the rise in XPTUSD quotes.

Despite the significant decline in the gold-platinum ratio from a record high of over 3.4 in April to 2.43, it remains above the historical average of 2. This indicates that the silver market may be undervalued. The demand for platinum is high in two key sectors: the automotive catalyst manufacturing sector and the jewelry industry. The former is experiencing sustained demand due to the slow replacement of gasoline and diesel engines with electric ones. The latter is driven by the ongoing demand for platinum in jewelry. Capital inflows into ETFs are a reliable indicator of increased investor demand.

Platinum Market in 2024–2025

Source: WPIC.

Platinum is benefiting from market concerns that gold is overbought. The XAUUSD pair’s inability to break above $3,500 is interpreted as a sign of waning bullish sentiment, prompting investors to explore alternative options. In the current environment, platinum has replaced gold as a primary investment vehicle.

Meanwhile, Congress’s approval of President Donald Trump’s bill has created strong headwinds for gold, allowing the XPTUSD to start an upward trend. The XAUUSD market is currently experiencing a period of uncertainty. Should it rise due to the increase in the US budget deficit and national debt, or should it fall due to the potential acceleration of the US economy? Against this backdrop, platinum is poised to capitalize on its main competitor’s imminent challenges.

Monthly Trading Plan for Platinum

A pullback after reaching the first of two previously set targets at $1,410 and $1,450 on the XPTUSD allows investors to increase long positions. If the price breaks through the resistance level of $1,430 per ounce, investors may consider opening more long trades with a target of $1,515.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of XPTUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.