Platinum is a rare precious metal used in the industrial and jewelry sectors. Therefore, investing in this asset requires a distinctive approach compared to other precious metals.

Besides, platinum is primarily a commodity rather than an investment asset. This precious metal plays a significant role in the automotive industry, particularly in the production of catalytic converters. Demand from car manufacturers makes up approximately 44% of the total global supply of platinum (XPT).

However, the platinum exchange rate is quite volatile. In November 2024, the price fell below $1,000.00 per ounce. What will be the precious metal’s price by the end of 2024 and beyond? Does it make sense to invest right now? This article aims to help you find answers to these questions.

The article covers the following subjects:

Major Takeaways

- The current price of XPT stands at $969.13 as of 19.11.2024.

- The highest XPT price of $1740 was reached on 2013-02-07, while the all-time low of $562.25 was set on 2020-03-16.

- Most experts forecast a positive trend for the XPTUSD rate over the next 12–14 months, with the precious metal potentially climbing to $1,054.00–$1,073.00. However, some suggest that this growth may be followed by a gradual decline to $984.55–$1,013.93 by mid-2025.

- Experts offer neutral forecasts for the platinum exchange rate in 2026. Some analysts expect growth toward $1,118.00–$1,205.00 per troy ounce. Others forecast the rate to fluctuate from $987.88 to $982.21 at the end of 2026.

- Analytical agencies’ general outlook for platinum in 2027–2030 is optimistic. Experts anticipate the precious metal price to soar to $1,273.00–$1,600.00 by 2030.

- Analysts are upbeat about the XPTUSD exchange rate in 2030–2050, predicting an increase to $2,200.00–$4,000.00.

XPT Real-Time Market Status

The current XPT price is $969.13 as of 19.11.2024.

It is crucial to monitor the following parameters to assess the prospects of the precious metal:

- Manufacturing demand for platinum, particularly in the automotive industry.

- Global geopolitical environment.

- Supplies from the main exporting countries. South Africa possesses 72% of platinum reserves, Russia accounts for 11%, Zimbabwe — 8%, and North America — 6%. China, Colombia, and Finland contribute 3% of global platinum production.

- US currency exchange rate. Platinum is quoted in US dollars. When the greenback weakens, platinum appreciates. Conversely, if the US dollar grows, the precious metal decreases.

- Investment demand for the metal from market participants: ingots, coins, ETFs.

- Investor sentiment in the commodities market.

- Technical indicators that help assess the current trend, volatility, and trading volumes of the asset.

These parameters reflect the current state of the precious metal in the market and provide an opportunity to forecast future exchange rate movement.

XPT Stock Price Forecast for 2024–2025 Based on Technical Analysis

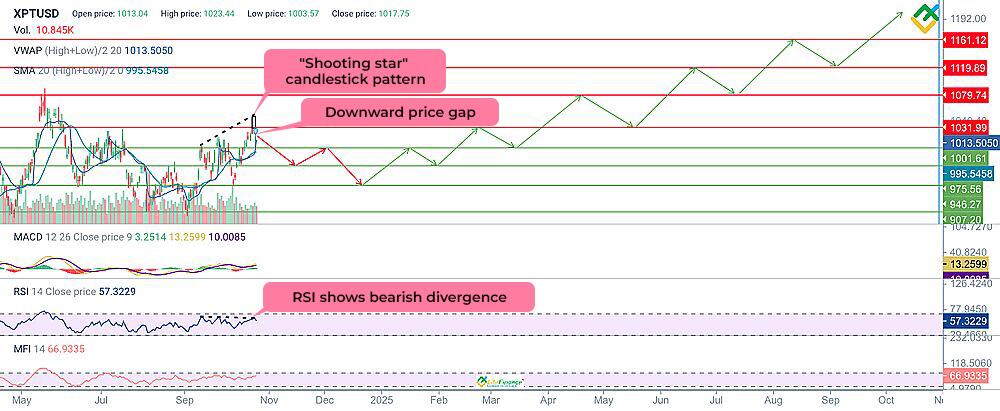

Let’s conduct a technical analysis of the XPT daily and weekly charts to predict its exchange rate for 2024–2025.

To assess the current market situation, consider technical analysis indicators, such as MACD, the RSI, the MFI, VWAP, the SMA, and tick volumes. These tools help track the cash flow movement, identify overbought and oversold conditions, as well as potential pivot points.

Furthermore, chart and candlestick patterns can provide early signals of trend changes, allowing you to determine more favorable market entry points.

Currently, the XPT price is declining. Notably, a “Shooting star” pattern near the resistance of $1,031.99 warns of a potential trend reversal or a downward correction. Moreover, the price has formed a downward gap, indicating growing pressure from bears.

The RSI shows a bearish divergence, which also confirms the downward movement. The MACD values are in the positive zone, meaning that the bullish trend is weakening.

However, the IMF indicator shows an inflow of liquidity, indicating buyers’ interest in the asset. VWAP and the SMA20 confirm it, as the indicators are below the market price.

A large “Symmetrical triangle” pattern has formed on the weekly chart. The price may pierce the pattern downward or upward with potential targets of $867.05 and $1,161.12 in bearish and bullish scenarios, respectively.

A “Dark cloud cover” pattern is also forming near the resistance of $1,031.99, signaling an upcoming downward price reversal.

The MACD values are gradually increasing in the positive zone, giving a potential signal to open long trades. The RSI is horizontal at 55.

The MFI is flat, providing no distinct signals to buy or sell. Such volume is commonly observed when “Triangle” patterns are forming.

The price will likely trade within a “Symmetrical triangle” in the next 3–4 months. The asset will trade in a narrow range and is expected to break through one of the pattern’s boundaries.

If the price consolidates above the key resistance of $1,031.99, the XPTUSD pair may grow to $1,079.74–$1,161.12 over the next 12 months.

An alternative scenario may unfold if the price breaches the lower boundary of the “Triangle” at $946.27, allowing traders to open short positions with targets of $907.20–$867.05.

|

Month |

XPTUSD projected values |

|

|

Minimum, $ |

Maximum, $ |

|

|

December 2024 |

947.27 |

985.01 |

|

January 2025 |

942.00 |

970.97 |

|

February 2025 |

968.34 |

998.18 |

|

March 2025 |

979.75 |

1,020.13 |

|

April 2025 |

962.19 |

978.87 |

|

May 2025 |

964.62 |

1,017.49 |

|

June 2025 |

1,012.23 |

1,078.06 |

|

July 2025 |

1,034.17 |

1,085.96 |

|

August 2025 |

1,024.51 |

1,110.54 |

|

September 2025 |

1,076.30 |

1,122.83 |

|

October 2025 |

1,074.55 |

1,141.26 |

Long-Term Trading Plan for XPTUSD

The asset is currently trading in a wide price channel. There are no clear sell or buy signals in the long term.

However, technical analysis has revealed key support and resistance levels that can be used when developing a trading strategy.

- A “Shooting star” and a “Dark cloud cover” bearish reversal patterns have formed on the daily and weekly time frames, signaling to open short trades for a period of 3 weeks to 2 months. Technical indicators also generate sell signals.

- Once the price breaks through the upper boundary of the “Symmetrical triangle” and settles above the key resistance of $1,031.99, long trades can be opened in the long term. Bullish targets are located in the $1,079.74–$1,161.12 area.

- Short trades can be opened if the asset breaches and consolidates below the support of $946.27 with targets in the $907.20–$867.05 area.

- Key support levels: $1,001.61, $975.56, $974.37, $970.63, $946.27, $907.20, $867.05.

- Key resistance levels: $1,031.99, $1,079.74, $1,119.89, $1,161.12.

Analysts’ XPTUSD Price Projections for 2024–2025

Many reputable analysts expect platinum to increase by the end of 2025.

Long Forecast

Price range: $910.00–$1,179.00 (as of 08.11.2024).

According to Long Forecast, the platinum price may rise to $1,035.00 by the end of 2024, hitting a high of $1,112.00 in December.

By the mid-2025, the quotes will reach $1,049.00. In August, the price will surge to an annual high of $1,179.00 and slide to $1,054.00 by the year’s end.

|

Month |

Open, $ |

Min–Max, $ |

Close, $ |

Change,% |

|

2024 |

||||

|

November |

1,000.00 |

910.00–1,075.00 |

1,021.00 |

2.1% |

|

December |

1,021.00 |

948.00–1,112.00 |

1,035.00 |

3.5% |

|

2025 |

||||

|

January |

1,035.00 |

993.00–1,097.00 |

1,045.00 |

4.5% |

|

February |

1,045.00 |

1,045.00–1,166.00 |

1,110.00 |

11.0% |

|

March |

1,110.00 |

996.00–1,110.00 |

1,048.00 |

4.8% |

|

April |

1,048.00 |

973.00–1,075.00 |

1,024.00 |

2.4% |

|

May |

1,024.00 |

939.00–1,037.00 |

988.00 |

-1.2% |

|

June |

988.00 |

988.00–1,101.00 |

1,049.00 |

4.9% |

|

July |

1,049.00 |

1,021.00–1,129.00 |

1,075.00 |

7.5% |

|

August |

1,075.00 |

1,067.00–1,179.00 |

1,123.00 |

12.3% |

|

September |

1,123.00 |

1,016.00–1,123.00 |

1,069.00 |

6.9% |

|

October |

1,069.00 |

953.00–1,069.00 |

1,003.00 |

0.3% |

|

November |

1,003.00 |

1,003.00–1,118.00 |

1,065.00 |

6.5% |

|

December |

1,065.00 |

1,001.00–1,107.00 |

1,054.00 |

5.4% |

Walletinvestor

Price range: $984.55–$1,101.47 (as of 08.11.2024).

Experts at Walletinvestor also offer optimistic forecasts. By the end of 2024, the cost of the precious metal will reach $1,016.18 per ounce.

At the end of the first half of 2025, the asset may stand at $1054.38. In the second half of the year, platinum will gradually decline to $984.55–$1,054.34 and close the year at $1,013.93.

|

Month |

Open, $ |

Close, $ |

Minimum, $ |

Maximum, $ |

Change,% |

|

2024 |

|||||

|

November |

1,026.57 |

1,026.01 |

1,025.39 |

1,029.96 |

-0.05 %▼ |

|

December |

993.44 |

1,016.18 |

987.08 |

1,016.18 |

2.24 % ▲ |

|

2025 |

|||||

|

January |

1,020.24 |

1,061.71 |

1,020.24 |

1,063.91 |

3.91 % ▲ |

|

February |

1,064.03 |

1,083.24 |

1,064.03 |

1,085.95 |

1.77 % ▲ |

|

March |

1,082.76 |

1,077.88 |

1,066.70 |

1,082.76 |

-0.45 %▼ |

|

April |

1,079.20 |

1,094.08 |

1,079.20 |

1,101.47 |

1.36 % ▲ |

|

May |

1,094.40 |

1,088.77 |

1,088.77 |

1,095.68 |

-0.52 %▼ |

|

June |

1,086.36 |

1,054.38 |

1,054.38 |

1,086.36 |

-3.03 %▼ |

|

July |

1,053.34 |

1,051.89 |

1,049.73 |

1,054.34 |

-0.14 %▼ |

|

August |

1,048.70 |

1,034.59 |

1,031.84 |

1,048.70 |

-1.36 %▼ |

|

September |

1,037.19 |

996.20 |

996.20 |

1,039.83 |

-4.11 %▼ |

|

October |

996.00 |

997.53 |

990.92 |

1,000.82 |

0.15 % ▲ |

|

November |

997.21 |

991.91 |

991.91 |

997.50 |

-0.53 %▼ |

|

December |

991.47 |

1,013.93 |

984.55 |

1,013.93 |

2.22 % ▲ |

Coin Price Forecast

Price range: $1,009.00–$1,073.00 (as of 08.11.2024).

Coin Price Forecast suggests that the XPTUSD pair may reach $1,010.00 by the end of 2024.

By mid-2025, the XPT price will trade near $1,015.00, reaching $1,073.00 by the end of December.

|

Year |

Mid-Year, $ |

Year-End, $ |

Tod/End, % |

|

2024 |

1,009.00 |

1,010.00 |

2% |

|

2025 |

1,015.00 |

1,073.00 |

8% |

BeatMarket

Price range: $984.55–$1,101.47 (as of 08.11.2024).

According to BeatMarket‘s experts, the precious metal’s value will advance over the next 6–8 months, hitting a low of $1,088.77 and a high of $1,088.77 in May 2025.

Analysts predict that platinum will trade between $984.55 and $1,086.36 from June 2025 to the end of the year.

|

Month |

Minimum, $ |

Maximum, $ |

Change, % |

|

December 2024 |

1,018.07 |

1,047.91 |

-0.33 USD (-0.03%) |

|

January 2025 |

1,020.24 |

1,063.91 |

+50.36 USD (4.83%) |

|

February 2025 |

1,064.03 |

1,085.95 |

+32.91 USD (3.06%) |

|

March 2025 |

1,066.70 |

1,082.76 |

-0.25 USD (-0.02%) |

|

April 2025 |

1,079.20 |

1,101.47 |

+15.6 USD (1.43%) |

|

May 2025 |

1,088.77 |

1,095.68 |

+1.89 USD (0.17%) |

|

June 2025 |

1,054.38 |

1,086.36 |

-21.85 USD (-2.04%) |

|

July 2025 |

1,049.73 |

1,054.34 |

-18.33 USD (-1.74%) |

|

August 2025 |

1,031.84 |

1,048.70 |

-11.77 USD (-1.13%) |

|

September 2025 |

996.20 |

1,039.83 |

-22.26 USD (-2.19%) |

|

October 2025 |

990.92 |

1,000.82 |

-22.14 USD (-2.22%) |

|

November 2025 |

991.91 |

997.50 |

-1.17 USD (-0.12%) |

|

December 2025 |

984.55 |

1,013.93 |

+4.53 USD (0.45%) |

Most analysts expect the XPT price to rise to $1,054.00–$1,073.00 over the next 12–14 months. However, some analysts predict that growth will be followed by a decline to $984.55–$1,013.93 starting from mid-2025.

Analysts’ XPTUSD Price Projections for 2026

Analytical agencies mostly give neutral forecasts for the platinum exchange rate in 2026.

Long Forecast

Price range: $871.00–$1,118.00 (as of 08.11.2024).

According to Long Forecast, the asset is projected to trade at $1026.00 per troy ounce at the beginning of 2026. By mid-year, the price will range between $890.00 and $999.00 and close June at $937.00.

By the end of the year, the asset value is expected to climb to $1,012.00.

|

Month |

Open, $ |

Min–Max, $ |

Close, $ |

Change,% |

|

January |

1,026.00 |

1,005.00–1,111.00 |

1,058.00 |

5.8% |

|

February |

1,058.00 |

942.00–1,058.00 |

992.00 |

-0.8% |

|

March |

992.00 |

959.00–1,059.00 |

1,009.00 |

0.9% |

|

April |

1,009.00 |

1,009.00–1,118.00 |

1,065.00 |

6.5% |

|

May |

1,065.00 |

949.00–1,065.00 |

999.00 |

-0.1% |

|

June |

999.00 |

890.00–999.00 |

937.00 |

-6.3% |

|

July |

937.00 |

937.00–1,045.00 |

995.00 |

-0.5% |

|

August |

995.00 |

990.00–1,094.00 |

1,042.00 |

4.2% |

|

September |

1,042.00 |

928.00–1,042.00 |

977.00 |

-2.3% |

|

October |

977.00 |

871.00–977.00 |

917.00 |

-8.3% |

|

November |

917.00 |

905.00–1,001.00 |

953.00 |

-4.7% |

|

December |

953.00 |

953.00–1,063.00 |

1,012.00 |

1.2% |

Walletinvestor

Price range: $982.21–$1,098.51 (as of 08.11.2024).

According to Walletinvestor, platinum may range between $1,017.71 and $1,098.51 in the first half of the year, closing June at $1,051.40.

In the second half of the year, the price is expected to plummet, reaching $1,011.42 by the end of December.

|

Month |

Open, $ |

Close, $ |

Minimum, $ |

Maximum, $ |

Change,% |

|

January |

1,017.71 |

1,058.61 |

1,017.71 |

1,060.85 |

3.86 % ▲ |

|

February |

1,060.69 |

1,080.73 |

1,060.69 |

1,083.24 |

1.85 % ▲ |

|

March |

1,080.82 |

1,074.31 |

1,064.02 |

1,080.82 |

-0.61 %▼ |

|

April |

1,077.22 |

1,092.44 |

1,077.22 |

1,098.51 |

1.39 % ▲ |

|

May |

1,089.31 |

1,087.23 |

1,087.23 |

1,093.04 |

-0.19 %▼ |

|

June |

1,085.16 |

1,051.40 |

1,051.40 |

1,085.16 |

-3.21 %▼ |

|

July |

1,051.96 |

1,046.81 |

1,046.81 |

1,052.29 |

-0.49 %▼ |

|

August |

1,045.58 |

1,033.85 |

1,029.18 |

1,045.58 |

-1.14 %▼ |

|

September |

1,033.93 |

995.05 |

995.05 |

1,036.83 |

-3.91 %▼ |

|

October |

994.52 |

995.28 |

987.88 |

998.10 |

0.08 % ▲ |

|

November |

995.07 |

989.42 |

989.42 |

995.35 |

-0.57 %▼ |

|

December |

988.46 |

1,011.42 |

982.21 |

1,011.42 |

2.27 % ▲ |

Coin Price Forecast

Price range: $1,057.00–$1,205.00 (as of 08.11.2024).

Coin Price Forecast predicts the XPTUSD pair to hit $1,198.00 per troy ounce in mid-2026.

By the end of the year, the average price of the asset will stand at $1,205.00.

|

Year |

Mid-Year, $ |

Year-End, $ |

Tod/End, % |

|

2026 |

1,198.00 |

1,205.00 |

23% |

BeatMarket

Price range: $982.21–$1,098.51 (as of 08.11.2024).

BeatMarket expects the platinum price to range between $1,017.71 and $1,080.82 in the first quarter of 2026. By the end of the second quarter, the rate will reach $1,051.40–$1,093.04 per troy ounce.

In December, the asset is projected to decline to $982.21–$1,011.42.

|

Month |

Minimum, $ |

Maximum, $ |

Change, % |

|

January 2026 |

1,017.71 |

1,060.85 |

+47.57 USD (4.58%) |

|

February 2026 |

1,060.69 |

1,083.24 |

+32.68 USD (3.05%) |

|

March 2026 |

1,064.02 |

1,080.82 |

+0.46 USD (0.04%) |

|

April 2026 |

1,077.22 |

1,098.51 |

+15.44 USD (1.42%) |

|

May 2026 |

1,087.23 |

1,093.04 |

+2.27 USD (0.21%) |

|

June 2026 |

1,051.40 |

1,085.16 |

-21.86 USD (-2.05%) |

|

July 2026 |

1,046.81 |

1,052.29 |

-18.73 USD (-1.78%) |

|

August 2026 |

1,029.18 |

1,045.58 |

-12.17 USD (-1.17%) |

|

September 2026 |

995.05 |

1,036.83 |

-21.45 USD (-2.11%) |

|

October 2026 |

987.88 |

998.10 |

-22.95 USD (-2.31%) |

|

November 2026 |

989.42 |

995.35 |

-0.61 USD (-0.06%) |

|

December 2026 |

982.21 |

1,011.42 |

+4.43 USD (0.44%) |

Analysts disagree on the XPTUSD rate movement in 2026. Some experts anticipate growth toward $1,118.00–$1,205.00. Others predict an increase to $1,051.40–$1,085.16, followed by a drop to $987.88–$982.21.

Analysts’ XPTUSD Price Projections for 2027

Most analytical agencies forecast a plunge in the platinum price by the end of 2027. The price is expected to hover below $1,000.00 per ounce.

Long Forecast

Price range: $855.00–$1,181.00 (as of 08.11.2024).

Long Forecast predicts the XPTUSD exchange rate performance will be mixed in 2027.

The price will hover around $1,012.00 per troy ounce at the beginning of the year. The first fiscal quarter is expected to close at $1,055.00, reaching an annual high of $1,181.00 in February.

Afterward, the asset will fall to $977.00–$920.00 until the end of 2027. At the same time, analysts do not rule out a slump below $900.00.

|

Month |

Open, $ |

Min–Max, $ |

Close, $ |

Change,% |

|

January |

1,012.00 |

1,012.00–1,129.00 |

1,075.00 |

7.5% |

|

February |

1,075.00 |

1,069.00–1,181.00 |

1,125.00 |

12.5% |

|

March |

1,125.00 |

1,002.00–1,125.00 |

1,055.00 |

5.5% |

|

April |

1,055.00 |

1,008.00–1,114.00 |

1,061.00 |

6.1% |

|

May |

1,061.00 |

947.00–1,061.00 |

997.00 |

-0.3% |

|

June |

997.00 |

959.00–1,059.00 |

1,009.00 |

0.9% |

|

July |

1,009.00 |

904.00–1,009.00 |

952.00 |

-4.8% |

|

August |

9,52.00 |

855.00–952.00 |

900.00 |

-10.0% |

|

September |

900.00 |

875.00–967.00 |

921.00 |

-7.9% |

|

October |

921.00 |

917.00–1,013.00 |

965.00 |

-3.5% |

|

November |

965.00 |

928.00–1,026.00 |

977.00 |

-2.3% |

|

December |

977.00 |

874.00–977.00 |

920.00 |

-8.0% |

Walletinvestor

Price range: $979.50–$1,095.28 (as of 08.11.2024).

Walletinvestor experts forecast growth of quotations in the first half of 2027. The price may fluctuate between $1,011.76 and $1,095.28, closing at $1,050.03 at the end of June.

In the second half of the year, the price is expected to reverse and decrease to $1,005.48 by the end of December.

|

Month |

Open, $ |

Close, $ |

Minimum, $ |

Maximum, $ |

Change,% |

|

January |

1,011.76 |

1,055.56 |

1,011.76 |

1,057.83 |

4.15 % ▲ |

|

February |

1,057.46 |

1,077.98 |

1,057.44 |

1,080.29 |

1.9 % ▲ |

|

March |

1,078.66 |

1,072.36 |

1,061.64 |

1,078.66 |

-0.59 %▼ |

|

April |

1,074.98 |

1,087.37 |

1,074.24 |

1,095.28 |

1.14 % ▲ |

|

May |

1,086.70 |

1,083.82 |

1,083.82 |

1,090.26 |

-0.27 %▼ |

|

June |

1,082.30 |

1,050.03 |

1,049.53 |

1,082.31 |

-3.07 %▼ |

|

July |

1,050.31 |

1,044.77 |

1,044.62 |

1,050.31 |

-0.53 %▼ |

|

August |

1,043.90 |

1,030.57 |

1,026.72 |

1,043.90 |

-1.29 %▼ |

|

September |

1,032.27 |

993.63 |

993.63 |

1,033.65 |

-3.89 %▼ |

|

October |

989.63 |

992.93 |

985.05 |

995.66 |

0.33 % ▲ |

|

November |

992.90 |

986.40 |

986.40 |

993.21 |

-0.66 %▼ |

|

December |

987.07 |

1,005.48 |

979.50 |

1,005.48 |

1.83 % ▲ |

Coin Price Forecast

Price range: $1,205.00–$1,237.00 (as of 08.11.2024).

Analysts at Coin Price Forecast, on the other hand, predict a bullish trend, with the price hitting $1,212.00 per troy ounce by the middle of the year and $1,237.00 by December.

|

Year |

Mid-Year, $ |

Year-End, $ |

Tod/End, % |

|

2027 |

1,212.00 |

1,237.00 |

26% |

BeatMarket

Price range: $979.50–$1,095.28 (as of 08.11.2024).

According to BeatMarket, the asset will trade between $1,049.53 and $1,082.31 by mid-2027.

In the second half of the year, a gradual downturn is expected until the end of the year, with the price reaching $979.50–$1,005.48.

|

Month |

Minimum, $ |

Maximum, $ |

Change, % |

|

January 2027 |

1,011.76 |

1,057.83 |

+43.08 USD (4.16%) |

|

February 2027 |

1,057.44 |

1,080.29 |

+34.07 USD (3.19%) |

|

March 2027 |

1,061.64 |

1,078.66 |

+1.29 USD (0.12%) |

|

April 2027 |

1,074.24 |

1,095.28 |

+14.61 USD (1.35%) |

|

May 2027 |

1,083.82 |

1,090.26 |

+2.28 USD (0.21%) |

|

June 2027 |

1,049.53 |

1,082.31 |

-21.12 USD (-1.98%) |

|

July 2027 |

1,044.62 |

1,050.31 |

-18.46 USD (-1.76%) |

|

August 2027 |

1,026.72 |

1,043.90 |

-12.15 USD (-1.17%) |

|

September 2027 |

993.63 |

1,033.65 |

-21.67 USD (-2.14%) |

|

October 2027 |

985.05 |

995.66 |

-23.29 USD (-2.35%) |

|

November 2027 |

986.40 |

993.21 |

-0.55 USD (-0.06%) |

|

December 2027 |

979.50 |

1,005.48 |

+2.68 USD (0.27%) |

Many experts provide negative outlooks for the XPTUSD rate in 2027, predicting the asset will trade between $979.50 and $874.00 per ounce. However, some experts do not exclude the growth to $1,237.00 by the end of the year.

Analysts’ XPTUSD Price Projections for 2028

According to experts, the XPTUSD market will remain bearish in 2028.

Long Forecast

Price range: $782.00–$1,025.00 (as of 08.11.2024).

Long Forecast predicts that in early 2028, platinum will sink to $920.00 per troy ounce. From February to September, the rate will fall, reaching the low of $782.00 in June. From October to December the price is expected to rise toward $969.00.

|

Month |

Open, $ |

Min–Max, $ |

Close, $ |

Change,% |

|

January |

920.00 |

920.00–1,025.00 |

976.00 |

-2.4% |

|

February |

976.00 |

884.00–978.00 |

931.00 |

-6.9% |

|

March |

931.00 |

854.00–944.00 |

899.00 |

-10.1% |

|

April |

899.00 |

844.00–932.00 |

888.00 |

-11.2% |

|

May |

888.00 |

791.00–888.00 |

833.00 |

-16.7% |

|

June |

833.00 |

782.00–864.00 |

823.00 |

-17.7% |

|

July |

823.00 |

791.00–875.00 |

833.00 |

-16.7% |

|

August |

833.00 |

789.00–872.00 |

830.00 |

-17.0% |

|

September |

830.00 |

830.00–925.00 |

881.00 |

-11.9% |

|

October |

881.00 |

837.00–925.00 |

881.00 |

-11.9% |

|

November |

881.00 |

866.00–958.00 |

912.00 |

-8.8% |

|

December |

912.00 |

912.00–1,017.00 |

969.00 |

-3.1% |

Walletinvestor

Price range: $976.57-$1,093.00 (as of 08.11.2024).

Walletinvestor‘s experts anticipate the rate to trade at $1,015.11 per ounce at the beginning of the year. During the first half of the year, the average price of platinum will range between $1,015.11 and $1,093.00, closing June at $1,045.23.

In the second half of the year, the price will decline, ranging from $976.57 to $1,045.40. In December, the asset will trade at $999.30 per troy ounce.

|

Month |

Open, $ |

Close, $ |

Minimum, $ |

Maximum, $ |

Change,% |

|

January |

1,015.11 |

1,054.32 |

1,015.11 |

1,054.81 |

3.72 % ▲ |

|

February |

1,054.23 |

1,075.60 |

1,054.23 |

1,077.10 |

1.99 % ▲ |

|

Mach |

1,076.40 |

1,069.32 |

1,059.16 |

1,076.78 |

-0.66 %▼ |

|

April |

1,075.70 |

1,085.50 |

1,075.70 |

1,093.00 |

0.9 % ▲ |

|

May |

1,084.60 |

1,081.05 |

1,080.94 |

1,087.36 |

-0.33 %▼ |

|

June |

1,080.81 |

1,045.23 |

1,045.23 |

1,080.81 |

-3.4 %▼ |

|

July |

1,044.56 |

1,042.07 |

1,041.80 |

1,045.40 |

-0.24 %▼ |

|

August |

1,040.95 |

1,030.34 |

1,024.28 |

1,041.37 |

-1.03 %▼ |

|

September |

1,028.31 |

988.80 |

988.80 |

1,031.48 |

-4 %▼ |

|

October |

985.80 |

989.86 |

982.47 |

993.10 |

0.41 % ▲ |

|

November |

990.62 |

985.40 |

984.24 |

991.08 |

-0.53 %▼ |

|

December |

982.33 |

999.30 |

976.57 |

999.30 |

1.7 % ▲ |

Coin Price Forecast

Price range: $1,237.00–$1,345.00 (as of 08.11.2024).

Experts at Coin Price Forecast offer an optimistic outlook for 2028. In the first half of the year, the platinum price is expected to climb to $1296.00. By the end of the year, the price will soar to $1345.00.

|

Year |

Mid-Year, $ |

Year-End, $ |

Tod/End, % |

|

2028 |

1,296.00 |

1,345.00 |

37 % |

BeatMarket

Price range: $976.57–$1,093.00 (as of 08.11.2024).

According to BeatMarket, the XPT price is expected to settle above $1,000.00 per ounce in the first half of 2028. In mid-year, platinum will trade in a narrow range of $1,045.23–$1,080.81.

Analysts predict a decline toward $976.57–$999.30 by the end of the year.

|

Month |

Minimum, $ |

Maximum, $ |

Change, % |

|

January 2028 |

1,015.11 |

1,054.81 |

+43.24 USD (4.18%) |

|

February 2028 |

1,054.23 |

1,077.10 |

+30.7 USD (2.88%) |

|

March 2028 |

1,059.16 |

1,076.78 |

+2.31 USD (0.22%) |

|

April 2028 |

1,075.70 |

1,093.00 |

+16.38 USD (1.51%) |

|

May 2028 |

1,080.94 |

1,087.36 |

-0.2 USD (-0.02%) |

|

June 2028 |

1,045.23 |

1,080.81 |

-21.13 USD (-1.99%) |

|

July 2028 |

1,041.80 |

1,045.40 |

-19.42 USD (-1.86%) |

|

August 2028 |

1,024.28 |

1,041.37 |

-10.77 USD (-1.04%) |

|

September 2028 |

988.80 |

1,031.48 |

-22.69 USD (-2.25%) |

|

October 2028 |

982.47 |

993.10 |

-22.35 USD (-2.26%) |

|

November 2028 |

984.24 |

991.08 |

-0.13 USD (-0.01%) |

|

December 2028 |

976.57 |

999.30 |

+0.28 USD (0.03%) |

Most analysts do not expect the value of platinum to increase in 2028, projecting a target range of $976.57–$912.00. However, optimistic predictions suggest a possible increase to $1,345.00 by year-end.

Analysts’ XPTUSD Price Projections for 2029

Experts’ opinions on the precious metal exchange rate in 2029 vary. Some analysts expect a gradual decline, while others anticipate growth.

Walletinvestor

Price range: $971.15–$1,078.50 (as of 08.11.2024).

Experts at Walletinvestor predict that the XPT price will range between $1,007.45 and $1,064.84 in the first half of 2029.

The platinum price may continue to slide, reaching $985.96 per troy ounce by the end of the year.

|

Month |

Open, $ |

Close, $ |

Minimum, $ |

Maximum, $ |

Change,% |

|

2029 |

|||||

|

January |

1,007.45 |

1,050.96 |

1,007.45 |

1,050.96 |

4.14 % ▲ |

|

February |

1,052.26 |

1,070.05 |

1,050.45 |

1,071.80 |

1.66 % ▲ |

|

March |

1,070.08 |

1,052.29 |

1,044.14 |

1,070.08 |

-1.69 %▼ |

|

April |

1,058.78 |

1,070.96 |

1,058.78 |

1,078.50 |

1.14 % ▲ |

|

May |

1,070.04 |

1,068.29 |

1,068.29 |

1,073.39 |

-0.16 %▼ |

|

June |

1,064.84 |

1,032.59 |

1,032.59 |

1,064.84 |

-3.12 %▼ |

|

July |

1,031.74 |

1,028.93 |

1,028.65 |

1,032.79 |

-0.27 %▼ |

|

August |

1,029.16 |

1,015.57 |

1,012.00 |

1,029.17 |

-1.34 %▼ |

|

September |

1,017.66 |

979.43 |

979.43 |

1,018.98 |

-3.9 %▼ |

|

October |

976.07 |

973.22 |

971.15 |

976.07 |

-0.29 %▼ |

|

November |

988.93 |

985.96 |

985.96 |

988.93 |

-0.3 %▼ |

Coin Price Forecast

Price range: $1,345.00–$1,372.00 (as of 08.11.2024).

Experts at Coin Price Forecast, on the contrary, predict a bullish trend, suggesting the price may grow to $1,347.00 by the middle of the year and to $1,372.00 by December.

|

Year |

Mid-Year, $ |

Year-End, $ |

|

2029 |

1,347.00 |

1,372.00 |

BeatMarket

Price range: $985.96–$1,090.64 (as of 08.11.2024).

BeatMarket experts forecast the price of the asset to rise to $1,079.53 by the middle of 2029. However, by December, the quotes will fall to $988.43 per troy ounce.

|

Year |

Mid-Year, $ |

Year-End, $ |

|

2029 |

1,079.53 |

988.43 |

Most experts predict the XPTUSD pair to decline to $985.96–$971.15 in 2029. However, some analysts expect a surge to $1,372.00 by the end of the year.

Analysts’ XPTUSD Price Projections for 2030

Analytical agencies forecast a significant increase in the value of platinum in 2030.

Coin Price Forecast

Price range: $1,372.00–$1,503.00 (as of 08.11.2024).

Coin Price Forecast expects platinum to advance to $1,406.00 per troy ounce by mid-2030. By the end of the year, the asset is projected to climb to $1,503.00.

|

Year |

Mid-Year, $ |

Year-End, $ |

|

2030 |

1,406.00 |

1,503.00 |

BeatMarket

Price range: $990.00–$1,600.00 (as of 08.11.2024).

According to BeatMarket, the precious metal’s value may skyrocket to $1,500.00 per troy ounce by the middle of 2030. By the end of the year, the bull run may continue up to $1,600.00.

|

Year |

Mid-Year, $ |

Year-End, $ |

|

2030 |

1,500.00 |

1,600.00 |

Techopedia

Price range: $991.69–$1,273.00 (as of 08.11.2024).

Techopedia experts anticipate the average price of the precious metal to hit $1,130.00 in 2030. Analysts suggest that the platinum supply will remain limited while demand from the manufacturing sector will grow.

|

Year |

Average, $ |

Minimum, $ |

Maximum, $ |

|

2030 |

1,130.00 |

991.69 |

1,273.00 |

Experts believe that platinum’s value will rise in 2030. The price is expected to range between $991.69 and $1,600.00 per troy ounce.

Analysts’ XPTUSD Price Projections until 2050

Experts are optimistic about the advancement of environmentally friendly technologies, which are driving a high demand for platinum. Analysts predict that the asset may increase to $2,000.00–$4,000.00 per ounce.

However, long-term forecasts tend to be less reliable because numerous factors can impact the asset’s price.

Coin Price Forecast

According to Coin Price Forecast, the XPTUSD uptrend will continue in 2031–2036. Thus, by 2033, platinum will reach $1,850.00.

The price is expected to jump to $2,248.00 by the end of 2036.

BeatMarket

Analysts at BeatMarket forecast the platinum price to rise by an average of 10%–15% annually between 2030 and 2050. The price may increase to $3,500.00–$4,000.00.

The following factors will be the main drivers of the platinum price growth in 2030–2050:

- continuing demand from the industrial sector;

- development of hydrogen energy;

- rising inflation, leading to an increase in real prices of precious metals;

- shortage of the metal on the market.

|

Year |

Coin Price Forecast |

BeatMarket |

|

2031 |

$1,630.00 |

$2,000.00 |

|

2035 |

$2,095.00 |

$3,500.00 |

|

2040 |

$2,248.00 |

$4,000.00 |

Experts predict that the platinum price will continue to climb in 2030–2050. According to more cautious estimates, the price will reach $2,200.00 per ounce. More optimistic predictions suggest that the rate will rocket to $3,500.00–$4,000.00.

Market Sentiment for XPTUSD (Platinum) on Social Media

Media sentiment (sentiment in social networks) is a parameter reflecting the opinions and attitudes of people in social networks regarding a particular asset. This indicator helps identify the current moods of market participants and possible trends in a trading instrument.

Evaluating sentiment on social media plays a crucial role in making successful trading decisions.

Google Trends data over the past three months indicate that online interest in purchasing platinum has fluctuated between 52 and 100, with 100 representing the highest level of popularity. Notably, within the past week, this interest metric has increased to 79, which may suggest a bullish trend for the asset.

According to the analysis of posts on the X social network, market participants expect platinum to skyrocket soon.

User @uselinkinv suggests that platinum is ready to join the precious metals uptrend. They believe the four-year “Inverse head-and-shoulders” pattern should end at $1,050.00.

According to @ffvasconcelos’ post, the XPTUSD price may soar after consolidating above the $1,060.00 mark.

User @graddhybpc believes that the platinum price is in a consolidation phase preceding a strong upward breakout. The independent expert suggests that this trend may be fuelled by the accumulation of the precious metal by Russia, China and Iran. Meanwhile, Russia is considering a ban on exports to other countries, which could further tighten market supply. According to the user, the platinum market has been stuck in a bearish trend for 15 years. However, historical data indicates that a bull rally may emerge once again, similar to what occurred in the 90s.

Thus, according to posts on the X social network, market participants are optimistic about the further platinum exchange rate performance.

XPT Price History

Platinum hit its all-time high of $1740 on 2013-02-07.

The lowest XPT price of $562.25 was set on 2020-03-16.

The chart below shows the XPTUSD pair performance over the last ten years. It is essential to evaluate historical data to make predictions as accurate as possible.

Since the end of 2015, the platinum price has been trading in a wide range, varying from $561.01 to $1,317.41 per troy ounce.

The growth of the precious metal from January to August 2016 was driven by increased industrial demand from the automotive industry, fuelled by the tightening of Euro-6 emission standards, as well as high investment demand for the metal in Japan. In addition, at that time, the platinum market was facing a deficit of around 380K ounces, which further boosted investor confidence in the asset.

The decline in price and the extended period of consolidation, ranging from $755.70 to $1,047.80 between August 2016 and 2020, can be attributed to the following factors:

- Surplus of precious metal in the market. Despite mining problems in South Africa, metal supplies remained at a high level. Producers refused to reduce metal exports due to high productivity amid a weakening rand.

- Investors’ concerns about the global economy overheating. A surge in global economic growth may have contributed to a decline in sales of cars that incorporate platinum in their manufacturing.

- The precious metal’s depreciation was driven by the strengthening of the US currency and a decrease in the share of diesel engines in the European market.

Due to the COVID-19 pandemic, the platinum exchange rate has dropped more than 47% to $561.01 in 2020.

From May 2020 to February 2021, the price rose to $1,317.41 per troy ounce, spurred by the recovery of the automotive and jewelry industries following the coronavirus pandemic.

The primary reason for the asset’s decline from March 2021 to September 2022 was a shortage of chips. This problem caused demand for catalytic converters to fall and manufacturers to produce fewer cars. Consequently, investment demand for the precious metal fell by 501K ounces.

The XPT price recovery from October 2022 to May 2023 was prompted by escalating tensions in the Middle East and Eastern Europe. Increased demand from the automotive sector, along with expanding production at glass facilities, elevated total demand by 14% YoY to 1.9 million ounces.

Since June 2023, the asset has been trading in a narrow channel, fluctuating between $845.75 and $1,090.38. Experts predict the appreciation of the asset due to a potential record shortage of metal. Besides, the development of hydrogen technologies and increasing investment demand for ingots and coins from China may push the price higher.

XPT Price Fundamental Analysis

Understanding the key factors influencing the XPTUSD price is essential for making informed trading and investment decisions.

What Factors Affect the XPT Price?

- Record platinum deficit. According to the updated forecast of the World Platinum Investment Council (WPIC), the platinum market deficit in 2025–2028 will average 769K ounces. This shortage is unlikely to have a major impact on platinum prices, as ETF sales will compensate for the metal’s deficit in the global market. As highlighted in the report, ETF sales may occur if prices exceed the ETF’s weighted average asset value of $1,100.00 per ounce. Larger sales would require higher prices.

- Replacing palladium with platinum. The WPIC forecasts further growth in the automotive industry’s demand for platinum, especially as palladium is increasingly replaced by platinum in the production of catalysts for petrol vehicles.

- Replacing palladium with platinum. The WPIC forecasts further growth in platinum demand from the automotive industry, driven by the increasing substitution of palladium with platinum in catalysts for gasoline vehicles.

- EU measures to reduce vehicle emissions. In 2023, the European Union introduced measures to curb harmful automobile emissions. This initiative may drive up production demand for platinum group metals, positively influencing the asset’s value. Moreover, the adoption of the Euro-7 standard, which establishes stricter limits on CO2 emissions, may boost the XPTUSD pair.

- Platinum plays a crucial role in the global transition to hydrogen energy. Successful implementation of innovative projects within the hydrogen sector may contribute to the growth of the precious metal’s value.

- Platinum is historically undervalued compared to gold. Platinum is less common than gold. The scarcity of this metal in conditions of restricted mining may become a driver for the XPTUSD price increase in the future.

- Investment demand. Rising demand for platinum ingots and coins from Asian countries may spur the XPT price growth.

More Facts About XPT

Platinum is the third most popular precious metal. When investing in this type of asset, a number of certain features should be taken into account:

- South Africa is the major miner of platinum, accounting for about 70% of the world’s reserves. Consequently, production levels are heavily influenced by the geopolitical and macroeconomic conditions in the region.

- Platinum serves as both an industrial and jewelry commodity, with the automotive sector driving most of the global demand, accounting for 44% of production. Meanwhile, the creation of ingots and coins makes up around 10%–15% of the market.

- Platinum is less liquid in the market than gold and silver due to low investor demand.

The development of green energy has a mixed impact on the use of platinum in manufacturing. On the one hand, the precious metal is used in the production of catalysts for diesel cars. On the other hand, the shift to electric vehicles, which do not require these catalysts, is pushing diesel and petrol engines out of the market.

However, hydrogen energy, which is rapidly advancing, is closely tied to platinum. Consequently, the future demand for platinum will largely hinge on the development of green energy.

The jewelry industry is the second largest sector in terms of consumption, representing nearly one-third of the total platinum supply. The main target market for jewelry made from this precious metal is China.

First and foremost, platinum is an excellent tool to diversify your investment portfolio, helping mitigate risks associated with other assets.

Platinum began to gain recognition as an investment asset in the second half of the 20th century. Nowadays, there are many ways to invest in this asset:

- buying shares in an ETF (exchange-traded investment fund) with net assets consisting of ingots;

- physical metal, such as platinum ingots and coins, buying;

- buying precious metal through opening an unallocated metal account in banks;

- use of complex derivative instruments, like futures or CFDs, for speculation on the financial market;

- investing in shares of public companies engaged in the exploration and mining of precious metals, including platinum.

Advantages and Disadvantages of Investing in XPT

Let’s delve into the pros and cons of investing in platinum.

Advantages

- Industrial significance of the precious metal. Platinum plays a huge role in the automotive and emerging hydrogen energy sectors. Its significance in these fields can contribute to sustained investor interest.

- Diversification of the investment portfolio. Adding platinum to your investment portfolio can serve as a protective measure against potential losses in other assets.

- Platinum’s undervaluation and upside potential. Current platinum prices are lower than historical averages, which may facilitate asset appreciation if demand rises or supply tightens in the market.

Disadvantages

- No regular income like dividends or interest on deposits. You have to sell some or all of your assets to make a profit.

- Volatility. Due to low market interest, the volatility of platinum is lower than that of gold or silver. In some cases, platinum prices may be more volatile due to industrial demand for the precious metal.

- Value-added taxation. Unlike gold, platinum is subject to value-added tax, which can negatively affect the overall profitability of investments. The only exception is if platinum is stored offshore or in bonded warehouses.

How We Make Forecasts

In order to forecast the platinum exchange rate, we use a comprehensive approach.

1. Fundamental analysis.

- Analyzing and evaluating forecasts of major analytical agencies;

- Analyzing supply and demand in the platinum market;

- Monitoring the exchange rate of the US dollar, the African rand, and the currencies of platinum-producing countries;

- Evaluation of progress in the green energy sector, as well as its development prospects (introduction of innovations, development of new products, etc.);

- Assessment of the news related to the precious metal;

- Estimation of geopolitical and macroeconomic factors affecting the precious metal’s value.

2. Market sentiment on social media analysis.

3. Technical analysis.

- Evaluation of technical indicators used to track current trends, determine their strength, and identify the potential buy/sell zones;

- Analyzing candlestick and chart patterns that allow you to predict changes in the precious metals market in advance.

The combination of these methods allows you to timely gauge the current market sentiment and open trades at the most favorable prices. Besides, it helps determine trading and investment targets in advance.

Conclusion: Is XPT a Good Investment?

The limited supply of platinum in the global market may lead to a surge in XPT prices in the coming years.

Most experts suggest that the platinum price will climb to $1,054.00–$1,073.00 during 2025.

Robust demand from the automotive and green energy sectors may spur the XPTUSD price to rise to $1,273.00–$1,600.00 per ounce by 2030.

Platinum exhibits an inverse correlation with gold and silver. This means that when the XAUUSD and XAGUSD prices drop, the XPTUSD rate tends to advance. This correlation is another valuable indicator for determining the current trend.

Platinum is an excellent tool for diversifying your investment portfolio and hedging risks. However, it is crucial to carefully analyze fundamental factors, market sentiment, and technical indicators before making investment and trading decisions. Nevertheless, platinum can be a very lucrative investment in the long term as many countries switch to green energy.

XPTUSD Price Prediction FAQ

The price of XPT is trading at $969.13 as of 19.11.2024.

Many experts forecast the platinum value to climb to $1,054.00–$1,073.00 per troy ounce in the coming year. This increase is primarily attributed to the record deficit of 769K ounces of the precious metal expected in 2025. Besides, strong demand from automakers, along with the growing trend of substituting palladium for platinum in the manufacturing of catalytic converters, is driving the price up.

Most analytical agencies offer optimistic forecasts for platinum over the next 12–14 months. Experts believe that the price will grow to $1,054.00–$1,073.00 per troy ounce. Some experts predict that platinum will trade in the range of $984.55–$1,013.93.

Analysts expect that the platinum price will remain stable in 2026, ranging between $982.21 and $987.88 per ounce. According to optimistic forecasts, the price will advance to $1,118.00–$1,205.00.

Various estimates suggest that the platinum price may surge to $1,273.00–$1,600.00 per ounce by 2030. Experts believe that factors such as the advancement of green technologies, growing demand from automotive manufacturers, and a diminishing supply of platinum will bolster the XPTUSD price.

Primarily, one may invest in platinum in 2024 to diversify the investment portfolio. Additionally, this asset will help hedge risks and avoid severe portfolio drawdown if other assets drop in value.

The choice between platinum and gold largely depends on your trading style. Market participants typically view both metals as protective assets to hedge risks. Platinum is primarily a production commodity, while gold is an investment one. Therefore, when investing in these metals, it is crucial to consider the duration and nature of your investment.

In the event of a recession, precious metals like platinum face significant risks of losing value. A drop in production leads to decreased demand from manufacturers, especially in the automotive and jewelry sectors. As a result, this downturn may negatively affect asset prices.

Yes, platinum definitely has a future. There is a high demand for platinum in the production of catalysts for automotive vehicles, even with the ongoing rise of electric cars. Furthermore, the development of green energy will also bolster demand for the precious metal and, consequently, the XPTUSD price.

Price chart of XPTUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.