The 10% rally in the XPTUSD at the end of spring was driven by investor confidence that platinum can replace gold in jewelry and ETF purchases. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- China is increasing platinum imports.

- Donald Trump’s threats of 50% tariffs against the EU have boosted the XPTUSD.

- Capital inflows into ETFs are good news for platinum.

- Long trades on platinum can be considered with targets at $1,175 and $1,240 per ounce.

Monthly Fundamental Forecast for Platinum

The best cure for high prices is high prices. After languishing in long-term consolidation, platinum prices skyrocketed at the end of spring, driven by a surge in demand for the metal in China and President Donald Trump’s announcements regarding tariffs on the EU. While Asia leads the global consumption of this asset in jewelry, Europe is a leader in its use in automotive catalysts. The US administration’s intention to reshape the global economy has triggered a rally in XPTUSD quotes.

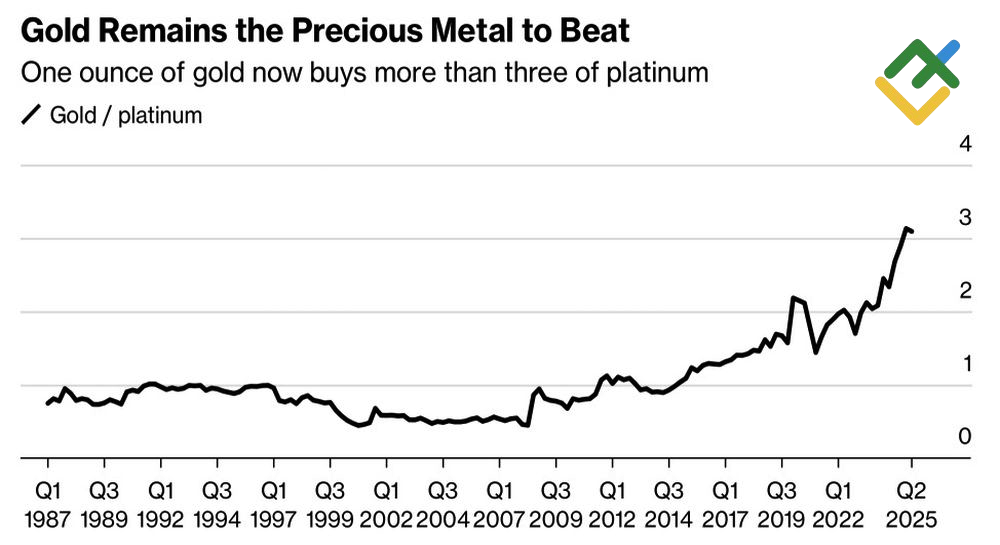

According to the World Platinum Investment Council (WPIC), demand for platinum jewelry surged by 28% in the first quarter, while demand for gold jewelry declined by 32% amid the XAUUSD’s surge to record highs above $3,500. In April, China imported 11.5 tons of platinum, marking the highest monthly import total for the year. The high and volatile nature of gold prices has prompted consumers to seek out alternative investment vehicles.

Gold to Platinum Ratio

Source: Bloomberg.

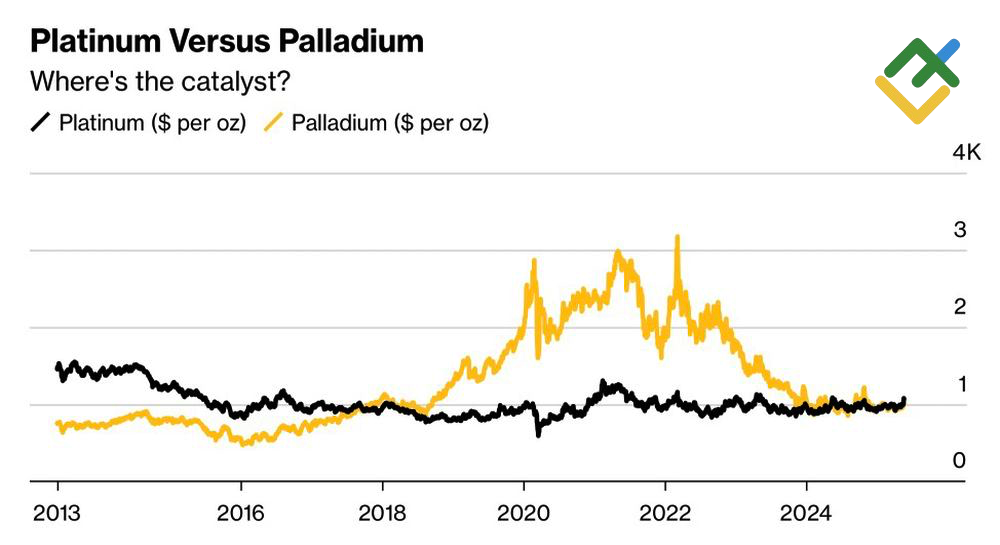

There was a transition from platinum, which was more expensive at the time, to more affordable palladium, causing XPTUSD prices to skyrocket. The substantial price disparity prompted a reversion to platinum, while the transition from gasoline and diesel vehicles to electric ones led to XPTUSD reaching a prolonged phase of consolidation. The prices remained close to the $1,000 per ounce mark.

Platinum Vs. Palladium Performance

Source: Bloomberg.

In 2025, the gold rally was driven, in part, by concerns regarding the potential import duties on gold by the US administration. This led to a transfer of bullion from Europe to North America and an increase in COMEX stocks. Concerns similar to these are impacting traders involved in platinum transactions. This is particularly relevant in light of President Trump’s recent threats to impose a 50% tariff on the EU.

A significant shift in preferences from gold to platinum in jewelry could establish a new trend for the investment sector. Many consumers purchase certain assets because of their appreciating value. The recent rise of approximately 10% in XPTUSD quotes could lead to a significant inflow of capital into platinum-focused ETFs.

As a result, the WPIC’s anticipated platinum deficit of approximately 1 million ounces in 2025 may reach a significantly higher figure, supporting the platinum price. The precious metals market is defined by substitutability. Given the significant appreciation of gold, which has gained more than 27% since the beginning of the year, it may be advantageous to explore alternative investment opportunities. Platinum is well-suited for this role. However, it is essential to ensure that high prices do not become a cure for high prices.

Monthly Platinum Trading Plan

The bullish outlook for the XPTUSD allows traders to purchase platinum on pullbacks with targets of $1,175 and $1,240 per ounce in the medium and long term.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of XPTUSD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.