Loss of respect from carry traders, rising volatility, a slowing Mexican economy, and the threat of Donald Trump returning to power make life difficult for USDMXN bears. Let’s discuss it and make a trading plan.

Monthly fundamental forecast for Mexican peso

Love and hate are just one step apart. Latin American currencies have long been the favorites of Forex investors, as their high rates and low volatility made them perfect for carry trades. For example, buying the Mexican peso against the Japanese yen yielded a profit of 50% from early 2023 to May 2024. However, elections turned the super-peso into an ugly duckling. In June, the currency lost more than 8% and became one of the outsiders on Forex.

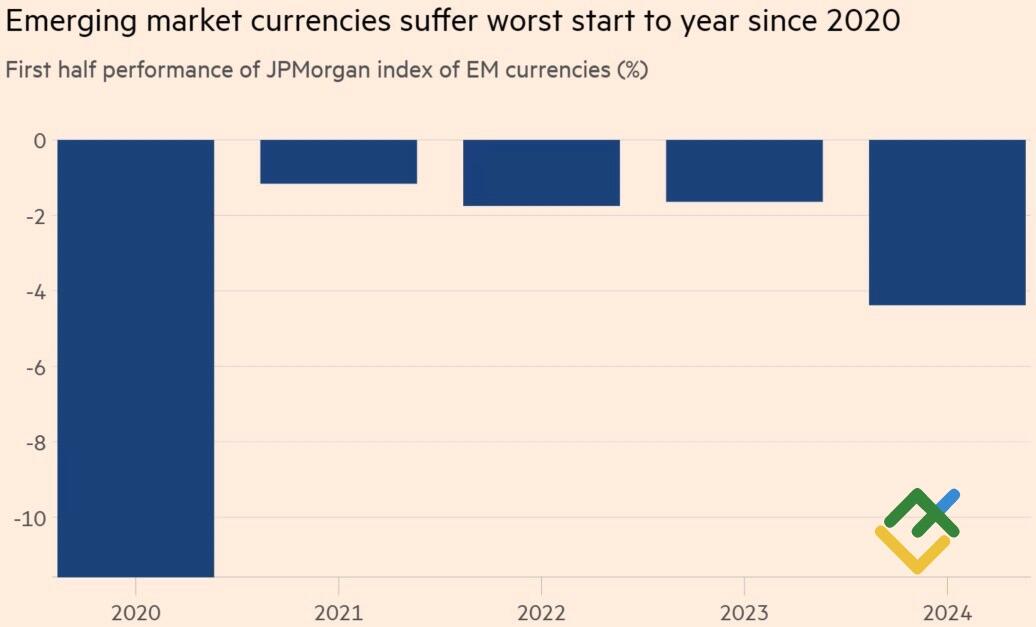

The JP Morgan Index of EM currencies fell 4.4% in the first half of the year, two times lower than over the same period of 2022-2023, let alone 2021.

EM currencies

Source: Financial Times.

Investors are fleeing emerging markets as the volatility of local currencies rises against the backdrop of parliamentary and presidential elections worldwide, the Fed keeping the federal funds rate at a plateau of 5.5% for a longer-than-expected period, and monetary easing cycles that have started in some countries.

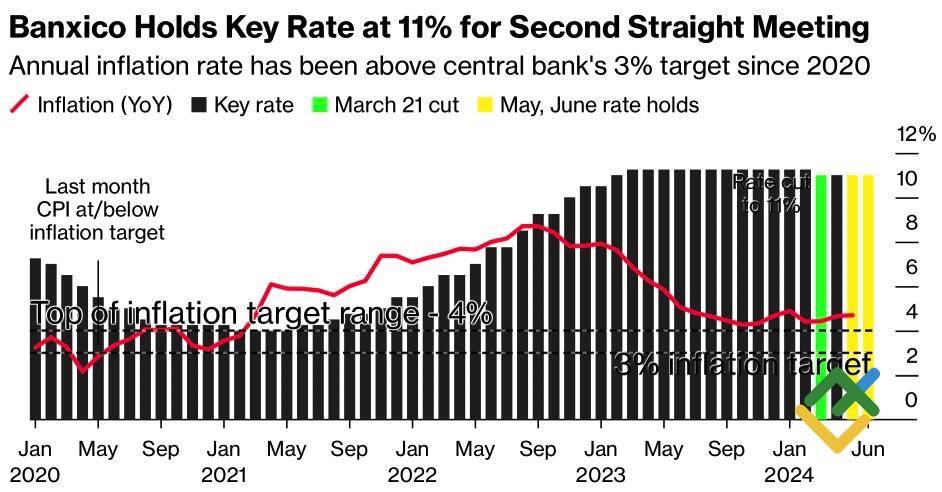

The Bank of Mexico had to extend the pause in cutting the key rate, keeping it at 11% in May and June. Moreover, Banxico Governor Victoria Rodriguez says the reason lies not in faster inflation but in the sharp increase in the peso’s volatility. A weak peso could accelerate consumer prices further, so the central bank’s best decision would be to wait and see how things develop.

Banxico rate and Mexican inflation trends

Source: Bloomberg.

Speculators don’t want to wait. Hedge funds reduced net longs on the peso at the third fastest pace on record, while asset managers brought them to their lowest in about two years. Money actively fled the country after Claudia Sheinbaum’s Morena party, which had intended to implement market-unfriendly reforms, won elections.

After USDMXN quotes soared to their highest since March 2023, the new president was forced to appoint to key government positions officials respected by investors, and Banxico started verbal interventions. This somewhat cooled the bulls, but they did not abandon their plans. Thus, Citigroup projects the US dollar to strengthen to 19.74 pesos in 2025 as Mexico’s GDP growth estimates are revised from 2.1% to 1.8% this year and from 1.5% to 1.2% next year.

Monthly trading plan for the USDMXN

Although the shock associated with the presidential elections is gradually fading, investors’ love for the super peso will not return. Respect is hard to earn and easy to lose, and traders who have lost their carry trade money will be afraid of trading the Mexican currency for a long time. Against the backdrop of the imminent resumption of Banxico’s monetary easing and growing risks of Donald Trump returning to power, the USDMXN pair risks resuming an upward trend. Use the current retracement to buy the pair with a target at 18.8 and 19.5.

Price chart of USDMXN in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.