Implementing a 25% tariff on all Mexican imports, as proposed by Donald Trump, would have a detrimental impact on the Latin American country’s economy. Approximately 80% of goods are currently sold in the US, making it challenging to replace such a significant trading partner. Let’s discuss this topic and make a trade plan for the USDMXN pair.

The article covers the following subjects:

Highlights and key points

- New tariffs on Mexico will put its economy at risk.

- China is hiding its direct investments in Latin America.

- Banxico will be forced to adjust its rate-cut cycle.

- The USDMXN pair may soar to 21.3 and 22.2.

Monthly fundamental forecast for Mexican peso

Donald Trump has pledged to swiftly renegotiate the USMCA and impose a 25% tariff on all Mexican imports if the flow of drugs across the US southern border does not cease. Trump is ready to raise import duties on China-related goods from Mexico to 200%. As anticipated, the imminent return of President Trump to the White House triggered a significant increase in the USDMXN, with the pair rising by 3%.

The peso experienced its most significant daily decline in three months, exerting downward pressure on the emerging market currency index. The decline was the most significant since February 2023. The implementation of tariffs and fiscal stimulus by Donald Trump will lead to an increase in US Treasury yields and a rise in debt service costs globally. This, combined with ongoing challenges in international trade, is likely to dampen global GDP growth.

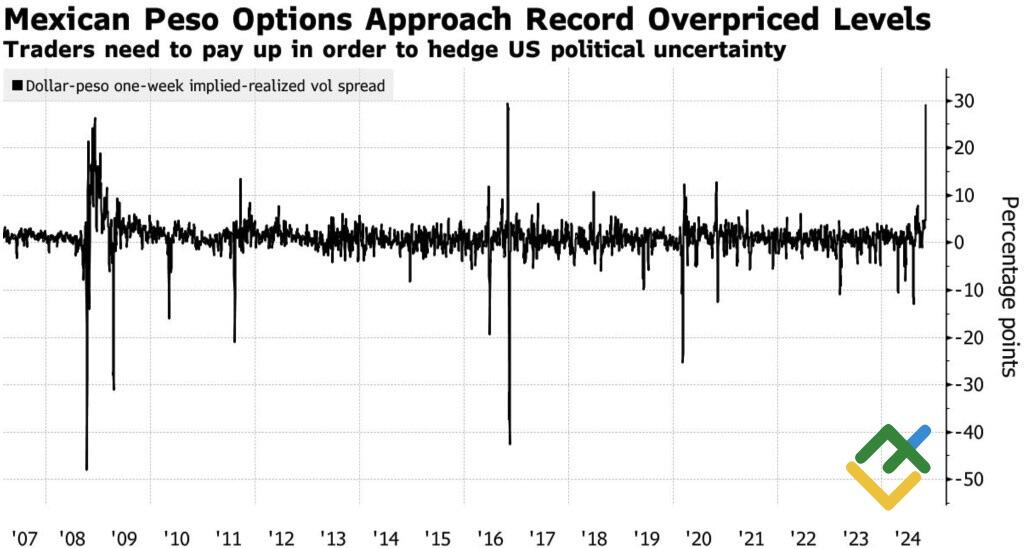

The Mexican currency has become the main casualty in this situation. The peso was regarded as an unlikely beneficiary of the Trump trade, given that the US represents the largest market for Mexico. Approximately 80% of Mexican exports are destined for the United States, with the USMCA increasing the share of duty-free trade to 75%, up from 62% under NAFTA. As a result, the volatility and cost of insurance against a USDMXN surge in the event of a Donald Trump victory have reached unprecedented levels.

Mexican peso volatility

Source: Bloomberg.

According to official figures, direct investments from China and Hong Kong in Mexico reached approximately $450 million in 2023. However, Rhodium research suggests that the actual figure may be six times higher. In an effort to circumvent tariffs, China is allegedly disguising its money.

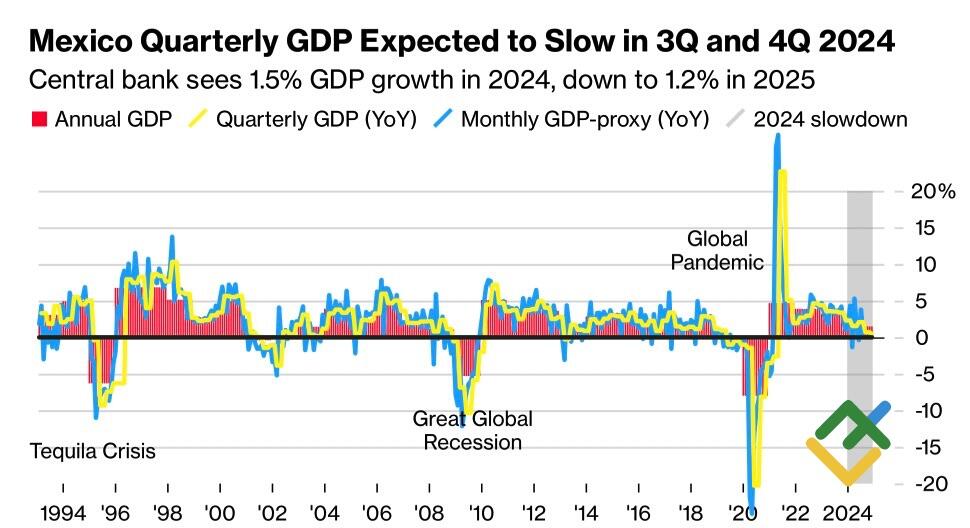

The return of Donald Trump to the White House is likely to have a detrimental impact on Mexican trade, further slowing an economy that is already losing momentum. A historical precedent is being repeated. Furthermore, the 2024 presidential election appears to be shaping up similarly to the 2016 election rather than the 2020 election. The Republican’s initial victory resulted in an 8.5% surge in the USDMXN pair, reaching an all-time high. However, if he previously lacked a defined strategy, the billionaire now has a clear plan and a significant opportunity. The red wave will allow him to achieve his goals with minimal effort.

Mexican economy’s performance

Source: Bloomberg.

The peso is expected to experience a more significant decline than it did eight years ago. The currency’s weakness may prompt Banxico to temporarily halt its monetary expansion cycle. In September, Banxico reduced its key rate by 25 bps to 10.5%, suggesting a potential cycle continuation. However, rising inflation in October and the USDMXN rally could adjust these plans, maintaining high borrowing costs and further slowing GDP.

Monthly USDMXN trading plan

The USDMXN pair will likely continue to soar towards 21.3 and 22.2. Therefore, consider keeping your long trades formed at 19.65 and 19.75 open and initiating more long positions on pullbacks.

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.