By Georgina McCartney

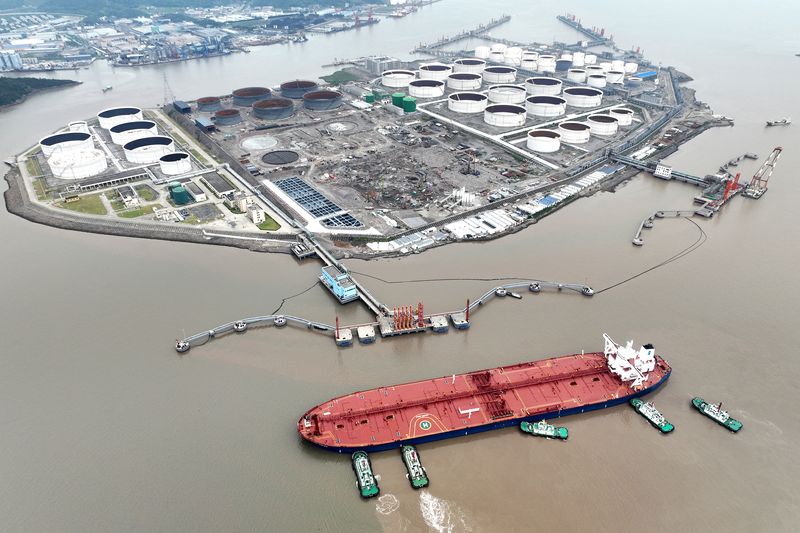

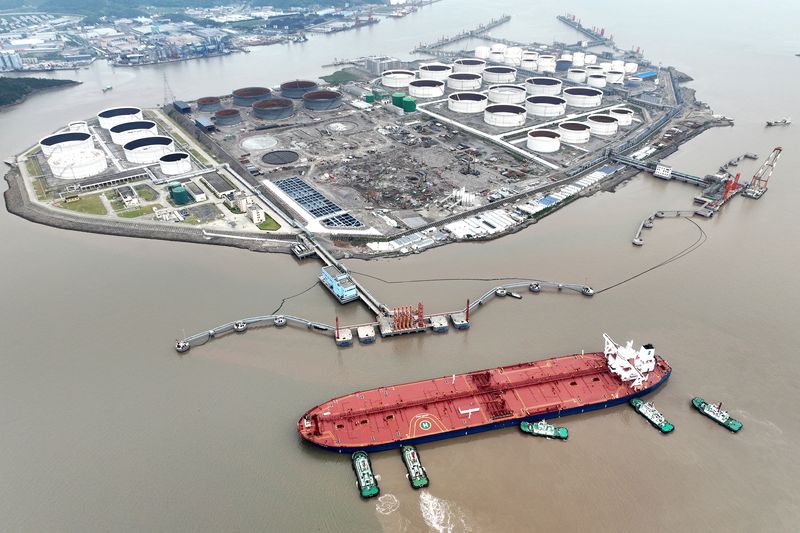

HOUSTON (Reuters) -Oil prices rose on Friday, reaching their highest levels since late April and bouncing back from early June-lows as investors eyed strong summer fuel demand and potential supply disruptions.

Brent crude futures were up 39 cents, or 0.45%, to $87.82 a barrel by 11:16 a.m. EDT. U.S. West Texas Intermediate (WTI) crude futures gained 48 cents, or 0.57%, at $84.36.

WIT did not settle on Thursday due to the Independence Day holiday, giving way to thin trading, but prices have risen this week on strong summer demand expectations in the U.S.

“The last couple of days represent the peak of the drive season, in terms of demand and prices continue to creep higher. This is coming from stronger consumer demand and the effects of Hurricane Beryl,” Tim Snyder, economist at Matador economics said in a note on Friday.

The U.S. Energy Information Administration (EIA), on Wednesday, reported a huge 12.2 million barrel inventories draw last week, compared with analyst expectations for a draw of 700,000 barrels. [EIA/S]

Meanwhile, Hurricane Beryl, a Category 2 storm, made landfall in Mexico, following its deadly trail of destruction across several Caribbean islands.

Mexico’s major oil platforms are not expected to be impacted or shut down, but oil projects in U.S. waters to the north may be affected if the hurricane continues on its expected path.

U.S. job growth slowed marginally in June, but a rise in the unemployment rate to more than a 2-1/2 year high of 4.1% and moderation in wage gains pointed to an easing of labor market conditions that keeps the Federal Reserve on track to start cutting interest rates this year.

Higher borrowing costs can slow economic growth and pressure oil demand.

Elsewhere, Reuters reported on Thursday that Russian oil producers Rosneft and Lukoil will make sharp cuts to oil exports from the Black Sea port of Novorossiisk in July.

“This is a positive signal for the forecast supply deficit over third quarter, but given Russia’s poor adherence to production quotas in the past, it will take some time to see if this will be delivered,” said Panmure Liberum analyst Ashley Kelty.

While Russian crude is sanctioned for U.S. and European buyers, a cut to global supplies is lending support to prices.

Canadian oil producer Suncor Energy (NYSE:SU) shut down its 215,000 barrel-per-day (bpd) Firebag oil sands site in northern Alberta and curtailed some production as a precaution due to a wildfire, according to the company and an Alberta government minister.

Saudi Arabia’s Saudi Aramco (TADAWUL:2222) has cut prices for the flagship Arab Light crude it will sell to Asia in August to $1.80 a barrel above the Oman/Dubai average, underscoring pressure faced by OPEC producers as non-OPEC supply grows.

This post is originally published on INVESTING.