Until October, sellers dominated the oil market amid a slowing global economy and rising production outside OPEC+. However, the escalation of conflict in the Middle East has changed the game rules. Let’s talk about it and make a trading plan for Brent.

The article covers the following subjects:

Highlights and key points

- Growing geopolitical risks pushed Brent above $78 per barrel.

- Israeli strike on Iranian oil infrastructure will drive prices higher.

- Symbolic retaliation will bring bears back to the market.

- Brent may rise to $87 or fall to $68 per barrel.

Fundamental weekly forecast for Brent

Will Brent skyrocket to $100 a barrel amid escalating conflict in the Middle East or drop to $50, as Saudi Arabia frightens OPEC+ members who are not fulfilling their production cut commitments? The answer to this question no longer depends on Riyadh. All investors’ attention is focused on Israel, which is preparing retaliation against Iran for its missile attack. In a region that understands only force, this cannot be avoided. But Jerusalem must be careful not to overact.

Déjà vu? In April, Tehran launched several hundred rockets into Israeli territory, and Israel responded with an attack on an airbase, which seemed to end the conflict. However, this time, the volatile oil reaction indicates that the situation is becoming more serious. Brent is set to record its most significant weekly gain since February 2023.

Oil weekly trends

Источник: Bloomberg.

Source: Bloomberg.

All this is happening in a market that, until October, was under the iron grip of the bears. The International Energy Agency forecasts that demand will increase by less than 1 million barrels per day in 2025 while supply will increase by one and a half times. By cutting production, OPEC+ is losing its market share. Unsurprisingly, the Alliance plans to abandon its commitments to reduce output by 2.2 million barrels per day by the end of next year. The process will begin in December, and this situation was pushing Brent prices down until the escalation of the conflict in the Middle East, just like the resumption of oil production in Libya, the rise in oil inventories in the U.S., and the weakest gasoline demand in the last six months.

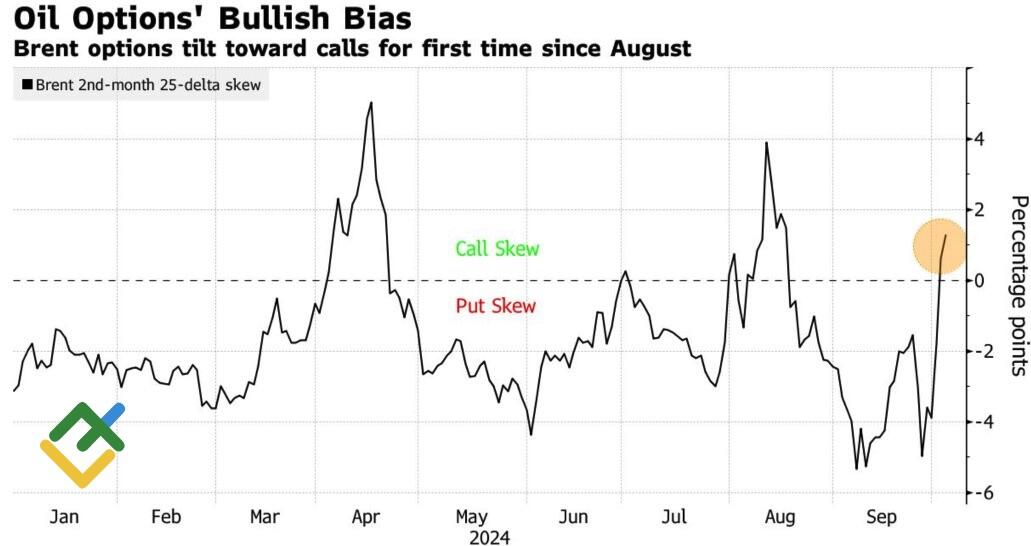

Slowing U.S., Europe, and China economies painted a grim future for North Sea Brent. However, after the invasion of Israel into Lebanon and the missile attack by Iran, the bulls sprang into action, and the risks of a reversal in Brent returned to positive territory.

Brent reversal risk

Source: Bloomberg.

The Middle East accounts for one-third of the world’s crude oil supply. Iran produces 3.3 million barrels per day and exports 1.6 to 1.7 million b/d, of which 1.5 million is supplied to China. If Israel attacks the oil infrastructure of its adversary, Citigroup predicts a reduction in global supply ranging from 300,000 to 450,000 b/d, up to 1.5 million b/d.

According to estimates from ClearView Energy Partners, an attack by Jerusalem on the massive terminal on Kharg Island in the Persian Gulf could push Brent prices up by $12 per barrel in the short term. If Tehran responds by closing the Strait of Hormuz, prices could rise by $28 within a week, leading to $100 per barrel in a bearish market!

Weekly trading plan for Brent

Israel has not yet decided what its retaliation will be; however, if Iran’s oil infrastructure is harmed, Brent will continue its rally to $82 and $87 per barrel. The recommendation is to buy. Conversely, a symbolic attack without a subsequent response from Tehran will bring bears back into the market and allow us to open shorts with targets at $71 and $68.

Price chart of UKBRENT in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.