Nvidia faces a $5.5 billion hit from Trump’s tariffs, casting a shadow over its

Nvidia H20 rollout in China and spooking the global tech market.

Nvidia’s

$5.5 Billion Hit on H20 AI Chips

Nvidia

just gave Wall Street a rude awakening, announcing it expects to swallow a $5.5

billion charge—blaming the cost squarely on Trump’s enduring tariffs on Chinese

tech. That’s right, NVDA investors: your favorite Artificial Intelligence (AI ) juggernaut just got caught

with a warehouse full of high-end semiconductors and nowhere to ship them.

BREAKING: Nvidia, $NVDA, says the US government has banned them from selling H20 chips to China “for the indefinite future.”

— The Kobeissi Letter (@KobeissiLetter)

Nvidia says this will come with a $5.5 billion charge to Q1 earnings.

The stock is down over -5% on the news. pic.twitter.com/SZwoytMjn5

The

cause? Inventory intended for China—particularly the Nvidia H20 chips that were

hyped as the company’s bespoke workaround to U.S. export restrictions. The

chips were designed to offer just enough AI capabilities to Chinese companies without

falling foul of U.S. restrictions on AI-related tech being sold to China. Now,

those same chips are stuck in silicon purgatory, and Nvidia’s balance sheet is

taking the hit.

Nvidia

H20: A Custom Chip Meets a Custom Mess

The

Nvidia H20 wasn’t just another GPU—it was a tailored response to Washington’s

increasingly complex export regulations. The chip was built to toe the line

between performance and compliance , offering China’s tech giants like Alibaba

and ByteDance

just enough AI power to stay interested without raising U.S. national security

eyebrows.

THIS IS MY BIGGEST WORRY WITH $NVDA

— Shay Boloor (@StockSavvyShay)

NVIDIA is taking a $5.5B hit this quarter tied to its H20 chips bound for China — a ~15% blow to gross margins in a single reporting cycle. Not because of demand collapse. Not because of pricing pressure. But because of geopolitics. Because… pic.twitter.com/Gtfzu5Y62e

Unfortunately,

tariffs—many of which are legacy Trump policies reinforced under Biden—mean

even these so-called “export-friendly” chips are stuck in limbo. According to Reuters,

the company had expected the H20 to fuel growth in China this year, but with

customs complications mounting, the chips are essentially glorified

paperweights.

According

to a statement

yesterday from the U.S. Commerce Department, “The

Commerce Department is committed to acting on the President’s directive to

safeguard our national and economic security.” The company’s shares slid

6% yesterday evening. Nvidia’s rival AMD is also suffering from the fallout, shares

were down 7% following the announcement.

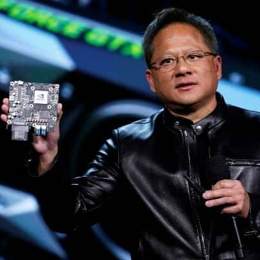

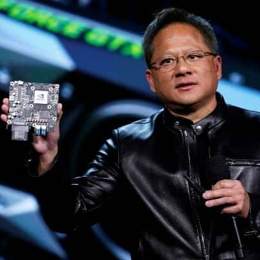

Just a month ago, Nvidia CEO Jensen Huang seemed to be

unconcerned about tariffs, when he said

to CNBC that, “We’ve got a lot of AI to build … AI is the foundation, the

operating system of every industry going forward. … We are enthusiastic about

building in America. Partners are working with us to bring manufacturing here.

In the near term, the impact of tariffs won’t be meaningful.” The CEO was

upbeat and skirted away from the tariff issue during the interview. Times have

changed.

For

NVDA shareholders, this isn’t just a supply chain hiccup—it’s a gut punch.

Market

Panic? When Nvidia Sneezes, Asia Catches a Cold

Nvidia’s

announcement set off a ripple of dread across global markets. Asian stocks and

U.S. futures dipped, with tech investors interpreting the news as a sign that

the U.S.-China chip war is far from over.

Asian

markets stumbled on Wednesday, ending a recent winning streak. The broader

Asia-Pacific index outside Japan declined by 0.9%, while Japan’s Nikkei dipped

0.5%. In China, blue-chip stocks edged down 0.6%, and Hong Kong’s Hang Seng

Index dropped 1.6%. Bucking the trend, Chinese semiconductor firms saw gains,

with Hua Hong Semiconductor climbing 4% and SMIC rising 1%.

For

context: Nvidia is the poster child of AI-fueled optimism. So when NVDA says

it’s down $5.5 billion, the entire sector listens—and shudders. Companies from

TSMC to Samsung could feel the fallout if chip exports remain a political

football.

And

let’s be real—if Nvidia H20, a chip meticulously designed to comply with U.S.

rules, can’t make it to its destination, what hope do other players have?

Trump’s

Trade Legacy Still Haunts Silicon Valley

Credit

where it’s due—this silicon saga starts with Donald Trump. His administration

slapped tariffs on a range of Chinese tech goods in the name of protecting

American interests. Those tariffs are now like that one gym membership you

forgot to cancel—still costing you years later.

Biden’s

White House kept the tariffs in place and even

doubled down in some cases, aiming to cripple China’s access to advanced AI

chips. But now, companies like Nvidia are collateral damage. Even when they

innovate, pivot, and build “compliant” hardware, they still get whacked with a

multi-billion-dollar tab.

NVIDIA says the US government has banned them from selling H20 chips to China for the indefinite future. Stock is down over 5% on the news. This is hardball. We’ve been arguing for smash mouth. I think we just got some from the US government. pic.twitter.com/2nAYTROmVl

— STEVE BANNON

(@Stevebannon_sk) April 15, 2025

The

kicker? Trump is likely thrilled. For him, this is proof the tariffs are

“working.” For NVDA? Not so much. Much of Trump’s base will no doubt be over the move. Certainly, Steven Bannon (remember him) and his viewers seem happy.

Where

Does Nvidia Go from Here?

Short-term,

Nvidia says it’s re-evaluating its inventory strategy. Translation: time to

find new buyers for the Nvidia H20 or eat more losses. China, once seen as a

growth engine, is quickly becoming a no-go zone.

NVDA

holders are hoping this is a one-off. If it is, it might just be a temporary

scar on an

otherwise stellar growth story. But if AI chip exports become a no-fly zone

for the foreseeable future, then Nvidia—and by extension, the whole tech

sector—may be entering a far more volatile phase.

In

the meantime, the NVDA stock chart is a rollercoaster, and Wall Street is

clutching its pearls.

For

more news around the edges of finance, visit our Trending and Fintech sections.

Nvidia faces a $5.5 billion hit from Trump’s tariffs, casting a shadow over its

Nvidia H20 rollout in China and spooking the global tech market.

Nvidia’s

$5.5 Billion Hit on H20 AI Chips

Nvidia

just gave Wall Street a rude awakening, announcing it expects to swallow a $5.5

billion charge—blaming the cost squarely on Trump’s enduring tariffs on Chinese

tech. That’s right, NVDA investors: your favorite Artificial Intelligence (AI ) juggernaut just got caught

with a warehouse full of high-end semiconductors and nowhere to ship them.

BREAKING: Nvidia, $NVDA, says the US government has banned them from selling H20 chips to China “for the indefinite future.”

— The Kobeissi Letter (@KobeissiLetter)

Nvidia says this will come with a $5.5 billion charge to Q1 earnings.

The stock is down over -5% on the news. pic.twitter.com/SZwoytMjn5

The

cause? Inventory intended for China—particularly the Nvidia H20 chips that were

hyped as the company’s bespoke workaround to U.S. export restrictions. The

chips were designed to offer just enough AI capabilities to Chinese companies without

falling foul of U.S. restrictions on AI-related tech being sold to China. Now,

those same chips are stuck in silicon purgatory, and Nvidia’s balance sheet is

taking the hit.

Nvidia

H20: A Custom Chip Meets a Custom Mess

The

Nvidia H20 wasn’t just another GPU—it was a tailored response to Washington’s

increasingly complex export regulations. The chip was built to toe the line

between performance and compliance , offering China’s tech giants like Alibaba

and ByteDance

just enough AI power to stay interested without raising U.S. national security

eyebrows.

THIS IS MY BIGGEST WORRY WITH $NVDA

— Shay Boloor (@StockSavvyShay)

NVIDIA is taking a $5.5B hit this quarter tied to its H20 chips bound for China — a ~15% blow to gross margins in a single reporting cycle. Not because of demand collapse. Not because of pricing pressure. But because of geopolitics. Because… pic.twitter.com/Gtfzu5Y62e

Unfortunately,

tariffs—many of which are legacy Trump policies reinforced under Biden—mean

even these so-called “export-friendly” chips are stuck in limbo. According to Reuters,

the company had expected the H20 to fuel growth in China this year, but with

customs complications mounting, the chips are essentially glorified

paperweights.

According

to a statement

yesterday from the U.S. Commerce Department, “The

Commerce Department is committed to acting on the President’s directive to

safeguard our national and economic security.” The company’s shares slid

6% yesterday evening. Nvidia’s rival AMD is also suffering from the fallout, shares

were down 7% following the announcement.

Just a month ago, Nvidia CEO Jensen Huang seemed to be

unconcerned about tariffs, when he said

to CNBC that, “We’ve got a lot of AI to build … AI is the foundation, the

operating system of every industry going forward. … We are enthusiastic about

building in America. Partners are working with us to bring manufacturing here.

In the near term, the impact of tariffs won’t be meaningful.” The CEO was

upbeat and skirted away from the tariff issue during the interview. Times have

changed.

For

NVDA shareholders, this isn’t just a supply chain hiccup—it’s a gut punch.

Market

Panic? When Nvidia Sneezes, Asia Catches a Cold

Nvidia’s

announcement set off a ripple of dread across global markets. Asian stocks and

U.S. futures dipped, with tech investors interpreting the news as a sign that

the U.S.-China chip war is far from over.

Asian

markets stumbled on Wednesday, ending a recent winning streak. The broader

Asia-Pacific index outside Japan declined by 0.9%, while Japan’s Nikkei dipped

0.5%. In China, blue-chip stocks edged down 0.6%, and Hong Kong’s Hang Seng

Index dropped 1.6%. Bucking the trend, Chinese semiconductor firms saw gains,

with Hua Hong Semiconductor climbing 4% and SMIC rising 1%.

For

context: Nvidia is the poster child of AI-fueled optimism. So when NVDA says

it’s down $5.5 billion, the entire sector listens—and shudders. Companies from

TSMC to Samsung could feel the fallout if chip exports remain a political

football.

And

let’s be real—if Nvidia H20, a chip meticulously designed to comply with U.S.

rules, can’t make it to its destination, what hope do other players have?

Trump’s

Trade Legacy Still Haunts Silicon Valley

Credit

where it’s due—this silicon saga starts with Donald Trump. His administration

slapped tariffs on a range of Chinese tech goods in the name of protecting

American interests. Those tariffs are now like that one gym membership you

forgot to cancel—still costing you years later.

Biden’s

White House kept the tariffs in place and even

doubled down in some cases, aiming to cripple China’s access to advanced AI

chips. But now, companies like Nvidia are collateral damage. Even when they

innovate, pivot, and build “compliant” hardware, they still get whacked with a

multi-billion-dollar tab.

NVIDIA says the US government has banned them from selling H20 chips to China for the indefinite future. Stock is down over 5% on the news. This is hardball. We’ve been arguing for smash mouth. I think we just got some from the US government. pic.twitter.com/2nAYTROmVl

— STEVE BANNON

(@Stevebannon_sk) April 15, 2025

The

kicker? Trump is likely thrilled. For him, this is proof the tariffs are

“working.” For NVDA? Not so much. Much of Trump’s base will no doubt be over the move. Certainly, Steven Bannon (remember him) and his viewers seem happy.

Where

Does Nvidia Go from Here?

Short-term,

Nvidia says it’s re-evaluating its inventory strategy. Translation: time to

find new buyers for the Nvidia H20 or eat more losses. China, once seen as a

growth engine, is quickly becoming a no-go zone.

NVDA

holders are hoping this is a one-off. If it is, it might just be a temporary

scar on an

otherwise stellar growth story. But if AI chip exports become a no-fly zone

for the foreseeable future, then Nvidia—and by extension, the whole tech

sector—may be entering a far more volatile phase.

In

the meantime, the NVDA stock chart is a rollercoaster, and Wall Street is

clutching its pearls.

For

more news around the edges of finance, visit our Trending and Fintech sections.

This post is originally published on FINANCEMAGNATES.