Ben Bilski, the Founder and former CEO of NAGA Group,

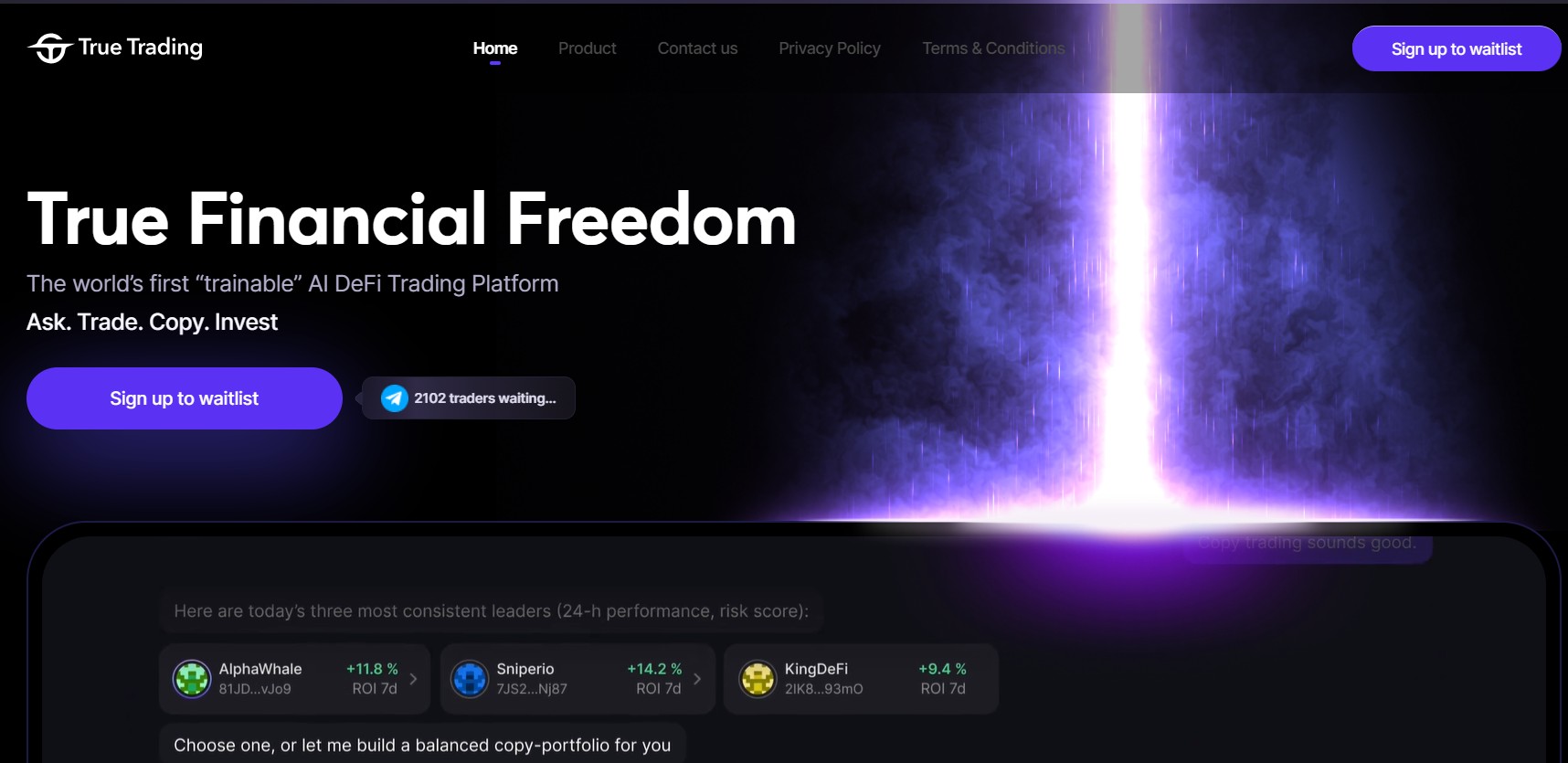

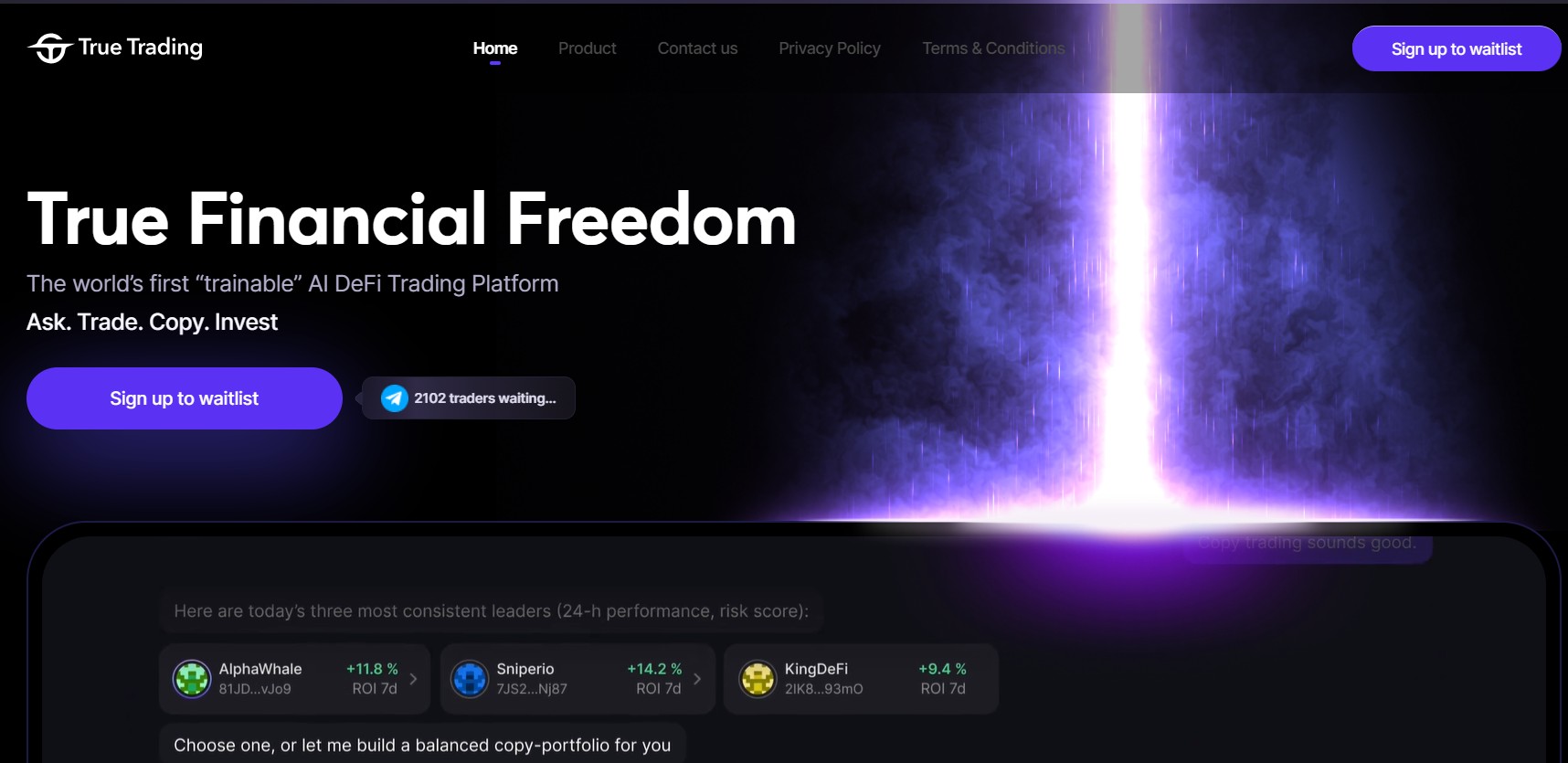

has launched a new crypto trading platform called True Trading, which is now

live in pre-launch.

According to Bilski’s announcement on LinkedIn, the

decentralized exchange incorporates a “trainable” artificial intelligence

engine and is built on a Layer 2 protocol using the Solana blockchain.

AI Functionality and Automation

According to its official website, True Trading describes

itself as an AI-native decentralized exchange. The platform features an

integrated large language model designed to improve over time by analyzing user

interactions, trades, and market data. It automates tasks such as risk management, KYC, and

payment flows, aiming to streamline the user experience.

True Trading reportedly uses smart contracts for all

trade executions, meaning users retain control of their funds at all times.

This design removes custody risk and enables transparency, as all liquidity is

sourced from public vaults and tracked on-chain.

The platform operates on its own Layer 2

infrastructure powered by Solana, allowing for high-speed transaction

processing and reduced costs. According to company disclosures, True Trading

Corp is incorporated in Panama.

Trading Features

True Trading offers several DeFi trading functions,

including: On-chain perpetual contracts, copy trading of high-performing

strategies, and yield earning through smart contract-based investment strategies. The platform does not facilitate the trading of

regulated securities, nor does it act as a broker, financial intermediary, or

custodian.

The platform has now entered a pre-launch phase and is

accepting early users. The company has not yet disclosed a full launch date or

details on governance or tokenomics, if any.

You may also find interesting on financemagnates.com: Grayscale Eyes IPO After Circle’s Listing Renewed Investor Interest

In March, Bilski announced plans to launch a new cryptocurrency trading platform to address inefficiencies in the

digital asset market. Following his departure from NAGA after its

acquisition by CAPEX.com, Bilski turned his attention to what he described as a

fundamental flaw in crypto markets’ operation.

In a LinkedIn post, he said he had identified “a

loophole that changes everything,” particularly in market-making and liquidity provision—two functions often criticized for their lack of transparency

and centralization.

“After years in crypto (since 2014), scaling companies

from scratch to IPO, and executing large-scale projects, I took a step back to

assess the imbalances and opportunities in the space. And I found something

truly exciting, a loophole that changes everything,” he wrote.

Ben Bilski, the Founder and former CEO of NAGA Group,

has launched a new crypto trading platform called True Trading, which is now

live in pre-launch.

According to Bilski’s announcement on LinkedIn, the

decentralized exchange incorporates a “trainable” artificial intelligence

engine and is built on a Layer 2 protocol using the Solana blockchain.

AI Functionality and Automation

According to its official website, True Trading describes

itself as an AI-native decentralized exchange. The platform features an

integrated large language model designed to improve over time by analyzing user

interactions, trades, and market data. It automates tasks such as risk management, KYC, and

payment flows, aiming to streamline the user experience.

True Trading reportedly uses smart contracts for all

trade executions, meaning users retain control of their funds at all times.

This design removes custody risk and enables transparency, as all liquidity is

sourced from public vaults and tracked on-chain.

The platform operates on its own Layer 2

infrastructure powered by Solana, allowing for high-speed transaction

processing and reduced costs. According to company disclosures, True Trading

Corp is incorporated in Panama.

Trading Features

True Trading offers several DeFi trading functions,

including: On-chain perpetual contracts, copy trading of high-performing

strategies, and yield earning through smart contract-based investment strategies. The platform does not facilitate the trading of

regulated securities, nor does it act as a broker, financial intermediary, or

custodian.

The platform has now entered a pre-launch phase and is

accepting early users. The company has not yet disclosed a full launch date or

details on governance or tokenomics, if any.

You may also find interesting on financemagnates.com: Grayscale Eyes IPO After Circle’s Listing Renewed Investor Interest

In March, Bilski announced plans to launch a new cryptocurrency trading platform to address inefficiencies in the

digital asset market. Following his departure from NAGA after its

acquisition by CAPEX.com, Bilski turned his attention to what he described as a

fundamental flaw in crypto markets’ operation.

In a LinkedIn post, he said he had identified “a

loophole that changes everything,” particularly in market-making and liquidity provision—two functions often criticized for their lack of transparency

and centralization.

“After years in crypto (since 2014), scaling companies

from scratch to IPO, and executing large-scale projects, I took a step back to

assess the imbalances and opportunities in the space. And I found something

truly exciting, a loophole that changes everything,” he wrote.

This post is originally published on FINANCEMAGNATES.