Donald Trump is threatening his neighbors, Mexico and Canada, with tariffs starting February 1. Will they be imposed, or is this part of his negotiating strategy? Let’s discuss this topic and make a trading plan for the USDMXN pair.

The article covers the following subjects:

Major Takeaways

- Tariffs against Mexico and Canada will accelerate US inflation.

- Retaliation by Mexico City and Ottawa will slow the US economy.

- The peso will be under pressure until February 1.

- Traders are switching from buying the USDMXN pair on rumors with targets at 20.9 and 21.2 to selling it on news.

Weekly Fundamental Forecast for Mexican Peso

The “America First” slogan has been a central tenet of the Trump administration’s trade policies. During his first term, President Trump imposed tariffs on steel and aluminum imports from allies. This time, he is prepared to take further action against neighboring countries. He has issued tariffs of 25% on goods from Canada and Mexico, effective February 1, which has boosted USDMXN quotes. However, the implementation of these duties remains uncertain.

The tariffs could potentially impact the economies of Canada and Mexico, as approximately 80% of their exports are directed toward the US market. However, these tariffs could also hit the wallets of American consumers. Ottawa supplies the US with approximately 4 million barrels of oil and softwood lumber used in construction. Protectionist measures may spur prices for gasoline, real estate, and food. Mexico exports a significant volume of goods, including tomatoes, peppers, avocados, lemons, limes, and other commodities, to the United States during the winter months.

At the same time, tariffs are expected to accelerate US inflation. Historically, rising inflation has been a key factor in Trump’s re-election. However, threats alone do not necessarily translate into actual policy changes. More likely, this will lead to a renegotiation of the USMCA agreement in 2026, during which the Trump administration will be able to exert pressure on both cross-border regions and China.

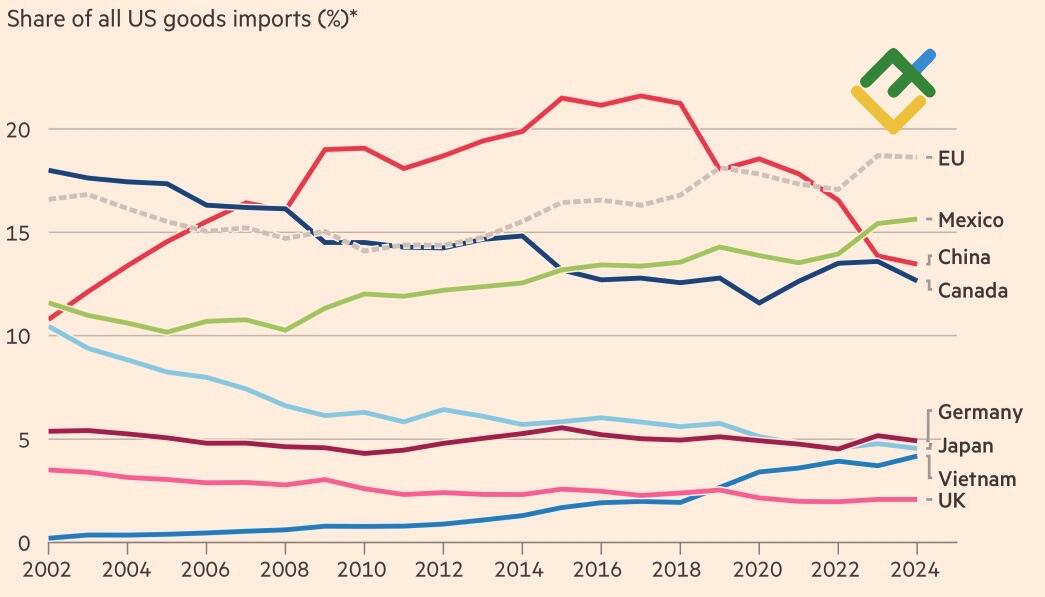

Share of All US Imports

Source: Financial Times.

Mexico has overtaken rival importers of goods to the US thanks to China transshipping goods through Latin America. Although Mexico’s president, Claudia Sheinbaum, suggests maintaining composure and refraining from responding to Donald Trump’s threats without waiting for concrete action, Mexico City is gradually distancing itself from Beijing.

Mexico’s strategy involves shifting its production to domestic markets to replace goods from Asia and reduce its $105 billion trade deficit with China. According to Finance Minister Rogelio Ramírez, increasing domestic production by 10% could boost Mexico’s GDP by 1.2%.

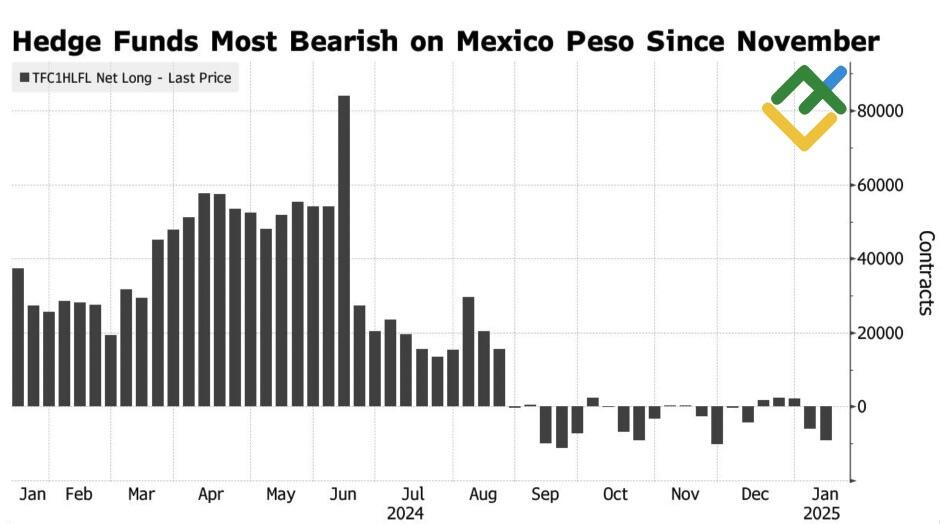

Canada is a significant export market for 36 US states, while Mexico exports its goods to 6 states. Retaliatory tariffs on these exports could potentially impede US economic growth. Meanwhile, speculators are increasing their short positions on the Mexican peso, indicating that they are taking Donald Trump’s threats seriously. However, the reality may turn out to be different.

Speculative Positions on Mexican Peso

Source: Bloomberg.

Weekly USDMXN Trading Plan

Markets are rising on expectations, so 25% tariffs against Canada and Mexico will likely bolster the USDMXN rally. However, should the tariffs not be implemented or their impact prove insignificant, the pair may face a sell-off. Therefore, the strategy of buying the pair until the end of January with the targets at 20.9 and 21.2 remains in play. After that, the quotes are likely to embark on a downward trajectory.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of USDMXN in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.