The Mexican peso has demonstrated consistent strength since the spring of 2020, reaching an eight-year high against the US dollar in April. However, the market dynamics shifted significantly by the end of the summer. Let’s discuss this topic and make a trading plan for the USDMXN pair.

The article covers the following subjects:

Highlights and key points

- The USDMXN’s trend reversed due to the elections in Mexico.

- The peso was falling on fears of Donald Trump.

- A winding down in carry trade also weakened the peso.

- The USDMXN pair reached its targets, but it is better to keep long trades open.

Quarterly fundamental forecast for Mexican peso

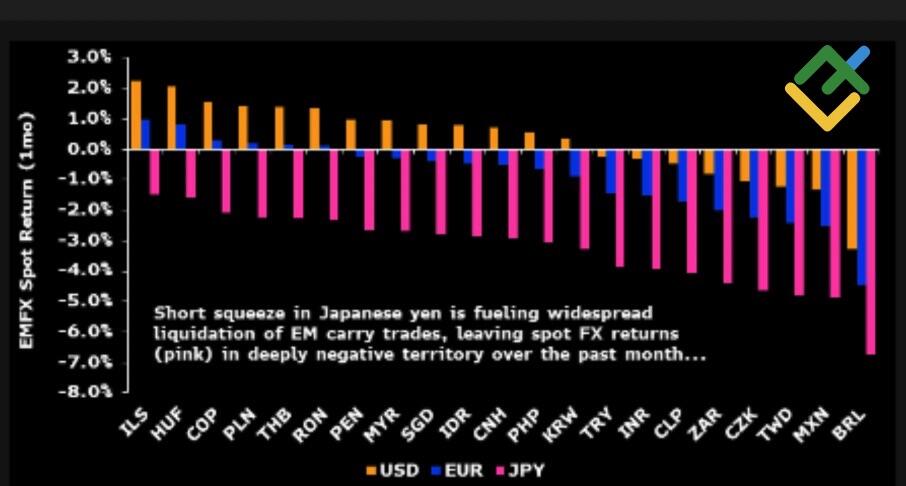

In any market, there will always be winners and losers. The Japanese yen was the primary beneficiary of the deceleration in US employment. The Mexican peso has suffered the most significant decline, losing its designation as a “super” currency. This Latin American currency appreciated 5% and 13% in 2022 and 2023, respectively. In July 2024, it depreciated by approximately 7.5% due to the closure of carry trade transactions, the cooling of the US economy, and the intention of Morena’s party, which won the elections, to redraw the legislation. USDMXN quotes have risen above the 20 level for the first time since October 2022, hitting the bullish target established in June.

The electoral success of the Claudia Sheinbaum-led party marked the beginning of the end of the so-called “super peso.” The new president plans to implement reforms initiated by his predecessor, which may prompt foreign investors to divest from Mexico.

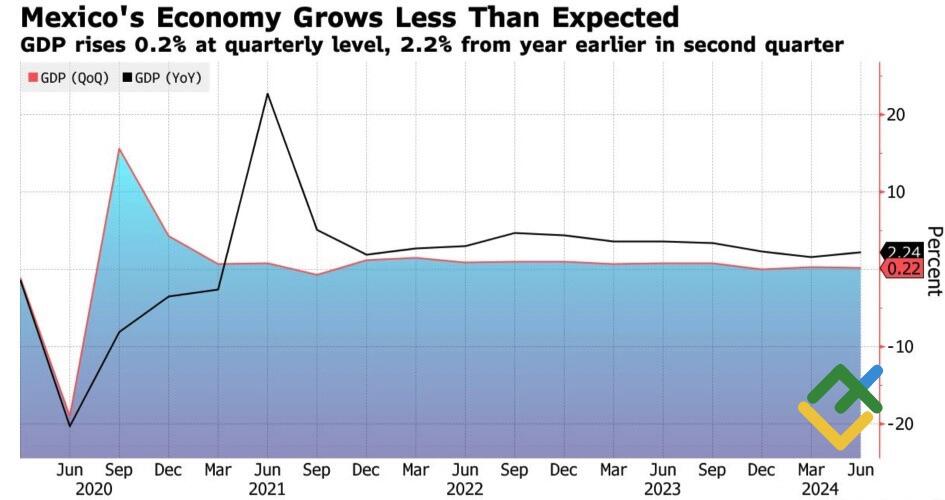

Further factors include Elon Musk’s reluctance to invest in the country’s economy due to concerns over Donald Trump’s introduction of punitive tariffs, which hit USDMXN bears hard. For an extended period, the peso benefited from preferential treatment due to carry trade, the relocation of manufacturing from the US and China to Latin America, and the strength of the US economy. However, this is no longer the case. As a result, Mexico’s second-quarter GDP figures fell short of expectations.

Mexico’s GDP performance

Source: Bloomberg.

Given that approximately 80% of Mexican exports are directed to the US, a deceleration in the American economy has an adverse effect on the peso. In particular, in the context of a potential recession, which is still only a possibility at this early stage of the year. Fears of a US recession led to a surge in market volatility, prompting the termination of numerous carry trade transactions. Furthermore, the Bank of Japan’s decision to maintain the normalization of monetary policy has effectively deprived those engaged in carry trade activities of a cost-effective resource.

The Mexican peso and Brazilian real were the primary beneficiaries of the carry trade. As anticipated, the yen’s 13% appreciation against the US dollar from July lows resulted in these currencies becoming the main victims.

Effectiveness of the carry trade strategy

Source: Bloomberg.

After Chicago Fed President Austan Goolsbee and San Francisco Fed President Mary Daly tried to calm investors with statements about the absence of recession in the US economy, the panic in the markets gradually subsided. However, this is not a reason to start buying the peso.

Quarterly USDMXN trading plan

Due to the vacation season in the Northern Hemisphere, liquidity is typically lower, and occasional spikes in volatility may occur in August. In September, the Mexican parliament will resume its sessions, and in October, the US presidential race will enter its final phase. Concurrently, the deceleration of the American economy diminishes the probability of a victory for Kamala Harris, and Donald Trump is regarded as a significant detriment to the peso. In this context, it is better to keep long trades initiated on the USDMXN pair at 18.1 open, adding more ones periodically.

Price chart of USDMXN in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.