In mid-August, the Mexican peso seemed to eliminate its negative factors. Carry traders returned to the market while Donald Trump’s position in the presidential race weakened. However, the optimism of the USDMXN bears was short-lived. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Highlights and key points

- Carry traders are reluctant to use the peso due to high volatility.

- Reforms in Mexico undermine the strength of USDMXN bears.

- The Mexican economy is slowing down.

- The USDMXN pair’s uptrend will remain intact as long as it trades above 19.23.

Weekly fundamental forecast for Mexican peso

Following rumors regarding a potential recovery in the carry trade and Kamala Harris’s presumed leadership in the swing states, USDMXN bears have seen an opportunity to recover from recent losses. Some of the losses incurred on Black Monday were recouped. However, the peso has already lost its ‘super’ status, as subsequent events have demonstrated. Mexico is facing political and economic challenges, which have led to the weakening of the country’s national currency.

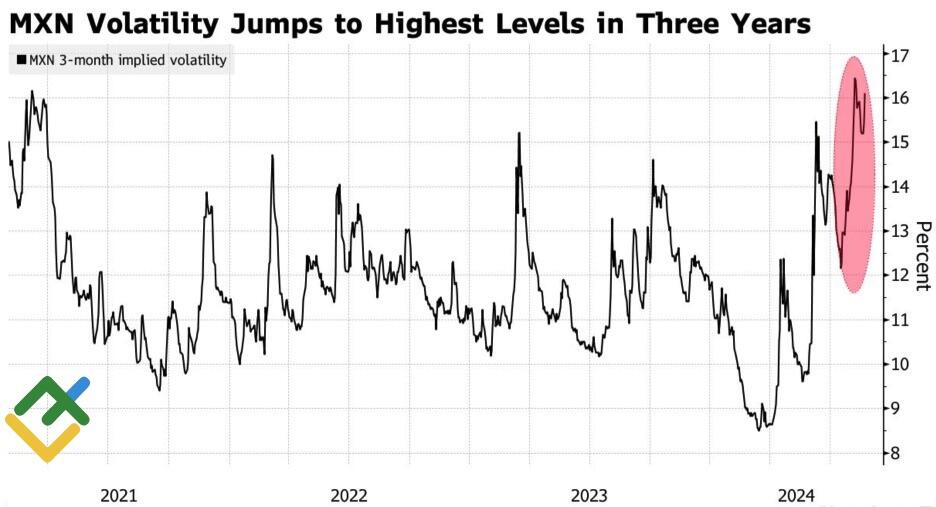

Citi research indicates that the carry trade swiftly recuperated from its difficulties by replacing the funding currency. Apparently, carry traders shelved the Japanese yen, and now they use the US dollar. The sales of the US currency against developing countries’ currencies are gaining momentum. However, the peso may remain out of the equation since its volatility has reached its highest level in three years against imminent discussions regarding market-unfriendly reforms in the Mexico’s parliament. The bottom line is that this is not good news for those benefitting from carry trade transactions.

Mexican peso volatility

Source: Bloomberg.

Another positive factor for USDMXN bears in the near term was the strong performance of Kamala Harris in the presidential race in swing states. If the Democratic Party maintains its position of power, President Trump’s proposed 200% tariff on Mexican goods of Chinese origin will not be implemented. This is beneficial for the peso and the economy. However, the election results will be announced in early November. Until then, the ongoing uncertainty will likely exert pressure on USDMXN bears. In 2016, Donald Trump was not considered the frontrunner, but he won the elections.

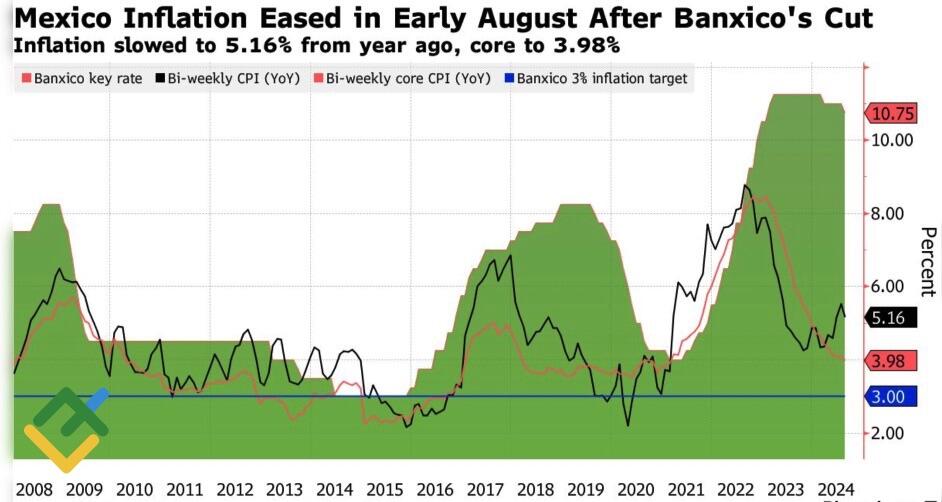

The introduction of new duties will exacerbate the already fragile state of the Mexican economy. The pace of growth began to decelerate as early as late 2023, largely due to elevated real interest rates. GDP growth was 0.1% in the first quarter and 0.2% in the second. In response to concerns about an impending recession, Banxico reduced its key interest rate from 11% to 10.75% in August despite the rise in inflation. The pace of growth decelerated in the first half of August, creating an opportunity for investors to speculate about the continuation of the monetary expansion cycle in September and to buy the USDMXN pair.

Mexico’s inflation and Banxico’s key rate

Source: Bloomberg.

The implementation of market-unfriendly reforms by the ruling party, limited use of the peso in carry trade transactions due to the currency’s high volatility, political risks in the US, a slowdown in the national economy, and expectations of aggressive easing of Banxico’s monetary policy will continue to exert pressure on the Mexican currency. Its gains in the second decade of August were merely a short-lived bounce.

Weekly USDMXN trading plan

The USDMXN pair’s pullback to the 18.6-18.8 area was a great opportunity to open more long trades, adding them to the previously initiated ones. As long as the pair is trading above 19.23, long trades can be considered.

Price chart of USDMXN in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.