Chief

marketing officers (CMOs) at online trading firms are leaving their jobs faster

than ever, with new data from FYI showing the median tenure has dropped to just

17.5 months across the industry.

CFD Industry CMO Tenure

Drops to Lowest Level Since 2014

The

findings come from an analysis of 50 data points covering 40 individual CMOs

across 38 companies in the CFD and online trading space between 2014 and 2024.

The research, which examined LinkedIn profiles and announcements,

paints a picture of an industry where marketing leadership struggles to gain

traction.

Nearly 40%

of the CMOs studied lasted less than one year in their roles, while only 4%

managed to stay five years or longer. The average tenure of 22.4 months is

pulled higher by a handful of longer-serving executives, but the median tells a

starker story.

“2024

showing the lowest average tenure in the entire dataset” suggests the

problem is getting worse, not better. The data shows no correlation between

company size and CMO turnover, with both large brokers and smaller firms

experiencing similar churn rates.

“Our aim

was to understand how long CMOs usually stay in these roles, why it’s so hard

for them to last long-term and what this says about leadership and marketing in

the online trading industry,” Christian Görgen from FYI commented on the report’s

findings.

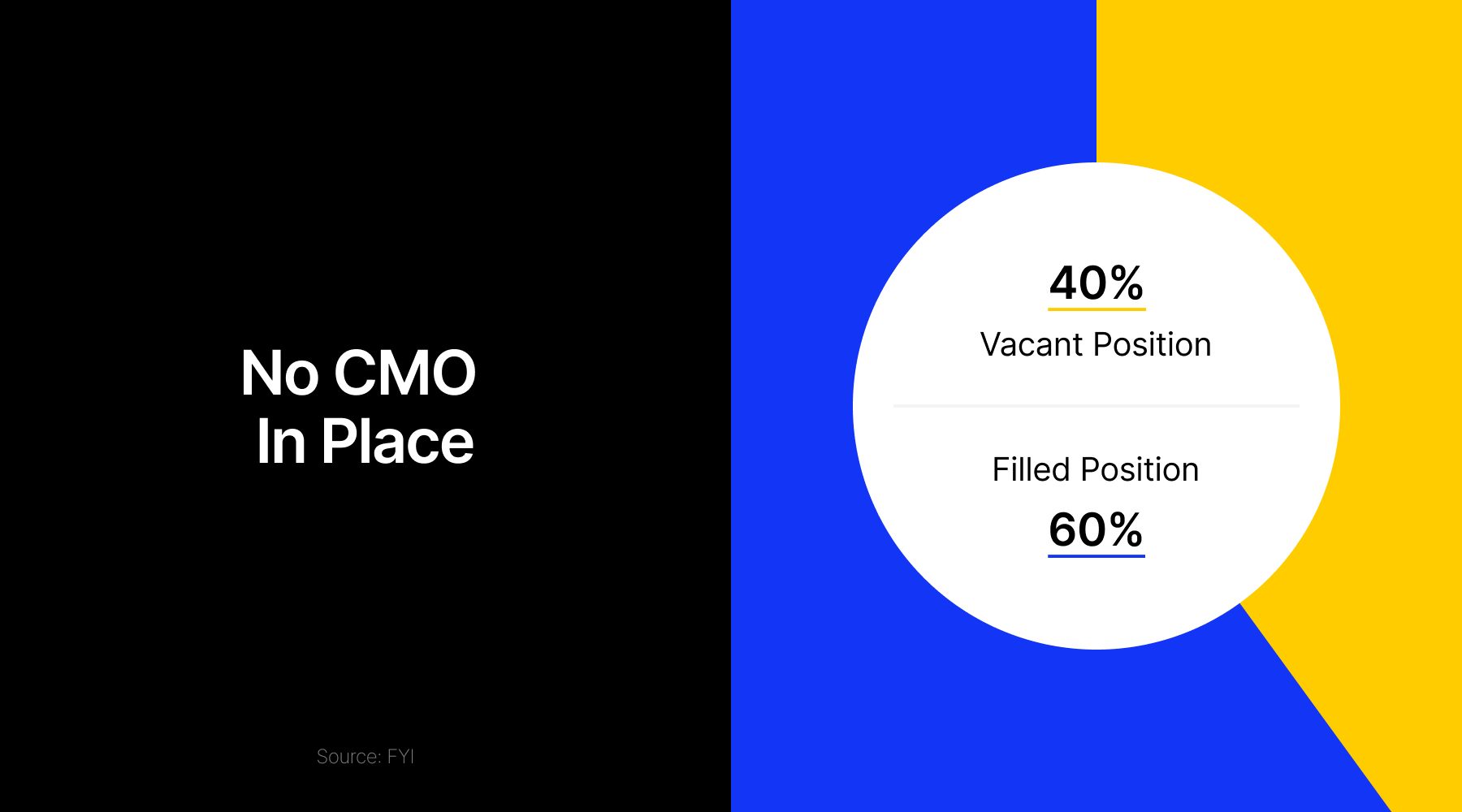

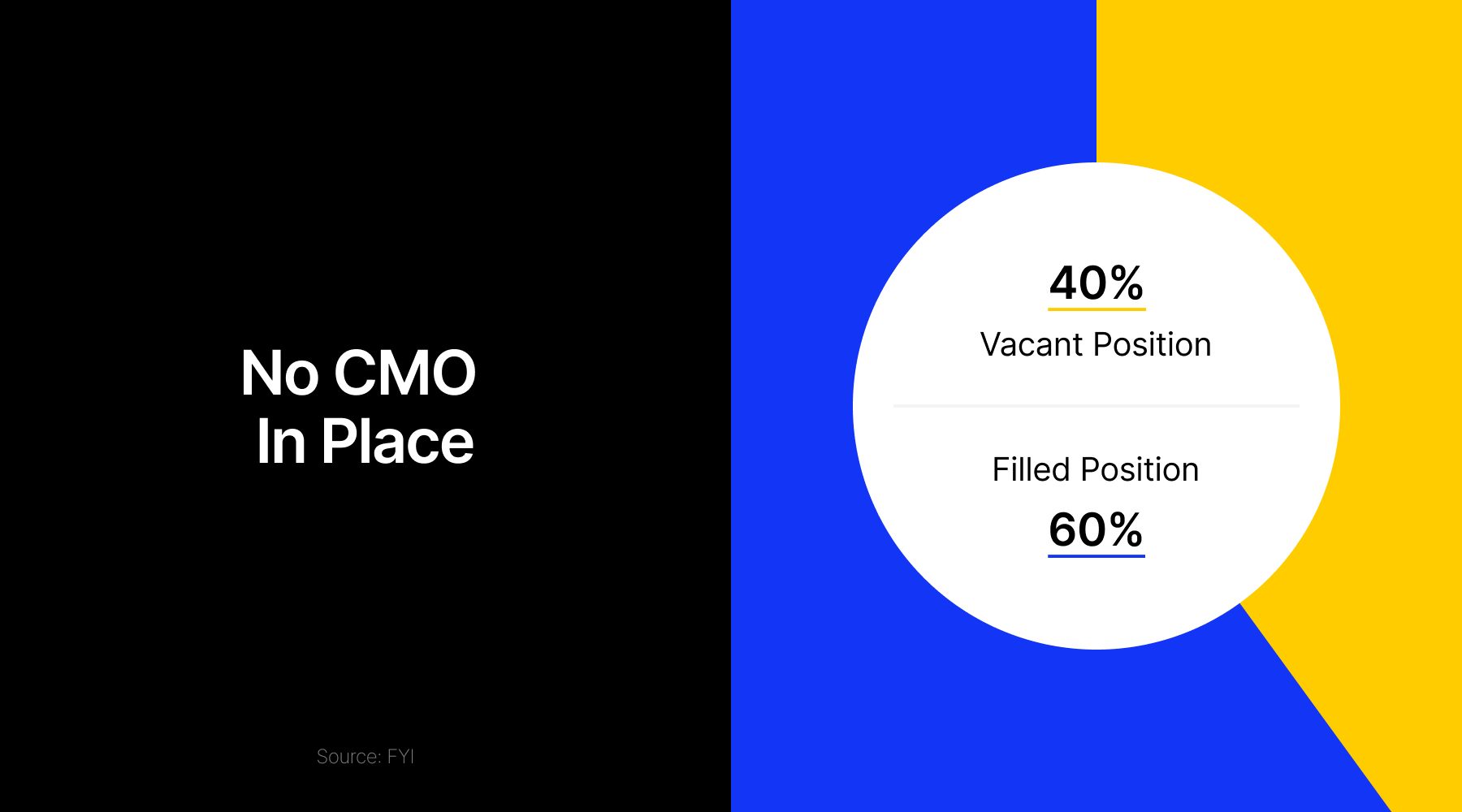

Perhaps

more telling is what happens after these marketing chiefs leave: 40% of the

brokers analyzed currently have no CMO in place following their previous

executive’s departure. Of the 40 brokers investigated, 16 had no one holding

the official Chief Marketing Officer title at the time of review.

Industry Structure Creates

Impossible Expectations

The

research points to fundamental misalignment between what CMOs can deliver and

what trading firm founders expect. Unlike technology startups that focus on

user engagement metrics, CFD brokers prioritize traditional financial KPIs like

customer acquisition cost and lifetime value.

“Founders

want rapid user growth and quick revenue, often within months. But marketing

isn’t something you can switch on overnight,” Görgen adds. This creates a

cycle where CMOs are brought in when growth stalls, expected to deliver

immediate results, then removed when quick fixes don’t materialize.

Especially since the CMO position is now the third-best-paid role in the industry, according to the latest data. Only financial and technology executives earn more. The average salary is currently €200,000 in Cyprus and nearly €230,000 in Dubai.

The

competitive landscape doesn’t help. Cyprus financial regulator CySEC lists 247

approved domains as of July 2025, with most offering similar services:

multi-asset access, fast execution, and tight spreads. This commoditization

makes differentiation difficult and puts additional pressure on marketing teams

to find unique angles.

The

research also highlights how heavily the industry relies on affiliate

marketing, with brokers often paying 25% to over 50% of their revenue to

affiliates and introducing brokers. While some affiliates provide legitimate

value, the analysis describes a “darker side” involving “fake

traffic, shady referrals and recycled client books.”

Successful Marketing

Leaders Buck Traditional Mold

The few

CMOs who do succeed in online trading don’t fit the typical marketing executive

profile. The research found that effective marketing leaders in this space

“tend to be hands-on, highly technical, and closely aligned with the

trading side of the business”.

Many come

from within the company or have backgrounds in business, computer science, or

trading rather than traditional marketing disciplines. “They follow

structured frameworks, focus on execution, and know when to turn up the

volume,” the analysis states.

This

suggests the industry may need to rethink what it looks for in marketing

leadership, moving away from brand-focused executives toward more

operationally-minded professionals who understand the technical aspects of

trading platforms.

The

research concludes that traditional CMO models aren’t working in online

trading, and that sustainable change requires treating marketing as part of

core business strategy rather than a support function brought in during growth

emergencies.

Chief

marketing officers (CMOs) at online trading firms are leaving their jobs faster

than ever, with new data from FYI showing the median tenure has dropped to just

17.5 months across the industry.

CFD Industry CMO Tenure

Drops to Lowest Level Since 2014

The

findings come from an analysis of 50 data points covering 40 individual CMOs

across 38 companies in the CFD and online trading space between 2014 and 2024.

The research, which examined LinkedIn profiles and announcements,

paints a picture of an industry where marketing leadership struggles to gain

traction.

Nearly 40%

of the CMOs studied lasted less than one year in their roles, while only 4%

managed to stay five years or longer. The average tenure of 22.4 months is

pulled higher by a handful of longer-serving executives, but the median tells a

starker story.

“2024

showing the lowest average tenure in the entire dataset” suggests the

problem is getting worse, not better. The data shows no correlation between

company size and CMO turnover, with both large brokers and smaller firms

experiencing similar churn rates.

“Our aim

was to understand how long CMOs usually stay in these roles, why it’s so hard

for them to last long-term and what this says about leadership and marketing in

the online trading industry,” Christian Görgen from FYI commented on the report’s

findings.

Perhaps

more telling is what happens after these marketing chiefs leave: 40% of the

brokers analyzed currently have no CMO in place following their previous

executive’s departure. Of the 40 brokers investigated, 16 had no one holding

the official Chief Marketing Officer title at the time of review.

Industry Structure Creates

Impossible Expectations

The

research points to fundamental misalignment between what CMOs can deliver and

what trading firm founders expect. Unlike technology startups that focus on

user engagement metrics, CFD brokers prioritize traditional financial KPIs like

customer acquisition cost and lifetime value.

“Founders

want rapid user growth and quick revenue, often within months. But marketing

isn’t something you can switch on overnight,” Görgen adds. This creates a

cycle where CMOs are brought in when growth stalls, expected to deliver

immediate results, then removed when quick fixes don’t materialize.

Especially since the CMO position is now the third-best-paid role in the industry, according to the latest data. Only financial and technology executives earn more. The average salary is currently €200,000 in Cyprus and nearly €230,000 in Dubai.

The

competitive landscape doesn’t help. Cyprus financial regulator CySEC lists 247

approved domains as of July 2025, with most offering similar services:

multi-asset access, fast execution, and tight spreads. This commoditization

makes differentiation difficult and puts additional pressure on marketing teams

to find unique angles.

The

research also highlights how heavily the industry relies on affiliate

marketing, with brokers often paying 25% to over 50% of their revenue to

affiliates and introducing brokers. While some affiliates provide legitimate

value, the analysis describes a “darker side” involving “fake

traffic, shady referrals and recycled client books.”

Successful Marketing

Leaders Buck Traditional Mold

The few

CMOs who do succeed in online trading don’t fit the typical marketing executive

profile. The research found that effective marketing leaders in this space

“tend to be hands-on, highly technical, and closely aligned with the

trading side of the business”.

Many come

from within the company or have backgrounds in business, computer science, or

trading rather than traditional marketing disciplines. “They follow

structured frameworks, focus on execution, and know when to turn up the

volume,” the analysis states.

This

suggests the industry may need to rethink what it looks for in marketing

leadership, moving away from brand-focused executives toward more

operationally-minded professionals who understand the technical aspects of

trading platforms.

The

research concludes that traditional CMO models aren’t working in online

trading, and that sustainable change requires treating marketing as part of

core business strategy rather than a support function brought in during growth

emergencies.

This post is originally published on FINANCEMAGNATES.