Will the USDCAD pair respond to the Bank of Canada’s decision to hold or lower the overnight rate in April? The Canadian dollar has demonstrated increased sensitivity to the US tariff policy. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Major Takeaways

- Slowing inflation allows the BoC to cut rates.

- Trade uncertainty suggests the rate will be kept unchanged.

- The loonie surged as Trump hit pause on tariffs.

- Short trades on the USDCAD pair can be opened with targets at 1.362 and 1.326.

Weekly Fundamental Forecast for Canadian Dollar

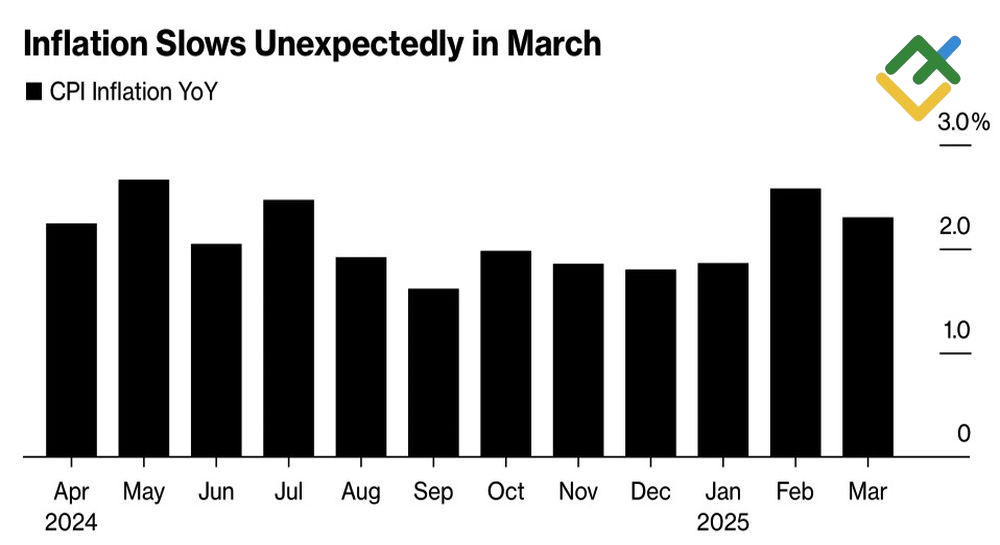

The US tariffs may trigger a recession in Canada. However, the inflation rate in Canada has slowed, which is likely beneficial to the country’s economy. In March, consumer price growth decelerated to 2.3% from 2.6%, driven by declining oil prices and a strengthening Canadian dollar. In April, the USDCAD pair declined by 3.5%, marking the most significant gain for bears since June 2019.

Inflation Rate in Canada

Source: Bloomberg.

The unexpected slowdown in inflation caused the futures market to briefly increase the odds of an overnight rate cut at the Bank of Canada’s April meeting to 45% from 35% before returning to their initial position. At the same time, experts are divided on this matter. Of the 30 experts surveyed by Bloomberg, 17 anticipate that borrowing costs will remain at 2.75%. They attribute this caution to the uncertain policy environment stemming from the US administration.

A minority of experts believe that the impact of Donald Trump’s tariffs has exceeded expectations, necessitating a sustained cycle of monetary expansion. In March, Canada lost 33,000 jobs, marking the most significant decline in three years.

While Canada and Mexico have been excluded from the US global universal tariff of 10%, their companies still face 25% duties on steel, aluminum, and automobile imports. However, they can avoid these tariffs by adhering to the principles of the North American Free Trade Agreement (NAFTA).

The pivotal shift in Donald Trump’s stance, which initially emphasized the importance of domestic production and protectionism, has contributed to a positive outlook for the loonie. The USDCAD reversal risks entered a negative zone for some time, pointing to a higher probability of a bearish reversal rather than a correction.

USDCAD Risk Reversals

Source: Bloomberg.

In fact, the Bank of Canada’s decision is unlikely to exert significant influence on the Canadian dollar. The USDCAD pair is more influenced by external factors, such as Donald Trump’s policies and tariffs, than by the interest rate differential. Investors flee US assets and the greenback, which is a more significant factor than the Bank of Canada’s cautious stance.

Meanwhile, the US will unlikely shift from its current stance. Based on the statements made by US administration officials, the 47th president still favors the idea of Canada becoming the 51st state of the US.

Weekly USDCAD Trading Plan

Donald Trump’s unconventional policies pose a significant risk to the US markets, potentially leading to an outflow of capital and a shift in market trends. Against this backdrop, USDCAD bears may gain the upper hand in the market. As a result, if the pair quotes rise in response to the Bank of Canada’s rate decision, short trades can be opened with targets of 1.362 and 1.326.

This forecast is based on the analysis of fundamental factors, including official statements from financial institutions and regulators, various geopolitical and economic developments, and statistical data. Historical market data are also considered.

Price chart of USDCAD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance broker. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2014/65/EU.

According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.