The Bank of Canada’s aggressive rate cuts have positioned the Canadian dollar as an outsider in the Forex market. While this policy has an adverse effect in the short term, the benefits of it will be seen in 2025. How will this affect the USDCAD pair? Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Highlights and key points

- The BoC intends to bring rates to a neutral level as soon as possible.

- Markets expect a 50 bps cut in the overnight rate in December.

- The agreement between the US, Canada, and Mexico favors the loonie.

- The USDCAD pair may fall to 1.3815 and 1.3755 if Kamala Harris wins.

Monthly Canadian dollar fundamental forecast

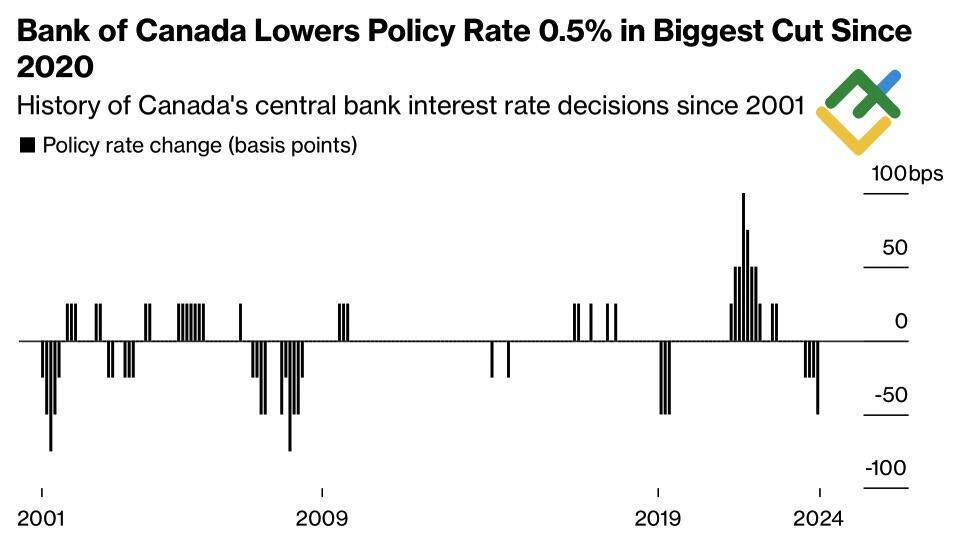

The Bank of Canada is aiming to bring the overnight rate to a neutral level of 2.25-3.25% as soon as possible to ensure a soft landing for the economy. The regulator has eased monetary policy for the fourth time in 2024, with a broad 50 bp move in October. The pace of monetary expansion has resulted in an almost linear upward trajectory for the USDCAD pair. The trading instrument has already reached the bullish targets of 1.387 and 1.3915. What will be the next target?

The Bank of Canada’s decision to cut the overnight rate by half a point was a bold move. Markets were expecting a relatively modest 25 bp cut, but the central bank decided to act more aggressively. Tiff Macklem stressed that Canada had returned to low inflation and that the monetary easing cycle would continue as long as the economy performed as forecast.

BoC policy rate change

Source: Bloomberg.

In September, inflation decelerated to 1.6%, while unemployment reached 6.5%, 2 pp above the record low set in July 2022. GDP growth in the third quarter was 1%, below the Bank of Canada’s forecast of 1.5%. This has prompted the futures market to anticipate another 50 bps cut in the overnight rate in December, forcing USDCAD bears to flee the market.

Tiff Maklem is not attempting to dissuade the markets. The BoC head maintains that sweeping changes are not a necessity during periods of economic turbulence. If the cost of borrowing has been increasing rapidly, it can also decrease quite quickly.

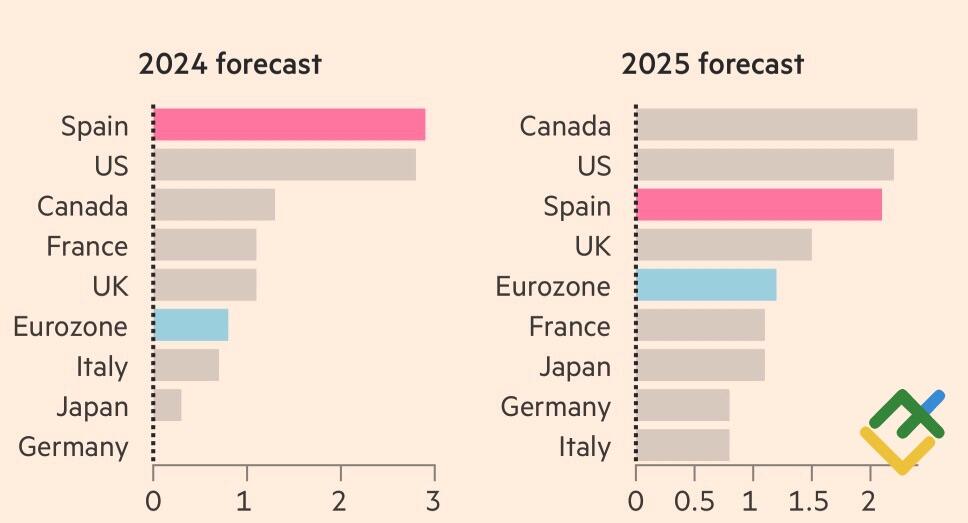

The Bank of Canada is adopting a forward-looking approach. The central bank anticipates that the economy will accelerate to 2% from 1.2% in 2025. The IMF estimates that the Canadian economy will see growth of 1.3%, with next year’s forecast standing at 2.4%. The latter figure represents the highest growth rate among major developed countries.

IMF forecasts for major economies

Source: Financial Times.

Canada will enjoy a competitive advantage due to the Bank of Canada’s aggressive monetary expansion and the US’s robust economy, which accounts for 80% of exports. Regardless of the outcome of the November election, the new president will likely pursue protectionist policies. Donald Trump has accused Mexico, China, Canada, and the EU of unfair trade practices, and Kamala Harris voted against the United States-Mexico-Canada Agreement (USMCA) in 2020. However, it may not be renegotiated until 2026, potentially giving the Canadian dollar a head start against other currencies sensitive to new tariffs.

Monthly USDCAD and EURCAD trading plan

A strong economy cannot have a weak currency. In 2025, the Canadian dollar is expected to recover from its current weakness and become a strong currency again. In the near term, positions can be considered based on the outcome of the US presidential election. Kamala Harris’ victory will give a sell signal for the USDCAD with the targets of 1.3815 and 1.3755. Conversely, if Donald Trump returns to the White House, short positions can be initiated on the EURCAD pair with targets of 1.5 and 1.485.

Price chart of USDCAD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.