Donald Trump’s tariffs will spur inflation in Canada and severely bruise the country’s economy. Meanwhile, the Bank of Canada (BoC) has decided that the most prudent course of action is to cut the overnight rate to 3.25% in December. Let’s discuss this topic and make a trading plan for the USDCAD pair.

The article covers the following subjects:

Major Takeaways

- The Bank of Canada’s rate cut is a measure to protect the economy.

- The BoC’s rate of monetary expansion is significantly faster than the Fed’s.

- Ottawa will lose the battle to Washington.

- The USDCAD pair may soar to 1.426 and 1.435.

Weekly Canadian Dollar Fundamental Forecast

The Bank of Canada was among the first to implement a more accommodative monetary policy, reducing the overnight rate by 125 basis points at four consecutive meetings. Eleven of the fifteen Wall Street Journal experts anticipate that borrowing costs will decline by an additional 50 basis points, reaching the upper boundary of the neutral 3.25% range on December 11. However, the introduction of tariffs by Donald Trump could result in inflationary pressures in Canada, creating a challenging environment for Tiff Macklem and his team.

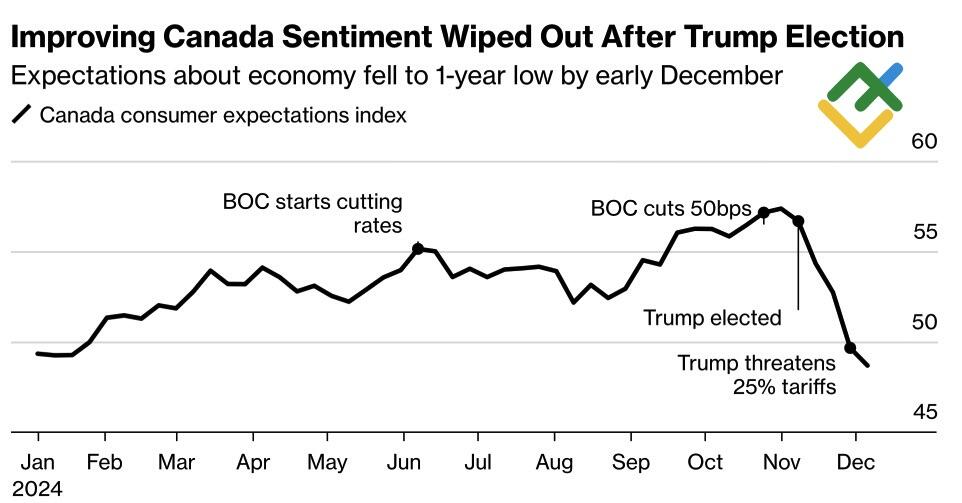

The Bank of Canada is taking action to protect the economy by lowering interest rates, aiming to prevent a decline. However, the impact of this strategy is already evident. Unemployment reached 6.8% in November, its highest level since 2021. With inflation near 2%, this indicates a continued need for monetary expansion. As rates fell, expectations for the Canadian economy rose but then declined due to concerns about the 25% tariffs pledged by Donald Trump.

Expectations for Canadian Economy

Source: Bloomberg.

Justin Trudeau has indicated that Canada will take retaliatory action in response to the United States’ decision to impose tariffs on imports. He has also recalled the events of eight years ago, when Canada introduced retaliatory tariffs in response to similar US trade measures. The Prime Minister was visibly displeased by President Trump’s remark that Canada could join the United States as the 51st state if Trudeau did not agree with his trade policies.

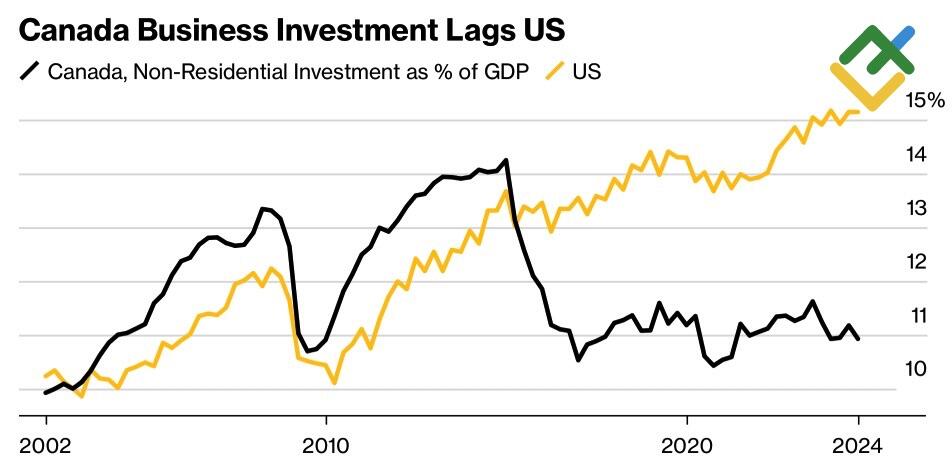

Indeed, Canada has more to fear than just trade wars; it also faces the prospect of a reduction in the US corporate tax rate from 21% to 15%. Currently, the overall tax burden in Canada is comparable to that in the United States, with a combined rate of 25-27% in Canada and 26-27% in the United States. However, the size of business investment in the US economy is significantly larger.

Business Investment in US and Canada

Source: Bloomberg.

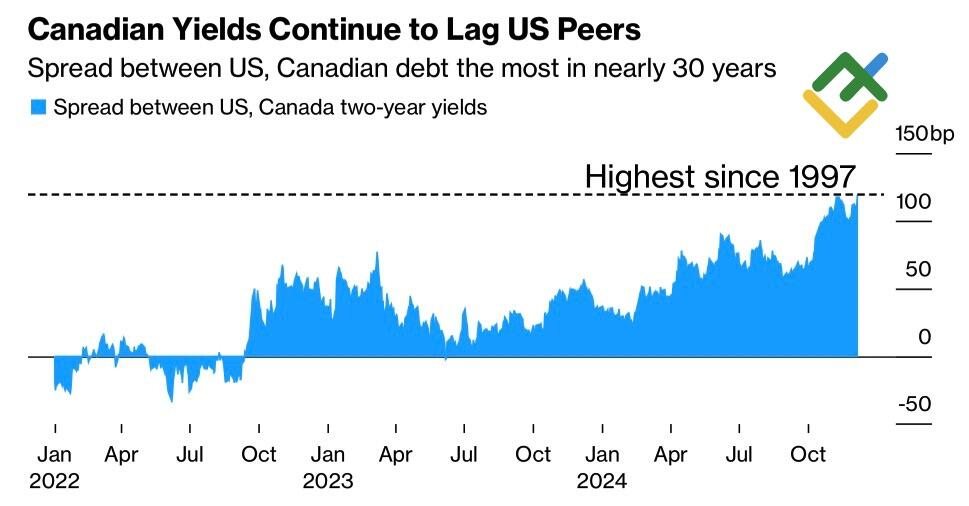

The Canadian dollar is facing headwinds due to heightened expectations. Despite initial assumptions that Donald Trump would not impact the Canadian economy, the country has been among the first to encounter pressure. With the overnight rate potentially declining by 175 basis points and the federal funds rate expected to drop by 100 basis points in 2024, the yield gap is favoring USDCAD bulls.

US-Canada bond yield differential

Source: Bloomberg.

As anticipated, the Canadian dollar has underperformed relative to other G10 currencies over the past month. Since the beginning of the year, it has only performed better than its New Zealand counterpart and the Norwegian krone.

Weekly USDCAD Trading Plan

The overnight rate cut by 50 bps at the BoC meeting on December 11 has already been reflected in USDCAD quotes, so a pullback in light of the buy the rumor, sell the news principle is a possibility. However, the dovish rhetoric of Tiff McLem and the severe economic challenges facing Canada due to the US tariffs indicate that any dips in the pair should be viewed as potential buying opportunities with targets at 1.426 and 1.435.

Price chart of USDCAD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.