The USDCAD‘s best winning streak since 2017 has not met the Reuters experts’ forecasts, predicting the strengthening of the loonie. This was due to the Bank of Canada’s intention to bring the rate to a neutral level as soon as possible. Let’s discuss this topic and make a trading plan.

The article covers the following subjects:

Highlights and key points

- The USDCAD pair marked its best winning streak since 2017.

- Canadian inflation fell below the target for the first time in three years.

- The BoC is required to cut the overnight rate by 50 bps in October.

- The USDCAD risks continuing to rally towards 1.387 and 1.3915.

Weekly Canadian dollar fundamental forecast

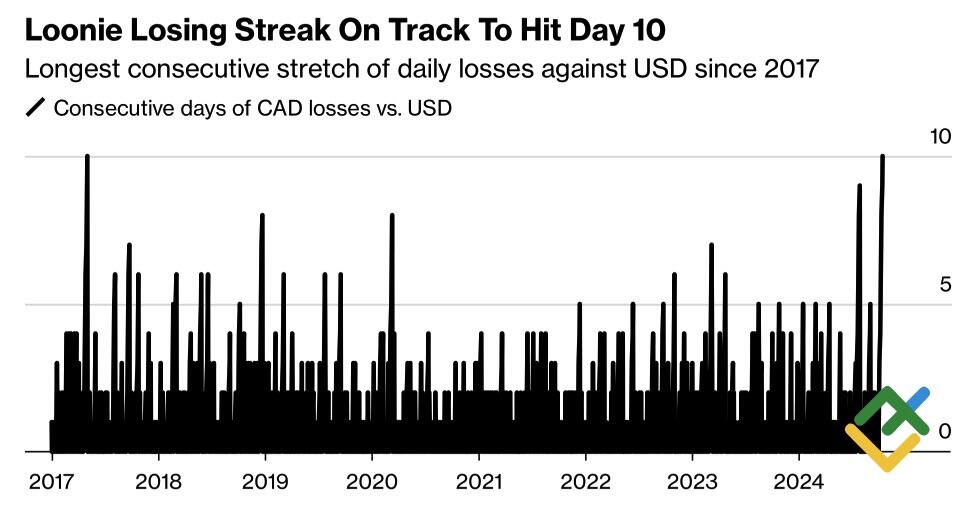

At the end of September and October, Reuters experts predicted that the USDCAD quotes would fall to 1.3514 in three months and 1.3275 in a year. The figures were below the August estimates, indicating optimism about the cycles of the Fed’s and the Bank of Canada’s monetary expansions. According to the regulators, the Canadian economy’s high sensitivity to low interest rates would facilitate the recovery of the loonie. However, the Canadian dollar has suffered its most significant decline against the greenback since 2017.

Canadian dollar’s losing streak

Source: Bloomberg.

Notably, over the past month, the Canadian dollar has experienced the smallest decline in value against the US dollar compared to other G10 currencies, with the exception of the Australian dollar. The US dollar index is experiencing growth, partly due to an increased likelihood of a Donald Trump victory in the presidential race. The Republican candidate has pledged to impose a 20% tariff on all imports into the US. Canada hopes that the free trade agreement will allow it to avoid this issue.

The USDCAD rally is primarily driven by the Bank of Canada’s more rapid pace of monetary expansion compared to the Fed. The Canadian economy is growing slower than the Bank of Canada’s projected 2.4% value. This factor and inflation falling below 2% for the first time in three years are prompting the central bank to act proactively. The regulator has already cut the overnight rate three times to 4.75% since the start of the cycle. Following the deceleration of consumer price growth to 1.6% in September, investors anticipate a significant shift in the market.

Following the US Fed’s decisive action in September, major banks, including Citi, are urging Tiff Macklem and his colleagues to consider a similar move in October, namely a cut of 50 bps in borrowing costs. The National Bank of Canada believes that this measure should be taken twice, in October and December, in order to prevent the economy from sliding into deflation.

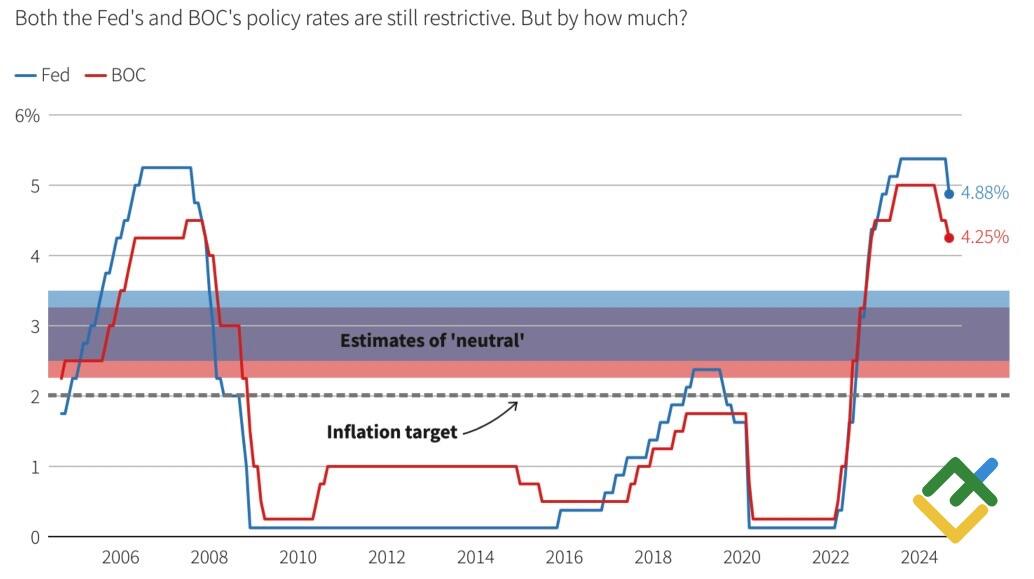

Canadian inflation and Bank of Canada’s rate trends

Source: Reuters.

The Bank of Canada should implement a neutral interest rate policy to stabilize the economy. The Canadian government believes the rate should be set within a range of 2.25% to 3.25%, with a midpoint of 2.75%. The FOMC officials propose a range of 2.5% to 3.5%, with a midpoint of 2.9%.

Following the release of Canadian inflation statistics, the derivatives market has increased the estimated magnitude of the overnight rate cut from 39 bps to 45 bps in October. This indicates that there is a 90% likelihood that the Bank of Canada will implement a significant change at the upcoming 23rd meeting. Besides, the risk of borrowing costs falling to 4% by the end of the year persists, exerting continued pressure on the Canadian dollar.

Weekly USDCAD trading plan

Expectations of the BoC monetary expansion cycle acceleration will support the USDCAD bulls. The pair has retreated after reaching the targets of 1.37 and 1.38 set a month ago. Consider long trades during an upward correction with the targets of 1.387 and 1.3915.

Price chart of USDCAD in real time mode

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

{{value}} ( {{count}} {{title}} )

This post is originally published on LITEFINANCE.